My morning train WFH reads:

• The global stock market rally isn’t as narrow as you think: “If you assign equal weights to the MSCI Europe, Japan and the US indices, this is the best start to a year since 1998, Lapthorne notes. In dollar terms the Nikkei 225 is off to its best start since 1999.” (Financial Times)

• Meta’s ‘Twitter Killer’ App Is Coming: Meta, which owns Facebook and Instagram, teased a new app called Threads that is set to take on Twitter for real-time digital conversations. (New York Times) see also So where are we all supposed to go now? It’s the end of a social era on the web. That’s probably a good thing. But I already miss the places that felt like everyone was there. (The Verge)

• Exploiting the wonderfully weird overnight drift of stocks: In practice the anomaly is impossible to easily exploit because of trading costs (liquidity is much lower overnight, and one-day holding periods would make it a high-turnover strategy). The NightShares ETF has actually lost almost 6 per cent over the past year, compared to the US stock market’s 18 per cent gain over the same period. (Financial Times)

• Re-Mixing Asset Allocation: Insurers Decrease Bonds, Then Do a Partial Reversal: The industry also is expanding its exposure to stocks and alts, amid rising rates. (Chief Investment Officer)

• TV’s Golden Era Proved Costly to Streamers: Streaming losses and layoffs were already leading to an industry retrenchment. Then the writers’ strike hit. (Wall Street Journal)

• The Explosive Growth Of The Fireworks Market: The changes really picked up the pace after 1972, when Congress set up the U.S. Consumer Product Safety Commission (CPSC). Fireworks, with their history of maiming people, were one of the agency’s first targets. The CPSC made sure for a rocket shooting off, that the bases were stronger and longer, so that the rockets didn’t tip over, and then you had a rocket shooting along the ground at spectator. They made sure fuses were consistent. (NPR)

• Joe Biden’s $400 Billion Man: Jigar Shah, who runs the Energy Department’s loan program, is trying to hand out a lot of money for green-technology projects, while navigating an unforgiving political environment https://www.wsj.com/articles/green-energy-climate-loans-49fda73b

• Asking Rent Growth Flat Year-over-year. Realtor.com: First Year-over-year Rent Decline in Their Data (Calculated Risk)

• Nonreligious Americans Are The New Abortion Voters: In 2021, the share of religiously unaffiliated Americans (a group that includes atheists, agnostics and people who identify with no religion in particular) who said abortion was a critical issue started to rise. And for the first time in 2022, the year the Supreme Court overturned the federal right to abortion in Dobbs v. Jackson Women’s Health Organization, the share of religiously unaffiliated Americans who said that abortion was a critical issue was higher than the share of white evangelicals who said the same. (FiveThirtyEight)

• Hollywood has a Jamie Foxx-shaped hole in its heart: The actor was not on the red carpet for the Miami premiere of ‘They Cloned Tyrone,’ but his presence was still felt. (Washington Post)

Be sure to check out our Masters in Business this weekend with Franklin Templeton CEO Jenny Johnson, which manages $1.5 trillion dollar in client assets. She has worked at FT since 1988, and held leadership roles in investment management, distribution, technology, operations, and high-net-worth clients. Franklin Templeton oversees more than 9000 employees and 1300 investment professionals. Johnson is on the list of most powerful women (Barron’s, Forbes, American Banker, and more). She has been CEO February 2020.

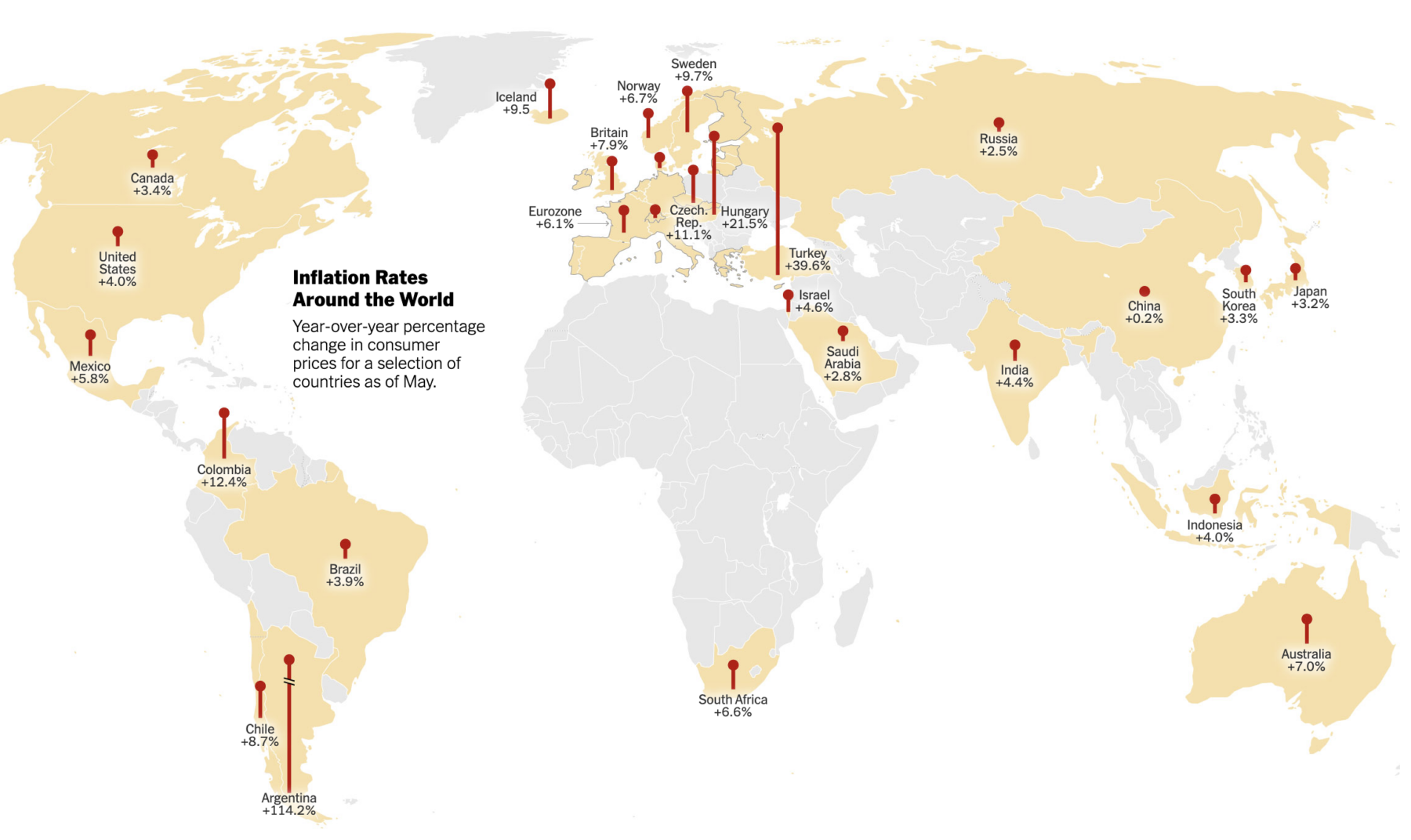

It’s a World of Inflation

Source: New York Times

Sign up for our reads-only mailing list here.