My mid-week morning train WFH reads:

• Measure It Differently, and Inflation Is Behind Us: Investors who think that underlying inflation is falling but not fast enough for the Fed should be troubled by an alternative measure of price increases. Measure U.S. price changes the way Europe does, and inflation was already there in May. Measure them as the U.S. does, and on Wednesday new figures are predicted by economists to show core inflation far higher, at 5% for June. (Wall Street Journal)

• There’s no such thing as “rolling recessions:” You predicted a recession and it didn’t happen? You are about to be interviewed by CNBC? Have no fear, you can always claim that there has been a “rolling recession.” It’s like a get out of jail free card. Except . . . Rolling recessions do not exist. The fact that weakness in housing was followed by weakness in manufacturing and then a few layoffs in tech doesn’t mean a thing if the overall economy continues booming. Claims of rolling recessions are used merely as an excuse for failed macroeconomic predictions that flowed from bad models. (The Money Illusion)

• Insurers tap money managers for opportunities in real estate, private credit markets: A recent surge in home construction has insurers eyeing investment opportunities in the single-family and multi-family residential sectors. (Chief Investment Officer)

• Municipalities aren’t going to drive US economic growth But they aren’t going to tank it either: The economics of state and local governments matter a great deal. Their spending makes up about one-tenth of US GDP. And municipalities employ nearly 20 million Americans, compared to the federal government’s roughly 3 million (that’s including the Postal Service), according to BLS data. (Financial Times Alphaville)

• Who Employs Your Doctor? Increasingly, a Private Equity Firm. A new study finds that private equity firms own more than half of all specialists in certain U.S. markets. (Upshot)

• Chris Miller, historian and author of “Chip War” In which I consult an expert on the battle to control the semiconductor industry. (Noahpinion)

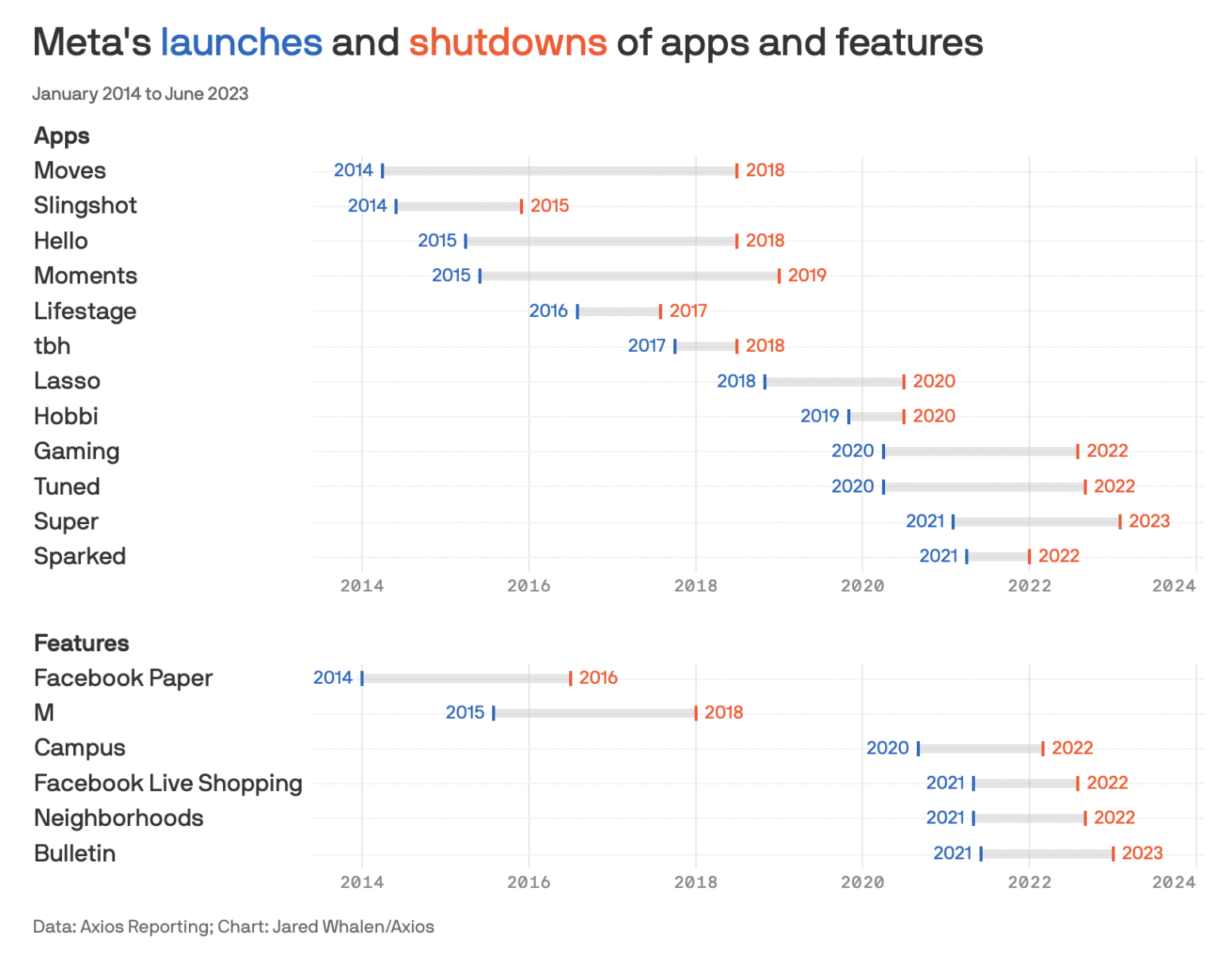

• Why the Early Success of Threads May Crash Into Reality: Mark Zuckerberg has used Meta’s might to push Threads to a fast start — but that may only work up to a point. (New York Times)

• Getting Locked Out of Your Digital Life Is Bad. Here’s How to Avoid It. Prevent lockouts by using multiple forms of verification. (Wall Street Journal)

• Summer is here. Where are the fireflies? Nearly 1 in 3 firefly species in the United States and Canada may be threatened with extinction, firefly experts estimate in a recent comprehensive assessment. Surveys abroad show declines from mangroves in Malaysia to grasslands in England. New research is shedding light on how these ethereal insects are struggling to thrive in the brightly lit world we have built around them. And the problem is bigger than a single type of bug. “The fireflies are the icons that tell you that the habitat is in trouble.” (Washington Post)

• Phoebe Waller-Bridge’s Great ‘Indiana Jones’ Adventure: Going from “Fleabag” to James Bond, “Indiana Jones” and “Tomb Raider” isn’t the most logical A-to-B move. So what is it that you think the people behind those projects see you as bringing to them, and does that line up with what you think you’re bringing? (New York Times)

Be sure to check out our Masters in Business this weekend with Franklin Templeton CEO Jenny Johnson, which manages $1.5 trillion dollar in client assets. She has worked at FT since 1988, and held leadership roles in investment management, distribution, technology, operations, and high-net-worth clients. Franklin Templeton oversees more than 9000 employees and 1300 investment professionals. Johnson is on the list of most powerful women (Barron’s, Forbes, American Banker, and more). She has been CEO February 2020.

Meta’s copycat machine

Source: Axios

Sign up for our reads-only mailing list here.