My mid-week morning train WFH reads:

• Birth, Death, and Wealth Creation: Investors seeking to generate excess returns can benefit from understanding the demographics of public companies and their patterns of wealth creation: 60% percent of the stocks of U.S. public companies failed to earn returns in excess of Treasury bills; only 2% created more than 90% of the aggregate wealth. The skewness in wealth creation suggests two approaches for investors: seek broad diversification or build a portfolio that tries to avoid the wealth destroyers while owning the wealth creators. (Morgan Stanley)

• How right-wing news powers the ‘gold IRA’ industry: Ads for gold coins have become a mainstay on Fox News, Newsmax and other conservative outlets, even as regulators have accused some companies of defrauding elderly clients. (Washington Post)

• A Flood of New Workers Has Made the Fed’s Job Less Painful. Can It Persist? Federal Reserve officials thought job gains would taper off more, but they’ve remained strong. An improving supply of workers has been crucial. (New York Times)

• The Hottest Office Market in America Is … Midtown Manhattan? Yes, vacancy rates are up. But thanks in part to all those new buildings on the far West Side, so is overall occupancy. (Bloomberg) but see Tech Firms Once Powered New York’s Economy. Now They’re Scaling Back. After years of steady growth, many technology companies are laying off workers and giving up millions of square feet of office space in the city. (New York Times)

• How Workers Really Spend Their Days: At the office, we kill time by surreptitiously staring at our phones. Working from home, we make breaks about more than mental distraction. (Wall Street Journal)

• Investors are still so scared: Last summer we saw some of the most pessimistic sentiment towards stocks in history. Some of that sentiment has started to shift a bit, like in the AAII and II polls. We’re back somewhere towards the middle in those. You need, at least, some bulls to buy stocks to have a bull market. But when it comes to Fund Managers, Cash is still their largest position, and they’re most bearish on equities. (All Star Charts)

• How California’s weather catastrophe turned into a miracle: Gushing waterfalls, swollen lakes and snow-covered mountaintops transformed the state’s arid landscapes. (Washington Post)

• Why Generative AI Won’t Disrupt Books: Every new technology from the internet to virtual reality has tried to upend book culture. There’s a reason they’ve all failed—and always will. (Wired)

• The weird sorrow of losing Twitter: Grieving a loss, when the loss is the hell-bird site you weren’t supposed to love. (Vox) see also If other media companies thought about brand equity the way Elon Musk thinks about Twitter’s (er, X’s): In the spirit of Tronc, Elon Musk has decided to throw away more than a decade of brand equity by changing the name of Twitter to…the letter X. Imagine if more media executives followed his lead. (Nieman Lab)

• Women are superstars on stage, but still rarely get to write songs: In 2022, hit songs had 6 songwriters on average: 5 men and 1 woman. But the average conceals a remarkable fact about the 42 songs that cracked the Top 5 of the Billboard Hot 100. While half of the songs had a songwriting team of all men… Only one had a songwriting team of all women. (The Pudding)

Be sure to check out our latest Masters in Business interview with Jawad Mian, CFA and Chartered Market Technician, who runs the independent global macro research and trading advisory firm Stray Reflections. The firm’s focus is on major investment themes, and its clients include many of the world’s largest hedge funds and alternative asset managers.

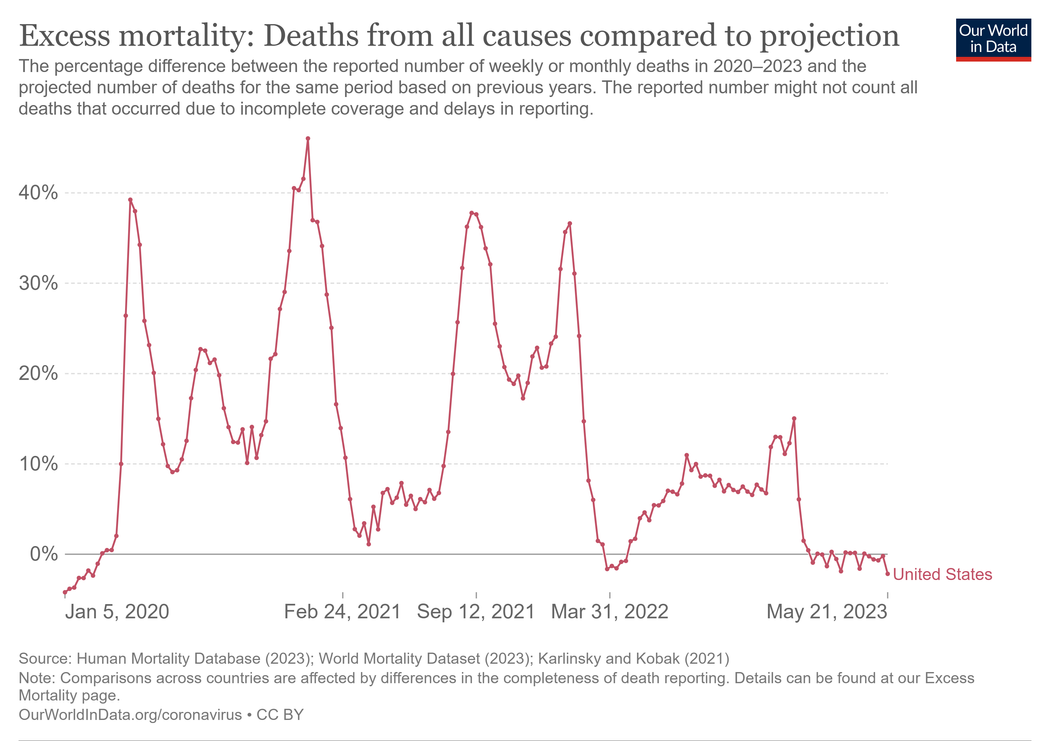

COVID pandemic is officially over in the U.S., excess-deaths data show

Source: Human Mortality Database via Marketwatch

Sign up for our reads-only mailing list here.