My back-to-work morning train WFH reads:

• The Legendary, Wildly Profitable QQQ Fund Makes No Money for Its Owner: An historical artifact prevents Invesco from profiting from its flagship ETF. The company’s Q-themed offshoots are finally solving that problem. (Businessweek)

• The New York Fed President Sees Interest Rates Coming Down With Inflation: In a wide-ranging interview with The New York Times, John C. Williams pondered the economy’s future. This is the full transcript. (New York Times)

• UBS: An introduction to Private Credit: Private credit strategies like direct lending can offer an attractive option for investors looking to generate higher yields and diversify their portfolio from traditional fixed income. Direct lending tends to provide more conservative risk-return profiles than leveraged loans and high yield bonds. For investors willing to lock up capital and commit for an extended period, direct lending offers access to an asset class with appealing enhanced yield and downside mitigation. (UBS)

• Inside the Slow, Yet ‘Incredible’ Installation of a $78,000 Tesla Solar Roof: Long Island homeowner Winka Dubbeldam describes a tedious process that in the end helped lower her electric bill while maintaining the appearance of her Cape Cod-style h ome. (Wall Street Journal)

• Why This Company’s Financial Crisis Threatens China’s Economy: Country Garden was China’s biggest real estate developer. Now it is staring down default, facing billions of dollars in losses and $200 billion in unpaid bills. (New York Times)

• LK-99 isn’t a superconductor — how science sleuths solved the mystery: Replications pieced together the puzzle of why the material displayed superconducting-like behaviours. (Nature)

• Tracking the EV battery factory construction boom across North America: Here’s where the US stands on EV battery production, 1 year after the Inflation Reduction Act was signed. (TechCrunch)

• How the collapse of the ruble could impact the war in Ukraine: The Russian ruble has been declining steadily and reached a 17-month low this week, tumbling past 100 rubles to the U.S. dollar. This gives the ruble less value than a single American cent and represents a loss of nearly 40% of its value since the beginning of the year. The ruble immediately plunged following Russia’s invasion of Ukraine in February 2022. It saw an uptick at the end of that year but has been falling ever since. (The Week)

• A brilliant biography of an elusive genius: Spinoza may be the master thinker to whom we owe modernity itself. • A brilliant biography of an elusive genius: (The Critic)

• The Biggest Question Mark in Astronomy? You’re Looking at It. Close scrutiny of a recent image from the Webb Space Telescope revealed some questionable punctuation. (New York Times)

Be sure to check out our Masters in Business with legal scholar Cass Sunstein, who founded and leads Harvard Law School’s program on behavioral economics and public policy. He authored several books, including the bestselling “Nudge: Improving Decisions About Health, Wealth, and Happiness.” (written with Nobel Laureate Richard Thaler) and the New York Times best-seller “The World According to Star Wars.” His new book is “Decisions about Decisions: Practical Reason in Ordinary Life.”

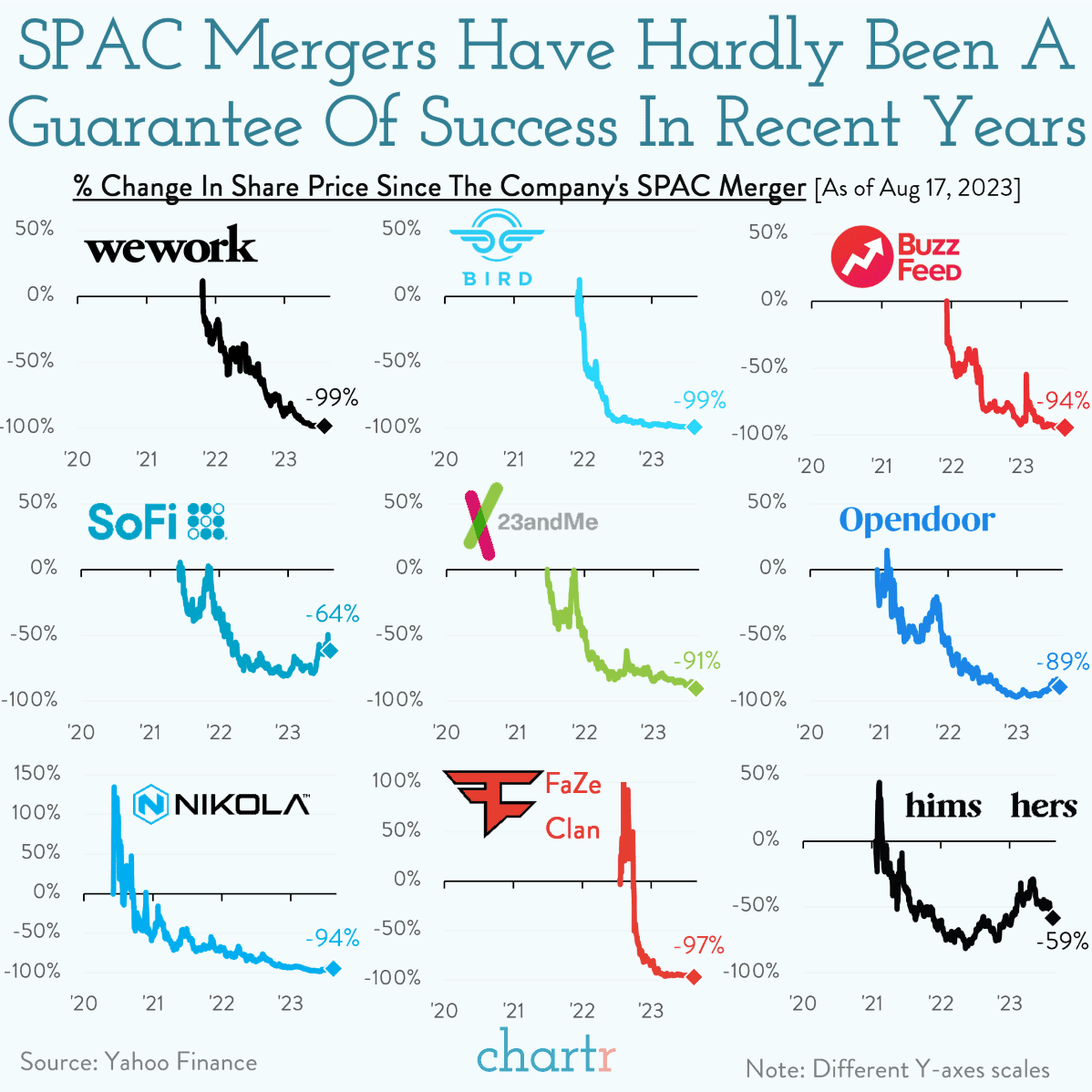

SPAC Mergers Have Hardly Been A Guarantee Of Success In Recent Years

Source: Chartr

Sign up for our reads-only mailing list here.