Source: Adam Khoo, Twitter

A preface before we get into this: Michael Burry has proven himself to be a rare fund manager. He has a great ability to identify a variant perception versus the Wall Street consensus and express that view in a deeply researched market position. As we learned in Michael Lewis’ book The Big Short, he had the courage of his conviction to stay with his position even as lots of others opposed it. The result was an incredible performance in the mid-2000s through the GFC — when real estate fell 32% nationally, and the S&P 500 crashed 58% peak-to-trough. Every long-only fund was deeply negative.

I share that caveat because making a bet and staying with it, is very different than making a forecast. What you say in an interview or tweet out during the trading day is free marketing, costs you nothing, and is typically forgotten.

Except when people like Adam Khoo‘s keep track of what you have been saying.

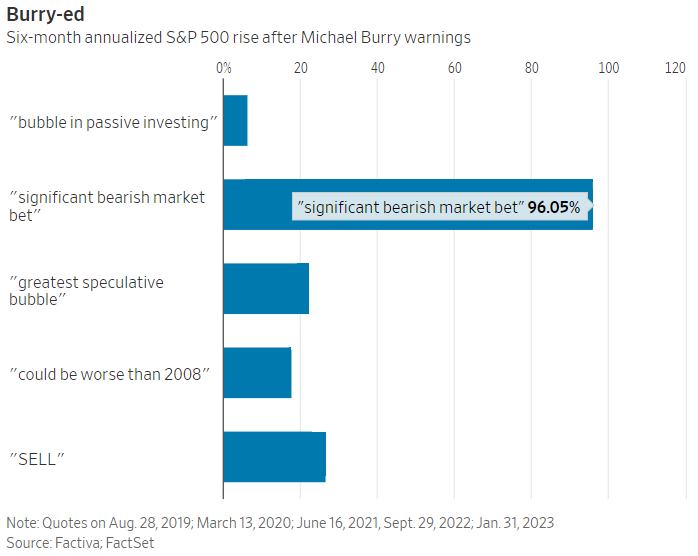

Khoo looked at Michael Burry’s predictions since 2015 and whether markets followed his forecasts or not. It was mostly “not;” Burry, since famously nailing the collapse of the subprime mortgage market, has been looking for a replay of that era to no avail, making regular predictions about an imminent stock market crash.

Khoo has tracked the result of these forecasts, and they are not exactly generating Alpha:

On Dec 2015, he predicted that the stock market would crash within the next few months.

-> SPX +11% Next 12 monthsOn May 2017, he predicted a global financial meltdown

-> SPX +19% Next 12 monthsOn Sept 2019, he predicted that the stock market would crash due to a bubble in index ETFs

-> SPX +15% Next 12 monthsOn March 2020, he revealed a massive bearish bet

-> SPX +72% Next 12 monthsOn Feb 2021, he predicted that the stock market would crash due to a speculative bubble. Shorts Tesla.

-> SPX +16% Next 12 monthsOn Sept 2022, he predicted that the stock market warned of more failures, bottom not hit yet.

-> SPX +21% Next 11 monthsOn Jan 2023, he predicts a recession and new round of inflation. Says “ SELL”

-> SPX +17% Year to DateOn Aug 2023, Reveals Short Positions on the SPY and QQQ

-> SPX ???

I always want to tread lightly when trashing someone else’s forecasts — it’s not that I am on the other side of the trade, or disagree with any single position, or this or that prediction. It’s the entire idea that you as an investor should care about anyone else’s forecasts.

If you want to dive into the why of this, see our archive of Predictions and Forecasts — its a great primer to start learning more about the Folly of Forecasts.

But this specific set of forecasts is problematic for a very specific reason: Forecasters who make one great outlier call correct a) tend to make lots more outlier forecasts; and, b) these tend to be believed by TV viewers.

We were reminded of this by Joe Keohane, writing at the Boston Globe in 2011:

“How can someone with the insight to be so right about a major event be so wrong about so many other ones? According to a recent study, it’s simple: The people who successfully predict extreme events, and are duly garlanded with accolades, big book sales, and lucrative speaking engagements, don’t do so because their judgment is so sharp. They do it because it’s so bad . . .

In other words, it got good to them. What should actually be a once-in-a-lifetime great or lucky prediction becomes their standard operating procedure. Keohane was writing about Nouriel Roubini, but it’s just as applicable to Burry.

The takeaway for investors is the same as always: If you are going to put capital at risk, make sure you know why. Understand what you want to get out of markets.

And always, Think for yourself.

UPDATE September 7, 2023

Peter Mallouk joins in the debate:

See Also:

That guy who called the big one? Don’t listen to him.

Joe Keohane

Boston Globe, January 9, 2011

(Mirror)

How to Get Rich and Famous From a Stock Market Crash

By Spencer Jakab

WSJ, Aug. 20, 2023

Previously:

Purposeless Capital (April 2, 2021)

Some Thoughts About Predictions (November 1, 2017)

Forecasting is Marketing (January 24, 2015)

Inside the Paradox of Forecasting (January 11, 2011)

The Folly of Forecasting (June 7, 2005)

Predictions and Forecasts (Archive)