My morning train WFH reads:

• “Room-temperature superconductor” would be a huge deal: The superconductor frenzy, explained. (Vox)

• Why Do Forecasters Disagree about Their Monetary Policy Expectations? While forecasters generally disagree about the expected path of monetary policy, the level of disagreement as measured in the New York Fed’s Survey of Primary Dealers (SPD) has increased substantially since 2022. What explains the current elevated disagreement in FFR forecasts? (Liberty Street Economics) see also The (In)Accuracy of Market Forecasts: A large body of evidence demonstrates that market forecasts from ‘gurus’ have no value in terms of adding alpha. (WealthManagement.com)

• Bitwise’s Plan to Get Crypto Into More Institutional Portfolios: A Hedge Fund of Funds. A peek inside the fund shows strategies run by Citadel and Bridgewater alumni. (Institutional Investor)

• Continuation Funds Raise Questions About Valuation Risk in Pension Portfolios: As more GPs pursue continuation funds, institutional investors are faced with new questions about the overall risk levels in their portfolios. (Chief Investment Officer)

• Billionaire Desmarais Family Quietly Reshapes a Financial Empire: Power Corp. lost its place as the standard-bearer in Canadian asset management. The clan behind it is now trying to modernize the firm and buy its way into higher-growth areas.. (Bloomberg)

• Converting Brown Apartments to Green Apartments: The conversion of brown office buildings to green apartments can contribute towards a solution to three pressing issues: oversupply of office in a hybrid-and-remote-work world, shortage of housing, and excessive greenhouse gas emissions. We propose a set of criteria to identify commercial office properties that are are physically suitable for conversion, yielding about 11% of all office buildings across the U.S. (NBER)

• Elon Musk’s plans could hinder Twitternomics: The site now known as X is extremely helpful to researchers. (Economist) see also It’s time to change how we cover Elon Musk: After a weekend of whoppers about X and fighting Mark Zuckerberg, the press should take a more skeptical approach. (Platformer)

• The Local-News Crisis Is Weirdly Easy to Solve: Restoring the journalism jobs lost over the past 20 years wouldn’t just be cheap—it would pay for itself. (The Atlantic)

• Putin’s Forever War: Vladimir Putin wants to lead Russians into a civilizational conflict with the West far larger than Ukraine. Will they follow him? (New York Times)

• ‘I gravitate towards the uncomfortable’: how John Wilson made TV’s most bizarre and brilliant docuseries: Sex cults, energy drink empires, his landlady – nothing and no-one is off limits for the creator and star of HBO documentary How To With John Wilson. (The Guardian)

Be sure to check out our Masters in Business interview this weekend with Ted Seides, founder of Capital Allocators, an advisory platform to managers and allocators. Previously, he worked under David Swensen at the Yale Investments Office, where he invested directly with three of Yale’s managers. We discuss his famous bet with Warren Buffett about whether a selection of hedge funds could beat the S&P 500 over a decade. (Buffett won).

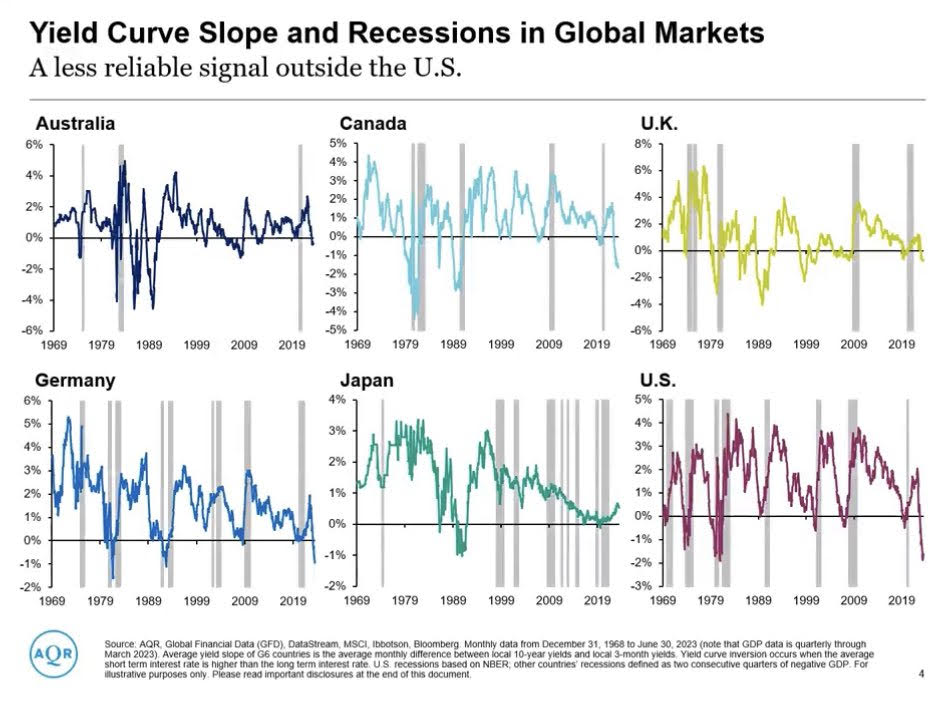

On yield curve inversion, and recessions: 1. It’s not worked in other countries. 2. Inversion is simply a sign of expected rate cuts.

Source: AQR via Sonu Varghese

Sign up for our reads-only mailing list here.