My end-of-week morning train WFH reads:

• How Blackstone Sprinted Ahead of Its Peers in AI: Eight years ago, Stephen Schwarzman decided to go all in on artificial intelligence — and never looked back. (Institutional Investor)

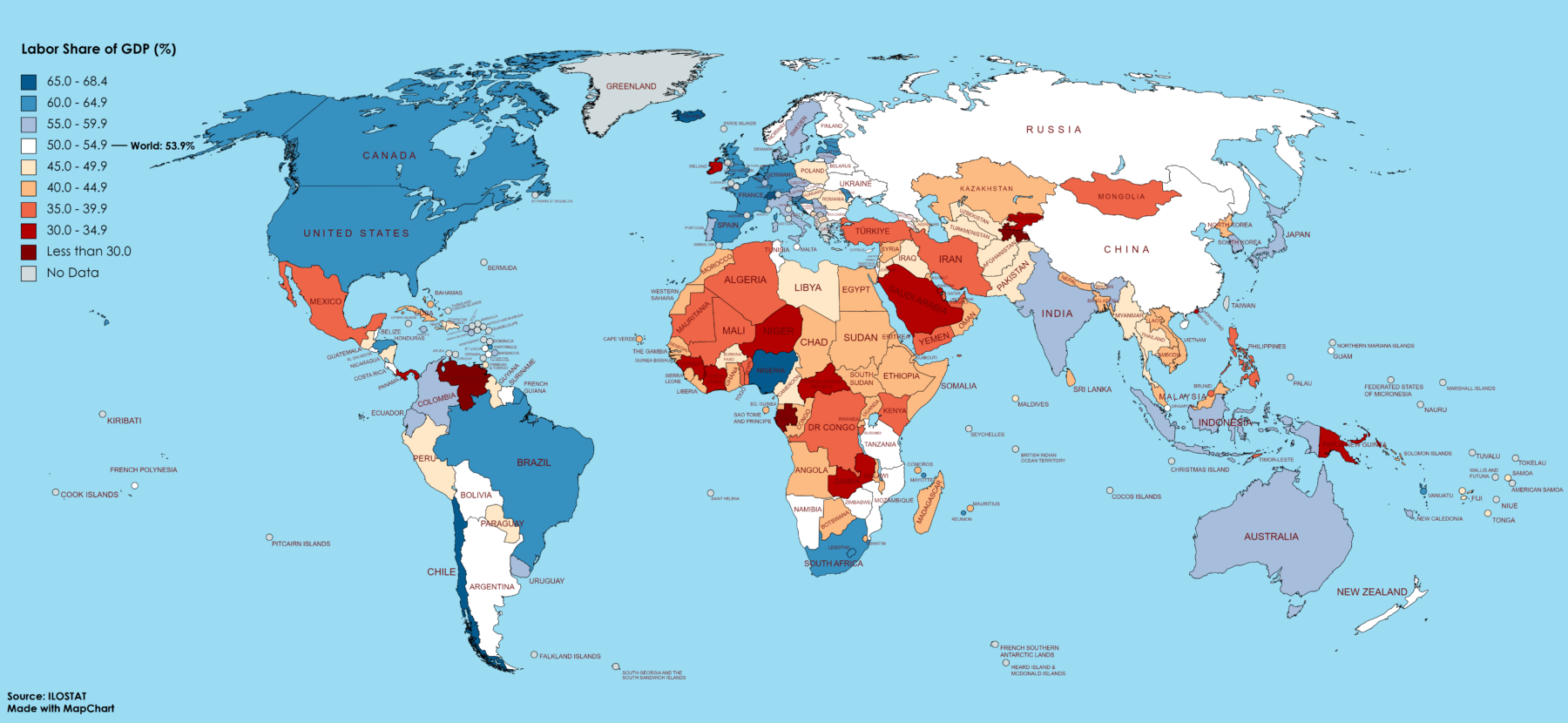

• Autoworkers Have Good Reason to Demand a Big Raise: Their real wages have fallen 30% over the past two decades. But can the Detroit Three really afford to bring back the old days? (Bloomberg)

• When Softbank is selling, why are you buying? Consider the identity of the seller: Softbank doesn’t have a great record with floats. Only four IPOs of Softbank-backed companies still trading are higher than their issue price, with 21 underwater. The average loss from IPO across the portfolio is 46%. (Financial Times)e

• Spotify’s $1 Billion Podcast Bet Turns Into a Serial Drama: The prospect of podcast riches led to aggressive investments in celebrity deals and original programming for what appeared a sky’s-the-limit media frontier. (Wall Street Journal)

• Four Questions to Find “The Force.” When sci-fi is more science than fiction. (Sapient Capital)

• Analyzing Tax Audits Across the Income Distribution: We find an additional $1 spent auditing taxpayers above the 90th income percentile yields more than $12 in revenue, (NBER)

• A $700 Million Bonanza for the Winners of Crypto’s Collapse: Lawyers. Bankruptcy lawyers and other corporate turnaround specialists have reaped major fees from the bankruptcies of five cryptocurrency companies, including FTX. (New York Times) l

• India’s Elite Tech Schools Are a Golden Ticket With a Dark Side: The Indian Institutes of Technology are a production line for global tech CEOs, but critics say they promote a toxic, discriminatory work culture. (Wired)

• What Are The Swing States Of The Future? Have Arizona and Georgia replaced Ohio as the nation’s presidential bellwether? Is once-swingy Florida officially a red state? Let’s talk about what are the swing states to watch in 2024 — and what are the states that could be toss-ups just a few election cycles from now. (FiveThirtyEight)

• The Decomposition of Rotten Tomatoes: The most overrated metric in movies is erratic, reductive, and easily hacked — and yet has Hollywood in its grip. (Vulture)

Be sure to check out our Masters in Business interview this weekend with Jon McAuliffe co-founder and Chief Investment Officer at the Voleon Group. Voleon was one of the first hedge funds to use AI as a core of its investing model. Previously, he was at D. E. Shaw & Co., where he researched, developed, and managed statistical arbitrage trading strategies. Dr. McAuliffe also helped to build the recommender system at Amazon.com.

Workers’ share of GDP across the world

Source: Reddit

Sign up for our reads-only mailing list here.