The Fed is done.

It’s unimaginable that they will do anything at the September FOMC meeting, and barring any radical change in the data, it’s unlikely they will be doing anything in November.

I have been saying since June 2022 that inflation had peaked; the data has been leaning that way since May 2022. If you were watching the video instead of the still pic, it was apparent that the biggest risk to the economy then was less rising prices than a tardy FOMC over-tightening.

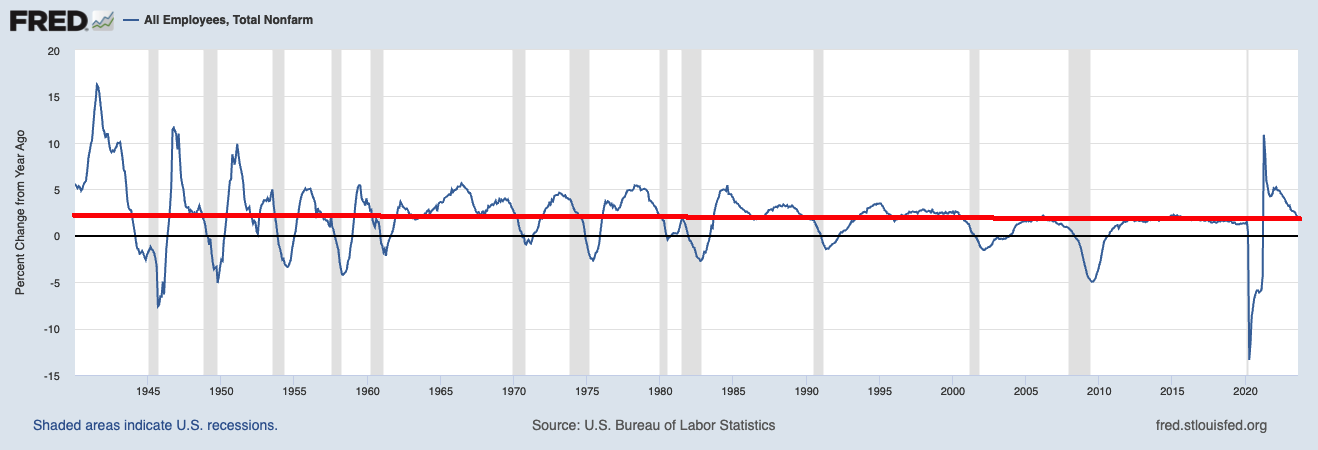

Not only did U3 unemployment tick up 0.3%, wage data continued to decelerate and revisions were downwards. Perhaps most intriguing is total employment: After collapsing during the pandemic, and then spiking upwards as we re-opened, this report shows it has returned to its long-term trend.

To repeat what I explained in Businessweek, earlier this month: Powell & Co. should take the rest of the year off and go somewhere and enjoy themselves. And you should take the long weekend to do the same!

Previously:

A Dozen Contrarian Thoughts About Inflation (July 13, 2023)

Why Is the Fed Always Late to the Party? (October 7, 2022)

Revisiting Peak Inflation (June 29, 2022)

Has Inflation Peaked? (May 26, 2022)

NFP Day: The Most Over-Analyzed, Over-Emphasized, Least-Understood Data Point (February 4th, 2011)