The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads:

• The Real Story of Musk’s Twitter Takeover: In an exclusive excerpt from his new biography ‘Elon Musk,’ Walter Isaacson offers a behind-the-scenes look at one of the most surprising and controversial decisions of the mogul’s career. (Wall Street Journal)

• Misled by the Phillips Curve: How Inflation Predictions Went Wrong: In a recent Barron’s article, I examined why last year’s predictions that fighting inflation would require an increase in the unemployment rate went so wrong. The flaws in these predictions can be traced back to three ideas: first, that vacancies are a good measure of labor market tightness; second. (Employ America) see also How the Inflation Reduction Act might affect you — and change the U.S. The package, while smaller than Democrats’ initial ambitions, would transform huge sectors of the U.S. economy and affect millions of Americans. (Washington Post)

• The Most Powerful Mental Model for Identifying Stocks.Pick up a business with good economics and with good margin of safety, and the probability of making money in the long run is high. Pick up a business with poor economics with any margin of safety, and the probability of losing your shirt, and entire wardrobe, in the long run is very high. (Safal Niveshak)

• This Company Created a Return-to-Office Plan That Employees Actually Like: J.M. Smucker is ordering workers to be at its Ohio headquarters for 22 ‘core’ weeks. It is a strategy that may resolve the tug of war over how we work. (Wall Street Journal)

• Hanging in the Balance Sheet: Dramatizing the quest for market share. Unfortunately, for all the bounty of potential source material that consumer capitalism has left us with, the strictures of corporate life mean that there’s little variety in the origin stories of salable items. Whether the product was introduced by a shoestrings startup or percolated through the mid-level management of a conglomerate, at some point the guy with the idea has to meet with the guy who has the power to bring it to market. (The Baffler)

• America Is Using Up Its Groundwater Like There’s No Tomorrow: Overuse is draining and damaging aquifers nationwide, a New York Times investigation found. (New York Times)

• The Final Days: Joe Biden was determined to get out of Afghanistan—no matter the cost. (The Atlantic)

• The Mystery of Long COVID Is Just the Beginning: At Yale’s clinic, medical sleuth Lisa Sanders is trying almost everything. (New York Magazine)

• One Man’s Quest to Heal the Oceans—And Maybe Save the World: “Suddenly, we’re seeing that the impacts of climate change are not something that is going to be suffered by somebody else. It’s here.” And so it is, in the wildfires, heat waves, and floods that have made the weather of summer 2023 some of the most extreme on record. (Time)

• Steve Carell’s college hockey teammates ‘didn’t know he was funny because we were idiots’ Carell’s time at Denison helped send him on a path that made him a comedic face of his generation. He went on to star in hit comedies “Anchorman” and “The 40-Year-Old Virgin,” and became a cultural pillar thanks to his portrayal of Michael Scott in “The Office.” In a bracket tournament of the best 21st century TV characters, created by The Ringer, readers voted the Dunder Mifflin Paper Company boss the winner. Carell’s ability to make Scott awkward, disconcerting and ultimately endearing won over viewers. (The Athletic)

Be sure to check out our Masters in Business this week with Jonathan Miller, CEO of Miller Samuel, a real estate appraisal and consulting firm he co-founded in 1986. He is a state-certified real estate appraiser in New York and Connecticut who performs court testimony as an expert witness, and holds the Counselor of Real Estate (CRE) and Certified Relocation Professional (CRP) designations. His weekly email Housing Notes is widely read in both the appariasal and real estate brokerage industries. Miller Samuel’s research and data analytics drive much of the national real estate brokerage publications and strategic plans.

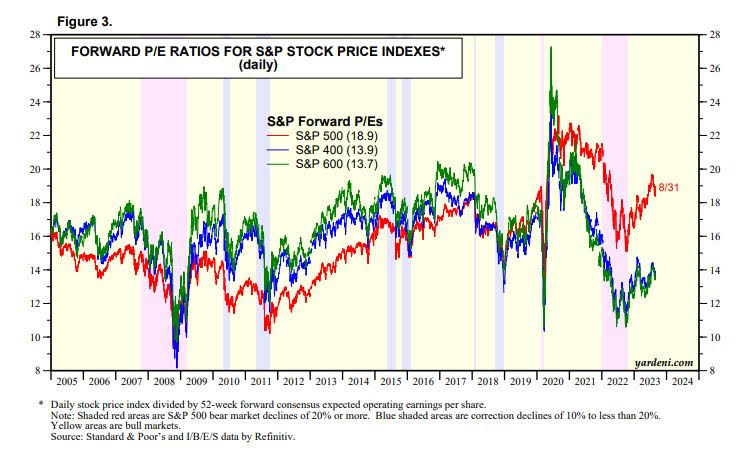

We are in the midst of one of the most significant valuation gaps ever between Large Caps and everyone else

Source: Yardeni Research via Compound

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.