My morning train reads:

• Here’s What We Do and Don’t Know About the Effects of Remote Work. Three years into a mass workplace experiment, we are beginning to understand more about how work from home is reshaping workers’ lives and the economy. (New York Times)

• The economy has been strong. Why are economists so eager to predict it will tank? That points to the question: Why do economists get these things so consistently wrong? And to a corollary: Why pay any attention to their forecasts? Why anyone would lend credence to economic projections that get revised on average nearly every other month is a mystery. (Los Angeles Times)

• How Private Equity Firms Can Protect ‘Treasure Trove’ From Digital Threats: With risks everywhere, responsibility for cybersecurity can be shared between financial services firms and their portfolio companies. (Chief Investment Officer)

• How a Social Network Fails: Elon Musk and Linda Yaccarino are making the same mistake that has tanked other social networks. (The Atlantic)

• How to make cars less dangerous for pedestrians: Technology abounds that can help keep vulnerable road users (VRUs) safer. VRUs include pedestrians, wheelchair users, cyclists, motorcyclists and scooter riders. Together they are the majority of people killed by cars globally. Yet some well-established safety features are not always integrated into new vehicles, safety ratings and regulations. (BBC)

• How Daniel Roseberry became the internet’s favorite fashion designer. Plain-spoken and cinema-star handsome, his fashion fantasy world is sweeping, uncomplicated and bubblegum. The clothes that come out of it are irresistible to anyone who learned about fashion not by attending fashion shows or reading magazines or wearing extraordinary garments, but by inhaling images of ridiculous and extravagant runways of the 1990s and ’80s online. (Washington Post)

• Twenty Years of Outsourced War: In Uncertain Ground, Phil Klay sets out to determine what twenty-first-century US foreign policy has done to the cocksure American mind. (New York Review of Books)

• What Do We Owe the Octopus? Mounting research suggests that cephalopods experience pain. Now, the National Institutes of Health is considering new animal welfare rules that would put them in the same category as monkeys. (Wired)

• For Supreme Court, ethics have become the elephant in the courtroom: Reports about some justices hobnobbing with billionaire friends on lavish trips and maintaining ties to those who have business before the court have become the elephant in the courtroom. (Washington Post)

• On a New ‘Frasier,’ James Burrows Has a Joke for You: Over nearly five decades, Burrows has directed a thousand sitcom episodes. Next up: the new Paramount+ series, which follows Frasier Crane’s return to Boston. (New York Times)

Be sure to check out our Masters in Business next week with Graeme Forster, a director at Orbis Holdings Ltd., which has $51 billion in assets under management. Orbis deploys a unique fee arrangement, where they are only paid a fee when they outperform their benchmark and refund fees to clients when they underperform. The Orbis Global Equity is their flagship fund, accounting for 67% of their assets, and has compounded at 11% annually, outperforming its benchmark since its 1990 inception.

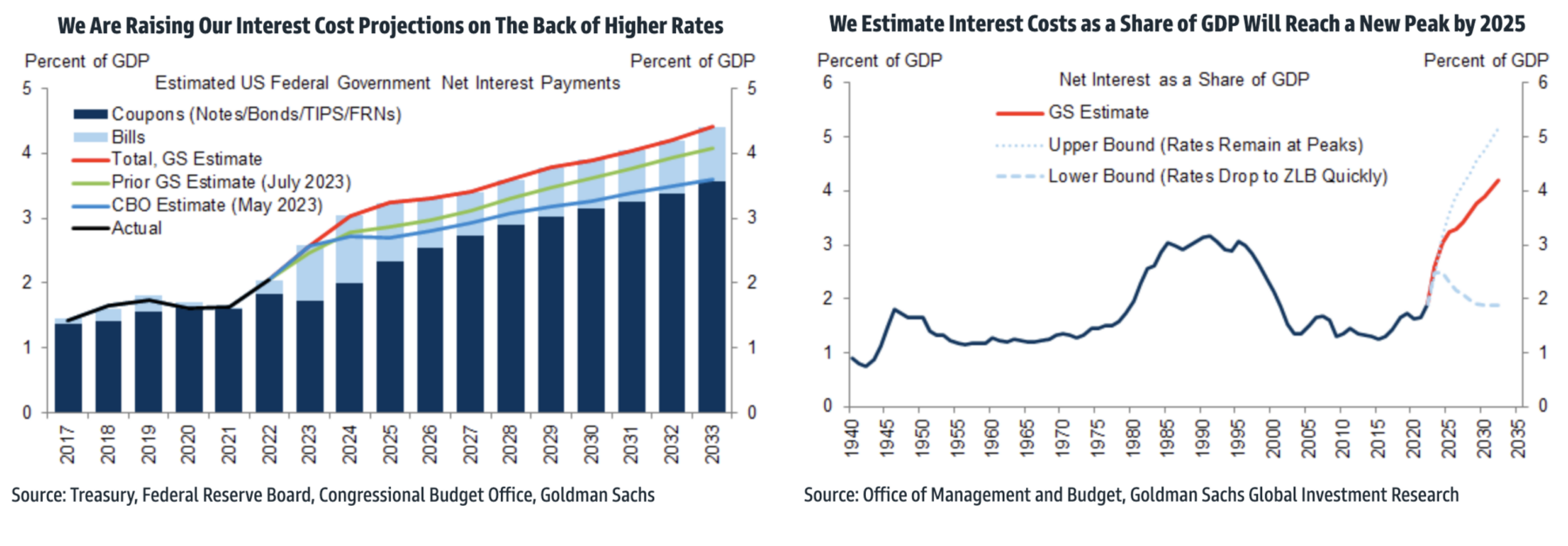

Interest Expense: A Bigger Impact on Deficits than Debt (Krupa/Phillips)

Source: Goldman Sachs

Sign up for our reads-only mailing list here.