My morning train WFH reads:

• Americans, especially wealthy ones, are still spending big: Continued consumer spending — on travel, concerts, restaurants and more — is propelling economic growth beyond what many had expected. (Washington Post)

• Your ‘Set It and Forget It’ 401(k) Made You Rich. No More. Stock-and-bond portfolios that worked for the past 40 years aren’t ready for what’s coming. (Wall Street Journal) see also What Did We Learn From the Last Bull Market? Three lessons from the pandemic boom. (Morningstar)

• Asset Managers Are Updating Bond Models to Capture a New Risk: Extreme weather has direct impact on real estate credit market Climate risks are resulting in mispricing of sovereign bonds. (Bloomberg Green)

• Indexing, private markets considered key disrupters of past 50 years. The ripple effects — which have thoroughly reordered a world of 60% stock, 40% bond pension portfolios run by bank trust departments — continue to be felt, even as newer influences, such as technology and artificial intelligence, appear poised to power the next wave of change. (Pensions & Investments)

• Springsteen Shows Private Equity Who’s Boss: If you’re going to sell out, do it at the top of the market. (Bloomberg)

• How to sell a haunted house: Ghostly tales from real estate agents that are even scarier than this housing market. (Washington Post)

• Cities Foster Serendipity. But Can They Do It When Workers Are at Home? Revisiting a theory about chance collisions and innovation. (New York Times)

• The Race to Save Our Secrets From the Computers of the Future: Quantum technology could compromise our encryption systems. Can America replace them before it’s too late? (New York Times)

• This new data poisoning tool lets artists fight back against generative: AI The tool, called Nightshade, messes up training data in ways that could cause serious damage to image-generating AI models. (MIT Technology Review)

• Voters under 30 are trending left of the general electorate: They could make a difference for Democrats in 2024 — if they bother to vote. (ABC News)

Be sure to check out our Masters in Business next week with Michael Carmen, who is the Co-Head of Private Markets at Wellington Management. He manages a diversified portfolio of late-stage growth equity in technology, consumer, health care, and financial services sectors. Wellington is one of the world’s top 20 asset managers, was founded in 1933, and runs $1.2 trillion in client assets.

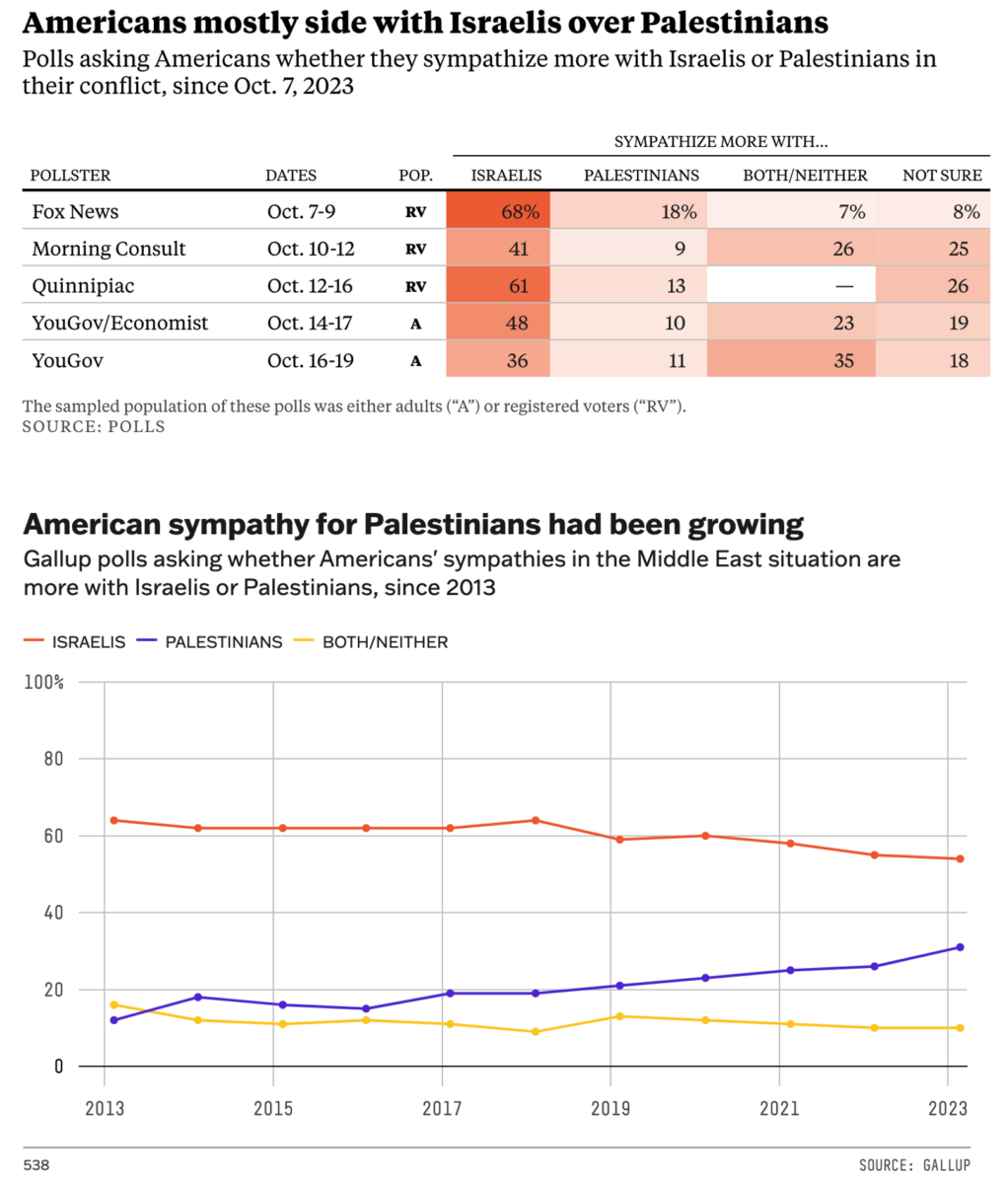

What Americans think about the war in Israel-Gaza

Source: ABC News

Sign up for our reads-only mailing list here.