My mid-week morning train WFH reads:

• The Free-Money Experiment Is Over: The carnage from the bond market—where the rout is worse than anything you’ll find in the history books since 1787—is spreading, and the implications are nasty. (Businessweek)

• Why Silicon Valley Falls for Frauds: FTX’s Sam Bankman-Fried will stand trial on charges of overseeing fraud that sucked in high-profile investors and hundreds of thousands of clients. Why do smart people buy into bad companies? (Wired)

• The New Kings of Wall Street Aren’t Banks. Private Funds Fuel Corporate America. With interest rates at multiyear highs, hedge funds and private equity are taking over lending. (Wall Street Journal)

• J.P. Morgan Promises Its Fundamental Portfolio Managers an AI ‘Co-Pilot,’ Not a Boss: “We teach our analysts what generative AI can do and what it cannot do. When you tell people about those limitations, they recognize that ‘ok, I’m still the decision maker here,’” says J.P. Morgan Asset Management’s Arezu Moghadam. (Institutional Investor)

• China’s Rich Entrust Total Strangers to Sneak Cash Out of the Country: Professional wealth advisers connect clients to remittance firms that rely on customer trust—and sometimes criminal cash. (Bloomberg)

• The Remaking of The Wall Street Journal: Emma Tucker, the top editor, is moving away from some of the organization’s traditions. (New York Times)

• Musk is nearly done destroying what made Twitter Twitter. For news organizations and consumers, Twitter was particularly useful. You could see what stories were being covered and how. You could watch as events occurred in real-time, thanks to people on the ground who were seeing what was unfolding. And you could share stories you found interesting, sending other users away only for them to come back and see what new news was emerging. (Washington Post) see also Did Elon Musk Endorse Biden, Come Out as Transgender and Die of Suicide? Popular posts on X showed several purported breaking news items with links to articles on Fortune.com and Axios.com. (Snopes)

• Is There Sunken Treasure Beneath the Treacherous Currents of Hell Gate? In the heart of New York City, a centuries-long hunt for Revolutionary War–Era gold. (Atlas Obscura)

• The Genius Behind Hollywood’s Most Indelible Sets: How Jack Fisk, the master production designer behind ‘Killers of the Flower Moon’ and many other films, brings the past to life. (New York Times)

• ‘I never lived a life I didn’t want to live’: Sly Stone on addiction, ageing and changing music for ever: The immeasurably influential, infamously erratic soul star has written an unlikely autobiography. In a rare interview, Stone opens up on drugs, feuds and his treasure trove of unreleased tracks. (The Guardian)

Be sure to check out our Masters in Business interview interview this weekend with author Michael Lewis. His latest book Going Infinite: The Rise and Fall of a New Tycoon about the rise and fall of FTX’s founder Sam Bankman Fried. Lewis spent a year embedded with Bankman Fried, who at one time was both the youngest billionaire worth nearly $100 billion dollars. The quirky crypto founder is now under arrest and awaiting trial for massive fraud.

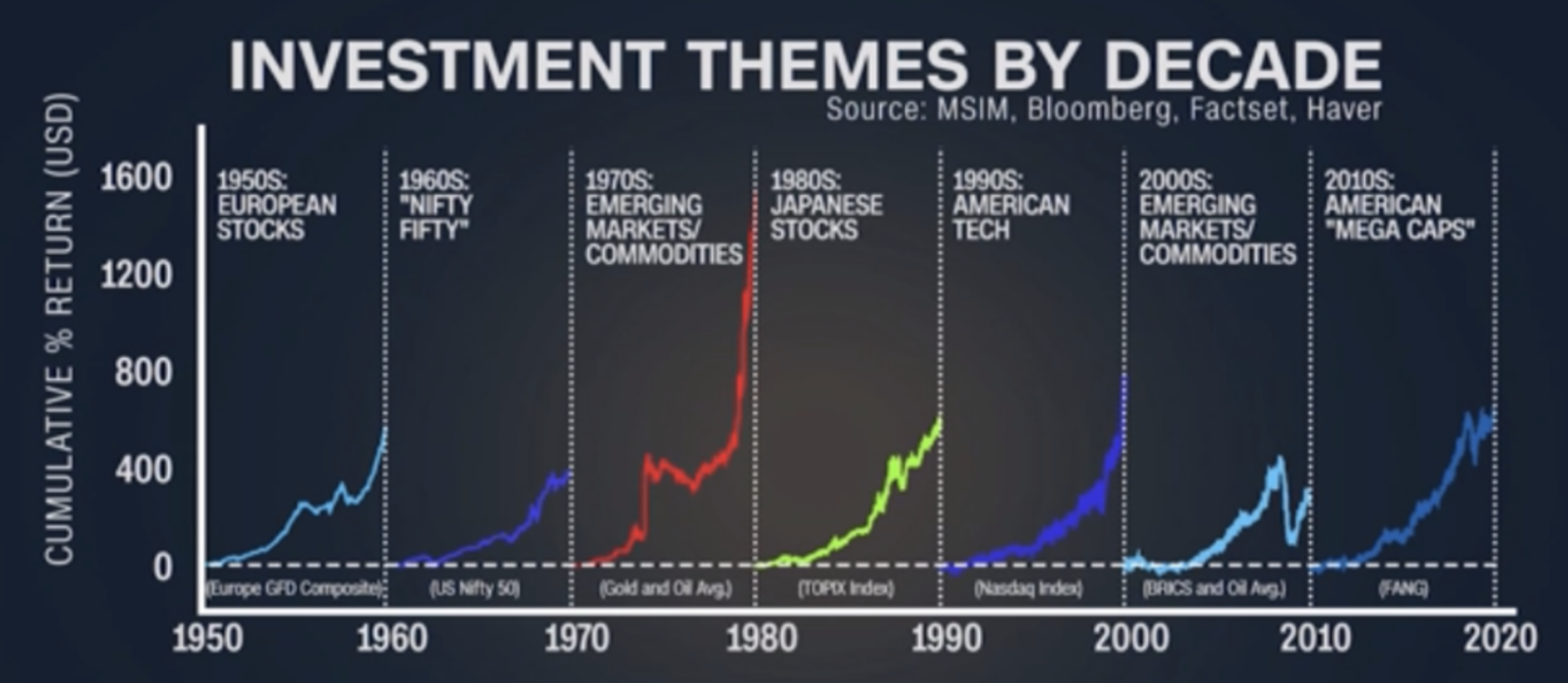

Investment Themes by Decade

Source: NS Capital

Sign up for our reads-only mailing list here.