My mid-week morning train WFH reads:

• How to Invest During Times of War: For those not directly facing conflict, you should focus your investments on those assets that do well during periods of higher inflation since inflation tends to be higher during wartime. Historically this meant investing in global equities, real estate, and short-term bonds. https://ofdollarsanddata.com/how-to-invest-during-times-of-war/ see also What Defense Stocks Say About a More Violent World: Though shares of military contractors only price in a small chance of escalation in Israel’s war with Hamas, financial factors muddle the signal. (Wall Street Journal)

• The Five-Day Office Week Is Dead: How many Americans swiped and tapped electronic cards to gain entry into their offices? This month, occupancy rates were at 50 percent of February 2020 levels. That is shocking — only half as many days are spent in the office compared with prepandemic times. (New York Times)

• Bloomberg Says It Is Using Machine Learning to Deliver Near Real-Time Bond Prices: “You can trust this price as a reference price for that bond at that point in time,” says Tony McManus, global head of enterprise data at Bloomberg. (Institutional Investor)

• Something Is Golden in the State of Denmark: Can Novo Nordisk’s success really be a problem for the Danish economy? (The Atlantic)

• Real Estate Brokers Pocketing Up to 6% in Fees Draw Antitrust Scrutiny: DOJ weighs case as class-action trial starts in Missouri Typical 5%-6% commission split by two brokers adds to costs. (Bloomberg) but see also Home Sales on Track for Slowest Year Since Housing Bust: Residential real-estate market hindered by mortgage rates, limited inventory. (Wall Street Journal)

• No, Really, What Is Going On With Sam Bankman-Fried’s Baffling Defense? His lawyers have confounded observers, pissed off the judge, and dropped few clues about their endgame. (Slate)

• You’re not going to like what comes after Pax Americana. This attack is probably an attempt to disrupt the possibility of an Israel-Saudi peace deal, which the U.S. has been trying to facilitate. Such a deal — which would be a continuation of the “Abraham Accords” process initiated under Trump —would make it more difficult for Hamas to obtain money from Saudi benefactors; it would also mean that every major Sunni Arab power recognizes the state of Israel, meaning that Hamas’ image as anything other than a client of Shiite Iran would be shattered. (Noahpinion)

• Octopus Intelligence Shakes Up Darwin’s Tree: There does not seem to be a Tree of Intelligence, which deepens the mystery of intelligence (Mind Matters)

• ‘Hackney Diamonds’ by the Rolling Stones Review: A Classic Band’s New Luster: The group’s first album of original material in nearly two decades feels genuinely fresh, and features Mick Jagger, Keith Richards and guests Lady Gaga and Paul McCartney in fine form. (Wall Street Journal)

• How the sole of the foot sparked a tactical revolution in football: Some coaches could react negatively to a player disagreeing with them on the training pitch and making a tactical suggestion, but that was never De Zerbi’s way. Vacca and others would spend hours in the coach’s office talking tactics. “People who don’t know him might have another idea, but he’s really humble and a footballer can tell him anything,” Vacca says. “He’s the one who has the final say, but when you say something to him, he’ll go away and think about. (The Athletic)

Be sure to check out our Masters in Business next week with Graeme Forster, a director at Orbis Holdings Ltd., which has $34 billion in assets under management. Orbis deploys a unique fee arrangement, where they are only paid a fee when they outperform their benchmark and refund fees to clients when they underperform. The Orbis Global Equity is their flagship fund, accounting for 67% of their assets, and has compounded at 11% annually, outperforming its benchmark since its 1990 inception.

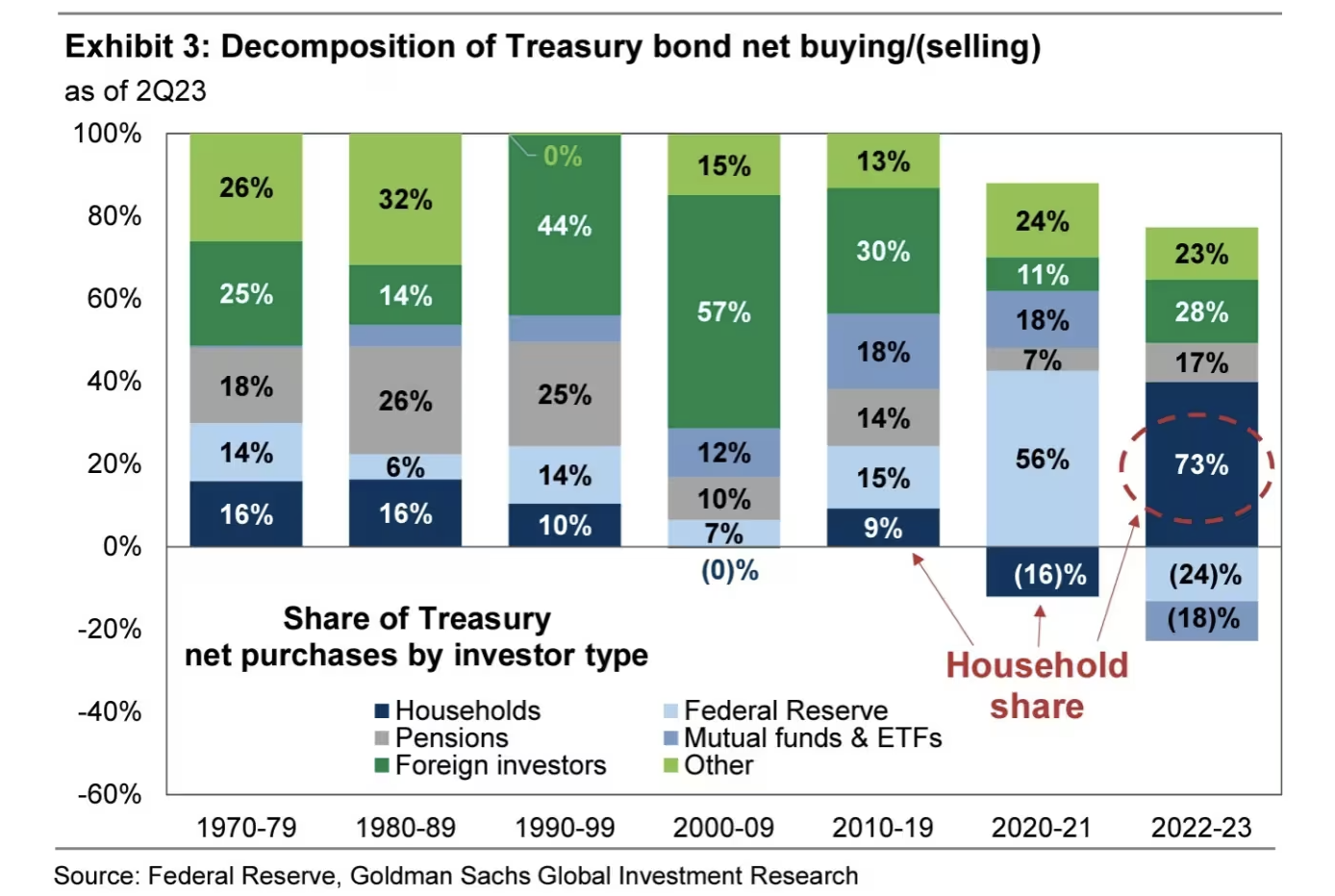

Americans Love Treasuries

Source: Goldman Sachs via Financial Times

Sign up for our reads-only mailing list here.