My end-of-week morning train WFH reads:

• What the US got right that Europe did not: America’s post-pandemic recovery has left Europe in the dust. (Financial Times)

• The Land Where Inflation Is Good News: Food and energy price increases triggered by the pandemic and the Ukraine war are helping end the long, bleak era of Japanification. (Wall Street Journal)

• The Real Reason So Many Asset Managers Are Struggling in China: The world’s second-biggest economy has its own rules of engagement. “You’re not going to change them. You have to accept what they are and find ways to adapt your business.” (Institutional Investor)

• Six Months Ago NPR Left Twitter. The Effects Have Been Negligible: The numbers confirm what many of us have long suspected — that Twitter wasn’t worth the effort, at least in terms of traffic (Nieman Reports) see also Twitter Was for News: Elon Musk keeps finding inventive ways to ruin the one thing his social network was great for. (Slate)

• OpenAI Is A Lot More Vulnerable Than You Think: All the press, money, and awards in the world won’t prevent OpenAI from the cold reality of competition. (Big Technology)

• The $2 Million Coal Mine That Might Hold a $37 Billion Treasure: Wyoming discovery could be America’s first new source of rare-earth elements since 1952. (Wall Street Journal)

• Electric Planes, Once a Fantasy, Start to Take to the Skies: How a small plane’s 16-day trip from Vermont to Florida might foreshadow a new era of battery-powered air travel long considered implausible. (New York Times)

• Dietary guidelines may soon warn against ultraprocessed foods: The guidelines could change the way Americans view nutrition by focusing on how their food is made and what happens to it before they bring it home. (Washington Post)

• The unmasking of the narcissistic, conspiracy-spreading baby-boomer rock star: “These days they’re just peddling nostalgia,” this person said, “along with the crazy stuff.” (Los Angeles Times) see also Why We Idolize Assholes: The asshole is the archetype of our time. That’s not a coincidence. (Fatherly)

• Danny DeVito Has Never Heard the Term “Short King” A long conversation with the legend about returning to the stage, being in a grandpa chat with Bruce Springsteen, and working with Arnold Schwarzenegger again. (GQ)

Be sure to check out our Masters in Business next week with Linda Gibson, CEO of PGIM‘s Quantitative Solutions, which manages $119 billion via quantitative and multi-asset solutions. PGIM is one of the world’s largest asset managers, running $1.27 trillion in client assets.

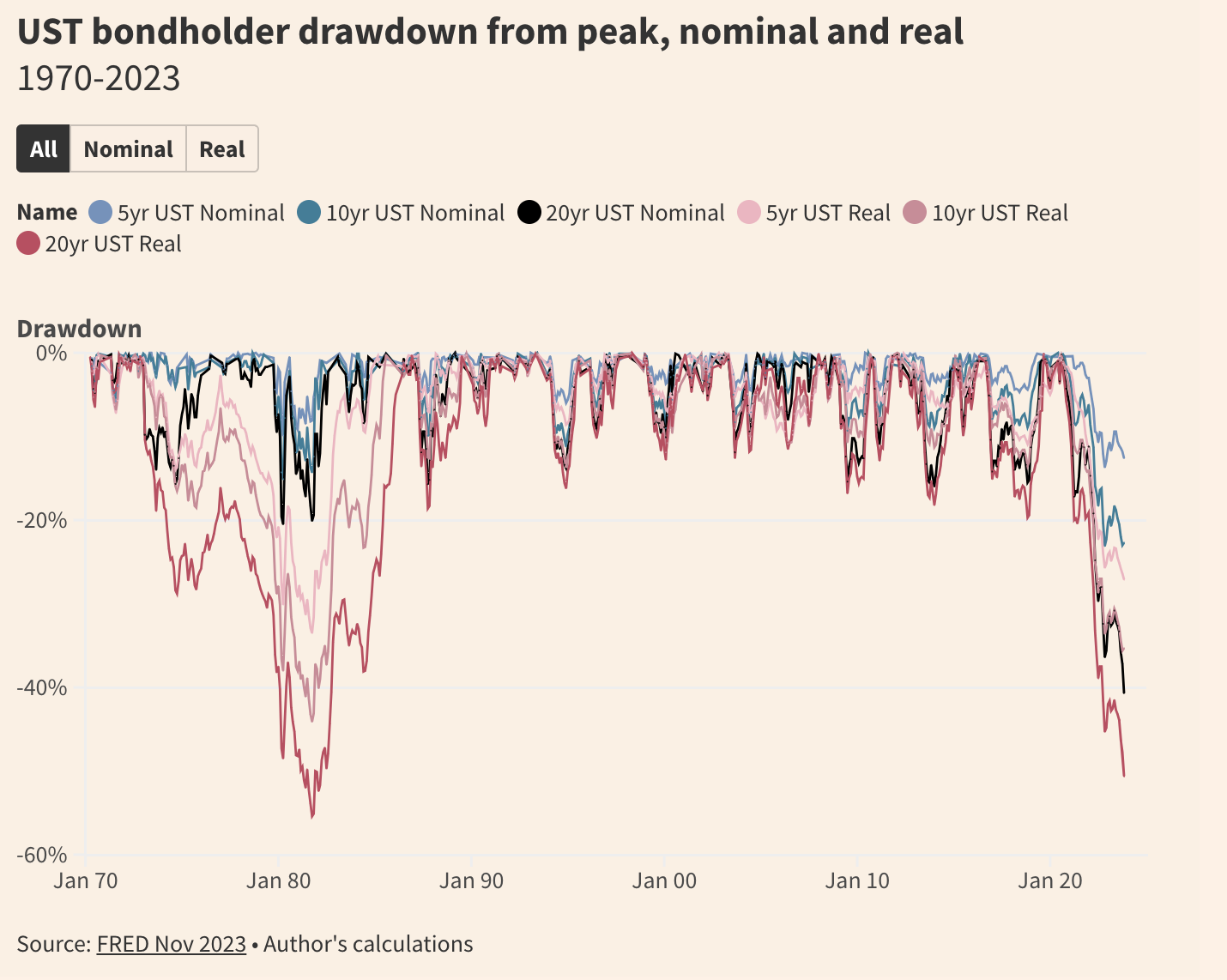

Is this bond bear market really worse than the 1970s?

Source: FT ALphaville

Sign up for our reads-only mailing list here.