Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures:

• Over Three Decades, Tech Obliterated Media: My front-row seat to a slow-moving catastrophe. (New York Magazine)

• A $560 Billion Property Warning Hits Banks From NY to Tokyo: Lenders face debt maturities, lower values after thaw in deals; Multifamily also a focus following change in New York rent law (Bloomberg)

• Anxiety, Mood Swings and Sleepless Nights: Life Near a Bitcoin Mine: Pushed by an advocacy group, Arkansas became the first state to shield noisy cryptocurrency operators from unhappy neighbors. A furious backlash has some lawmakers considering a statewide ban. (New York Times)

• Realtor Commissions Are Still a Hefty Part of Home Sales. Maybe Not for Long. Despite years of technology disruption, home commissions remain stuck near 6%. Now courts, consumers, and some brokers are fighting back. (Barron’s)

• How bad is Tesla’s hazardous waste problem in California? Investigators digging through Tesla’s trash discovered hazardous waste violations at more than 100 facilities. (The Verge)

• Six Reasons Why It’s So Hard to Get Your Weight-Loss Drugs: An array of obstacles makes it difficult for patients to obtain Wegovy or Zepbound. Finding Wegovy is “like winning the lottery,” one nurse practitioner said. (New York Times)

• Publix versus the public: By 2019, Publix became the second-largest distributor of oxycodone in Florida, surpassing CVS and trailing only Walgreens. (Popular Information)

• Inside the Underground Site Where ‘Neural Networks’ Churn Out Fake IDs: The site, called OnlyFake, threatens to streamline everything from bank fraud to money laundering, and has implications for cybersecurity writ large. (404)

• He Hunts Sloppy Scientists. He’s Finding Lots of Prey. Meet Sholto David, whose error-spotting has raised a question: If researchers aren’t getting the little things right, what else might be wrong? (New York Times)

• Prediction Markets Have an Elections Problem: Weeks after it was clear that Donald Trump lost the 2020 election, you could still make pennies on the dollar betting Joe Biden would win. Why doesn’t smart money drive out dumb money in election markets? (Asterisk)

Be sure to check out our Masters in Business this week with David Einhorn, Greenlight Capital, a value-oriented hedge fund founded in January 1996. Since its inception, Greenlight has outperformed the S&P 500 by more than 300 basis points annually. He famously shorted Allied Capital and Lehman before its bankruptcy and was named one of Time magazine’s 100 most influential people in the world.

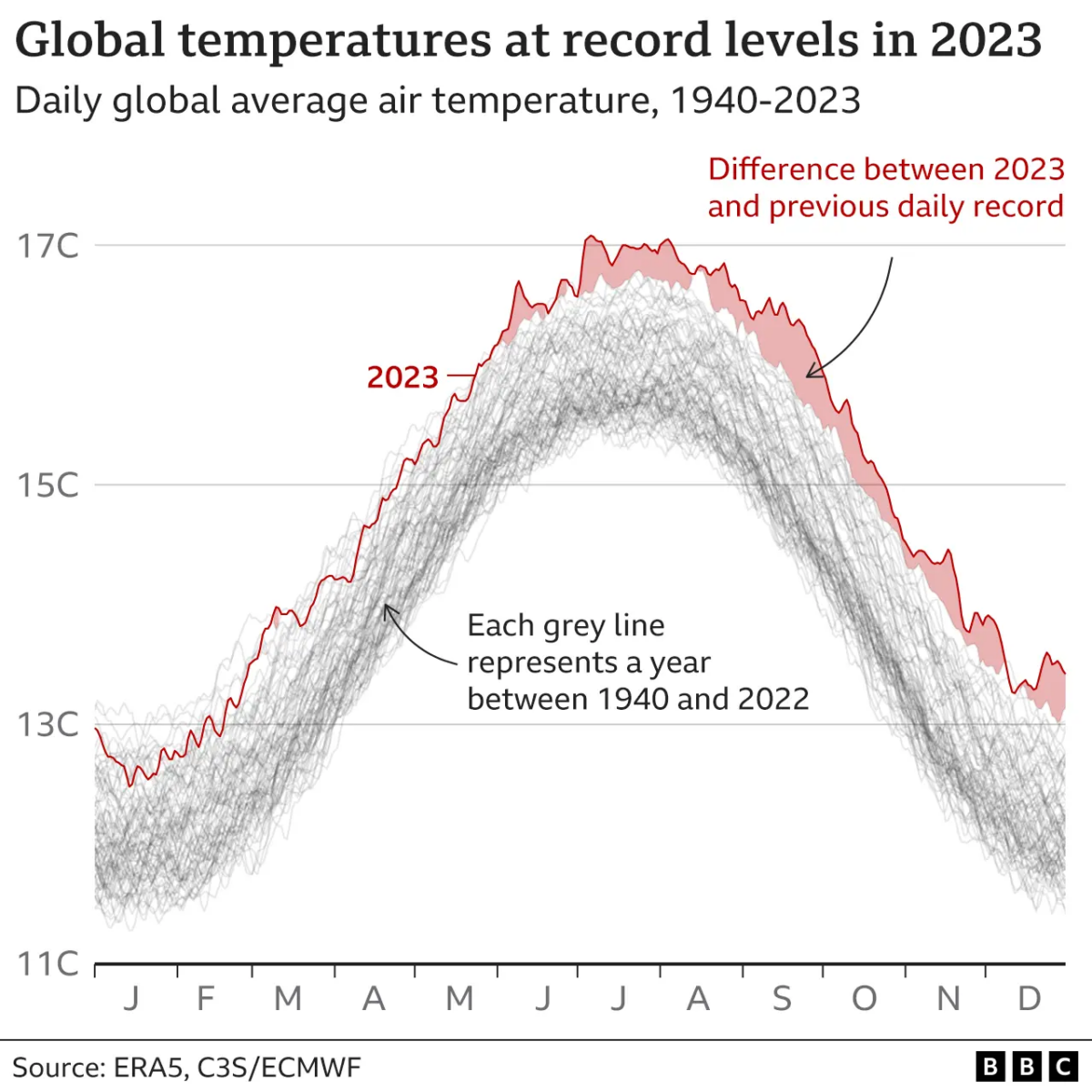

2023 confirmed as world’s hottest year on record

Source: BBC

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.