@TBPInvictus here:

The most recent Employment Situation Summary a/k/a “jobs report” a/k/a NFP showed a healthy gain in jobs, albeit with some meaningful downward revisions to prior months.

It also showed an unemployment rate of a still-low 4.1%. That rate is calculated by taking the unemployment level (Numerator) and dividing it by the labor force (Denominator). The product of that calculation – the quotient – is the unemployment rate. Last month (in thousands), it was 6,811/168,009 = 0.0405 or, with rounding, 4.1%.

Friend of The Big Picture and former Fed economist Claudia Sahm conceived of a real-time recession indicator many years ago, a rule that now bears her name, i.e. the Sahm Rule. The purpose of the Rule, said Claudia in a Substack post, was to assist and guide with policy:

The Sahm rule was born for a specific purpose: a tool for better policy.

I created the Sahm rule to send out stimulus checks automatically. The idea was to act fast to make the recession less severe and help families.

Think about it: It can take months/years for the NBER – the official arbiter of recession dating – to let us know that yes, we just went through a recession, which does absolutely nothing for the unemployed and others suffering the brunt of it. A contemporaneous indicator could be immensely useful to policy makers.

The Rule is simple, elegant, and rarely triggers a false positive: When the three-month moving average of the national unemployment rate is 0.5 percentage point or more above its low over the prior twelve months, we are in the early months of recession.

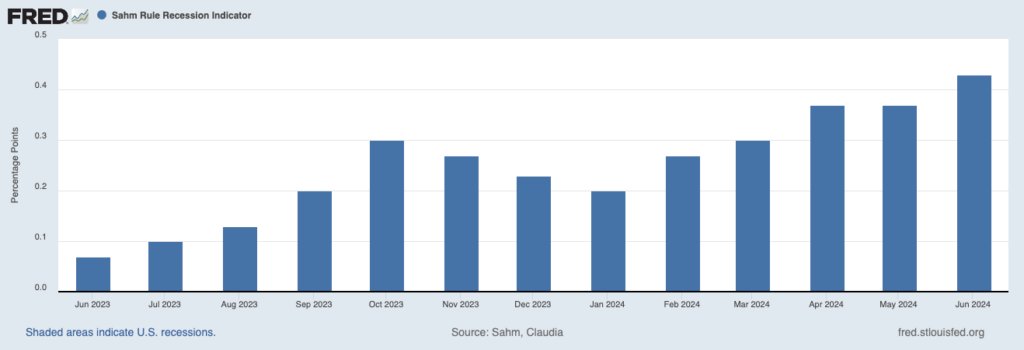

Since February of this year, the Rule has gone from 0.27 to 0.30 to 0.37 to 0.37 and, most recently, to a worrisome 0.43. Which is to say that it could, most likely will, trigger next month. (See graph at top).

So, is it time to worry? Probably not, as Claudia wrote late last year:

After more than two years of severe labor shortages, workers are still coming back at a somewhat faster pace than new jobs being created. The labor force participation of prime-age women is at an all-time high after an outsized decline in 2020 in what was dubbed a “she-cession.” Workers with disabilities and Black men made historic gains this year, too. After a stoppage during the pandemic, immigrants on work visas are entering the country. Taken together, economist Julia Coronado, the president and founder of MacroPolicy Perspectives, argues that the rising supply of workers is good for the rebalancing of the labor market, even if it shows up initially in somewhat higher unemployment rates.

If that’s the case, recession indicators based on the unemployment rate, like the Sahm rule, may not be as accurate this time. On the path back to normal, unemployment may move above 4% for some time, which would trigger the rule but not a recession as jobs catch up to supply. The Sahm rule would not be the first recession indicator to “break” in this cycle. Last year, real gross domestic product declined for two consecutive quarters without the National Bureau of Economic Research declaring a recession — something that hadn’t occurred in the US since 1947. The declines were driven by a sharp drop in net exports and large swings in inventories – both of which are consistent with resolving disruptions in global supply chains.

Most economists – and we here at TBP know lots of them – believe the Sahm Rule could, in fact, trigger a false positive next month.

The reason this is important, and that we are getting out ahead of it, is that there are bad faith commentators and pundits who are going to seize upon a trigger to advance a political narrative. It will be very low-hanging fruit, and they will be unable to resist it, even though they’ve probably never mentioned the Sahm Rule previously and likely have no idea what it is or how it works. A trigger = recession = Biden’s poor stewardship of the economy. It is not going to be that simple, and you should not fall for it.

Yes, the economy is showing signs of slowing. Yes, we believe the Fed could be behind the curve on rate cuts and that could, perhaps, prove problematic. But no, we do not believe a trigger of Claudia’s rule next month will signal an economy in recession.

UPDATING with a final thought: If the Sahm Rule triggers on August 2 it will, as mentioned, be seized upon by the right to bash Biden’s stewardship of the economy. If the Fed then reacts as it should – arguably should have already – by cutting rates on September 18, the right will be apoplectic that Jay Powell is in the tank for Biden. They will want to have it both ways, i.e. claim the economy’s in recession but that Powell is wrong to try to address it. It will be hilariously epic.

~~~

Barry adds: I have two additional thoughts to the discussion of the Sahm rule.

First, as Claudia wrote, “The Sahm Rule is a historical pattern, not a law of nature.” We have no rule of economics that has a perfect track record. Even ones that have gotten 9 out of 10 right. Even the Yield Curve Inversion in the U.S. (but not overseas) has such a small sample set it cannot be blindly relied upon.

Second, we have no historical analog to the current era: Two decades of ultra-low or Zero rates, followed by a pandemic lockdown, and massive fiscal stimulus, with shortages of labor, houses, semiconductors, etc.

While some people toss around the word “unprecedented,” I find the framework that is most parallel to the present to be the post-WW2 era of the late 1940s and early 50s. The massive shift from wartime to civilian consumption led to all sorts of anomalies and one-offs.

I would be curious to see if we could apply the Sahm Rule to that era, just how well it would have performed…

Previously:

MiB: Identifying Recessions in Real Time (August 17, 2020)

At the Money: Forecasting Recessions (January 31, 2024)

Sources:

The Sahm rule: I created a monster

by Claudia Sahm

Stay At Home Macro, December 30, 2022

Why My Recession Rule Could Go Wrong This Time

By Claudia Sahm

Bloomberg, November 7, 2023

Economics is a Disgrace

Claudia Sahm

MacroMom July 29, 2020