The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads:

• America may be on the brink of an epic vibe shift: Stock prices at records, gas prices falling, and the Fed is cutting. Will it be enough to lift the sour consumer mood that set in during the pandemic? (Sherwood)

• The Mr. Beast Memo is a Guide to the Gen Z Workforce: Mr. Beast is one of the most fascinating people in the world. He is somewhat of an Isaac Newton or a da Vinci… for the digital age. He is obsessively a master of his craft, making clickbait-y game show style YouTube videos, with titles like “50 YouTubers Fight For $1,000,000” or “$456,000 Squid Game In Real Life!” with many getting more views than the presidential debate. He has more followers than people than there are people in United States—about 430 million across all his channels. Extrapolating that a bit, he’s a king. He clears north of $500 million each year, plows it all back into making videos and donating to charity. (Kyla’s Newsletter)

• Cliff Asness Has Steered Hedge Fund AQR Through Not One, Not Two, But Three Quant Crises: The self-proclaimed “world’s worst meditator” is still defending value — and railing against private equity. (Institutional Investor)

• The Subprime AI Crisis. It feels like the tides are rapidly turning, and multiple pale horses of the AI apocalypse have emerged: “a big, stupid magic trick” in the form of OpenAI’s (rushed) launch of its “o1 (codenamed: strawberry”) model, rumored price increases for future OpenAI models (and elsewhere), layoffs at Scale AI, and leaders fleeing OpenAI. These are all signs that things are beginning to collapse. As a result, I think it’s important to explain how precarious things are, and why we are in a trough of magical thinking. I want to express my concerns about the fragility of this movement and the obsessiveness and directionlessness that brought us here, and I want some of us to do better. (Where’s Your Ed At?)

• Israel’s ‘Hand of God’ Operation: A force that is looking in fear at its own iPhones and BlackBerrys is not in top condition to fight. (The Atlantic)

• The iPhones 16: But the iPhone has never really been fundamentally a telephone. On the iPhone, the Phone was always just another app. A special app, no question. Default placement in the Dock at the bottom of the Home Screen. Special background privileges within an otherwise highly constrained OS where most apps effectively quit when you’d go back to the Home Screen. Incoming phone calls instantly took over the entire screen. Jobs spent a lot of time in that introduction demonstrating the Phone app — including Visual Voicemail, a genuine breakthrough feature that required AT&T/Cingular’s cooperation on the back end. (Daring Fireball)

• A National UK Strategy for Bitcoin? Sell it all now! We doubt that Bitcoin has positive long-run fundamental value. Given the energy costs of settling transactions and producing Bitcoin, as well as cryptocurrency’s role in facilitating illicit finance, Bitcoin’s social value could be very small or even negative. With this in mind, we argued that, rather than elaborating a regulatory framework that helps legitimize crypto, authorities should simply let it burn (see here and here). Indeed, in the absence of legal protections, Budish concludes that the value of Bitcoin probably would collapse if it were widely used. (Money and Banking)

• The hidden value of vultures: Researchers believe a massive die-off of the birds led to over 100,000 additional human deaths per year in India. (Washington Post)

• Philosophy of the people: How two amateur schools pulled a generation of thinkers from the workers and teachers of the 19th-century American Midwest. (Aeon)

• Emmys Analysis: How ‘Hacks’ Beat ‘The Bear,’ ‘Shogun’ Changed the Game and Peacock Got on the Map. As voters contemplated whether The Bear is really a comedy, I suspect that many arrived at the conclusion that they should not punish the talent from The Bear for being promoted as such — but had pause about giving the show once again a prize called best comedy, which has historically gone to laugh-out-loud programs like Modern Family, Veep, Schitt’s Creek and Ted Lasso. (Hollywood Reporter)

Be sure to check out our Masters in Business this week with Victor Khosla, Founder and CIO of Strategic Value Partners. The firm manages $19 billion in client assets across a range of global private credit, distressed debt, hard assets (RE, infrastructure, planes, power plants) and event-driven opportunities. He established the proprietary trading desks at both Citi and Merrill Lynch, served as President of Cerberus Capital, and ran MooreSVP, a joint venture with Moore Capital.

Controlled Descent

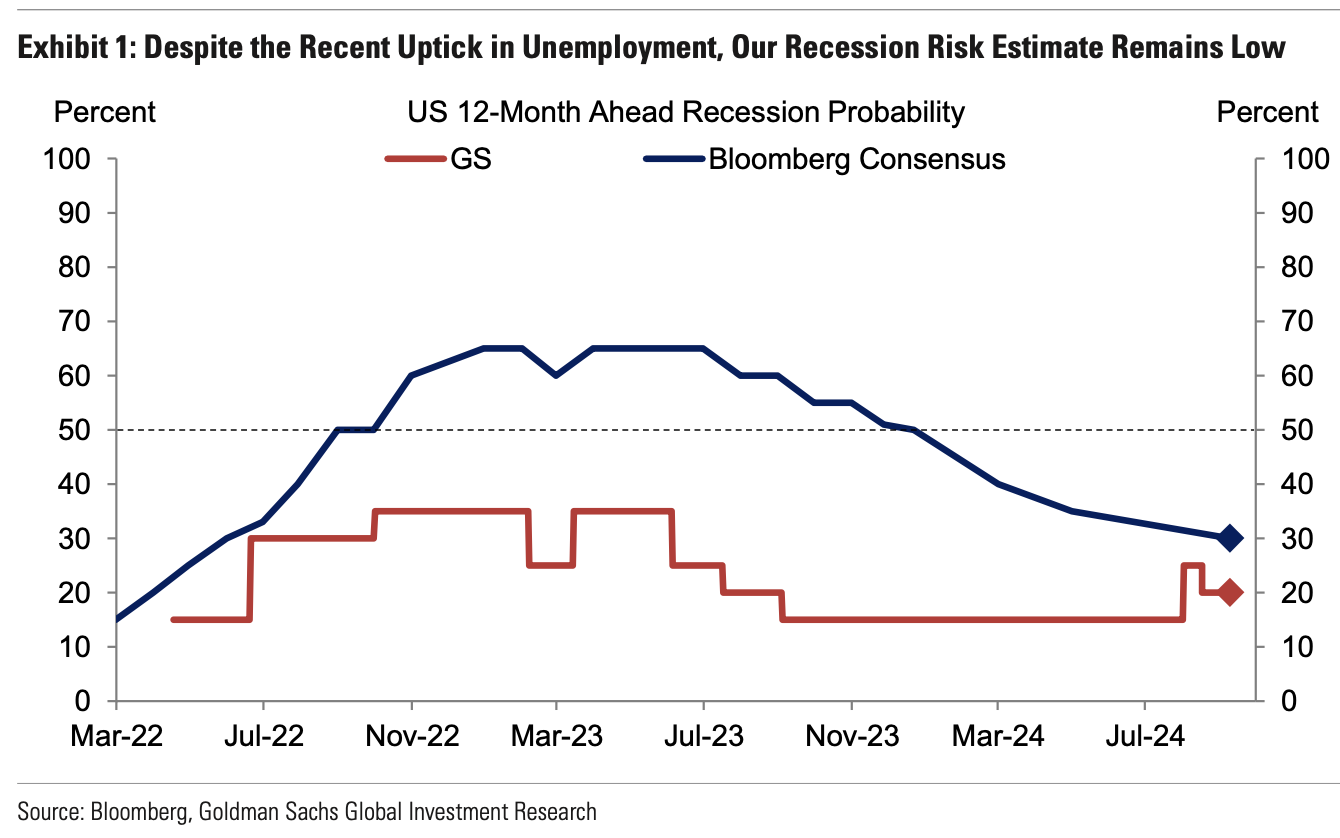

Source: Goldman Sachs

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.