My end-of-week morning train reads:

• The Plethora of Unknowns Means Questions for Bond Investors in 2025: Private and global credit offerings could provide diversification as debt markets deal with political and policy uncertainty. (Chief Investment Officer)

• After a Great Run for Stocks, Be Ready for Something Different: Sizzling returns may well continue, but our columnist suggests that it would be wise to prepare for the next storm. (New York Times)

• Mega Cap World Domination: Markets are hard because most things exist in shades of gray. It’s difficult to be certain about anything because no one knows what the future holds and the past can be unreliable when used incorrectly.(Wealth of Common Sense)

• Skydiving without a parachute: When bonds can’t save your portfolio. (Optimisticallie)

• Goldman Sachs destroys one of the most persistent myths about investing in stocks: “While valuations feature importantly in our toolbox to estimate forward equity returns, we should dispel an oft-repeated myth that equity valuations are mean-reverting,” Goldman Sachs analysts wrote. (TKer)

• Generational Shift—Data Centers Bring Change to Energy Landscape: Deals involving the data center sector are occurring regularly, as tech companies make moves to ensure they have a reliable supply of power for their energy-intensive operations. (Power)

• Have Americans Ever Really Been Healthy? Medical historians say that the phrase “Make America Healthy Again” obscures a past during which this country’s people ate, smoked and drank things that mostly left them unwell. (New York Times)

• The Universe Is Teeming With Complex Organic Molecules: Wherever astronomers look, they see life’s raw materials—and hints at answers to one of the great mysteries of science. (Wired)

• 11 Practical Life Hacks “Future You” Will Be Grateful For: Think of these as favors for Future You: low-lift, high-reward upgrades that you can spend a little time and money on now in order to reap the benefits down the road. Try one, two, or all of these simple steps that several Wirecutter journalists have successfully taken to better their everyday lives. (New York Times)

• How the biggest rock band in the world disappeared: Michael Stipe turned 65 right after New Year’s. Every generation has their “our childhood heroes are how old now?” moment — jaws surely dropped when Rita Hayworth turned 65, which is the precise age she became soon after Stipe’s band, R.E.M., released “Murmur,” its first album — but there is something about this particular rock star becoming eligible for Medicare that sticks in one’s gullet. Kurt Cobain, were he still here, would be just a couple of years from turning 60 himself. So you know. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Jonathan Clements. He has been a personal finance reporter at the Wall Street Journal for over twenty years and has written more than 1,000 columns. Last summer, Jonathan received a terminal diagnosis and announced it at his site. DON’T MISS his discussion of why “Dying is hard work” and what we all need to understand about money, life satisfaction, and planning.

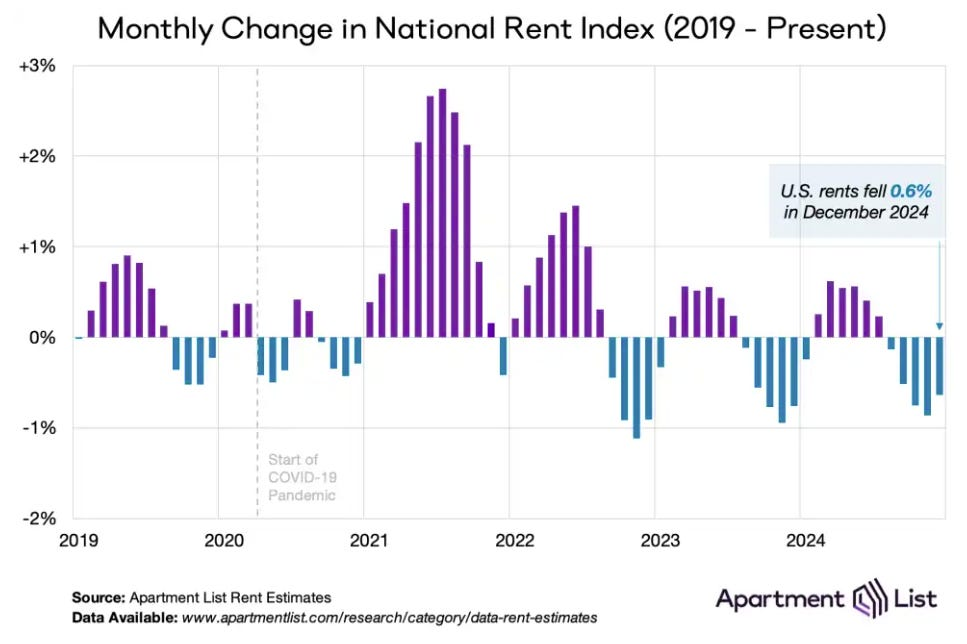

Asking Rents Mostly Unchanged Year-over-year

Source: Calculated Risk

Sign up for our reads-only mailing list here.