• The damning statistics that reveal the true cost of Brexit: on As January marks five years on from Britain leaving the EU, Alicja Hagopian and Kate Devlin explore its impact. (The Independent)

• On Bubble Watch. Exactly 25 years ago today, I published the first memo that brought a response from readers (after having written for almost ten years without receiving any). The memo was called “Bubble.com,” and the subject was the irrational behavior I thought was taking place with respect to tech, internet, and e-commerce stocks. The memo had two things going for it: it was right, and it was right fast. (Oaktree Capital) see also Seven pillars of market bubbles: We appear to be in the midst of a raging bitcoin bubble. The stock market, or at least its lunatic fringe of meme stocks and crypto-related firms, is not far behind. How can we understand the origins of speculative mania? Here are seven phrases of timeless relevance: (Acadian)

• J.P. Morgan’s Michael Cembalest Predicts Trump “Alchemists” Will Prompt a Correction in 2025: “They are going to break something. I just don’t know what.” (Institutional Investor)

• The Internet Is Worse Than a Brainwashing Machine: A rationale is always just a scroll or a click away. (The Atlantic)

• Annual ‘winners’ for most egregious US healthcare profiteering announced: Selling body parts without consent and billing desperate parents $97,599 for air transport among worst examples. (The Guardian) see also 2024 Shkreli Awards: Welcome to the 8th annual Shkreli Awards, the Lown Institute’s top ten list of the worst examples of profiteering and dysfunction in healthcare, named for the infamous “pharma bro” Martin Shkreli. (Lown Institute)

• Schools and City Governments Rely on Property Taxes. What Happens When Homeowners Revolt? Property tax reforms may address local government inequities. (Slate)

• The Militia and the Mole: A Freelance Vigilante: A wilderness survival trainer spent years undercover, climbing the ranks of right-wing militias. He didn’t tell police or the FBI. He didn’t tell his family or friends. He penetrated a new generation of militia leaders, which included doctors and government attorneys. Experts say that militias could have a renaissance under Donald Trump. He sent ProPublica a massive trove of documents. The conversations that he secretly recorded give a unique, startling window into the militia movement. (Pro Publica)

• L.A. Fires Show the Reality of Living in a World with 1.5°C of Warming: “Wildfires do not care about jurisdictional boundaries,” said Kathryn Barger, the chair of the Los Angeles Board of Supervisors, at a Jan. 9 news conference. Meanwhile, the sextet of localized blazes—the Palisades fire, the Eaton fire, the Hurst fire, the Sunset fire, the Lidia fire, and the Kenneth fire—blurred in the public mind and in the sprawl of destruction into one great undifferentiated inferno. (Time) see also In the Palisades, an Evacuation Disaster Was Years in the Making: Some Pacific Palisades residents said the community had long asked for more detailed fire preparation plans. When a fire raged through the community this week, gridlock ensued. (New York Times) see also Falsehoods around the L.A. fires are proliferating on the right: Anything to keep the realities of climate change from spreading. (Washington Post)

• Mark Zuckerberg’s Fact-Checking Announcement Is Worse Than You Think: Meta’s return to political content, looser moderation rules, and Trump-friendly policies look a lot like Musk’s vision for X. (Slate)

• How Fear and Conspiracy Theories Fuel South Korea’s Political Crisis: Right-wing YouTubers helped President Yoon Suk Yeol win his election. They are now his allies in the wake of his botched imposition of martial law. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Brian Hurst, founder and CIO of ClearAlpha, a multi strategy hedge fund managing $1 billion in client assets. Hurst was Cliff Asness’ first hire in the Quantitative Research Group at Goldman Sachs Asset Mgmt, where he built the portfolio management and trading technology for the Global Alpha Fund. He was the first non-Founding Partner at AQR Capital Management, where for 21 years he served variously as PM and head of trading for the firm and designed and built AQR’s trading platform.

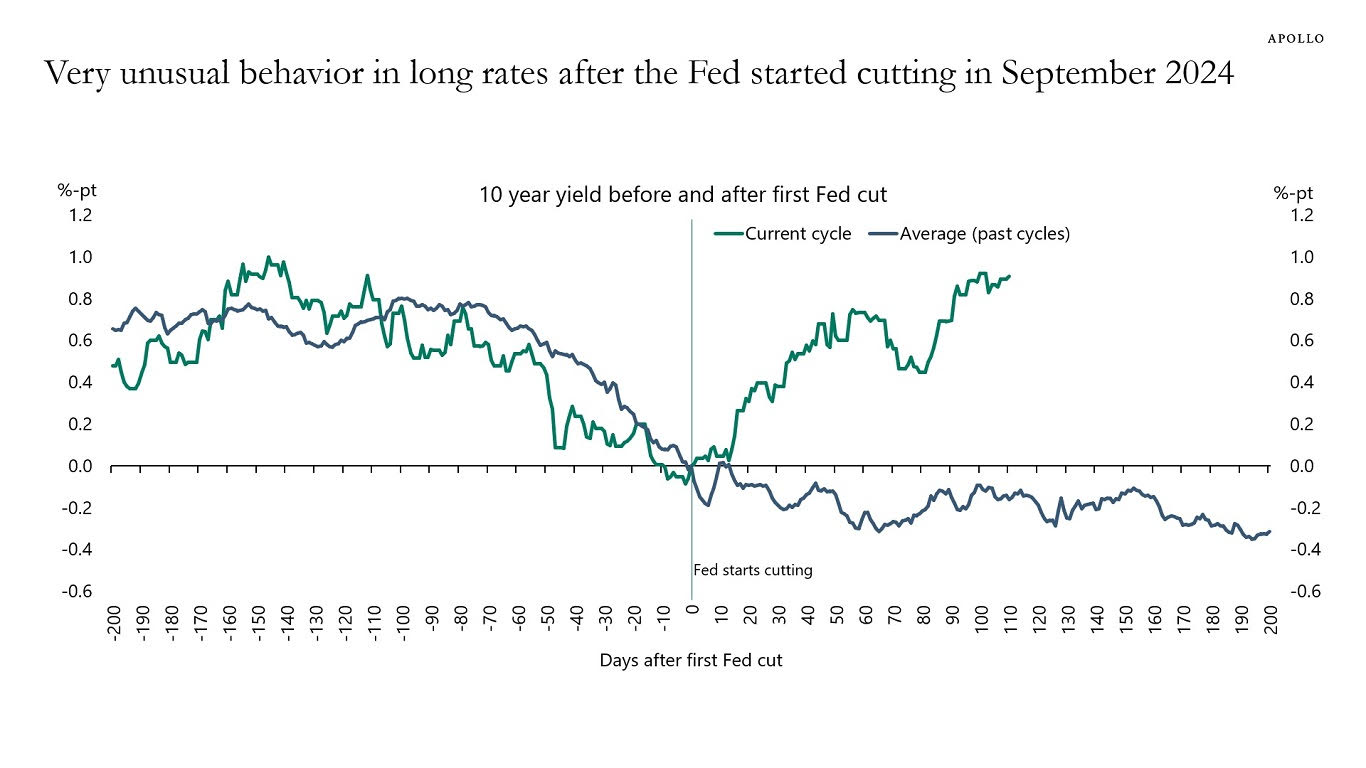

The Move in Long Rates Is Very Unusual

Source: Apollo

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.