My end-of-week morning train WFH reads:

• Nasty Money: Nature is fantastic at devising numerous methods to continue the propagation of the species. Thermonasty is a case in point. (A Teachable Moment)

• Is the Stock Market Cheap Yet? US stocks are trading at a 5% discount to their fair values, according to Morningstar’s analysis. (Morningstar)

• Most of what you’ve heard about the stock market’s gyrations is wrong: With the stock market experiencing gyrations that haven’t been seen in, well, months, investors are fretting about the future of their portfolios and the prospects of a recession triggered by President Trump’s will-he-or-won’t-he follow-through with his tariff threats. (Los Angeles Times)

• Mean reversion in the stock market is an optical illusion: No wonder why we don’t hear about people consistently beating the market by trading mean reversion .(TKer)

• Vroom! Touring Italy’s Supercar Factories: In the country’s “Motor Valley,” racecar enthusiasts can admire, and even drive, Maseratis, Lamborghinis, Ferraris and more. (New York Times) see also China’s EV Boom Is Bad For U.S.Tech:.The future of cars is code, not chrome. Volvo’s ES90 is the latest example of computing’s conquest of the automotive industry. Industry insiders might shrug and say “so what.” But Volvo’s announcement serves as a stark reminder: While Tesla may appear to dominate the electric vehicle market, it’s facing intense competition. Chinese automakers aren’t just coming – they’ve already arrived. (Crazy Stupid Tech)

• Global Investment Returns Yearbook 2025 – what 125 years of history tells us about the future: Here is what a 125 years of historical market data looks like. In light of rising market concentration and correlations, this year’s Yearbook includes a special chapter on global and multi-asset diversification. (UBS)

• A Guide to Refinancing Your Mortgage When the Time Is Right: Buying a house usually means years of monthly payments to a bank. But the terms are surprisingly negotiable — and trading your existing rate for a lower one can save you thousands of dollars. (Bloomberg Wealth)

• Why the Maga mindset is different. US decisions can no longer be analysed using assumptions shared across the democratic west. (Financial Times) see also Remember the Greatest Generation? Today’s GOP Is the Worst Generation: Republican pols, I listened to you prattle on for years about fascism and freedom. You were lying the whole time. (New Republic)

• Tesla faces trouble from BYD’s new EV charger breakthrough. Here’s what to know: China’s biggest seller of electric cars now claims to have the fastest chargers around. (Quartz)

• Edgar Allan Poe’s life was a mess. But his work was in his command. A new biography by Richard Kopley is a sympathetic portrait of the horror master, connecting his life story to his fiction. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Jim O’Shaughnessy, founder and CEO of O’Shaughnessy Ventures LLC (“OSV”), an investor in and accelerator of creative endeavors, fueling the worlds of art/science/tech. He is also the host of the Infinite Loops pod. Previously, he was founder andchair OSAM, which developed Canvas custom index (since sold to Franklyn Templeton), and Firector of Systematic Equity for Bear Stearns. His latest book is “Two Thoughts: A Timeless Collection of Infinite Wisdom.”

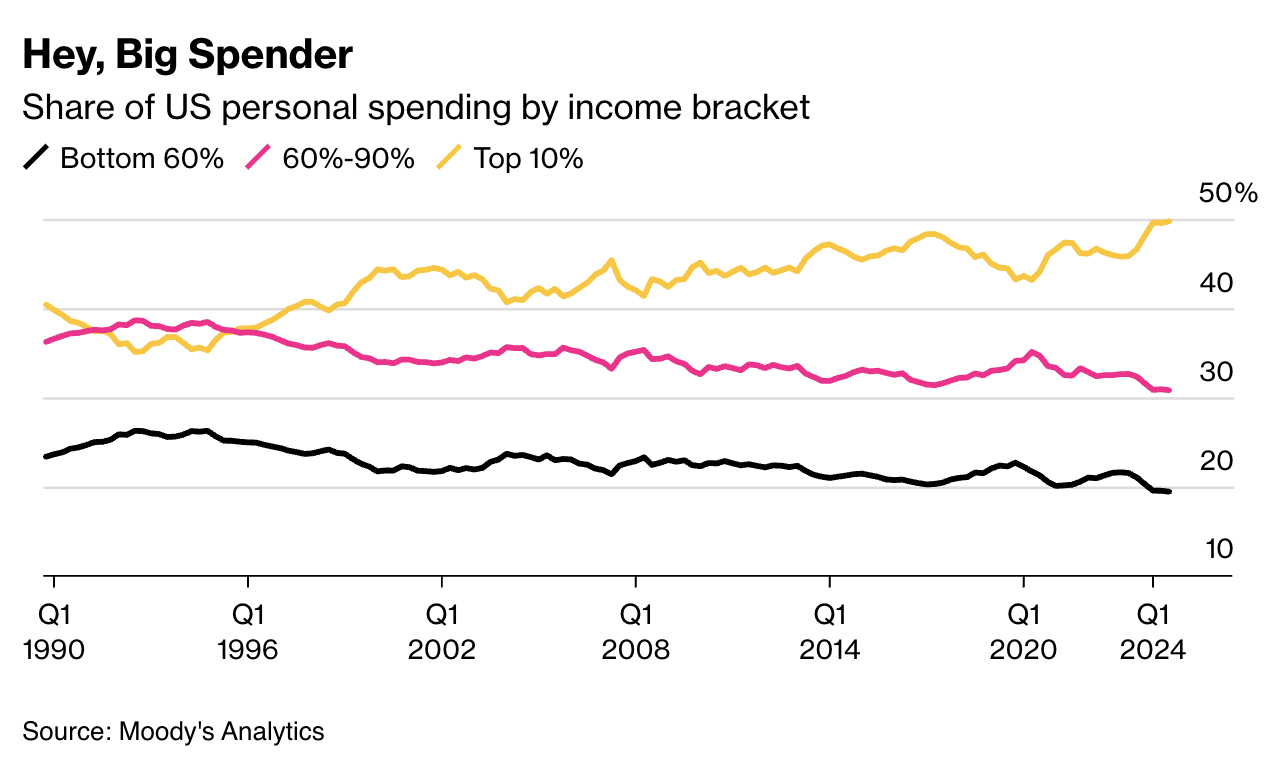

Industries get recalibrated, economic signals get crossed, and the social fabric begins to fray

Source: Businessweek

Sign up for our reads-only mailing list here.