My end-of-week morning train WFH reads:

• The Market Check: Congress Blinks; Law Firms Cower; The Market Speaks. (Intrinsic Value by Roger Lowenstein)

• Tariff Q&A: Welcome to the Actual Inbox: A brief comprehensive guide that hopefully answers all your questions. (Kyla’s Newsletter) see also The Trump White House Cited My Research to Justify Tariffs. It Got It All Wrong. Trade imbalances between two countries can emerge for many reasons that have nothing to do with protectionism. Americans spend more on clothing made in Sri Lanka than Sri Lankans spend on American pharmaceuticals and gas turbines. So what? That pattern reflects differences in natural resources, comparative advantage and development levels. The deficit numbers don’t suggest, let alone prove, unfair competition. • The Trump White House Cited My Research to Justify Tariffs. It Got It All Wrong. (New York Times)

• How Long Does it Take for the Market to Recover? When we examine all drawdowns exceeding 20%, the typical time to hit the bottom (from an all-time high) is anywhere from 7-24 months (0.6-2 years). You can see this in the table below which shows the median number of years for the market to go from an all-time high to a known decline of various magnitudes. (Of Dollars and Data)

• Ken Griffin Pushed the Luxury Home Market to New Highs—For Better or Worse: The billionaire hedge-funder’s presence in the market has driven prices higher than ever before. (Wall Street Journal)

• Bill McBride is on Recession Watch Metrics: I am now on recession watch, but still not yet predicting a recession for several reasons: the U.S. economy is very resilient and was on solid footing at the beginning of the year, the administration might reverse many of the tariffs (we’ve seen that before), and Congress might take back complete authority for tariffs. Also, perhaps these tariffs are not enough to topple the economy. (Calculated Risk) see also How to Prepare for a Recession: The older you are, and the more likely you are to get laid off, the more important it is to have liquid savings. (The Atlantic)

• US houses are shrinking as inflation pushes ‘McMansions’ out of reach: Even in Texas, the American dream of home ownership is being downsized because of an affordability crisis. (Financial Times)

• Everybody Hates Howard Lutnick: Meet the man who’s displaced Elon Musk as the most loathed member of Trump’s inner circle. (New Republic)

• 28% Loaded. Another trip around the sun. Some thoughts on saying goodbye to my mid-20s, going monk mode for a few months, etc. (Young Money)

• Will Shortz Is Back in the Game: The Times’ crossword-puzzle editor returns to work — and table tennis — after two strokes that nearly ended his career. (Vulture)

• Tracy Chapman Wants to Speak for Herself: For years, the singer and songwriter has avoided the spotlight. But she is breaking her silence to look back on her self-titled debut and its powerful hit “Fast Car.” (New York Times)

Be sure to check out our Masters in Business this week with Tony Yoseloff, Managing Partner and Chief Investment Officer at the $35 billion Davidson Kempner. He is Chairman of the New York Public Library’s endowment, sits on the Board of Trustees of Princeton and the Board of Directors of its endowment, and is Vice Chair of the investment committee at New York-Presbyterian.

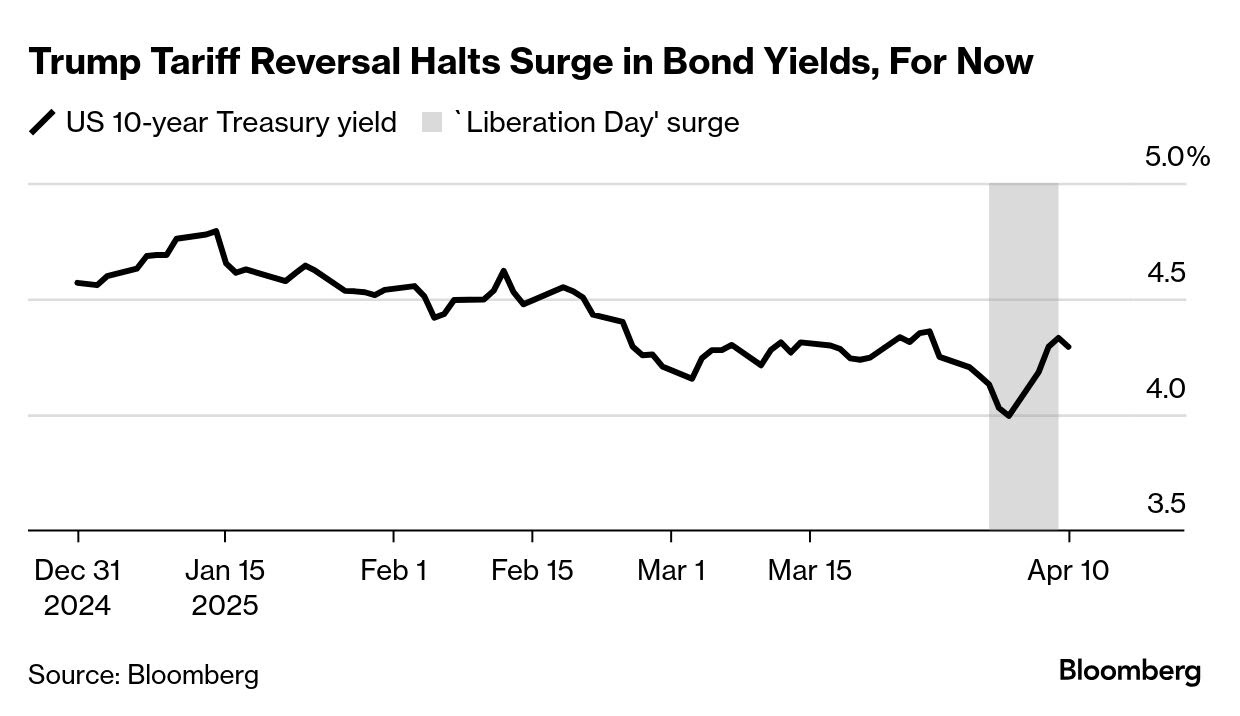

For all of the attention paid to the slump in stocks, it was the bond market that prompted President Trump to reverse course on tariffs

Source: Bloomberg

Sign up for our reads-only mailing list here.