My end-of-week morning train WFH reads:

• Tesla’s ‘Headwinds’ Are Coming From Its C-Suite. Elon Musk is a key figure in the economic environment that’s punishing sales. Plus: India’s car tariffs are under pressure. (Bloomberg)

• The Failure of Warren Buffett: The best version of capitalism wasn’t good enough. (How Things Work) see also Be Like You: Statistically, the probabilities are overwhelming that you are not one of the world’s greatest investors. The odds are a staggering 100 million to 1. And that’s fine. You don’t have to be the GOAT to do perfectly well in the stock market. (The Big Picture)

• We figured out where gold comes from. The answer is explosive. A new study has found that such heavy metals may have formed through eruptions on a rare type of star called a magnetar. (Washington Post)

• AI Beneficiaries: Investing in Second-Order Effects: For over 20 years, Counterpoint Global has had a dedicated research effort focused on disruption and innovation. While big technological innovations create huge investment opportunities, we have found that it’s often the companies that leverage the technology, rather than the suppliers that create the most enduring value for investors. We believe this insight applies to AI and automation and we propose a way to systematically identify which companies are set for efficiency gains and increased profitability from adopting AI. (Counterpoint Global)

• Toyota Says Tariffs Will Erase $1.3 Billion in Profits in Just 2 Months: The automaker’s somber forecast for the fiscal year underscored how quickly fortunes had turned for many companies reckoning with President Trump’s tariffs. (New York Times)

• Rats In The Cellar: Tariffs Are About To Hit The US Consumer And No One Sees Them Yet: Consumer or Administration Still Has No Clear Understanding Of The Tariff Plan/Strategy Canadian And Chinese Exports To The US Are Plummeting, Shelves Expected To Be Lighter Within The Month Consumers Still Perceive Real Estate As Best Long-Term Investments. (Housing Notes)

• The WSJ’s Jonathan Clements Wants to Leave a Living Legacy: After receiving a terminal cancer diagnosis, the former columnist hatched a plan to turn kids into lifelong savers. (Wall Street Journal)

• You’re Going to Die. That’s a Good Thing. If you can accept your mortality, you will feel more alive. (The Atlantic) see also Where Does Consciousness Come from? Two Neuroscience Theories Go Head-to-Head: Two leading theories of consciousness went head-to-head—and the results may change how neuroscientists study one of the oldest questions about existence. (Scientific American)

• Dining In: The demise of outdoor dining in New York City isn’t really what anyone wants. So how did we end up here? (Slate)

• Seven Roles That Explain the Deeply Nuanced, Not Crazy Art of Nicolas Cage: Don’t reduce his career to his unhinged characters. The actor’s work is often more textured and soulful than he’s given credit for. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Karin Risi, former Managing Director at the Vanguard Group, the world’s 2nd largest asset manager. She helped to create and lead the firm’s Personal Advisor business from 2015 to 2020, which now manages $350 billion in client assets; she also headed comms, strategy and other divisions over the years, reporting directly to each of the past three Vanguard CEOs. Risi has been named to every Top 100 Women in finance list, and in May joined the Board of HarbourVest.

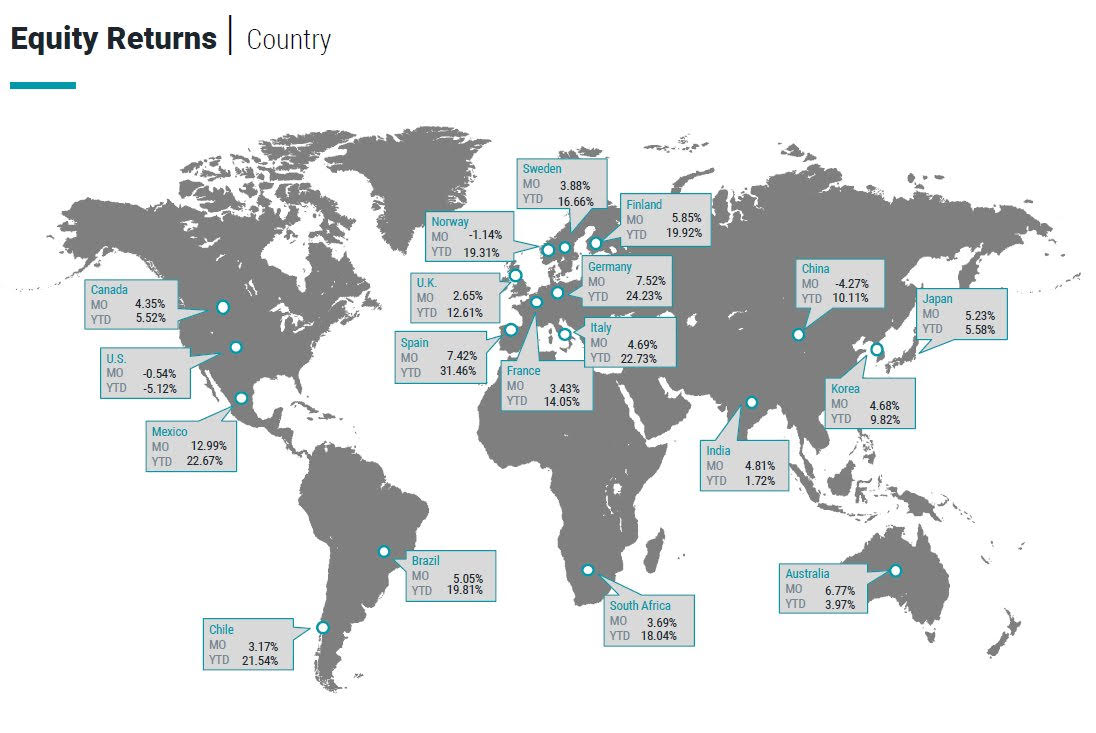

Market returns by country

Source: Avantis via PeterMallouk