My end-of-week morning train WFH reads:

• Consumers Prop Up the Economy. They’re Showing Signs of Strain. The U.S. consumer has seemed unstoppable in recent years, spending throughout soaring inflation and the highest borrowing costs in decades. That resilience helped to keep at bay a recession that many thought inevitable after the pandemic. (New York Times)

• Walmart Becomes Biggest Retailer Yet to Pass Through Tariff Price Increases: Company plans to raise prices this month and early this summer; other retailers likely will follow. (Wall Street Journal) see also Confused about Trump’s tariff policy? Join the club. So too are economists, trade experts, political prognosticators and Trump himself. Their bewilderment has only intensified with the White House’s recent announcement of trade “deals” with Britain and China. Those quote marks are proper, because it’s unclear how much of a bargain Trump has struck with those countries despite his triumphalist rhetoric. (Los Angeles Times)

• Shifting Product Priorities: What Firms Have Added in the Last Five Years: New polling data shows asset managers prioritizing alternatives, ETFs, and personalized investment solutions to meet evolving investor demands. (Institutional Investor)

• Why Are Muni Bond Funds Losing Money in 2025? Vanguard’s Malloy says that muni underperformance has these funds as ‘cheap as it gets.’ (Morningstar)

• Jimmy Kimmel Roasts His Employer and Boosts ‘60 Minutes’ at Disney Upfront: The late-night host also took his usual potshots at rival networks and streamers. (Hollywood Reporter)

• Two Million Meat Sticks a Day Isn’t Enough for Chomps’ CEO: Rashid Ali, head of one of the US’s fastest-growing food brands, can’t keep up with demand. (Bloomberg) see also The End of Chicken-Breast Dominance: The price of boneless chicken thighs is finally catching up with the price of white meat. (The Atlantic)

• How to Live a Miserable Life: Inversion is a mental model that flips the script on traditional problem-solving. Rather than look at a problem in a linear, forward, logical manner, you think about it in reverse. It forces you to think differently about the problem—to see it from a new angle, from a fresh perspective. It provides a unique lens to simplify the complex. Well, there is one complex, foundational problem that is truly universal: How do you live a good life? Let’s harness the power of inversion to address it: Here are 20 ways to live a miserable life… (The Curiosity Chronicle)

• The rise of the regretful Trump voter: Trump is squandering one of his biggest 2024 electoral accomplishments. (Vox)

• 25 Years of AudaciousSmoke-FreeMolecularBurger-CentricHipster한식#InfluencerOutdoorNostalgic Dining in New York City: A timeline of major food moments — restaurant openings, innovations, fads, pop culture cameos, blackouts and bans — that changed life in New York City in the first quarter of the 21st century. (New York Times)

• Nicolas Cage is NFL coach John Madden in upcoming film: Amazon MGM Studios released a first look at the film “Madden.” (NBC News)

Be sure to check out our Master’s in Business with John Montgomery, founder and CEO of Bridgeway Capital. The firm, which was founded in 1993, manages ~$5B in assets; they have become known for donating 50% of their annual company profits to non-profit organizations.

A Market Puke and Rally

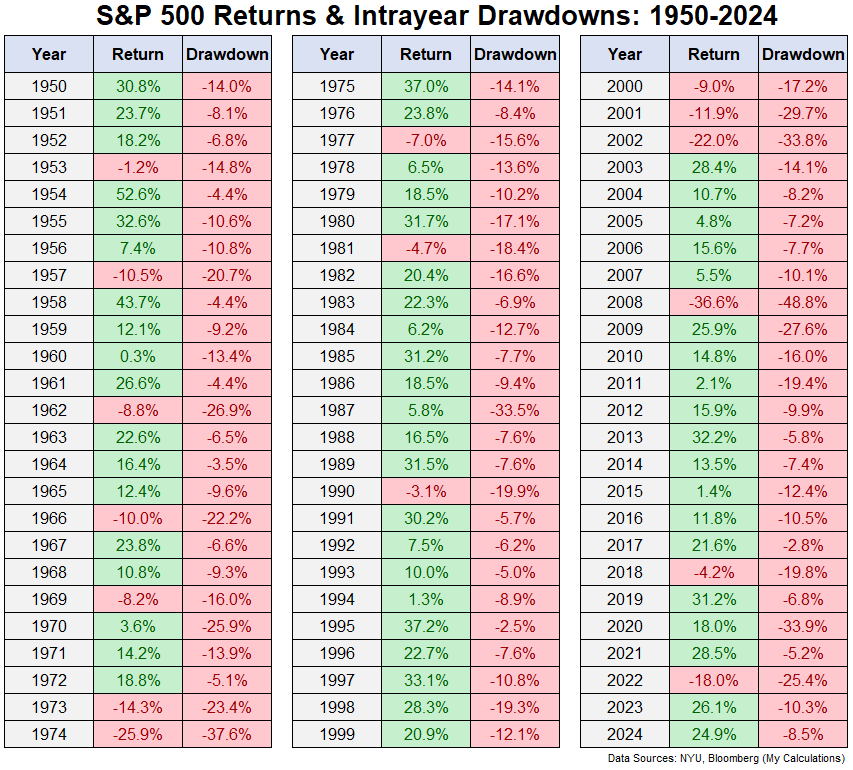

Source: A Wealth of Common Sense

Sign up for our reads-only mailing list here.