My back-to-work morning train WFH reads:

• A Tidal Wave of Change Is Headed for the U.S. Economy: American consumers are not yet seeing much evidence of the drastic changes President Trump has made on trade. But they are on their way. (New York Times)

• Stock Market Bulls Have Gone Into Hiding. Why Our Money Pros Are the Most Bearish in Nearly 30 Years. Big Money pros are more anxious now than during the bursting of the dot-com bubble, the 2008-09 financial crisis, and the Covid-19 pandemic. (Barron’s) see also Warren Buffett’s Favorite Valuation Indicator Flashes Buy Signal. The “Buffett Indicator” measures the ratio of the US stock market’s total value to the dollar value of US gross domestic product and is currently at its lowest level since early September. The indicator is now at 180%, around where it stood after a brief selloff last year, and is signaling that equities are relatively cheap.The measure is still above levels it plumbed during past market bottoms, including the Covid-19 selloff of early 2020, when it fell to nearly 100%. (Bloomberg)

• We’ve unlocked a holy grail in clean energy. It’s only the beginning. The incredible technology is harnessing the potential of solar and wind — and quietly revolutionizing the energy system. (Vox)

• Rebecca Patterson: Farewell, Ye Mighty Dollar. Was Nice Knowing You: A search for new safe harbors began. In the week ending April 16, gold funds had their biggest inflows since 2007, while selling of U.S. bond funds was the highest recorded since late March 2020. Stock markets churned in ways not seen since either the pandemic or the 2008 financial crisis. (New York Times)

• How Warren Buffett Changed the Way Investors Think of Investing: The idea of “value investing” had long existed. But no one did it as successfully or for as long as he did. (Dealbook) see also Who Is Gregory Abel, Warren Buffett’s Successor? Mr. Buffett won renown and made billions as one of the most successful stock pickers of all time. Mr. Abel’s strengths lie more in running businesses. (New York Times)

• The MAHA-Friendly App That’s Driving Food Companies Crazy: Yuka and other apps are influencing shoppers’ purchasing habits; ‘There are a lot of opinions out there’. (Wall Street Journal)

• The world–politely–tells Trump to take a hike: In Canada and in Europe, some very interesting news. (The Crucial Years)

• When ChatGPT Broke an Entire Field: An Oral History: Researchers in “natural language processing” tried to tame human language. Then came the transformer. (Quanta) see also In the age of AI, we must protect human creativity as a natural resource: As AI outputs flood the Internet, diverse human perspectives are our most valuable resource. (Ars Technica)

• Tina Fey’s reboot of ‘The Four Seasons’ feels like a throwback: Steve Carell, Colman Domingo and Will Forte join Fey in this feel-good comedy about marriage, divorce, friendship and GenX. (Washington Post)

• We just had the most preposterous year of Aaron Judge: Yankees captain’s past 162 games deserves legendary status in class of Babe Ruth, Barry Bonds and Ted Williams (Yahoo Sports)

Be sure to check out our Masters in Business this week with Sander Gerber, the CEO/CIO of Hudson Bay Capital. The firm is a global multi-strategy investment firm based in Greenwich, with offices in NY, Miami, London, Hong Kong, and Dubai. Founded in June 2005 (with Yoav Roth) they manage $20B in client assets.

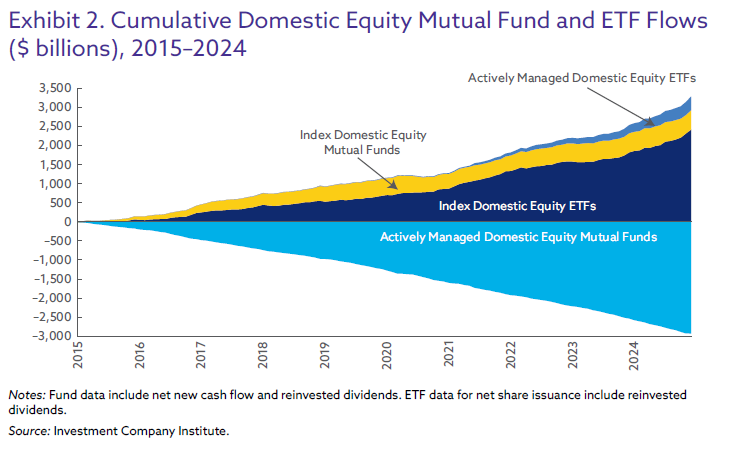

ETFs Won. Now What?

Source: Nadig.com

Sign up for our reads-only mailing list here.