There have been many winners and losers over the past few months. Perhaps none have been revealed for having furious, unbridled power more than the U.S. equity markets. That’s right, it was not Carville’s Bond Market that made the White House cry “Uncle!” but rather, it was U.S. equities markets.

Its naked power and abilities to inspire fear, panic, and even terror are unsurpassed. Bonds might drive the intellectual debate around policy, but it’s the equity markets that politicians pay closest attention to…

Allow me to share three historical examples:

October 2008: During the month following Lehman Brothers’ September 2008 implosion, then Federal Reserve Chairman Ben Bernanke testified to the House Committee on the Budget on Monday, October 20, 2008. He reminded members that the Federal Reserve’s charter was to maintain high employment and low inflation. The Fed, he also reminded, was not authorized to manage the stability of the financial system or keep credit markets flowing; it was not the FOMC’s charge to address any of the myriad issues that had endangered the financial system’s functioning.

A fiery speech from someone (maybe Rand Paul?) led to a vote against Bernanke’s funding and authority request. He would not be getting the tools necessary to unfreeze credit and keep the banking system operating.

Sayeth Mr. Market: “Hold My Beer.”

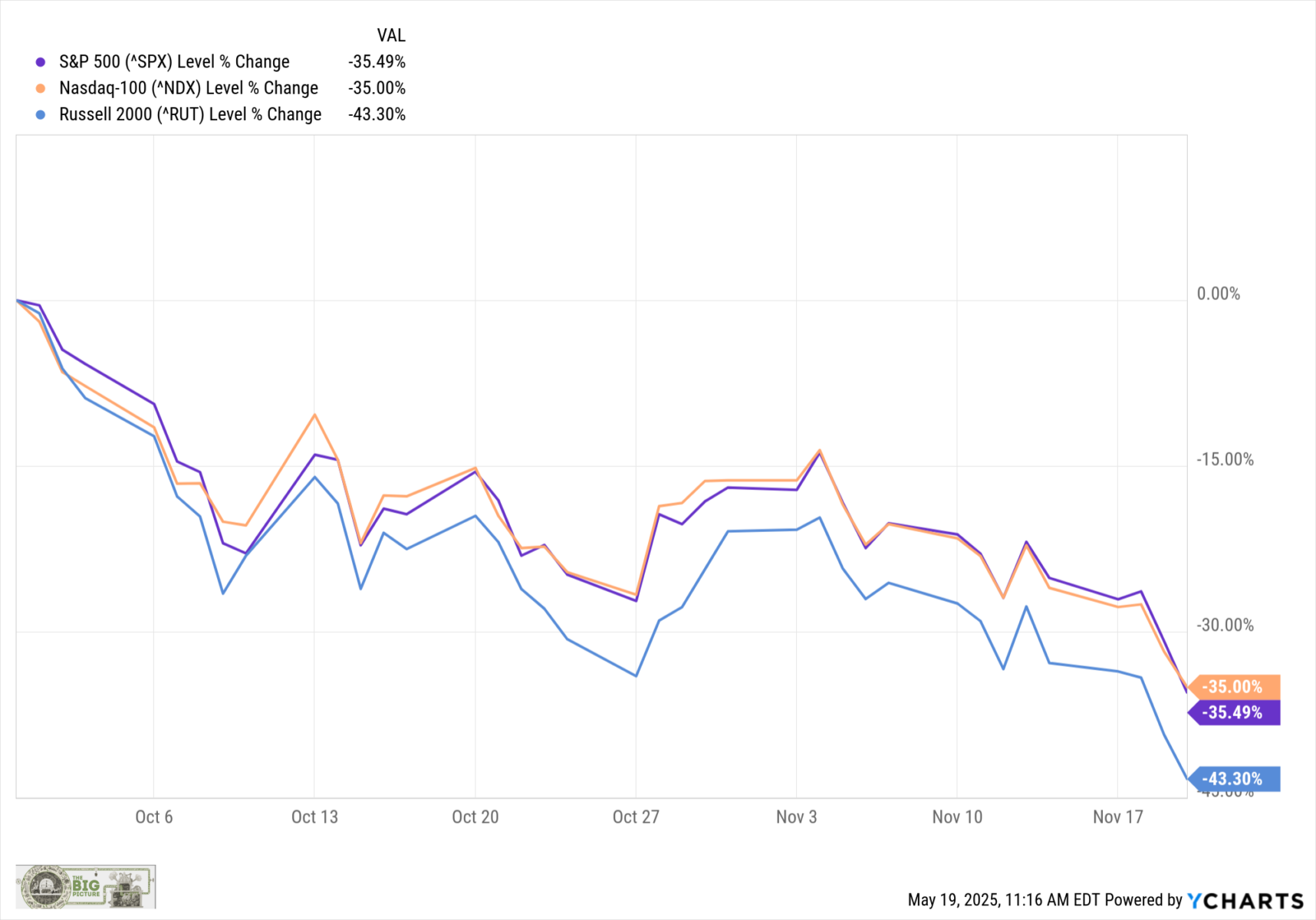

The sell-off began immediately after the vote; over the next five trading days, from recent highs, the S&P 500 fell 13.9%, the Nasdaq was right behind it at 13.5%, and the Russell 2000 crashed 18%. MOSTLY IN ONE WEEK.

Congress reconvened and passed both the necessary authority and the dollars that the Fed chairman had requested. By November 4th, all of the losses had been made up and then some.

Don’t fix the credit markets, and put corporate revenue and payrolls at risk?

FAFO.

March 2020: The first hint I had that something was amiss occurred in February 2020. My sister and I were looking at assisted living facilities for my mom. “As long as I’m out here, why don’t we swing by Target to pick up a few things.” She was visiting the ‘burbs from her New York City apartment, moved into once the kids went off to college from their suburban home.

Target was out of hand sanitizer, many cleaning products, Lysol, and rubbing alcohol; they were completely sold out of bleach, and, of course, there wasn’t a single piece of toilet paper to be found.

A few weeks later, Congress was debating the renaming of a Washington, D.C. library. The back-and-forth on C-SPAN was as tedious as it was unproductive. (Stalemate, nothing done.) It reminds one of the old joke, “Why are academic politics so vicious? Because the stakes are so low and the issues so unimportant.”

March 11, 2020, a day after the Congress critters couldn’t agree on renaming a library, it became apparent that this was no ordinary flu. There were numerous events throughout the day that were concerning, but once the NBA game between the Oklahoma City Thunder and the visiting Utah Jazz was cancelled — Jazz center Rudy Gobert had tested positive for COVID-19 — things got bad fast.

All hell broke loose the next day. This set the stage for the lockdowns to begin in earnest and tipped the global economy into shutdown mode.

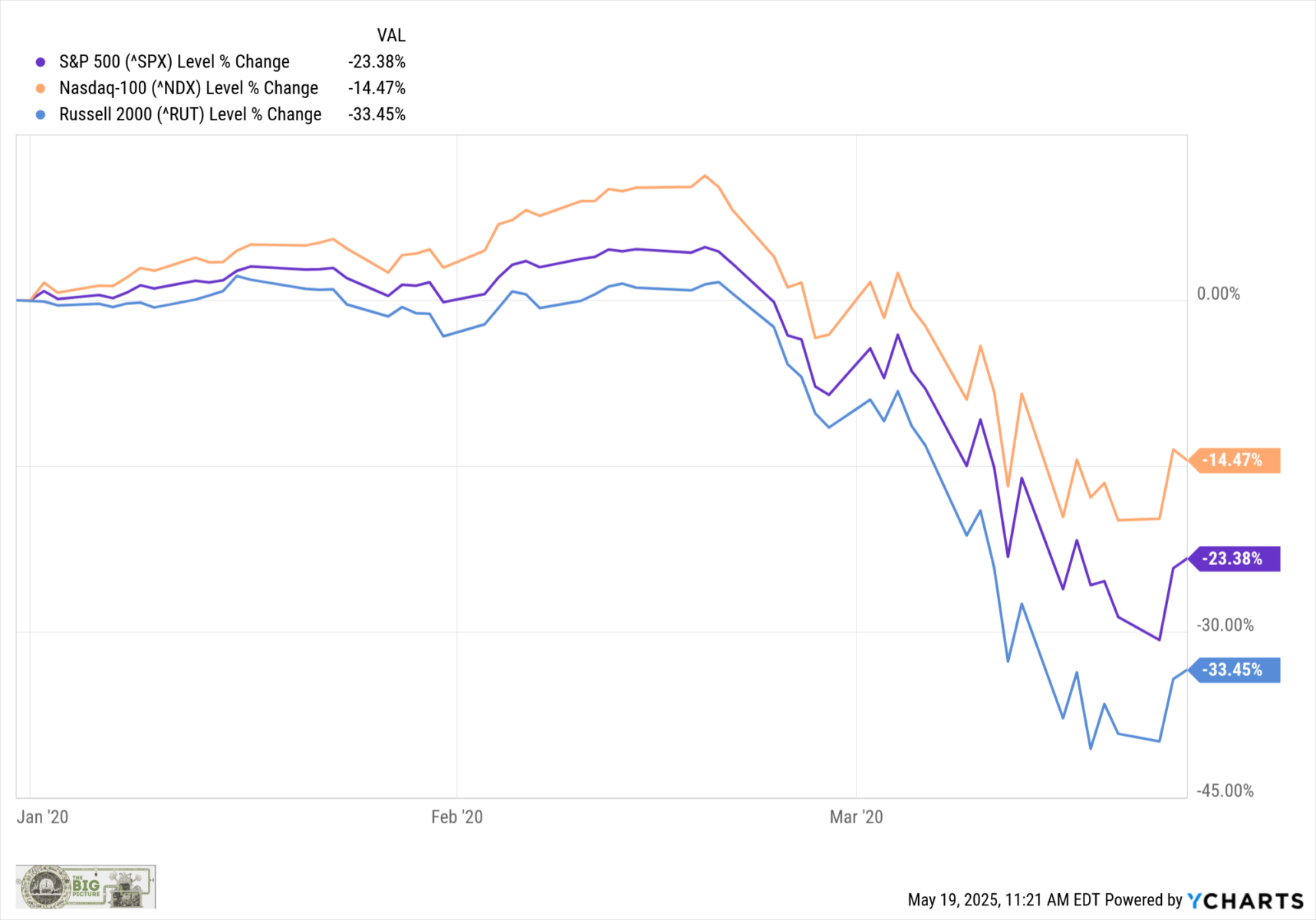

Then came one of the fastest sell-offs of all time, a decline of 34% in just 17 trading days.

Congress, under then-President Trump (45), soon passed the CARES Act. At 10% of GDP, it was the single largest fiscal stimulus since World War 2. This ~$2 trillion legislation was soon followed by the CARES Act 2 ($800 billion), also under Trump. Not long after President Biden (46) was elected, he passed the CARES Act 3, another trillion-dollar bill.2

That fiscal stimulus turned what looked like another GFC crash into a robust recovery and rally once the government acted. Markets rose 69% from their March 2020 pandemic lows to the end of 2020; they gained another 28% in 2021.

Feel free to debate renaming libraries or taking down statues all you want, but close the global economy in a way that dramatically slashes corporate revenue and profits without addressing the impact of what you’ve done?

Good luck, Chuck!

April 2025: President Trump campaigned on instituting tariffs; instituted a variety of tariffs in his first term; called himself “Tariff Man,” and said, “Tariffs are the most beautiful word in the dictionary.”

So why was the market so surprised by the April 2nd “Liberation Day” announcements? Two reasons: First was the sheer size and scope of the tariffs. But don’t overlook the opaque and ham-fisted communications strategy that accompanied them.

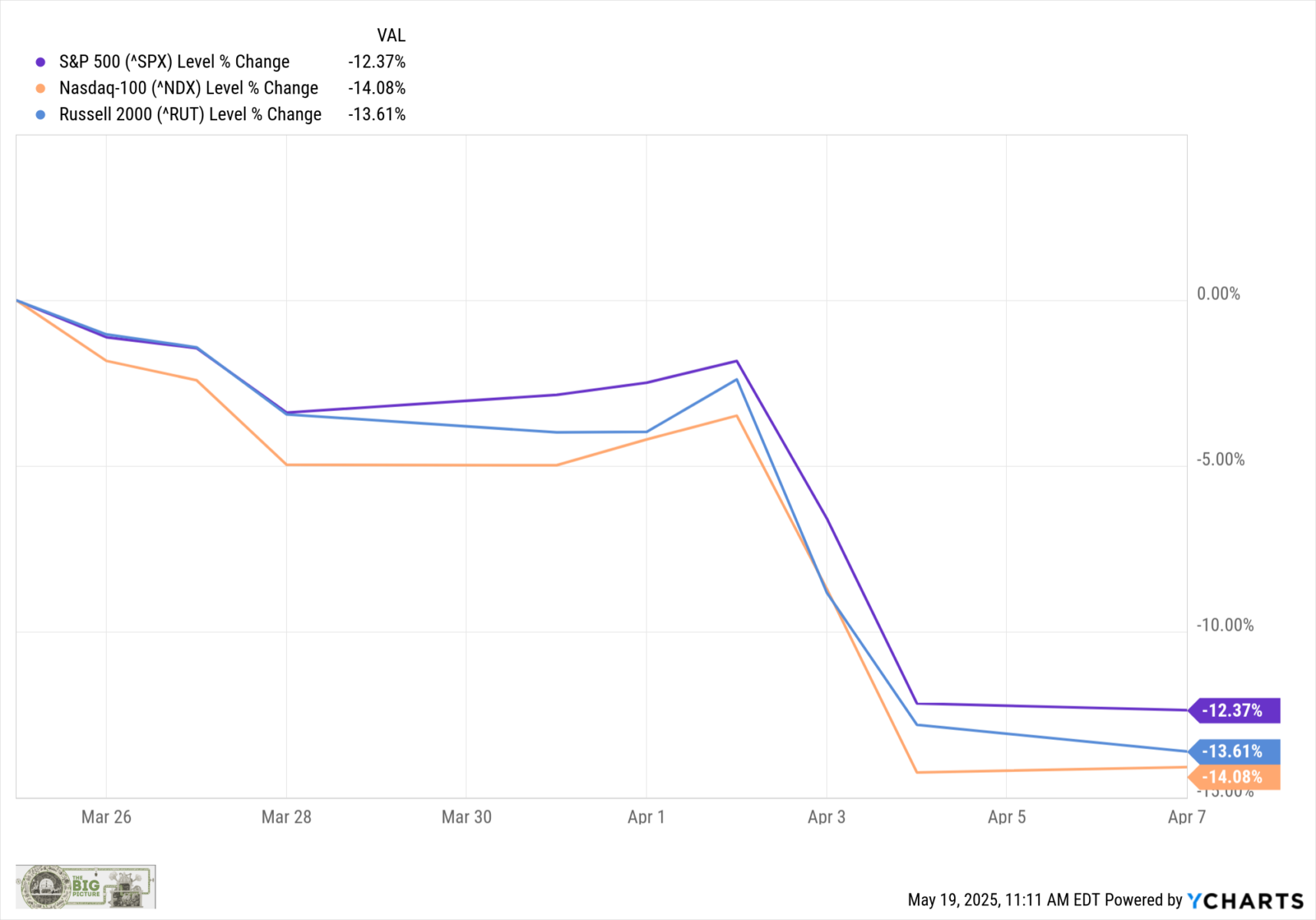

Prior tariffs had been in a 10-20% range; 100% tariffs applied to 182 countries worldwide – and Antarctica! – was simply a bridge too far. Markets are a future discounting mechanism for corporate revenues and profits, and the market calculated that a giant U.S. consumer VAT tax would reduce corporate revenues 10 to 20%, and profits 20 to 30% (or more).

Hence, the markets were priced at least 20% too high. A week later, the S&P 500 was down 12.4% from its March highs; the Nasdaq 100 sold off 13.6%, while the small-cap Russell 2000 was hit the hardest -14.1%.

This sent Treasury Secretary Scott Bessent into the Oval Office, pleading with POTUS to pause the tariffs for 90 days. If not, “You’ll be the next Hoover – or worse.”

The recovery began immediately. Five weeks later, all the post-liberation day losses had been recovered.

~~~

While everybody has been focused on the size of the tariffs, let’s discuss the communication strategy. A “compare & contrast” with how the Federal Reserve communicates changes in interest rate policy is instructive.

The Federal Reserve announces new policy leanings three to six months in advance. They discuss it at each meeting, notifying stock and bond markets that a change is coming. They review the various data series they’re relying on (PCE vs CPI), they discuss changes in the economy, and we see the dot plot shift during a few meetings prior.

Then, a month or so before, the seven members of the Board of Governors and the twelve Federal Reserve district Presidents fan out to speak in various public forums. They address the Petroleum Club of Houston, and they speak at the Economic Club in New York; they present at Stanford and Yale and everywhere in between.

Say what you will about the Federal Reserve, but they are transparent and informative and do not surprise markets. The White House took a different route, shocking equity traders with a vast, unexpected policy shift.

“Hell hath no fury like a market surprised.”

Look, the rules here are pretty straightforward:

Show respect to the collective insight of the market when it comes to setting prices, integrating risk factors, and summarizing the crowd’s collective expectations. Recognize that current equity prices reflect the probabilities of corporate revenues and profits a year or so out, a future discounting mechanism times some multiple, which itself is driven primarily (but not exclusively) by collective investor/crowd psychology.

If you imagine yourself more powerful than Mr. Market, take just him on directly. Imagine yourself as smarter, more powerful, able to direct events with greater alacrity and influence.

Surprise the markets and watch the results. You will quickly learn who is the market’s bitch.

James Carville famously said, “I used to think that if there was reincarnation, I wanted to come back as the President or the Pope or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody.”

Perhaps in his day, he was right.

But me?

When I die and am reincarnated, I want to come back as the U.S. equities markets…

“The stock market remains undefeated.”

See also:

The Stock Market Remains Undefeated: AN Interview with Barry Ritholtz

Wall Street Breakfast

Seeking Alpha, May 11, 2025

Previously:

What Are the Best & Worst-Case Tariff Scenarios? (April 15, 2025)

The Consequences of Chaos (April 7, 2025)

7 Increasing Probabilities of Error (February 24, 2025)

Why Macro Forecasting Is So Hard Impossible (April 24, 2025)

__________

1. Some years later, Bernanke disclosed that he had sent his wife to the bank to withdraw as much cash as she could before the system crashed completely.

2. President Biden also drove several other important fiscal legislation – the Infrastructure Bill, Semiconductor Act, the Inflation Reduction Act, and others. These were primarily 10-year spending bills, reflecting his legislative priorities and/or attempt to Fight the spiking inflation caused by all three cares act fiscal stimulus. I don’t consider these a panic reaction to equity prices.