My morning train WFH reads:

• The Year’s Hottest Crypto Trade Is Crumbling: Selloff in bitcoin and other digital tokens hits crypto-treasury companies. Shares of “crypto-treasury” companies, like Micro-Strategy, have fallen significantly, with Micro-Strategy’s value dropping from $128 billion at its peak to $70 billion. (Wall Street Journal)

• Nobody’s Buying Homes, Nobody’s Switching Jobs—and America’s Mobility Is Stalling: The paralysis has left many people in houses that are too small, in jobs they don’t love or shackled with ‘golden handcuffs.’ For everyone, there are economic consequences. (Wall Street Journal) see also The Affordability Curse: Politics isn’t just about the words you put on your bumper stickers. It’s about what you do if the bumper stickers work. (The Atlantic)

• China’s Stocks Are Flying as Beijing Doubles Down on Tech. Why the Economy Is Still Struggling. China’s commitment to innovation poses a long-term threat to U.S. companies. What it needs now is for its citizens to spend more. (Barron’s)

• OpenAI’s Chairman Is Thinking a Lot About Bubbles Right Now: Bret Taylor, who helped shape Google and Facebook and now runs a $10 billion AI customer service startup, thinks Silicon Valley will be just fine. (Businessweek)

• A Flood of Green Tech From China Is Upending Global Climate Politics: At this year’s climate summit, the United States is out and Europe is struggling. But emerging countries are embracing renewable energy thanks to a glut of cheap equipment. (New York Times)

• How luxury apartments became basic: Old money v. new money is a debate as old as New York. When it comes to housing, luxury apartments are giving older buildings a run for their money. A boom in apartment construction has meant new luxury might be more attainable. (Business Insider) see also Builders Are Offering Mortgage-Rate Discounts. Home Buyers Aren’t Biting. New homes are sitting unsold, despite builders using sweeteners to shift inventory. (Wall Street Journal)

• An old manufacturing city sputters back to life: Once a hub for guns and electrical wiring, Bridgeport, Connecticut, is now home to artisanal manufacturing businesses and a healthy real estate market. (Washington Post)

• How to help friends and family dig out of a conspiracy theory black hole: Some tried and trusted techniques that might help. (MIT Technology Review)

• NASA’s Quiet Supersonic Jet Takes Flight: The X-59 successfully completed its inaugural flight—a step toward developing quieter supersonic jets that could one day fly customers more than twice as fast as commercial airliners. (Wired)

• How a beloved TV nerd became ‘one of the greatest actors of his generation:’ Jesse Plemons broke out on “Friday Night Lights.” Now, he’s entering the best actor Oscars race with his riveting performance in “Bugonia.” (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Kristin Olson, global head of alternatives for wealth at Goldman Sachs. She led GS’s alt capital markets group for 23 years, overseeing $500 billion in alt investments annually from wealth management clients.

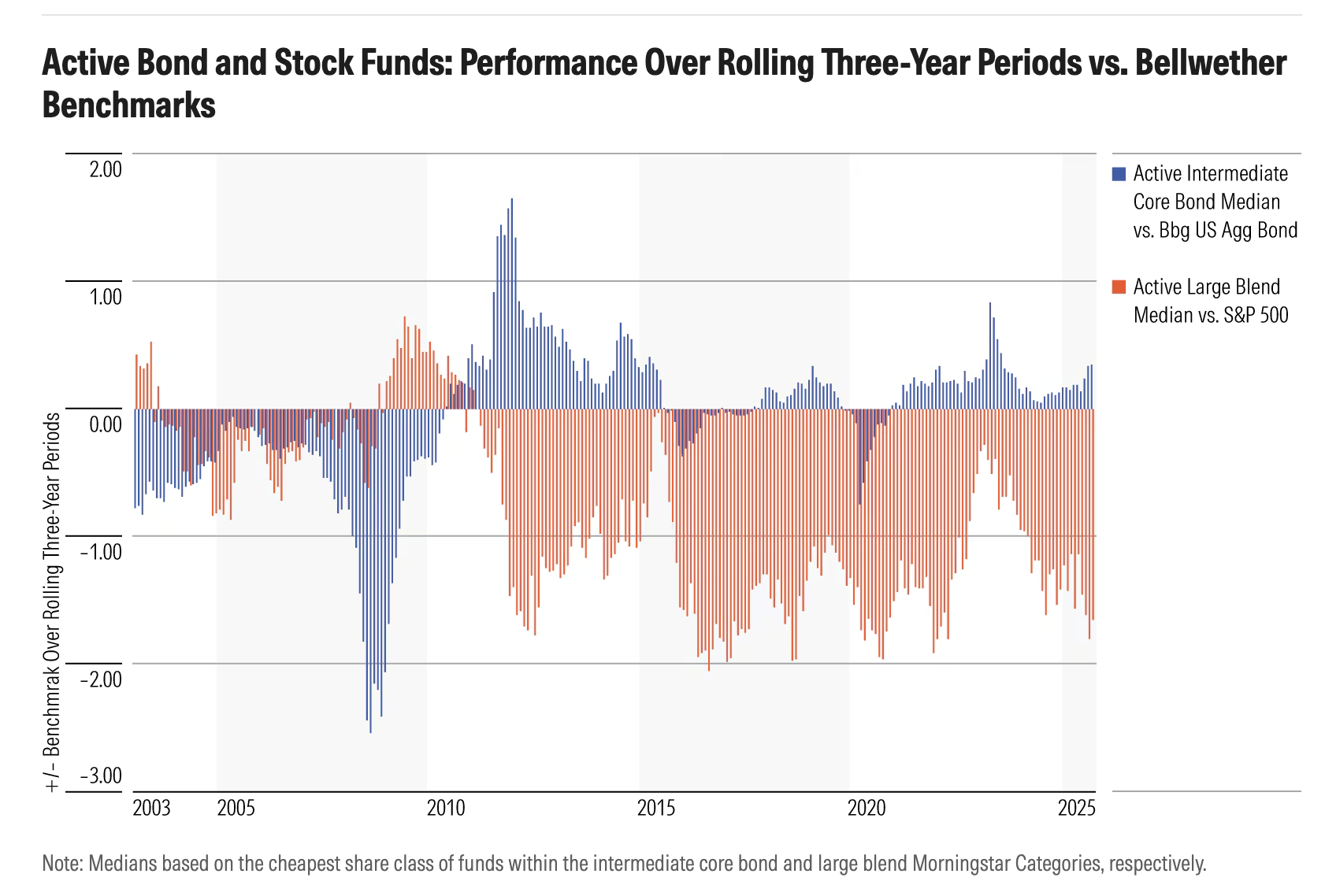

It’s easier to make a case for using fairly priced, proven active bond funds than it is for active stock funds.

Source: Morningstar

Sign up for our reads-only mailing list here.