Giving the Fed Excuses for More Tightening

We noted last week that the shorter term risk was to the upside. After outlining many of the technical positives of the market, we noted...

Maybe this will help explain the street’s obsession with running any and every piece of data is through a “Fed lens . . .” As the...

Maybe this will help explain the street’s obsession with running any and every piece of data is through a “Fed lens . . .” As the...

We’ve run numerous stories discussing the decline of the middle class in the US. Historically, the middle class as we have come to...

We’ve run numerous stories discussing the decline of the middle class in the US. Historically, the middle class as we have come to...

Fascinating discussion on the cratering of the Middle Eastern bourses, and what the impact could mean socially in the region: WSJ: ...

Fascinating discussion on the cratering of the Middle Eastern bourses, and what the impact could mean socially in the region: WSJ: ...

Am I seeing this correctly? Has Barron’s finally thrown in the towel on the Citibank Panic Euphoria measure? We have voiced our...

Am I seeing this correctly? Has Barron’s finally thrown in the towel on the Citibank Panic Euphoria measure? We have voiced our...

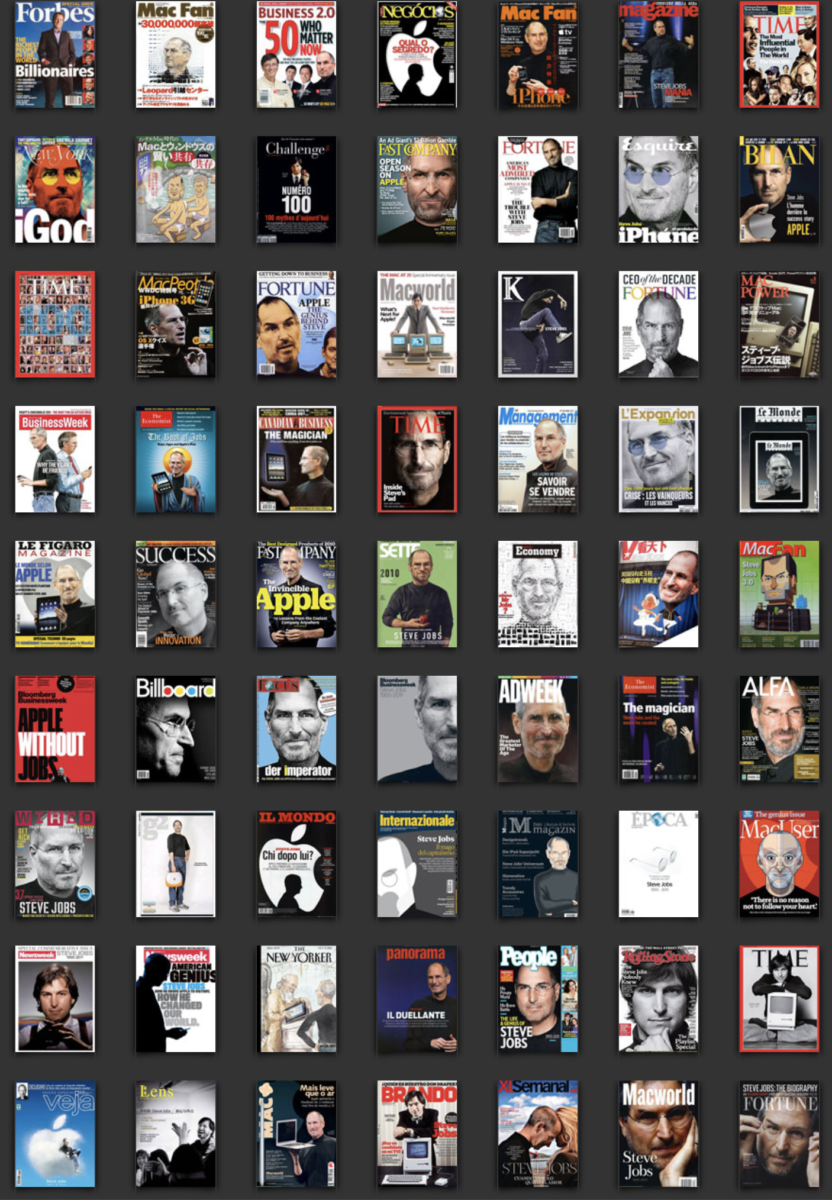

In the past, I have warned against relying on the magazine cover indicator for specific companies. There are some very specific caveats...

In the past, I have warned against relying on the magazine cover indicator for specific companies. There are some very specific caveats...