A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam...

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam...

Read More

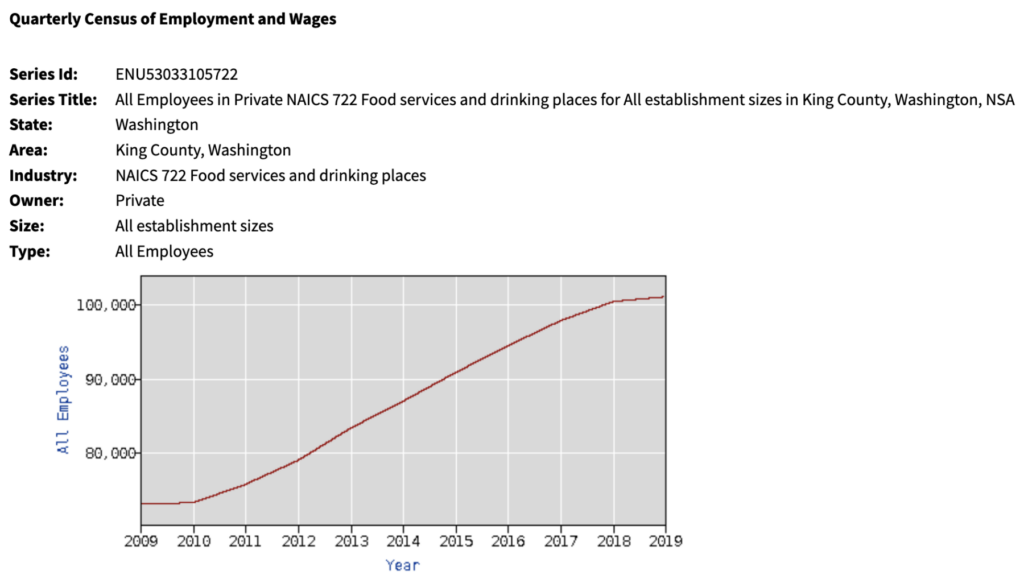

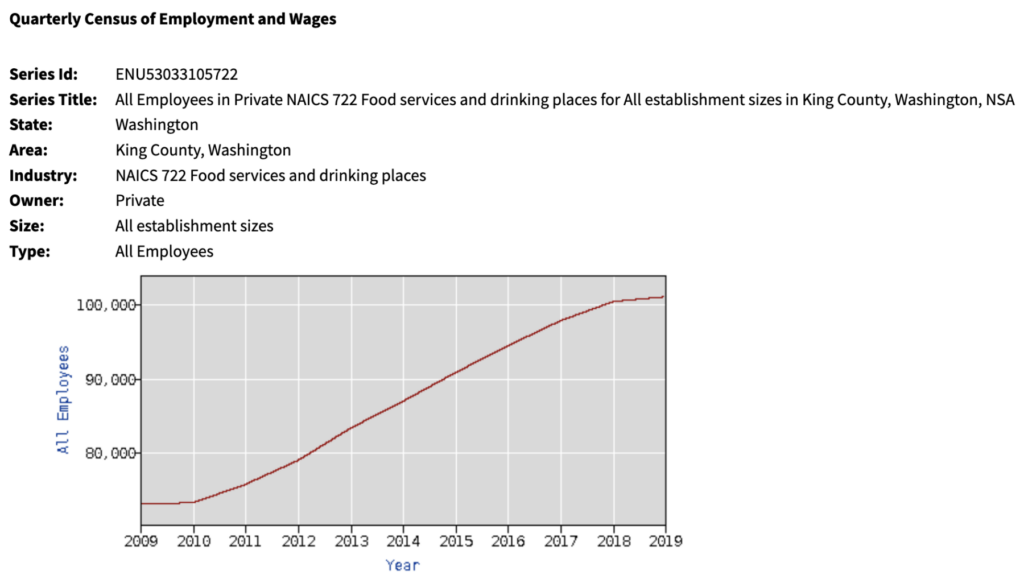

@TBPInvictus here. About a decade ago, the city of Seattle undertook to raise its minimum wage, over time, to $15/hour. Massive credit...

@TBPInvictus here. About a decade ago, the city of Seattle undertook to raise its minimum wage, over time, to $15/hour. Massive credit...

Read More

I spend a lot of time debunking investment-related bullshit. Given the general innumeracy of the public, it’s easy...

I spend a lot of time debunking investment-related bullshit. Given the general innumeracy of the public, it’s easy...

Read More

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

Read More

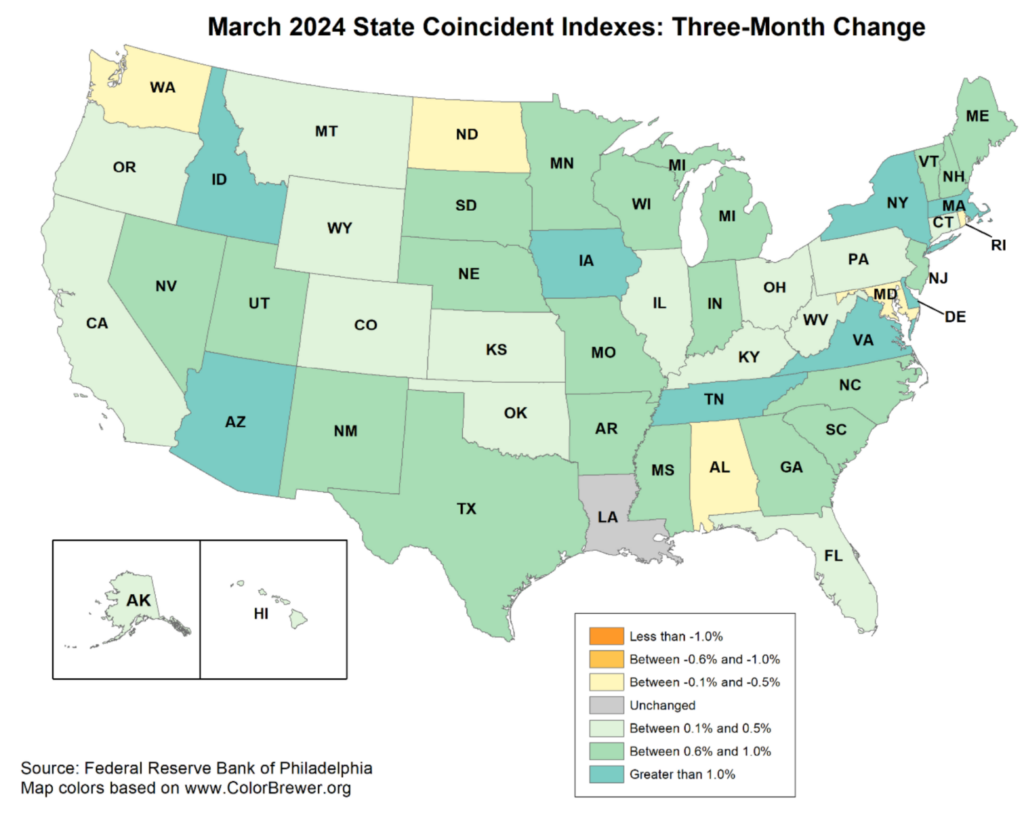

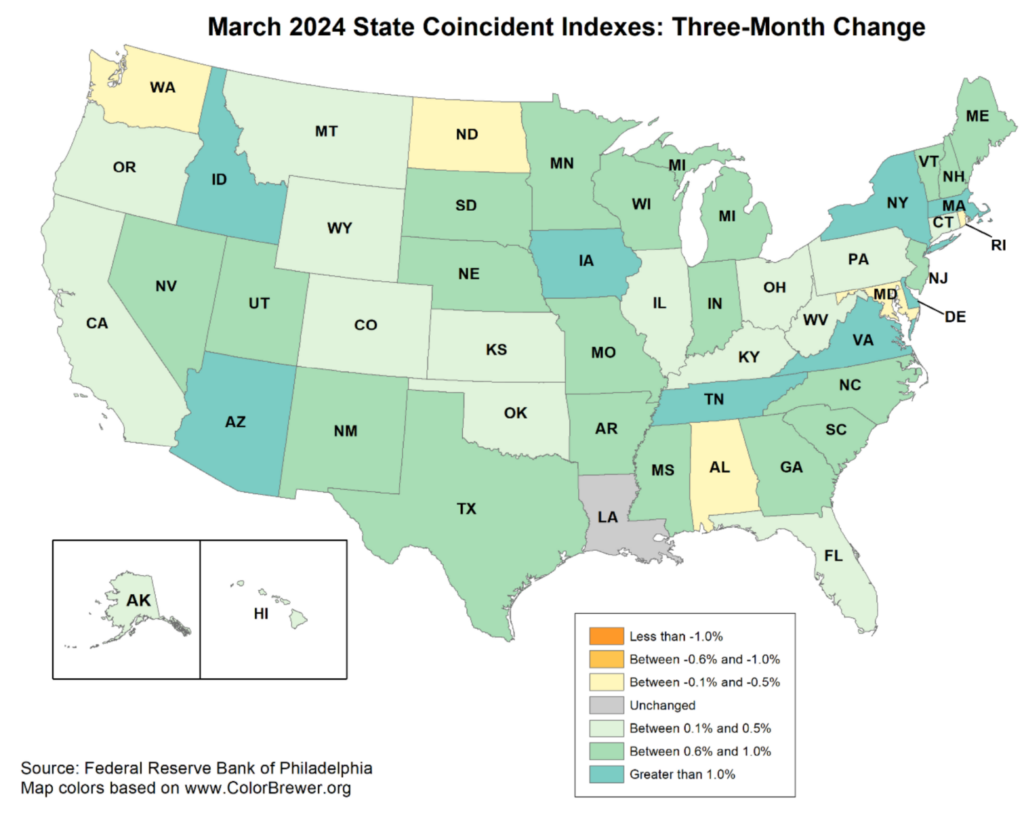

A quick note on the state of the economy in light of some recent data. Q1 2024 Gross Domestic Product expanded at a...

A quick note on the state of the economy in light of some recent data. Q1 2024 Gross Domestic Product expanded at a...

Read More

At the Money: What Data Matters and What Doesn’t (April 24, 2024) Bill McBride has spent the past 20 years...

Read More

Between book leave and COVID I have been pretty quiet lately. Since it’s been a few months, I thought we could take a...

Between book leave and COVID I have been pretty quiet lately. Since it’s been a few months, I thought we could take a...

Read More

We sometimes say “Demographics is Destiny,” but that’s abstract. To get a visual sense of what that looks like,...

Read More

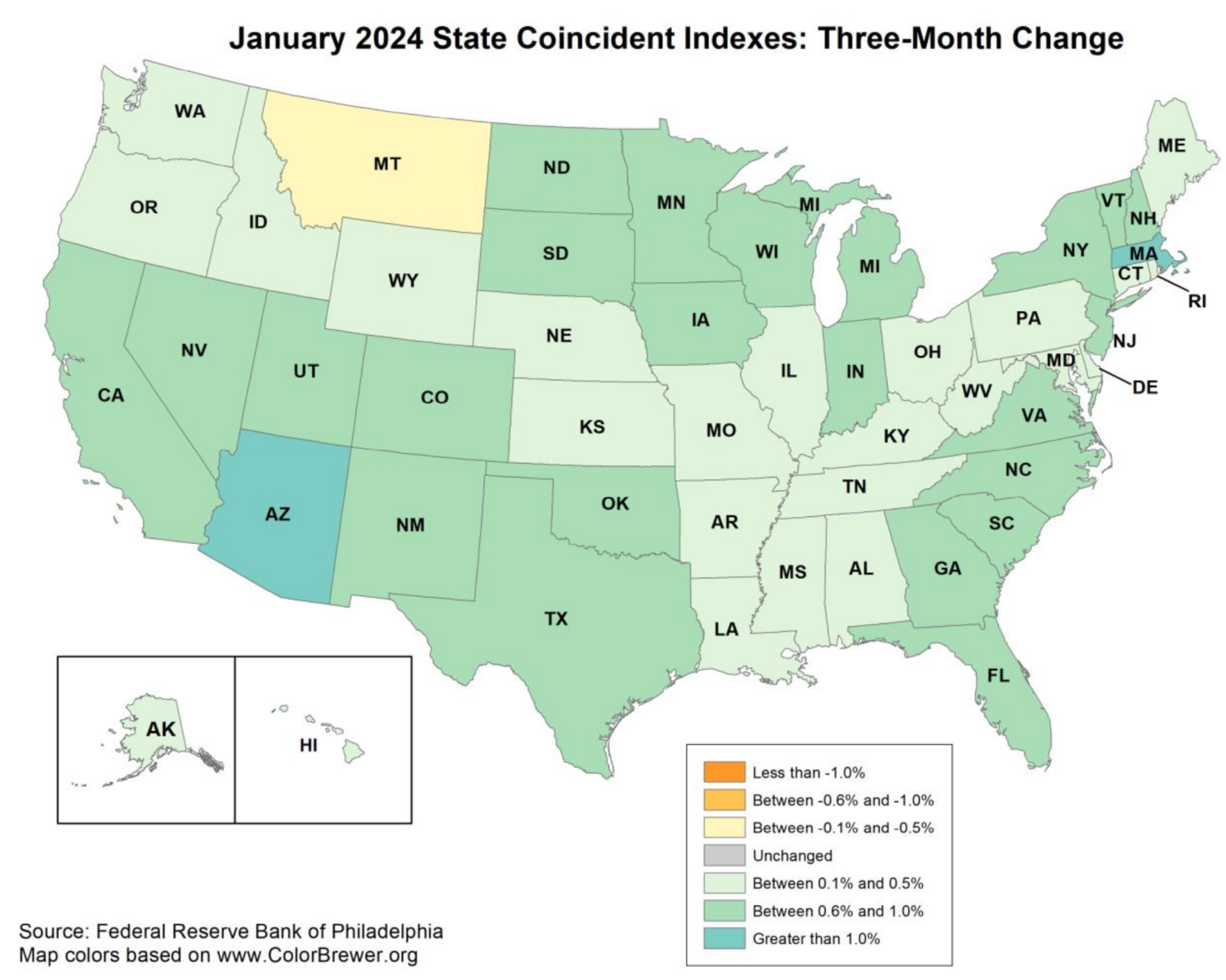

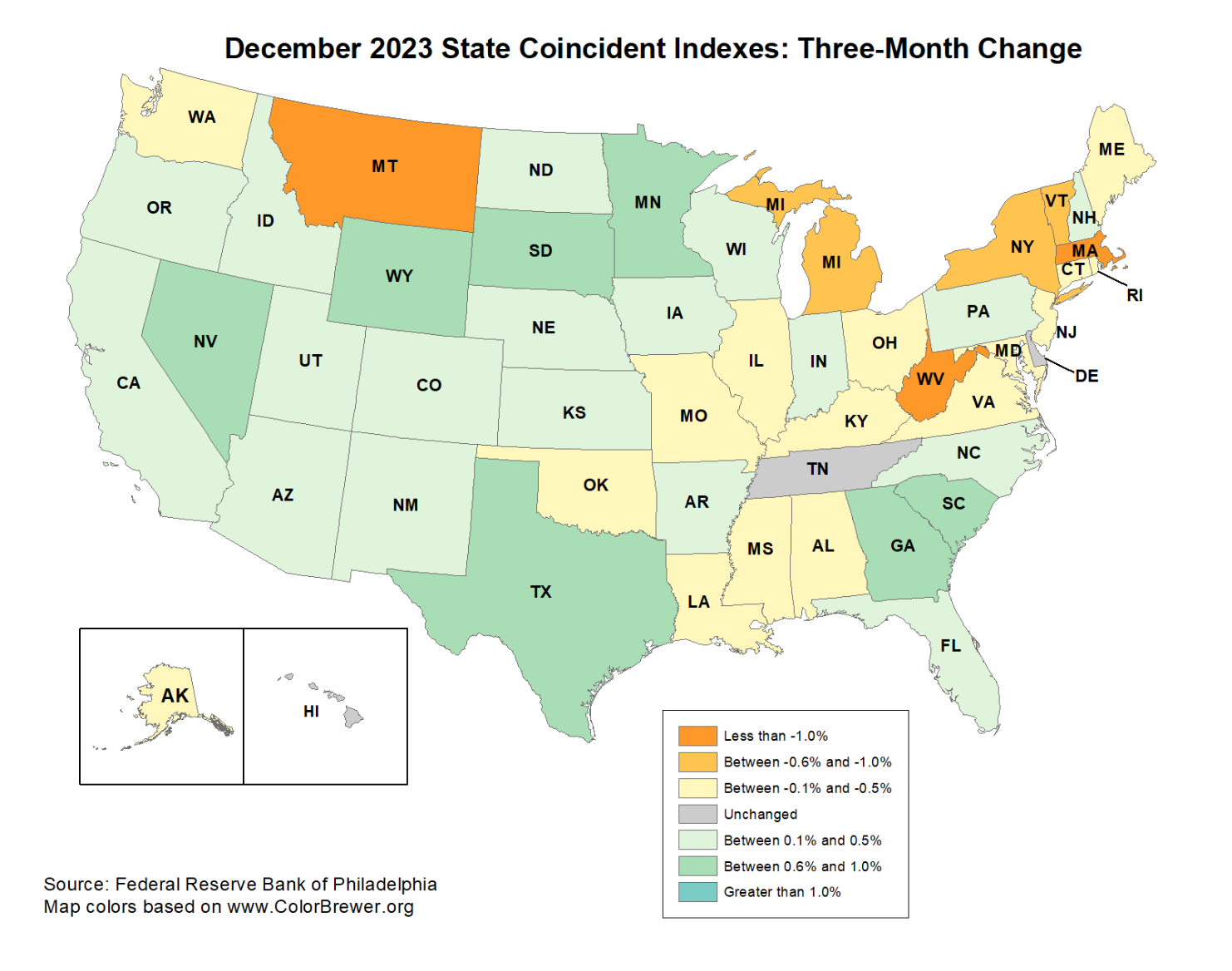

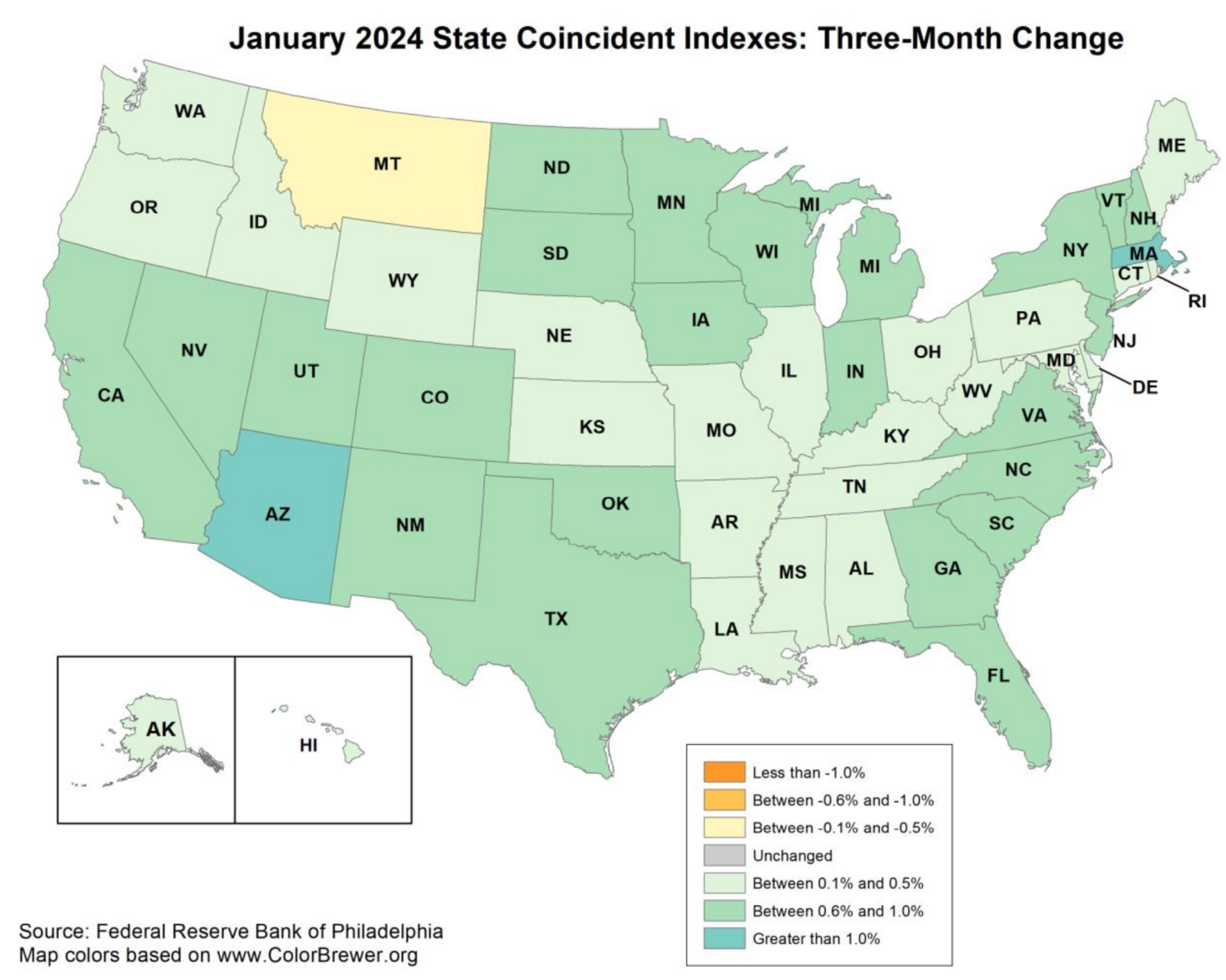

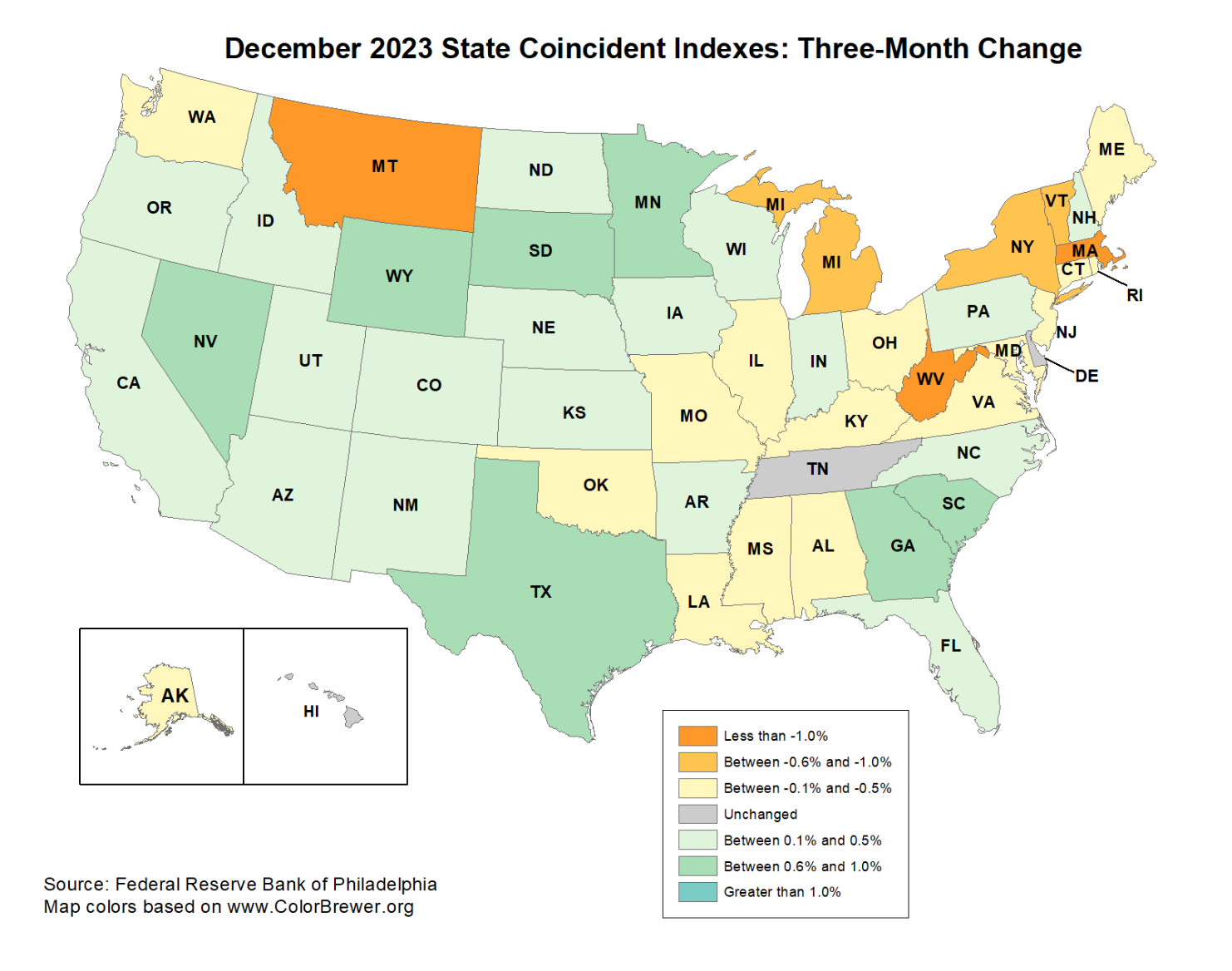

A quick follow-up to last month’s note on slipping coincident indicators: December was relatively stable compared to the...

A quick follow-up to last month’s note on slipping coincident indicators: December was relatively stable compared to the...

Read More

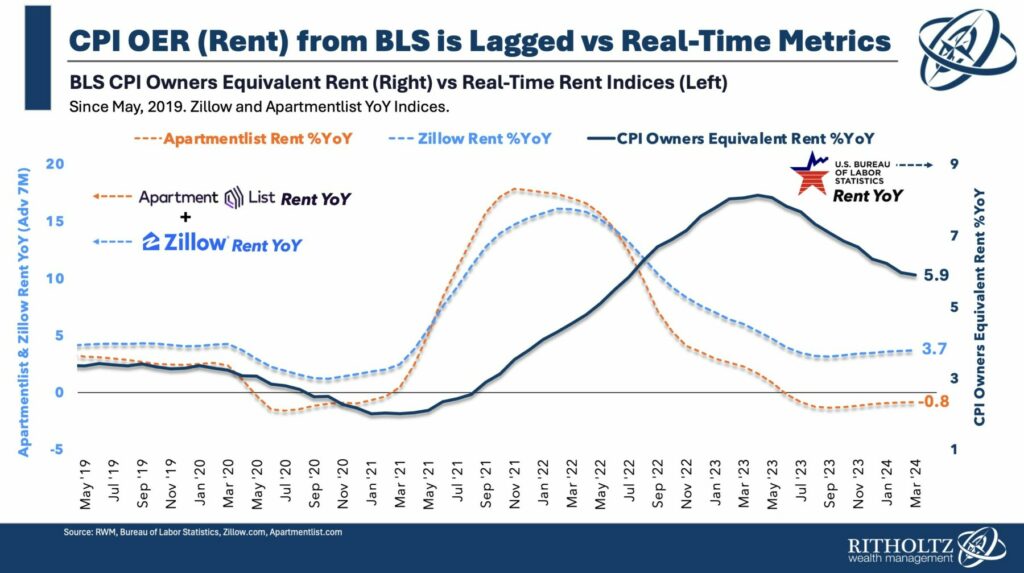

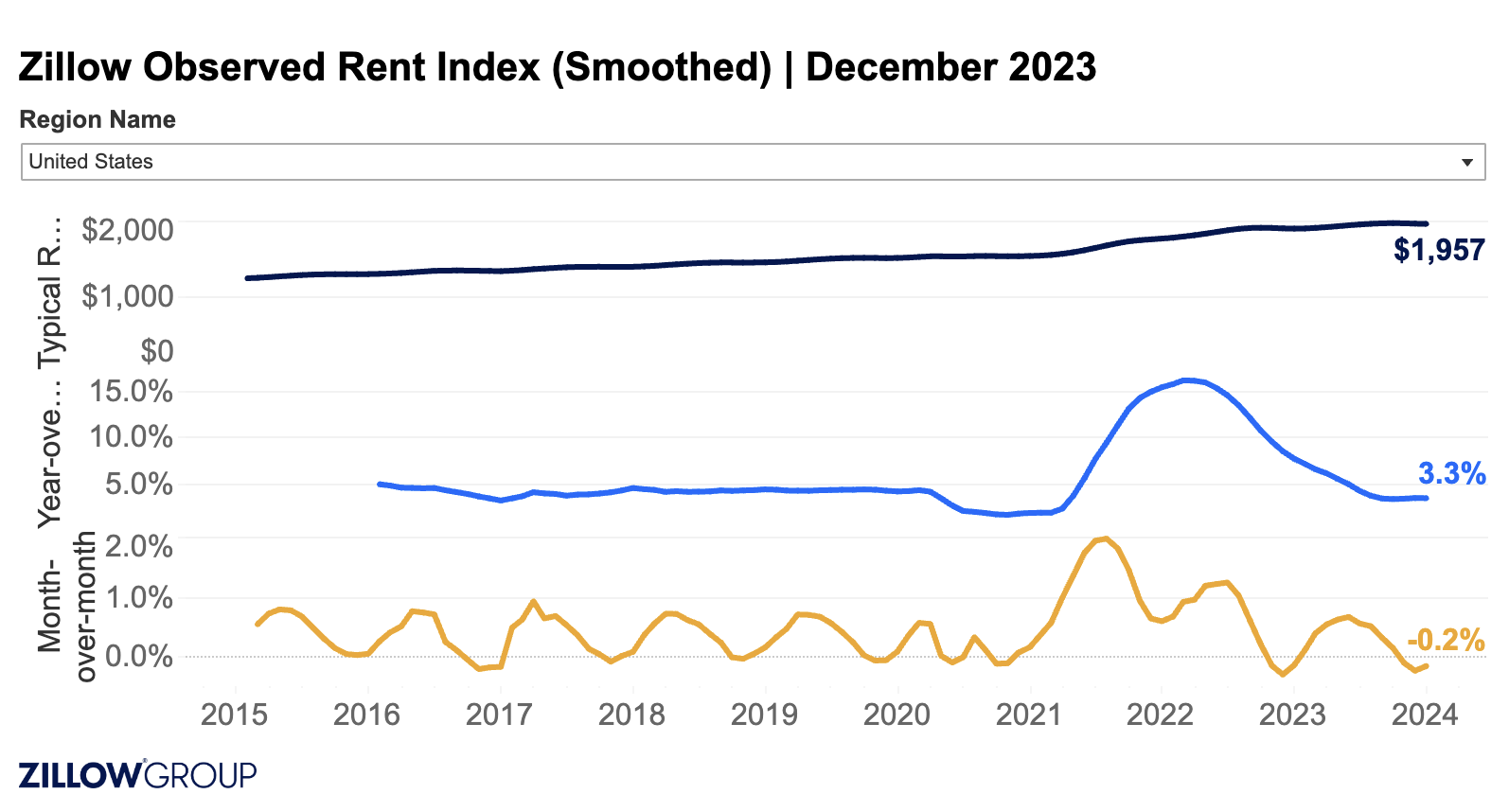

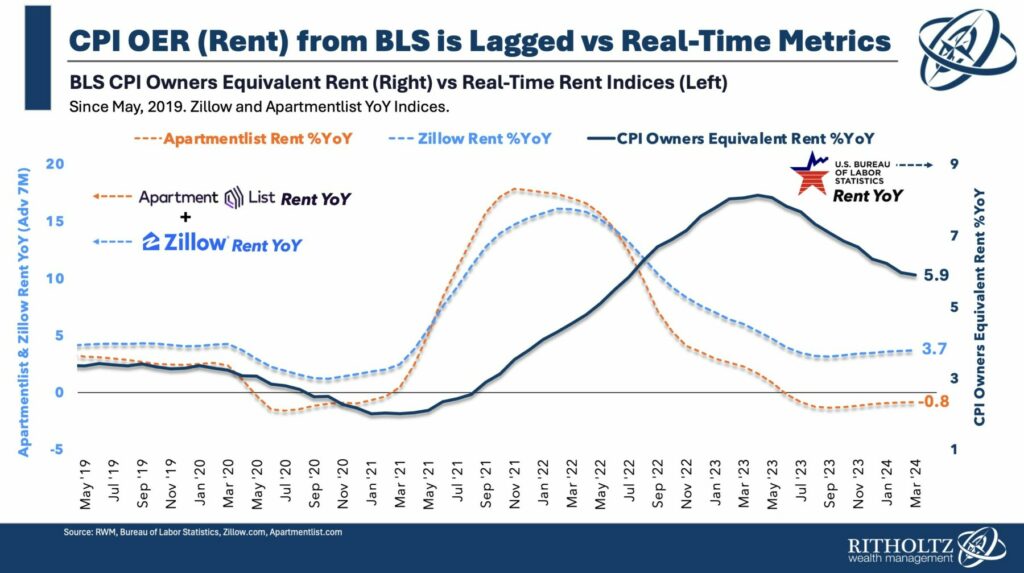

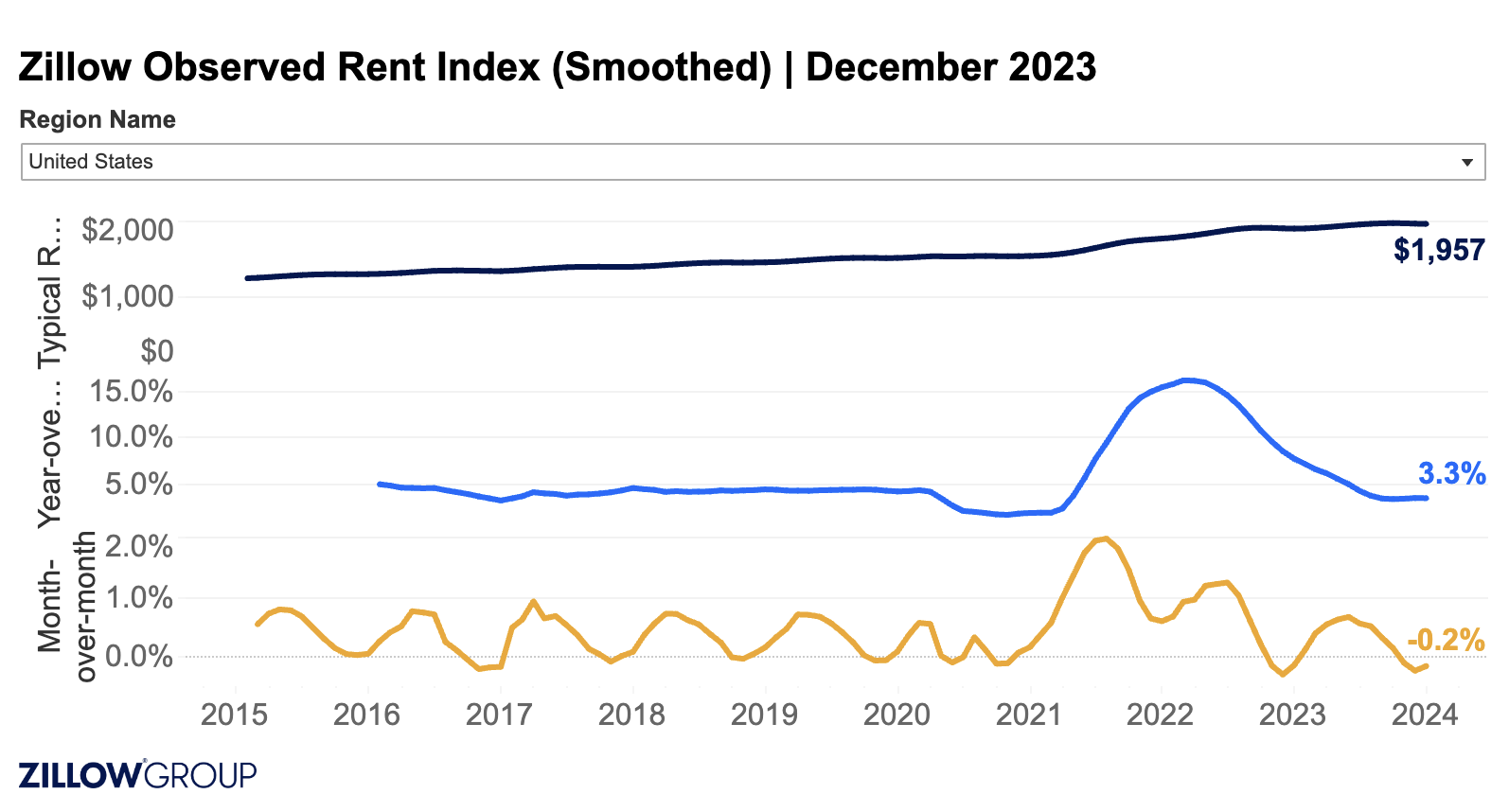

I am popping out of book leave to just throw a few charts at you regarding the Inflation data for December. CPI came in a 0.3%...

I am popping out of book leave to just throw a few charts at you regarding the Inflation data for December. CPI came in a 0.3%...

Read More

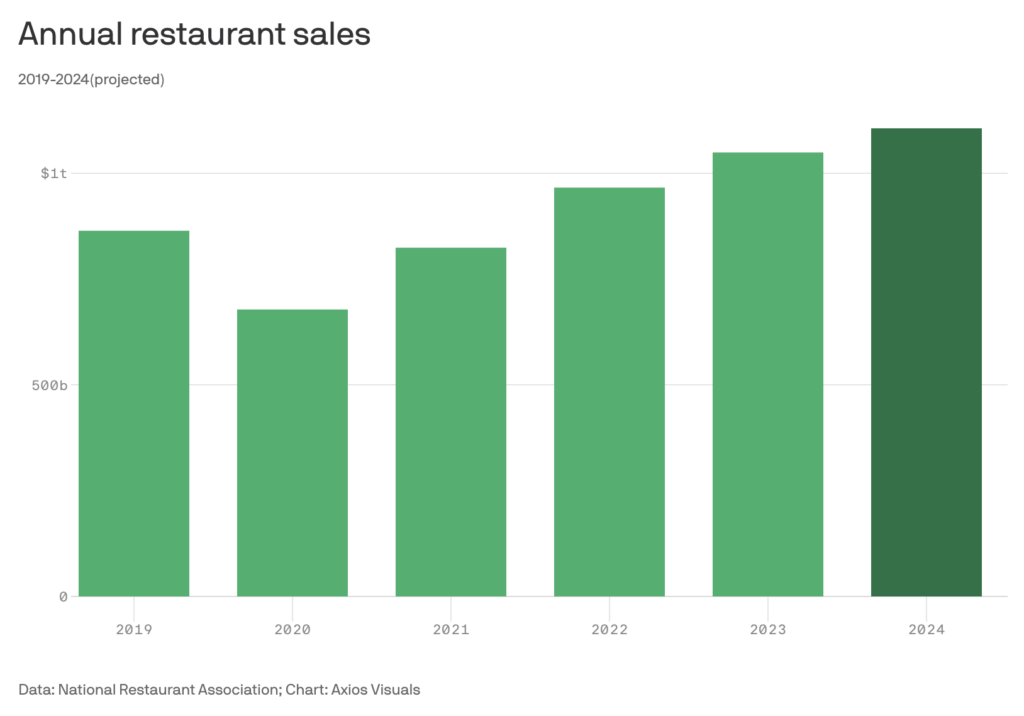

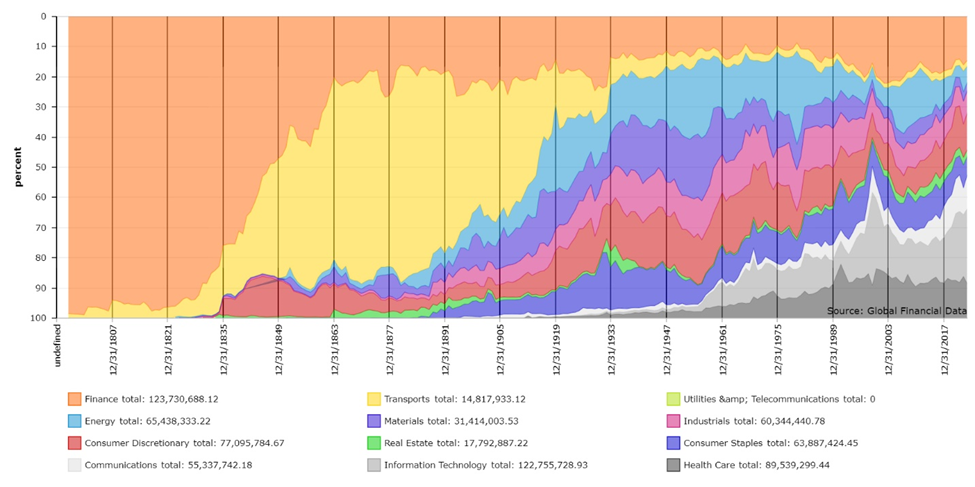

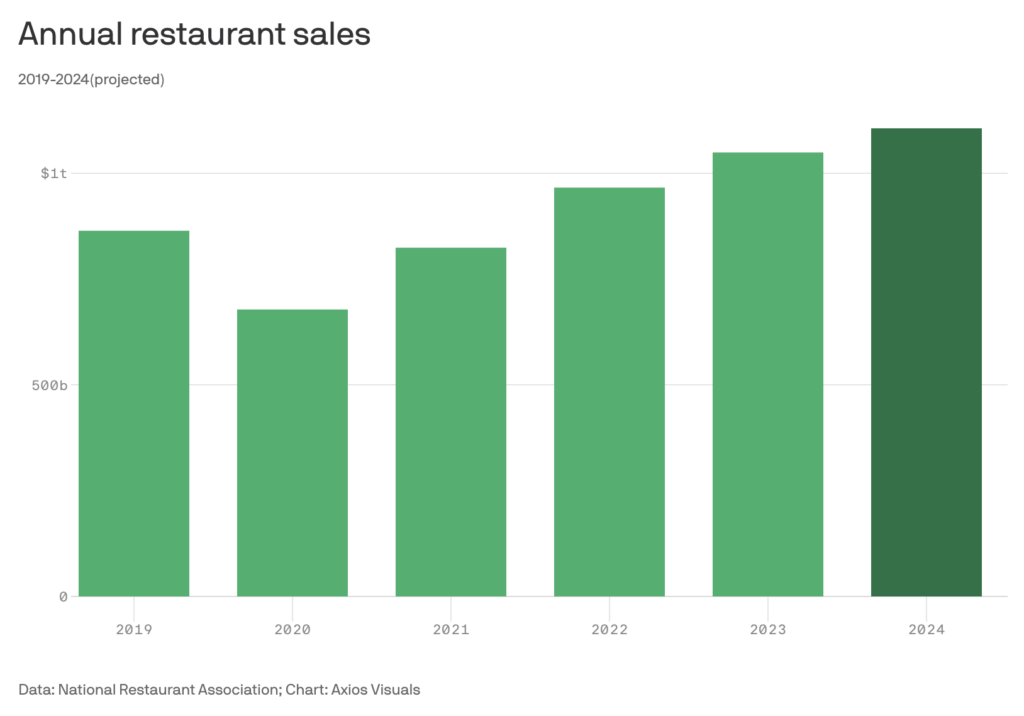

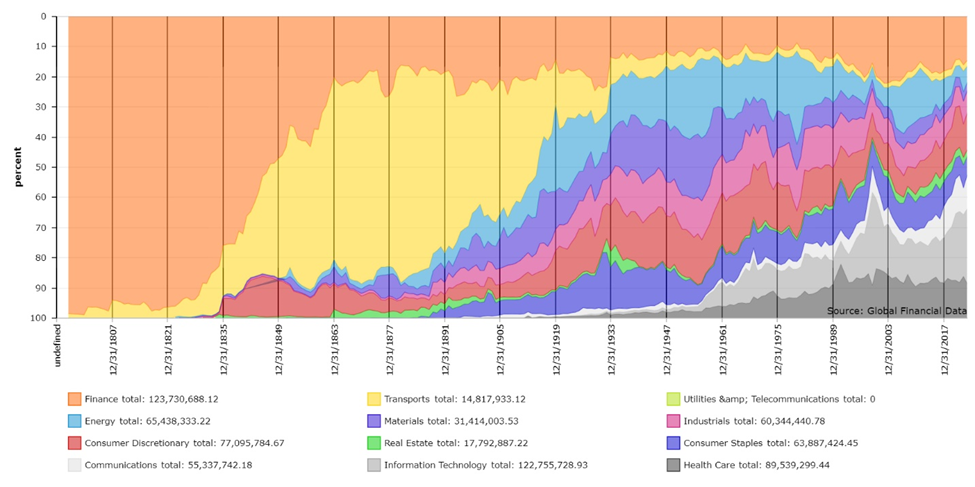

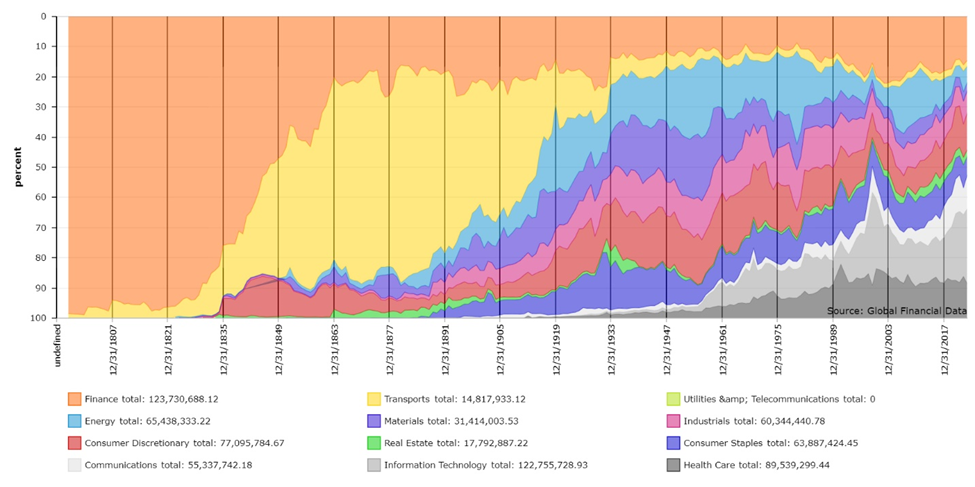

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam...

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam...

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam...

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam...