I’ve been having an interesting discussion with my friend Tony Dwyer of FT Finacial over the impact of year-over-year changes in S&P500 earnings on subsequent market performance. TD is a savvy market technician whose charting work is both straightforward and yet different enough from the mainstream as to be value added and worthwhile.

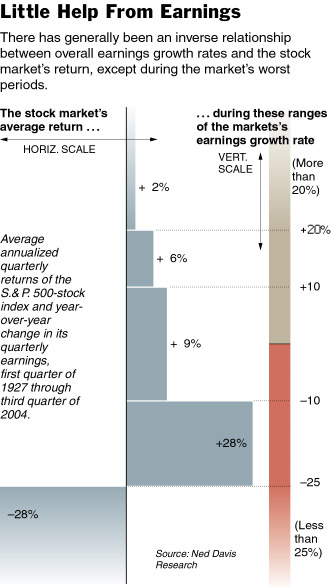

“Since 1927, according to data from Ned Davis Research of Atlanta, the market has performed best during quarters when earnings are as much as 25 percent below year-earlier levels. When earnings are growing strongly, as many expect them to do this year, the market has tended to have below-average performance.”

“Since 1927, according to data from Ned Davis Research of Atlanta, the market has performed best during quarters when earnings are as much as 25 percent below year-earlier levels. When earnings are growing strongly, as many expect them to do this year, the market has tended to have below-average performance.”

A recent study confirms this: “Stock Returns, Aggregate Earnings Surprises, and Behavioral Finance,” by S. P. Kothari, an accounting professor at the Massachusetts Institute of Technology; Jonathan W. Lewellen, an M.I.T. finance professor; and Jerold B. Warner, a finance professor at the University of Rochester, has been circulating as an academic paper since last year.

I actually disagree (in part) with the explanation why the overall market “fails to react more favorably to rapidly rising earnings.” The profs argue that earnings growth itself is not bearish, but rather the problem, is that “growth usually leads to higher interest rates. When rates rise, the net present value of future earnings, cash flow and dividends automatically falls, and this generally causes the market to decline.”

I see a behavioral explanation rather than an interest rate when – but they are two sides of the same coin. To me, when earnings are plummetting, its because the economy is in or about to enter a recession. Stocks have likely already had a big run up in the pre-recession period. So stocks get dumped in this period. Think 1991 or 2002.

The Profs focused on the powerful role of interest rates, as it relates to stock market’s valuation. They wrote that Market tends to perform best when aggregate corporate earnings are falling — which typically occurs when rates drop like stones. Again, consider what the sentiment is like during these periods.

Ned Davis Research determined that “since 1927, the Standard & Poor’s 500-stock index has risen at a 28 percent annualized rate – nearly triple its historical average – during quarters in which earnings were 10 to 25 percent lower than where they were in the periods a year earlier.”

Lastly, NDR noted that the bullish effect vanishes, when earnings are falling too much. That’s typically because the economy is in the earlier stages of a longer contraction. During those quarters when earnings were more than 25 percent below their year-earlier levels, the S.& P. 500 declined at a rate of 28 percent, annualized (since 1927).

The academics explained it thusly: “The positive effects of lower interest rates, though strong enough to overcome the negative consequences of more modest declines,” he said, “are unable to overcome them when earnings are falling by a huge amount.”

Kinda like 2000?

The key to this lies with psychology: Perception versus reality. When year-over-year earnings improve from awful to merely bad, the headlines are still extremely negative. But this is the earliest partof the recovery, and no one — at least, almost no one — has recognized the changing character of the economic cycle. Hence, event though the mood is palpably morose, that’s when you gotta buy ’em: Not only when everyone hates ’em, but when we see quantititative proof of the cycle turning.

Admittedly, this is easier said than done.

Source:

If Profits Grow, How Can the Market Sink?

Mark Hulbert

NYT, February 6, 2005

http://www.nytimes.com/2005/02/06/business/yourmoney/06stra.html

Study Links Slower Market Growth With Higher Stock Returns

A recent study, “Stock Returns, Aggregate Earnings Surprises, and Behavioral Finance”, by S. P. Kothari, Jonathan…

The correlation between the change in the market and the change in earnings is essentially zero

(-0.004). While the correlation between the change in the PE and the change in the market is 0.85.

Even if you have perfect knowledge of what earnings growth will be it is of no help in telling you what the market will do . You would be better off flipping a coin then betting that the market and earnings change in the same direction.

One of the most dangerous times to be in the market is right after eps growth turns positive.

Historically, eps growth tended to lead interest rates.

Based on the above chart, this is another line of evidence that this correction is not ready to turn into a bear market decline. Earnings are forecast to be strongly up, not down. See http://www2.standardandpoors.com/spf/xls/index/SP500EPSEST.XLS.

Therefore, certainly returns might be LESS but certainly nothing near the -28% decline in the above chart.