Comparing present with 1973-74 cycle

May 8, 2006 6:28am by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Previous Post

May fest!Next Post

How This Recovery Stacks Up

I’m gonna keep repeating myself:

I made a Bullish call for the first half 2006 back in from December 2005: Dow 11,800, Nasdaq 2600, and SPX 1350 by mid year.

You can see this 2006 market forecast in print in the Business Week Year end issue). I repeated the same expectations in January (Here Cult of the Bear part III).

I anticipate up to a 25% sell off in the S&P into Q3/4

Go read the Cult of the Bear series . . .

Barry-

Why do you continually do the work for lazy “readers” who belong to the “It’s going to the Moon!” crowd? It’s got to be tiring for you. Hell, it’s tiring for ME to keep reading it and I love your work. Just asking.

The macro environment today is frighteningly similar to 1974. Btw, both post 1929 and post 1968, the two prior equity bubbles, we had very nice rallies. Actually 1929’s rally was huge compared to this rally.

The Transports retested their bear market lows in both instances. ie, 2002 lows. I surely don’t see that happening but to ignore the possibility ……..

Is 1350 something you just feel in your gut? 1350 is a .87 retracement of the 1550 (1558?) high.

That’s not fib friendly. A 75% retrace would fit into Gann (if I understand that correctly).

Why 1350? Just a hunch.

Do tell Senior Ritholtz.

-Mike

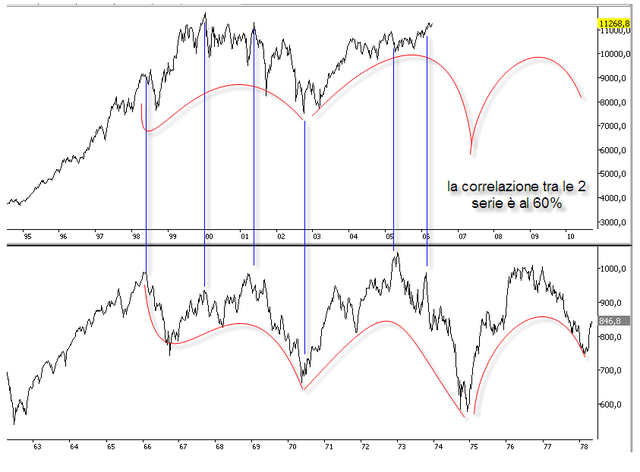

It is interesting that the chart is in Italian: “The correlation between the two series is at 60%.”

hence the phrase “rough outline . . . things rarely repeat perfectly”

Barry, thanks for posting my chart.

As you properly commented this charts are rough outlines, i’m not in love with analog charts myself.

A 60% correlation is quite high though, imho, and that’s why i linked it to you in a previous post.

So this is no pray, no hope, no forecast at all… just playing around with numbers but sticking to a macro vision.

La prima vitima de la saggezza e le innocenza.

GAWD Barry! Remaining longer term bearish on the markets in the face of ALL THIS GOOD NEWS! IDIOT!

I mean, you’ve gotta be one of the few true believers still left. I expect a formal apology permanently posted at the top of your homepage when the Dow hits 36,000 in 2008. Wait, did I say 2008, I meant next Tuesday!!!

In all seriousness, I expect to be pushing up daisies when the Dow hits 36,000 in, oh, say, 2025 or so. And the increasing number of flames on the website tell me you may hit the nail on the head with at least two of your predictions. I happen to disagree that the COMP will get anywhere close to 2600 in the second half, but the Dow and S&P predictions are looking pretty precient at the moment.

I meant first half – not second. Oops

Byno – You may be right as to the Nasdaq — The big cap nazzy stocks are going nowhere fast: Intel, MSFT, DELL, CSCO, EBAY, SUNW, ADBE etc.

But the Dow and the SPX calls are lookin none too shabby (better to be lucky than good).

I was beginning to wonder if they could hold the averages while a rotation took place under the surface that would pump up tech one final time. Still might but it appears tech is doomed to continue its underperformance in this cycle. The bulls just keep pushing the same theme. And, with summer coming, I can’t see a breakout in tech.

Speaking of bulls, er bullsh*t, who is this company that wants to buy Inco for $16 billion? They are taking down one of my favorite investments! An easy, very low risk 50% on each reflationary cycle. Inco has been public for at least forty years. It has followed the price of nickel up and down every reflationary cycle. Well, there is no need for a log scale over the last forty years. It’s been range bound between 10 and 30ish. So, now in a massive metals bubble, they are going to be taken over for 2x the highest price ever achieved in a range bound commodities stock? Are you kidding? When they could surely pick it up in the future for 40% of that price? Maybe the near future?

How can I get one of these Wall Street jobs where you “con” companies into this ridiculous M&A scam? I wonder what Buffett, Grantham or Graham would say about this merger.

Barry-

What’s the latest on the advisory service? Or did all our comments that we would gladly pay 50 cents per week for that scare you off? Or have sales of The Sweater been so rich that the advisory service is unecessary? :)

Here’s a thought on those year ends:

Wednesday, Ben Dover says that the Fed has decided to pause, immediately causing a huge spike in the markets. Unfortunately for the bulls, the indices are already overbought, and a spike to 1350 on the S&P causes maximum over-boughtness. The rally gets faded from 3:00 on, and that’s all she wrote for the three and a half year old rally.

Seem plausible to anyone?

Mark,

Maybe we should up the ante to a buck. Actually, I’d happily pay more than RM charges for Ritholtz institutional research, but like you, I haven’t seen any new news.

Byno-

Or, alternatively, they hike to 5, and hint there’s likely to be more coming, sending the market into a broad sell off. Nah. Anyway, I have been thinking May as the top for this pig for 3 months now.

Doesn’t matter to me. I’m hedged out the wazoo and could care less about Livermore’s “the last eighth”of this trade.

While the internals are deterriorating and the dulls of summer are around the corner, the market seems very strong in the same theme stocks. It’s sort of funny that the NDX has made its high for the day during this short rally in the first 30 minutes then basically treaded water the rest of the day. That looks like a buyer’s strike to me.

Looks like the bulls sent out an expeditionary force this morning with some reasonable volume. I think they are sniffing bears and trying to see if they can pop out and shorts. No success if that is what happened, they gave up in the AM. Let’s see what happens post 2pm. Maybe another short squirt up. I just wonder how many bears even have shorts in place any more. We are moving in on a seven month rally and that is the longest this bull cycle along with 2003. Final wave #5? A few more months at most. And if we got a few more months, I’d be worried that the downside would simply be worse. Alot of this “stuff” theme looks like blow offs to me. 30-50-80% moves in six months in whole sectors. That is not orderly, sustainable market behavior. I like 80% but on a large cap in six months, it wreaks of unhealthy greed.

The market could indeed tank on Bernanke’s news BUT some data I’m looking at says we might be readying another assault to the up side. It’s hard to believe but what the hell. I can’t believe copper is at $3.50 either. MIGHT IS THE KEY.

We had one minute on the Q’s that traded 600 shares? Uh, on a good day we get 130 million shares traded. 5 million so far on the semis that usually trades 30 million. Anyone else notice this? This has happened a few times recently. The volume is drying up. Even Friday volume sucked. The tape is almost eerily quite.

Would you wanna hop in the way of BOHICA Ben (wink and a nod to the military guys)? I wouldn’t be doing shit till 2:15 Wednesday, and even then, I’d wait to see the initial reaction so I could play the fade.

Some folks here need to look at Mandelbrot’s work… markets are fractal….

Mandelbrot pulled his hair out and proved nothing about market action. I don’t buy that thesis completely either. It implies chaos as a foundation. A very smart mathematician but he he can’t pick stocks or market direction as well as a good quant and he spent many years trying to formulate a mathematical foundation for markets with no success.

Doesn’t Ron Sen over at Technically Speaking subscribe to Mandelbrot a bit? (as well as DeMark)

I remember when Mandelbrot got all of this notoriety because he had thought he was on the verge of finding the holy grail of market action. That was so long ago that I was a young engineer just out of school. That hype died a quiet death because try as he may, he was unable to prove anything or come up with anything you could use. DeMark is what Ron follows as I recall. I do to because so many people follow it that it is somewhat self fulfilling. Although anecdotally so. I’ve read all of Tom’s work. Most I wonder why I did. I wonder how someone can come up with some of the stuff he does and say it has proven to work without any back testing. It isn’t back tested because it too is alot of bullsh8t. That said, all of the blow off indices that were hot this cycle are on monthly Demark 9 or 13 sequential sells.

You were asking about Teck Cominco, B. They are a very well run diversified exploration and mining company. They will use their HUGELY run-up shares to acquire the merely overpriced shares of Inco. Seems okay to me from a strategic and value perspective.

Anyone read ‘Complexity’ by Mitchell Waldrop? Chaos theory is absolutely fascinating, but I agree it’s more for backdrop and perspective than anything truly predictive… Texas Hold ‘Em probably gives a better mental model for this market. Right now the bulls are doing a Doyle “Texas Dolly” Brunson and laughing from behind their big pile of chips. But the Brunsons of the world are also notorious for blowing out their stack out in just one or two bad hands.

Off topic post of today but one of a few reasons I believe China’s about to sh*t in its shorts. Interesting if nothing else. Especially since 30% of China’s economy is their own real estate bubble. And take down all of those natural resource feeder nations with it.

Btw, consumer sentiment in the US is already below prior recessionary levels.

http://www.oftwominds.com/blogmay06/housing-global-recession.html

Speaking of DeMark, I thought you might find this interesting:

If I’ve done my math right, the Dow Jones has triggered a TD Setup Sell Signal and a Perfection Sell Signal. And, barring a sell off today, a TD Countdown Sell Signal will be triggered in addition to a TD Countdown Perfection Sell Signal. The stop limit is @ 11,646.

I’m not saying to do anything, as I’ve never really traded based on DeMark’s work. But, if you’re playing the game by his rules, unless I’ve done a miscalc…

Also, the Naz has already triggered all the necessary sell countdowns – stop loss is @ 1755 on that one.

Not recommending ANYTHINg – just sharing info

Check that – the buy stop on the Naz is @ 1780 – a hell of a loss to take if you wanna be short. Not exactly a pretty setup.

I haven’t put alot of focus behind the Dow or Naz because I’ve been so fixated on the market leaders but it makes sense to me. With the monthly setups complete on the business cycle leaders and the blow off runs we’ve had recently, I wouldn’t be at all surprised that we start cratering soon. I also wouldn’t be surprised if we run a little more. ie, Nothing surprises me any more except the retards who think we’ve cheated the business cycle and are on our way to Dow 36,000.

I tend to think anecdotally that it also explains why we seem to have a lack of buyers this past few weeks. I can’t imagine a savvy market professional wanting to bid prices up right here if for no ohter reason than we have hit these signals and so many professional traders follow them. Especially with the dollar flirting with a break of its long term trading band. I also haven’t looked at the forex market but we might be nearing a buy signal on the dollar too. Forex traders are huge Demark users. But, I tend to think that would be a daily as the monthly might be quite a different story.

I aslo tend to think we might be on the verge of seeing the Asian century take a big dump in favor of the continued American century. Isn’t the world convinced this is the Asian century? How long would it take for China to recover from a Japanese style collapse without a consumer based economy run by the centrally planned politburo? Longer than Japan which was much more market based. Right now, I would not want my money parked anywhere but the good old US of A. Will be interesting to see how the next few years play out.

Centrally planned, but as much as yesterday, not as much as tomorrow. B, your bias is gonna get you killed.

IMO, the 2000’s are gonna be the “European Century”. Mark it down.

Thank god for Excel – that sell stop on the Dow is ACTUALLY 11,658. Also, it is worth noting that this is 3rd, count em 3rd, DeMark sell signal the dow has triggered this year. The Naz has triggered two, and the sell stop there is ACTUALLY 1766

Hopefully you mean figuratively. Is the Chinese mafia after me? Mark my word. India will be the next Asian economic power. Not China.

It won’t be Europe either. Our greatness is due to our immigration growth. We see how ugly the French and Germans are. They want immigrants as indentured servants but don’t want them to be equal citizens. Without population growth via immigration, all of the reforms in the world will not help a declining population in Europe.

Speaking of Asia, it’s becoming more clear that Bernanke ignores the dollar it his peril.

He’ll have to trash it in the final act, of course, but it’s still a bit early for that.

The real problem the bulls have here is that 1) foreign investors are getting no juice from these gains whatsoever, due to the offset of currency devalution, and 2) Asian exporters + Middle East exporters are losing their taste for the ‘vendor finance’ game as the American consumer slides into the wall.

The dollar has played a major role in the path of equity markets before. Secretary Baker comes to mind…

Check this out from Andy Mukherjee: http://tinyurl.com/kdllf

just looked. 9-13-9 completed on nyse composite and s&p MONTHLY. 9 completed on nasdaq monthly. i’m off for now.

And now, just for fun, we’ve got Shimon Peres doing a Travis Bickel impression:

http://tinyurl.com/jw5yy

“Yo Mahmoud. You talkin’ ta me? You talkin’ ta ME? ‘Cause I’m the only Israel here…”

ever thought the us wanted the dollar to fall? did you see martin feldstein’s piece recently? he presided over a huge drop in the dollar as reagan’s top dog and just wrote that we need to do it again. he was also who i wanted to be named fed chair………..and that jives with the G7 dollar comments recently and secretary snow’s refusal to clarify that we don’t want the dollar to fall two weeks ago on tv.

just a thought that seems to have a policy behind it. china and asia can kiss their ass good bye. that way they don’t need to subsidize the dollar because the won’t be selling us anything to subsidize if that comes to pass. an extreme statement that isn’t based in truth……….entirely.

This summer’s big dip in US stocks is going to be about herd instinct, disappointingly slow growth, and the slow realization that the kids’ Xmas is coming out of their college funds until we get all the 18-wheelers running on Ethanol.

Yes indeed… of course the US wants the dollar to fall. That’s plain as day. ‘Competitive Devaluation’ is our whole strategy for getting out of this trade deficit mess.

But the problem, as I’ve said before, is that the “party in the basement” scenario also happens to be the “screw the bagholder” scenario, and the bagholders ain’t too keen on that.

When we talk about letting the dollar fall in a big way to solve our fiscal problems, we are simultaneously talking about screwing over any and all foreign holders of dollar-denominated assets. It’s a sort of prisoners-dilemma scenario, but worse, because this scenario ends with a shootout.

Consider Asia’s position: if we follow through on Feldstein’s wishes and devalue the dollar to our hearts content, they know they are screwed.

Asia is still heavily reliant on US consumer demand as many have pointed out. They have not yet made the transition to internal domestic demand. This means that they have to play nice with America. But it also means that a USD competitive devaluation scenario will be the end for them. If our currency plummets and theirs goes sky high, their export-led economies will implode. Not much upside in imploding.

So, if Asia knows that our downward dollar plan will eventually frag them, why should they sit around and take it? What incentive do they have to keep playing nice with us?

As long as the American consumer is chugging along, there is a reason for both parties to engage in Bretton Woods II.

But as soon as the consumer slows to a significant enough degree, or US imports of Asian goods slow to a significant enough degree, the incentive for Bretton Woods II collaboration disappears. The fact that someone will get screwed is guaranteed; it becomes a matter of who gets screwed first.

This logic applies to the Middle Eastern oil exporters also. They have been recycling their petrodollars into the system to help keep the game going. But at some point, the financial costs of dollar devaluation outweight their incentive to keep recycling petrodollars into dollar-denominated assets.

We may still be the big fish in the pond, but this is a situation where the crazy little fish realize they will soon have nothing to lose. That’s a recipe for new outbursts of nationalism, protectionism, and other frightening displays. Think Tony Montana on the balcony.

And though I hinted at it obliquely with the earlier Baker reference, let me say it again more directly: our willingness to screw foreign investors by “letting the dollar go” was the trigger for the crash of 1987.

Actually, what triggered the crash in 1987 was a culmination of many events. Not the least of which was an explosion in long term rates leading the market to be market to be the most overvalued it has been at any time post 1970 except 2000. Along with a big turd sandwich in program trading because of that explosion. Some of that was because of a falling dollar. But, as soon as it dropped it came right back and finished the year higher than it was the December of 1986. ie, It was not an economic event.

I don’t know that anyone thinks a reval is going to fix our problems but they hacked the hell out of it and kaboshed Bretton Woods II during Reagan’s tenure. The next ten years after that were some of the best in our history. And some of the worst in Japan, who we were targeting amongst others. There are many unforeseen risks with this but what is worse? More of the same is worse for us in the long run. That is why I pray if it does happen, it is orderly. If anyone comes out smelling the rosiest in this, it will be us. And, frankly, if Asia won’t reform their economies to drive their own consumer demand and they’ve had 70 years post WWII to do it, F#CK them. They aren’t doing me any favor by buying our bonds. They are only doing so because they are bankrupting us with all of their sh*t that they should be consuming themselves if they’d address structural reform. So, if they would get their house in order, we likely wouldn’t be building up this massive debt. ie THEIR lack of reform is THE problem and it’s bankrupting us.

The main reason for a currency revaluation is not to solve the trade deficit. It is to put the Asian central banker’s and politician’s balls in a vice and force domestic consumption reform which would also be a tremendous boom for America exporters and service companies. And regardless of all of the hogwash, we actually increased our percentage of global manufacturing output by 1% to 21% in the last five years so we have lots of sh*t to sell them. We are the only major nation other than China to be able to say that. And that I support 110%! I just don’t want a crisis in the mean time. These other countries need to get their shit together. I’m goddamn sick of being responsible for consuming the world’s output to keep their economy afloat. Without us the global economy goes to hell in a handbasket. Do these other countries give a sh*t if they bankrupt us as long as they shovel more sh*t at our doorstep? All while we go further in to debt. One more time. F#CK THEM!

LOL!

Good points, good points… I fail to disagree… the one thing that bugs me is our utterly shitty track record at global crisis prevention…

B-

I’m nominating you for The Big Picture’s “Tony Montana Solution Award” for 2006! This prize is given annually to the trader who gets on the balcony, screams “F#ck you!” at the world and let’s the machine gun just start blazing. Are there any other nominations out there? Send them to me. Results to be disclosed at the same time the Fed statement is released. We’ll see if we can move the market with this one!

Say hello to my little friend!

Jason at Minyanville has an excellent article on market divergence with his look at Fidelity Select Funds. Take a gander at the parallels:

http://www.minyanville.com/articles/index.php?a=10279

What can I say. It’s a versatile word. Hey, Pacino liked it. And more importantly Tony liked it. But, I don’t believe in guns or violence of any kind unless it is directly towards people dishing it out.

And, actually I’m quite fond of the Asian culture so my statements were not about anything other than wanting our government to quit playing the lackey in economic politics.

So F#CK YOU! lol. I am obviously kidding. Or maybe not so obvious.

trader 75 deserves a Pulitzer

only thing missing on above chart is the point where stephen roach turned optimistic in ’73….

The DJIA cycles really reflect the political cycles of the various generations as they come into adulthood. Just like the cycles of fashion and music, there are cycles of conservative vs liberal. The graphs could be useful to investors and traders alike if they know how to find the meaning in them.