Scott Patterson in today’s WSJ writes:

“The housing news has been so grim for so long that

investors seize on any data that is less than disastrous as a sign of a

recovery right around the corner.That is a risky bet based more on wishful thinking

than common sense. With the economy teetering on recession, credit

tight and the labor market weakening, odds are that housing will keep

getting worse before it starts to get better.Tuesday’s National Association of Realtors’ report on

existing-home sales in March will test investor thirst for good news.

Economists surveyed by Dow Jones forecast that March sales will drop 2%

from the previous month. If the report is better than that, expect to

hear talk about more lights flashing at the end of the tunnel.”

The WSJ article looks at 3 factors that are continuing to impact Home

Sales: Falling prices,a weakening labor market, and very tight credit

markets.

Despite those three very real concerns, I am going to make a bold forecast: Existing Home Sales (untis, not price) may very likely to increase when reported today at 10am.

An even bolder forecast: Existing Home Sales may very likely to show increases in total homes sold each and every month from now through August.

Why? As we have discussed before, its the Seasonality factor.

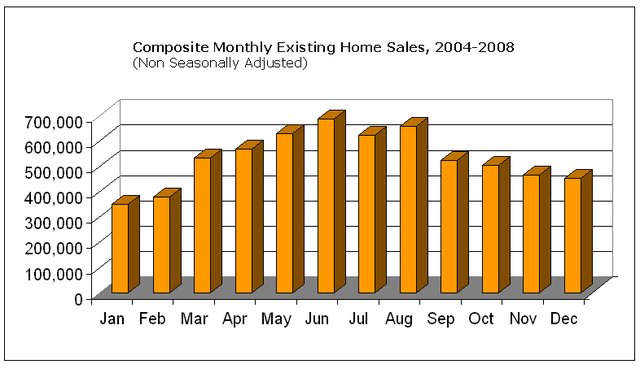

Have a look at this chart:

>

Composite Monthly Sales non-seasonally adjusted

>

That explains the month to month permutations, and why you need to look at year-over-year data.

>

(more on this later today)

>

Previously:

Existing Home Sales, Non Seasonally Adjusted, Explained

http://bigpicture.typepad.com/comments/2008/03/existing-home-s.html

Source:

Home Data May Inspire False Hope

SCOTT PATTERSON

WSJ, April 22, 2008; Page C1

http://online.wsj.com/article/SB120881342587332523.html

Home sales damn well better improve. I have a relative who is listing a modest home later this week in order to move to a retirement complex.

Back to the oil topic … When $125+ oil migrates down to gas, and both natural gas and heating oil rise in parity, expect nothing but necessities to sell very much. Maybe small home that are less expensive to maintain will see higher demand. People will just hunker down.

This is the inflation that is worth creating a recession over. There is too much easy capital chasing too few hot opportunities. Time to sponge up the excess, and fast. Anyone who mistakes oil prices today for cost push inflation is an idiot or someone who finances the speculators.

I hope housing improves, but if commodity prices remain high, we can all expect a new, lower equilibrium level of sales for just about everything, including housing. It won’t be a recesssion … it will be a change to a permanent lower standard of living.

Given that housing has been on a downward trend for the past few years, it really isn’t useful to show a chart that compares Jan and Feb 2004-2008 to the rest of the year 2004-2007. That March bar is going to drop a lot once this year’s March numbers are reported. All the other bars will drop as the year goes on.

Also, the NAR reports seasonally adjusted numbers, so the normal Feb to March increase should not show up as an increase. Unless you can demonstrate that their seasonal adjustment methodology is faulty, you shouldn’t pretend that their numbers are not seasonally adjusted.

I hope housing improves, but if commodity prices remain high, we can all expect a new, lower equilibrium level of sales for just about everything, including housing. It won’t be a recesssion … it will be a change to a permanent lower standard of living.

Who are you and what have you done to cinefoz?

Walker, exactly!

When my contrary indicator starts making sense, it is either because he’s taking his AD/HD meds or the thorazine is finally working. Either way, damn science. It ruined a perfectly good money making weather vane!

Bring back the real Cinefoz!!!

Walker, it’s me.

If prices right themselves and/or a stock market bottom is hit AND a rise is going to come along within a couple of months, I will become Mr Optimist again … and sell at a profit when it goes up. I made a few measly percent last week when I cashed out and am in the green for the year.

I’m not a gloomster, I see rises and falls. I try to figure out why for myself and I believe close to nothing anyone else claims to know. Upon reflection, I have come to decide that I don’t understand the concept of bull or bear. Both are one dimensional concepts and are empty suit philosophies. Anyone who is either is a sucker waiting to be fleeced.

I don’t wait for the absolute bottom or absolute top. Nobody can guess those. I just try to get close and hope to book something on the range I expect to see. This is a ‘maximize the minimum gain’ strategy. The two downsides are selling too soon or holding too long and having to make the gain a second time. The best I can hope for is using education and experience to get closer to each extreme, so that the range is good to me.

BTW, this site has improved a lot. It may, on first glance, look like a gloomster site. But the postings have not been glorified ‘Boo…’ missives for a few weeks. The tone is negative, but things are not very good right now, so the tone is appropriate.

Walker, Ross, others … Just because I’ve joined the dark side for now, this doesn’t mean we’re friends. My membership is, hopefully, only temporary. I’m waiting to see what happens with rates next week. Happy people are much more fun to be around, although it’s always a good time to point out the flaws in gloomster logic when things are looking up.

WTF? The NAR publishes y/y SA and y/y NSA data and they are different. That buggers all.

If you look at all Govt data, the NSA y/y and the SA y/y is essentially exactly equal. And it should be, Feb to Feb, March to March is the same in both cases. So WTF is the NAR doing?

Single home sales for Feb

-22.9% y/y SA

-18.5% y/y NSA

How is this possible?

Barry –

Point #3 on the link to “Existing Home Sales, Non Seasonally Adjusted, Explained” remains incorrect, in this case, you are incorrectly comparing seasonal to non-seasonal numbers to make your point. As you are repeating that post, I repeat the correction of that factual mistake below.

You state:

“3) The average increase from January to February over the past 4 years has been 7.2%. Yesterday’s monthly “improvement” is less than half what we have been typically seeing.”

I believe you are comparing Apples to Oranges. The 7.2% average Jan to Feb improvement is non-seasonally adjusted. The 2.9% I believe you are referring to as “Yesterday’s monthly ‘improvement'” is the seasonally adjusted number.

The non-seasonally adjusted Jan to Feb increase in 2008 from the NAR site is actually higher than the 2.9% – it is 12.2%. See the excel file at: http://www.realtor.org/Research.nsf/files/EHSreport.XLS/$FILE/EHSreport.XLS

So the February increase is higher than typical, in fact, nearly twice as high.

It would seem to me this analysis supports (albeit with only one small datapoint) the inference drawn from the NAR seasonally adjusted 2.9% increase that this Feb showed the slightest bit of an uptick.

Otherwise, as usual, great analysis.

Cinefoz,

Who is a gloomster? It’s a beautiful Tuesday morning in Texas and I’m watching ‘Red River’ on TCM. The beef critters are mooing and the horses frisky. Hell, I think I’ll burn a steak for breakfast.

If you treat the markets like a treasure hunt instead of a game, you’ll miss all the fun!

Warning: anecdotal evidence ahead.

Unless the county records are not up to date, it looks like the county I am watching, Okaloosa Florida, sales are down -43.6% YoY and -6.15% MoM for March.

Prices are up 6.5% MoM and down -5% YoY.

Keep in mind the seasonal factors will be pulling DOWN sales.

From 1971 to 2007 the March increase in Single family home existing sales has been 31.6% up from the Feb prior. NSA

During those same years the SA increase has been 0.1% m/m increase. So on average the seasonal factors pull sales down 31%

Well Feb pending sales were at a record low and a lot of those probably fell through so I am not as positive as you.

We have been bouncing around 5 million for months.

Wake me up when we move meaningfully off that run rate.

You gotta love the NAR.

March single family existing sales are up 19% m/m NSA.

The average pull down over 35 years to seasonally adjust data in March is 31%, and the average over the last 5 years is 35% (most X11 and X12 SA programs use the most recent 5 years of data).

So Seasonally adjusted sales ought to be around -12% m/m or -16% m/m. What does the NAR give us?

-2.7% m/m

Seriously how to they do it with a straight face?

The number dropping highlights 2 more possible problems with the economy. One, the home buyers where the sub-prime has not been a real problem are now “in-play” as job cuts and inflation rises. Second, the lack of people who can qualify for mortgages begins to crimp the home buyers as home prices continue well above the level where housing would be affordable.

Ok, this has pissed me off for so long I must now ask in writing: Why the f&^k does anyone give any attention to what the NAR puts out as “data?” IMO about as believable as human rights data put out by the Chinese government.

I made two awesome (well I think they’re cool) charts.

First chart is how the data would look if the NAR used the 39 year historically SA adjustment.

Second chart is today’s actual NAR data release.

The takeaway. The 4 March’s the NSA data has been down, down, down, down. (makes sense)

The SA data? down, down, down, UP

Way to go NAR! (click on me to see charts)

The seasonal adjustment for this particular year’s March might have varied from prior March due to the timing of Easter. That’s my guess.

I am sorry, the number did not go up. Even you can get it wrong sometimes. I lost all faith in forecasters. I agree that in a bust, you should look at history of busts to make any prediction, not looking at numbers from last 5 years. I do like your website though. thank you.