On Monday, we looked at Weekend Bailouts and Subsequent Market Reactions. CitiFX took a closer look at the data, and they confirm our prior position: Namely, that “Support levels were eventually breached and the market trended lower.”

CitiFX Technicals adds:

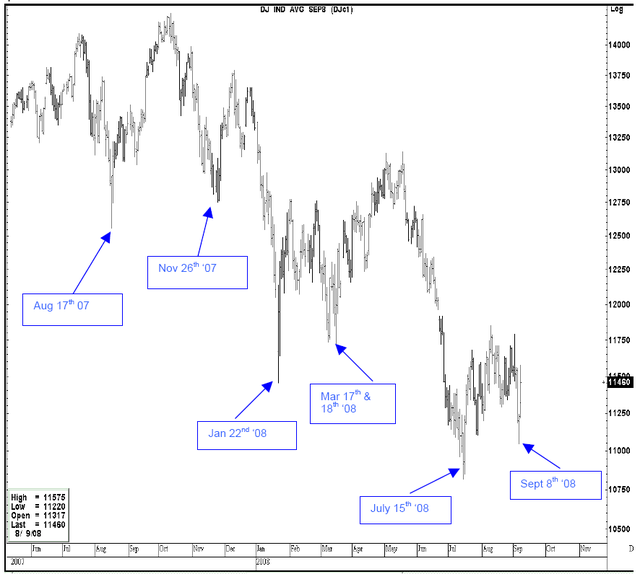

As the market falls aggressively, we find that there are further developments from authorities that act as ST supports for the Dow. But the real concern is that each crisis has been followed by a bigger crisis and this just does not feel like the “capitulation blow out”

Here’s their chart, along with comments:

1. August 17, 2007: The Federal Reserve Board announced a reduction in the primary credit discount rate from 6.25% to 5.75%. DJIA rallies 1,680 points over 9 weeks

2. November 26, 2007: Significant changes in limits for SOMA securities lending programme (federal reserve banks of NY). DJIA rallies 1,056 points over 3 weeks

3. January 22, 2008: FOMC decided to lower its target for the federal funds rate 75 b.p.s in an unscheduled meeting. DJIA rallies 1,134 points over 2 weeks

4. March 17/18, 2008:Bear stearns takeover on 17th March and FOMC decided to lower its target for the federal funds rate 75 b.p.s. Market expected 100 b.p.s. DJIA rallies 1,400 points over 8 weeks

5. July 15, 2008: Paulson’s testimony before Senate Banking Committee outlining plan to support GS’S (liquidity, sufficient capital and Fed consultative role). DJIA rallies 1,039 points over 9 weeks

6. September 08, 2008 Treasury takes control of Fannie and Freddie.

Source:

Welcome to the U.S.S.R. (United States Socialist Republic) Citigroup (PDF)

Tom Fitzpatrick, Shyam Devani

CitiFX® Technicals – Bulletin

08 September 2008

Controlled crash? Bottom of maybe 9500 if we can get all of the bad news behind us?

Off-topic, but WTF is up with Gold? What is the 25% drop in this commodity’s price telling us about expected inflation? I bought it as a hedge against inflation that we all see, but it’s gotten crushed in the last several months. Any thoughts about staying the course or getting the heck out?

TIA

DSL getting hit pretty good today. You have to think they’re getting taken out this Friday, no?

And perhaps WM the week after (or at least within 30 days)?

So then the FDIC is the next thing to be “rescued”, in what, 30-60-90 days?

The dominos are just going to continue to fall.. but slowly – just like the government wants.

Why is the vibe of nearly every news item on this subject a a full ladle of ‘the bottom’ talk? Does further price discovery somehow threaten GE, Time Warner, FOX, Disney and the other corporate ‘beheMOUTHS?’

Oh and just as Warren Buffet’s pulling out of insuring bank deposits, the gov’t’s jumping in… now who’s a better investment “tell?”

http://www.bloomberg.com/apps/news?pid=20601087&sid=aM9grZP8NNrw&refer=home

“The dominos are just going to continue to fall.. but slowly – just like the government wants.”

Chinese water torture! But one these days the Chinese will find other uses for their surplus dollars like shoring up their own failed banks and enterprises and stimulating their economy from riots.

Bye, bye Treasury market and the waterfall capitulation into complete banana republic.

Jdamon, There are several reasons gold is selling off, not the least of which has been a rise in the $usd. I view this to be a very temporary rally, and there is excellent commentary on the dollar phenomena here: http://goldmoney.com/en/commentary.php

Next, I’ve been following/trading/storing gold since 2001/2002. Keep your eye on the GDX, $hui, and others. When the indices and stocks stop dropping in reponse to falling or volatile gold prices, the bottom is probably in. That said, I see major support for gold at $700.

IMHO it is around time to rally for a bit, which will provide ample opportunity in several markets to re-sell.

Long term we are very likely going to revisit 8550 type levels in the DJI.

Quite frankly I expect more like 7700 as a “must reach” eventual target.

It really isn’t that far.

Also as for Gold, we will see 730$, then 700$ and also potentially worse(640$ is the first sensible area again, then around 605$). The people who don’t “get why it’s going down if inflation is still rampant” and “can’t fundamentally see it do anything but go up” are basically the reason it will blow out so strongly. There are no one sided trades, there is no free lunch.

Gold isn’t an inflation hedge. It’s tied almost 100% to the USDX, which in turn is linked over half to the EURUSD’s fate.

Has anyone seen the EURUSD chart lately?

Exactly. (1.6 => 1.4 as of now)

Disbelievers in the USD are getting just as much hit as the disbelievers in a stock bear market. Inflexibility is the death of many a investor and trader.

IMHO we’re going to get that giant meltdown in the carry trade and most of it will come on the back of a crush against the yielding pairs, which are pegged against the USD, hence boosting that in turn, exception being the YEN.

Someone jot this down and remember it for when we reach sub 140 levels in EJ and those DJI levels. :)

I’ll be ready to trade it as it occurs.

Barry, Fascinating numbers, all those rallies. Thanks for the post.

Consider what we saw with each rally was the triumph of optimism over analysis. Or of the factors of structural trend, fundamentals, even technicals it was the psychology of sentiment that allowed/enabled the rally. Which also meant denial of deteriorating fundamentals. It seems to me we’re in the process of sentiment rolling over where realization of deeper economic problems is beginning to sink in. Not there yet but “progress”. As the economy worsens will the weight shift from fantasy to data or not ?

How much after WM goes under the US Govt CDS doubles!

NEW YORK (Reuters) – The cost of protecting U.S. Treasury debt with credit default swaps hit record highs on Tuesday amid concerns about the cost of a government bailout of mortgage finance companies Fannie Mae (FNM.N: Quote, Profile, Research, Stock Buzz) and Freddie Mac (FRE.N: Quote, Profile, Research, Stock Buzz).

Five-year credit default swaps for Treasury debt traded at an all-time high of 17.5 basis points, or $17,500 a year to insure $10 million of debt, up from 15.5 basis points on Friday before Sunday’s bailout announcement, according to data from CMA DataVision.

Treasury’s 10-year credit default swaps traded at a record 21.4 basis points on Tuesday, up from 18.5 basis points Friday.

The cost to the U.S. government from taking on liabilities of the two companies was said to be behind the rise, according to Lou Brien, a strategist with DRW Trading Group in Chicago.

The Treasury Department committed to provide up to $200 billion to buy shares in the struggling companies as part of a takeover aimed at supporting the U.S. housing market and warding off more financial market turbulence.

The takeover could mean more government borrowing and federal exposure to risky mortgage assets that have been battered by the housing slump, analysts said.

Posted by: Jdamon | Sep 10, 2008 12:14:34 PM

Jd,

you may want to check-out Jim Sinclair’s site:

http://jsmineset.com/

and/or http://www.financialsense.com

for additional background/info.

Also, I was wondering if this thread had a take, pro or con, on Sinclair’s..

to the post: with charts like that, no wonder CNBC sticks to tick-by-tick and ‘weeklies’..

funny how the Frame changes the Picture..