We noticed in the last part of August that there was an onslaught of critical pieces in highly regarded media outlets about gold. Gimlet-eyed scrutiny is always helpful but we could not help noticing that almost without exception the stories were embedded with curious logic that naturally led to illogical conclusions (most often something to the effect that “you better be careful because gold looks like a bubble”). Irrefutable economic and financial identities were ignored in favor of regurgitating sloppy, disproven metrics rationalizing the forty year-old unreserved credit build-up. Sadly, even the requisite favorable arguments towards gold, no doubt inserted for journalistic balance, were way off-point.

The media should not be blamed. Writers write, journalists journal and neither should be expected to know about matters with which they have not personally studied deeply. A seasoned journalist covering the financial beat thinks in terms of finance, not in terms of commerce or business, and one covering economics only knows political economics. It is understandable then that with gold setting new nominal highs the financial media tapped into their collective Rolodex to get expert analysis from financial authorities on a matter that threatens finance and from political economists trained to seek economic fixes through already-failed monetary or fiscal policies:

Journalist: “So tell me, Mr. Fox, should we be concerned these gold hens are out of their cages?”

Highly regarded financial analyst or economist: “Off the record…yes, gold is being driven higher by a bunch of unsophisticated ideologues. On the record…(earnest face)…the gold price shows a fear of inflation, which by the way, doesn’t show up in any data. Nevertheless that fear can’t be completely discounted until leaders stop their bickering and work out a plan. Then it won’t be such a good idea to own gold.”

Of course, the established stalwarts make no mention of what “the plan” is shaping up to be – devaluing our baseless global currencies against gold. Market strategists generally do not understand the forces behind valuing money nearly as well as the relationship connecting available systemic credit to nominal output growth and nominal financial asset valuations, and independent economists actually willing to connect all the dots are generally too “responsible” to speak of formal devaluation before all other policy options are exhausted.

Political economy is practiced in Washington and on Wall Street, and, ergo, the only brand of economics taught in schools looking to gain employment for their alumni. Political economists have been trained to see economics through the prism of government. Liberal ones prefer a heavy dose of Keynesianism, and are quick to suggest fiscal policies to re-balance their sense of fairness, if not economic equilibria. Conservative economists prefer less fiscal intervention and are keener to reduce tax rates or manage money supply to maneuver economies. Both factions, however, seek annual nominal output growth at all costs, (even at the expense of negative real growth), and neither sees the aggregate economic incentives of commercial counterparties as the nexus of an economy’s direction and sustainability. Neither self-proclaimed “conservatives” nor “liberals” accept the possibility that conventional government intervention could ever be ineffective. Yet this is precisely the case today.

Established political, financial and economic operators, and the media that covers them, are focused on the impractical demands of the far left and far right and concerned with what might happen if such demands continue to polarize the public. What they are failing to grasp is that they are part of the circus too. Policy makers are boxed in a debt trap from which there is no conventional escape. Media elders are taking dictation from disproven financiers and economists like cub reporters. (If they are “lucky enough” they gain access to money-grubbing politicians who don’t know enough to realize (or care) that their benefactors will be powerless when the dollar fails!) The establishment is earnestly debating whether Nero should fiddle in c-major or in g.

The reality of contemporary economies is that financialism has become unquestioned and fidelity has been de-commissioned. We believe strongly, and you should too, that the odds are heavily in favor that outcomes considered economically taboo today will occur tomorrow. The forty year-old dollar-based global monetary system is functionally unsustainable, long-in-the-tooth, and now noticeably failing. Conventional policy or politicking cannot fix it. The international pendulum has already begun swinging back towards hard money (and scarce resources), and its velocity is accelerating.

Thinking that centrism, compromise, American Exceptionalism, or a new Winston Churchill singularly or collectively have the ability to somehow secure the common good and Western balance sheets is fatuous. The influence of each was borne of and sustained by the very same incentives of the bourgeoisie that political leaders and policy makers are now going out of their way to circumvent. It should be becoming obvious to all that perpetuating the status quo is not in the common good. Such idiocy, regardless of its omnipresence in capitals, financial markets and international media, should be ignored by adult investors seeking positive real returns.

The reluctance to embrace gold as a viable asset, (let alone as the ultimate stand-alone currency), may be psychologically understandable. Forty years after the world’s governments and commercial counterparties accepted a baseless form of monetary exchange, the fundamental value in gold can only be seen through independent critical analysis. Today’s uncollateralized monetary system is an absolutely faith-based social construct that requires shared and unified beliefs across all economies and cultures. It is logical that the tenets behind the faith required to perpetuate such a system would be promoted by its sponsors and beneficiaries. But agreeing to play along cannot change value or, more importantly, the recognition of value.

We have no doubt that for many/most of you what we have written in the past and write below may strike you as logical and maybe even likely, but that acting on it would give you great dissonance. We know this because data show ownership of what needs to be owned to survive monetary change with purchasing power intact is so low that it is almost negligible. While we have mostly discussed why we think excessive inflation is a lock and have directly discussed gold as a natural beneficiary of this macroeconomic course, we think the time has finally come for us to get more specific about the merits and risks of investing within the gold space and how we have chosen to do so for the fund.

The views expressed in this paper promote our largest fund weighting. Please know that we have maintained and increased this weighting since 2007, not because it has worked well, but because gold is becoming fundamentally cheaper than when we first made our allocations. Gold is not in a bubble. It has not even begun to percolate yet. We look forward to taking gains one day but current valuations suggest aggressive buying.

Your Gold Teeth

Gold is not a financial asset to be compared with dot-com stocks or Miami condos and it is not a commodity like pork bellies or crude oil. It is the ultimate currency for the truly sophisticated wealth holder in a time of substantial unreserved credit promotion. In today’s environment, the great risk in gold is not owning it and not owning it right.

Gold is currently not sanctioned as money by any government for any economy or for exchange in global trade: no official authorities promote its use in domestic or international commercial exchange; no government-issued currency is collateralized by it; one cannot use it to pay federal income taxes. Indeed, Ben Bernanke declared last month before Congress that gold was not money.

So then why do some people place any value at all on these inert rocks? Why are there futures contracts in the US, Europe and Asia that allow the ostensible purchase and sale of it? Why do Treasury ministries and central banks continue to own it, why are they buying it now (and why don’t they simply buy their gold on the futures exchanges rather than from each other)? We believe answering these questions reveals much about gold’s true value.

Q: Why do some people place any value at all in gold?

A chunk of gold is indeed a worthless rock until it is either: 1) generally thought of as money by private commercial counterparties, or 2) officially deemed “money” by government authorities. When either happens, other forms of currency lose their value against it. This process may happen over time or suddenly (or first the former then the latter). Simply, gold is the global money form that has a long history of inevitably becoming sovereign over provincial baseless currencies issued and sanctioned by governments. Gold’s value at any point in time, therefore, ((as expressed in terms of quantities of baseless currencies (e.g. $1,800/oz)), is a function of discounting the sustainability of baseless currencies in existence.

We view discussions about record nominal gold prices or CPI-adjusted gold prices unworthy of serious thought. Such metrics do not address the fundamental driver of gold’s value to humanity: its exchange ratio with other currencies based on purchasing power parity for goods and services.

We believe the fundamental value in gold is easily apparent today by comparing the quantity of government-sponsored base money to claims for it (debt), a.k.a. systemic monetary leverage. The wider the spread becomes, (the more systemic leverage), the less sustainable the currency in which it is denominated becomes because more currency must be created to service and/or retire the debt. So the value of gold is inversely correlated over time to the perceived sustainability of baseless currency. It appreciates vis-à-vis baseless currencies and against assets denominated in them because debt becomes more likely to be defaulted upon, either in real or nominal terms.

Given the very high level of systemic leverage that currently exists in the West and the universally accepted monetary strategy of creating either more credit or more base money to remediate slowing nominal output growth, chatter about a “gold bubble” seems patently misplaced. Both unreserved credit creation and base money creation increase the debt-to-base money ratio. How could base money creation increase the debt to base money ratio? Because the means of creating base money (more actual currency) is achieved through debt monetization. Central banks explicitly buy newly-created debt with newly created money or buy existing debt with tacitly created new funding facilities. In the current monetary regime, all currency is debt and new money or credit is new debt.

Gold is an asset that is not an obligation of any government (as far as we know). It is a government asset like a national park, a military or the ability to collect taxes. Unlike those assets, gold is the only potential monetary asset. Chairman Bernanke was absolutely right last month declaring gold is not money. But the follow up question should have been; “might it be if Americans, international commercial traders or dollar reserve holders lose faith in dollars as a store of purchasing power?” He would have had to say “yes”.

Perhaps this explains why global treasury ministries and central banks have begun to buy gold for their own accounts? US Federal Reserve Notes are backed by the full faith and credit of the US Treasury, which is to say by Treasury’s obligation to have the Fed print more money to pay off all existing dollar obligations. That is all.

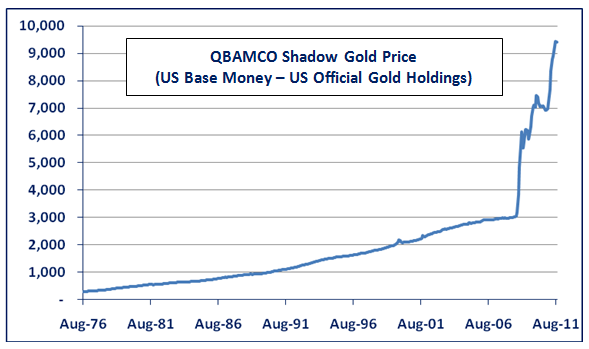

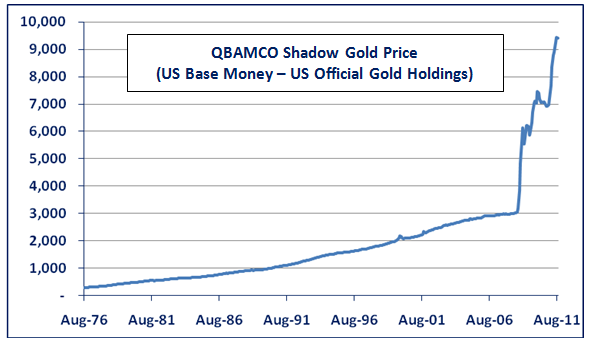

As most of you know, we developed a “Shadow Gold Price” (SGP) that attempts to value currency, (in this case the US Dollar), using the same metric used under the Bretton Woods Agreement from 1944 to 1971 (US base money – now about $2.7 trillion, divided by official US gold holdings, which has been relatively static at about 8,300 hundred metric tons). Given the increasing amount of base money and the relatively static stock of Treasury gold, the SGP is approaching $10,000/oz.

As most of you know, we developed a “Shadow Gold Price” (SGP) that attempts to value currency, (in this case the US Dollar), using the same metric used under the Bretton Woods Agreement from 1944 to 1971 (US base money – now about $2.7 trillion, divided by official US gold holdings, which has been relatively static at about 8,300 hundred metric tons). Given the increasing amount of base money and the relatively static stock of Treasury gold, the SGP is approaching $10,000/oz.

Further, any new base money production would increase the Shadow Gold Price even more, and virtually all observers believe there will be more “liquidity” created in an effort to either stimulate nominal output that would decrease unemployment or to merely save creditors or debtors from widespread failure.

The reality, however, is that our SGP is woefully insufficient in capturing the true amount of dollar denominated claims that must be satisfied with currency that does not yet exist. Regardless of whether the Fed’s guess of about $55 trillion in total USD claims or Pimco’s estimate of $75 trillion is more accurate, the intrinsic value of gold would be far, far higher than $10,000/oz.

Any calculation that seeks to find the intrinsic value of gold based on purchasing power parity becomes socially problematic in the current environment because the debt-to-base money ratio is already so far above commonly acknowledged spot gold pricing and very likely to move significantly higher still. Whether or not the market or policy makers perform the necessary adjustment, any step-shift towards such a figure would imply the complete failure of the dollar, and with that the complete failure of the current global monetary system. But that is what the numbers are and that is the point.

Dollar (and Euro and Yen) denominated obligations are irreconcilable unless a massive amount of debt is simply forgiven (naturally or by decree), or the currency is devalued. Our guess is that there will be a mix of both. Perhaps the worst systemic debts will, one way or another, be transferred to government entities where they can be “jubilee’d” at taxpayers’ expense? But it seems obvious that the most efficient and politically expedient way to reset the monetary system will be through devaluation vis-à-vis the monetary asset that millennia of political leaders have used (and the one all nations are now scrambling to get).

If global policy makers continue down the road they are on, (and there is no sign yet they can gain the political capital necessary to act preemptively prior to a market-based monetary failure), then we think there will be a period, hopefully short-lived, in which gold loses its bid for dollars. In other words, holders of the metal will not be willing to exchange it for baseless currencies at any exchange rate (price). Property and labor would still have value of course, but the media commonly used to value them would have to be reset.

If such an event were to occur our sense is that major currencies in existence today would not be devalued according to a mathematical model because “fair value” numbers would be too high and governments would not need to go that far to find an acceptable price where current gold holders would meet government tenders for gold. Even if inflation (past and necessary future money creation) puts purchasing power parity at, say, $50,000/oz. when screens go blank, international gold holders would likely see $10k/oz. or $15k/oz as a windfall IF paper gold’s last trade on exchanges were much lower.

If such an event were to occur our sense is that major currencies in existence today would not be devalued according to a mathematical model because “fair value” numbers would be too high and governments would not need to go that far to find an acceptable price where current gold holders would meet government tenders for gold. Even if inflation (past and necessary future money creation) puts purchasing power parity at, say, $50,000/oz. when screens go blank, international gold holders would likely see $10k/oz. or $15k/oz as a windfall IF paper gold’s last trade on exchanges were much lower.

Q: Why are there futures contracts on gold and why is the front-month futures contract (“spot gold”) the benchmark price for exchanging gold?

It is unclear to us that publicly listed gold futures are justified by commercial participants. The vast majority of open interest is not comprised of gold producers or jewelry manufacturers seeking to hedge future production or sales. It is safe to assert then that gold futures are levered currency derivatives that provide speculators with financial gains and losses. (We do not judge whether or not gold futures should exist, as we do not judge whether burlap futures, lotteries or Texas hold-em futures should exist. Our interest is in clinically understanding price.)

Less than 1% of all gold futures settle for cash. Put another way, over 99% of gold futures are rolled each month and almost no participants in the futures market take delivery of bullion. Thus, it would be accurate to say that gold futures are paper gold. Further, futures contracts are leveraged forms of unallocated gold “ownership”. For example, one futures contract on the CME, for which an investor must put up only $9,450, represents about $180,000 of gold (100 ounces per contract at $1,800/ounce). So, one need only post about 5% of notional value to ostensibly control 100 ounces of gold. (This margin requirement was actually raised twice in August to 5%).

The absolute profits and losses generated by a vehicle with such explicit leverage may make it appear to casual observers that the value of gold itself must be volatile. However, the price of an unlevered ounce of gold has changed less over time than: 1) the price of an unlevered unit of equity shares, and 2) the long-term growth rate of US systemic debt and the three-year growth rate in base money that are the fundamental drivers of gold’s value (see above). So, it would seem accurate to argue, (and would be consistent with centuries of history), that physical gold is the anchor of sustainable value around which other forms of wealth storage, (baseless currencies and financial assets denominated in them), revolve.

The amount of gold ounces represented on futures exchanges vastly exceeds the amount of deliverable gold in the world, and the perpetual rolling of front-month contracts insures very little physical gold actually changes hands. Further, claims for gold represented by other derivative vehicles off futures exchanges but priced off futures, such as ETFs, gold swap agreements, and even fully paid-for yet unallocated gold held in storage, cannot be satisfied.

We do not have a problem with gold futures per se, (in contrast to many gold fans who decry naked shorting), because for every seller of gold claims there must be a buyer. But it is important to recognize that the leverage inherent in gold futures changes its character; physical gold is a real asset while gold futures are financial assets. Like other financial asset markets, the paper gold market is grossed-up with leverage but its open interest nets out at equilibrium pricing.

This does not mean that equilibrium pricing in gold futures necessarily represents “fair pricing”. We believe participants in gold futures include: 1) speculators at every level of sophistication who buy and sell them seeking financial gain from either price changes or, at times, positive carry; 2) banks that create unreserved credit denominated in baseless money, who short gold futures because they have incentive to sustain the current monetary system and maintain control over credit distribution, and; 3) sophisticated international purchasers of physical gold that short futures to keep the benchmark price low so they can amass more physical bullion.

If the preponderance of sellers of gold futures enjoy far better funding terms than do their buyer counterparties, then it would seem logical there would be great advantage to sellers to maintain prices lower than they would otherwise be if funding of futures were equitable. (We do not distinguish here among the daily pricing of gold futures and any other financial asset that may be pressured higher or lower based on preferential funding.)

Consider the gold lease rate. The 1-month gold forward offered rate (GOFO), which is the rate at which banks comprising the London Bullion Market Association (LBMA) lend gold on swap versus US dollars, was 0.39% on August 31. Meanwhile, 1-month US LIBOR was 0.22%. Thus, the gold lease rate (LIBOR – GOFO = Lease Rate) was negative 0.17%. This negative rate means there is a lack of demand among banks to borrow gold.

Banks borrow gold to service customer shorts, not to deliver gold to each other. It is safe to assume then that bank customers participating in the gold futures market have no interest in borrowing gold so they may short it. We conclude that banks, which are not pressured to produce physical bullion to be shorted, must comprise the short side of the gold futures market.

Given that banks and large offshore investment accounts, (rumored to represent foreign emerging sovereigns), comprise the majority of open interest in gold futures, and given that both have very preferential funding (banks fund at 0% while sovereigns may print their own money or use amassed dollar reserves), and given that both would have substantial incentive to suppress gold prices, (banks to support the value of their assets and underwrite more credit in existing currencies and sovereigns to buy physical gold from the West more cheaply); it seems logical that gold futures pricing does not reflect the intrinsic value of physical gold.

If our fundamental analysis is anywhere near accurate, (the Shadow Gold Price is nearing $10,000/oz before QE3), then it would seem gold futures participants with preferred funding have been very successful in suppressing the perception of the intrinsic value of physical gold through the gold futures market. Perhaps this is why there is a gold futures market and why sovereigns cannot simply exercise futures to amass more gold? Paper gold is not gold. It is all a notional fabrication.

Best to Play Along

Some people believe that if powerful forces act aggressively in a unified fashion then it is good to get out of the way. We believe it is better to take their side. As banks and sovereigns retard the price appreciation of gold futures they diminish the public perception of value in physical gold, which in turn keeps cheap physical gold available. As investors, we like this.

There are only two ways to own physical gold: 1) take possession of above-ground bullion and 2) own a permitted mine filled with proven reserves. The former requires no claim on property, only protection and storage. A shareholder in a gold miner does not have to pay for protection and storage; however to retain a claim on future mine production he must rely on the legal enforcement of property rights.

As we noted above, we believe other forms of gold “ownership” are baseless claims with counterparty risk because the amount of gold claims vastly exceeds the amount of above-ground gold in existence. Even fully-funded unallocated gold “ownership” is very different from possessing gold bullion or having a direct claim on numbered, allocated bullion. A claim on gold that has been fully paid for but that is not directly backed by allocated physical gold is, like futures, simply a claim on something that does not exist. Paper gold, like the vast majority of paper money, is essentially fractionally reserved credit.

We have made the case repeatedly that gold is the only currency that periodically becomes sovereign to all other baseless money issued and sanctioned by governments. Given this status, we believe that unreserved paper gold claims will significantly under-perform above-ground and in-ground extractable gold. If/when holders of physical gold or owners of gold mines are no longer willing to exchange their bullion for USDs, EURs, Yen, etc., then fractionally-reserved gold exchanges, (in which open-interest is comprised of both naked longs and naked shorts), would likely cease trading and be forced to settle all long and short positions with credits and debits in that paper media – not in gold. Gold futures and all derivatives that get their value from “spot gold” (like gold ETFs) would also be forced to stop trading and settle for cash in static quantities of baseless money.

So while there may not be nominal losses for holders of paper claims on gold, such holders would be stopped out of maintaining their purchasing power when the scarcity property that gives gold its true value is needed most. Investors in these instruments will discover they have owned financial assets, not hard assets.

Is Confiscation a Risk?

Since 1973, when it became legal again (after 40 years) for private parties in the US to hold gold, a perceived risk to holders of above and below-ground gold has been government confiscation. In fact, last month in Venezuela — a country where private property rights are not a high priority – the government effectively confiscated private sector gold mines. Is it possible that confiscation could occur in developed Western economies if/when it is perceived that such confiscation would serve the public good?

Anything is possible, but we think: 1) confiscating private gold would not solve anything for governments because doing so would not increase base money, which is the source of their economies’ leverage problems, and 2) confiscation is highly unlikely until governments are ready to formally devalue their currencies, which implies far more currency and levered financial asset deterioration in the markets vis-à-vis gold. So while anything is possible, we do not see confiscation as a risk to above- or below-ground gold owners.

To be sure, there is precedent for government confiscation within developed economies. President Roosevelt delivered Executive Order 6102 to Congress on April 5, 1933, which forbade “the hoarding of gold coins, gold bullion and gold certificates in the continental United States by individuals, partnerships, associations and corporations.” Roosevelt cited Section 5(b) of the Act of October 6, 1917, as amended by Section 2 of the Act of March 9, 1933, entitled: “An Act to provide relief in the existing national emergency in banking…”

Below is the Order in its entirety. Feel free to skip over it if the particulars of no interest to you:

I, Franklin D. Roosevelt, President of the United States of America, do declare that said national emergency still continues to exist and pursuant to said section to do hereby prohibit the hoarding gold coin (sic), gold bullion, and gold certificates within the continental United States by individuals, partnerships, associations and corporations and hereby prescribe the following regulations for carrying out the purposes of the order:

Section 1. For the purpose of this regulation, the term ‘hoarding” means the withdrawal and withholding of gold coin, gold bullion, and gold certificates from the recognized and customary channels of trade. The term “person” means any individual, partnership, association or corporation.

Section 2. All persons are hereby required to deliver on or before May 1, 1933, to a Federal Reserve Bank or a branch or agency thereof or to any member bank of the Federal Reserve System all gold coin, gold bullion, and gold certificates now owned by them or coming into their ownership on or before April 28, 1933, except the following:

(a) Such amount of gold as may be required for legitimate and customary use in industry, profession or art within a reasonable time, including gold prior to refining and stocks of gold in reasonable amounts for the usual trade requirements of owners mining and refining such gold.

(b) Gold coin and gold certificates in an amount not exceeding in the aggregate $100.00 belonging to any one person; and gold coins having recognized special value to collectors of rare and unusual coins.

(c) Gold coin and bullion earmarked or held in trust for a recognized foreign government or foreign central bank or the Bank for International Settlements.

(d) Gold coin and bullion licensed for the other proper transactions (not involving hoarding) including gold coin and gold bullion imported for the re-export or held pending action on applications for export license.

Section 3. Until otherwise ordered any person becoming the owner of any gold coin, gold bullion, and gold certificates after April 28, 1933, shall within three days after receipt thereof, deliver the same in the manner prescribed in Section 2; unless such gold coin, gold bullion, and gold certificates are held for any of the purposes specified in paragraphs (a),(b) or (c) of Section 2; or unless such gold coin, gold bullion is held for purposes specified in paragraph (d) of Section 2 and the person holding it is, with respect to such gold coin or bullion, a licensee or applicant for license pending action thereon.

Section 4. Upon receipt of gold coin, gold bullion, or gold certificates delivered to it in accordance with Section 2 or 3, the Federal reserve bank or member bank will pay thereof an equivalent amount of any other form of coin or currency coined or issued under the laws of the Unites States.

Section 5. Member banks shall deliver alt (sic) gold coin, gold bullion, and gold certificates owned or received by them (other than as exempted under the provisions of Section 2) to the Federal reserve banks of there (sic) respective districts and receive credit or payment thereof.

Section 6. The Secretary of the Treasury, out of the sum made available to the President by Section 501 of the Act of March 9, 1933, will in all proper cases pay the reasonable costs of transportation of gold coin, gold bullion, and gold certificates delivered to a member bank or Federal reserve bank in accordance with Sections 2, 3, or 5 hereof, including the cost of insurance, protection, and such other incidental costs as may be necessary, upon production of satisfactory evidence of such costs. Voucher forms for this purpose may be procured from Federal reserve banks.

Section 7. In cases where the delivery of gold coin, gold bullion, or gold certificates by the owners thereof within the time set forth above will involve extraordinary hardship or difficulty, the Secretary of the Treasury may, in his discretion, extend the time within which such delivery must be made. Applications for such extensions must be made in writing under oath; addressed to the Secretary of the Treasury and filed with a Federal reserve bank. Each applications must state the date to which the extension is desired, the amount and location of the gold coin, gold bullion, and gold certificates in respect of which such application is made and the facts showing extension to be necessary to avoid extraordinary hardship or difficulty.

Section 8. The Secretary of the Treasury is hereby authorized and empowered to issue such further regulations as he may deem necessary to carry the purposes of this order and to issue licenses there under, through such officers or agencies as he may designate, including licenses permitting the Federal reserve banks and member banks of the Federal Reserve System, in return for an equivalent amount of other coin, currency or credit, to deliver, earmark or hold in trust gold coin or bullion to or for persons showing the need for same for any of the purposes specified in paragraphs (a), (c), and (d) of Section 2 of these regulations.

Section 9. Whoever willfully violates any provision of this Executive Order or these regulation (sic) or of any rule, regulation or license issued there under may be fined not more than $10,000, or, if a natural person may be imprisoned for not more than ten years or both; and any officer, director, or agent of any corporation who knowingly participates in any such violation may be punished by a like fine, imprisonment, or both.

This order and these regulations may be modified or revoked at any time.

/s/Franklin D. Roosevelt

President of the United States of America

April 5, 1933

So basically there seems to be precedent and we must presume it is legal for the US President to unilaterally decide what is and is not a legal form of savings and store of wealth for Americans. The rationalization for this order was clearly to save the US banking system. After confiscating privately-held gold from the public, Roosevelt then de-valued dollars vs. gold, from $20.67/oz. to $35.00/oz. He effectively tried to save private bank capital structures at the expense of private savers.

The differences between then and now are not as great as one would think. FDR formally devalued the dollar by re-pegging it to gold at a higher price. We think President Obama or whoever comes next will have no choice but to formally devalue the dollar by pegging it to gold. FDR had to re-peg dollars (devalue) because there was already a gold exchange standard in 1933, meaning the Fed could not create new money as it is doing today (through QE). FDR’s team was very conscious then that abandoning the gold-exchange standard would risk the dollar’s fate. It could have failed almost immediately as the Papiermark did in Weimar Germany 10 years before.

This time, we think a contemporary Cabinet will have to devalue and then re-peg (with a 40-year lag, since 1971) after it becomes clear that there are diminishing economy-wide benefits from central bank money printing and debt shifting. Formal devaluation will be the least painful way of de-leveraging economies.

For investors in gold today, we think the pertinent risk-related questions are these:

1. “Could the US government confiscate privately-held bullion and publicly-held shares in gold miners without significantly altering established property rights law? Wouldn’t economic conditions have to decline meaningfully first?”

2. “What justification would the US government have to confiscate gold and gold miners at a time when, unlike in 1933, gold does not back money?”

3. “Could the US government confiscate all shares in gold miners throughout all domains owned by international shareholders, or would Canadians say “get oot” and Australians say “G’Day”?”

While governments may try to do whatever they like, we think they would not succeed in the current environment. Confiscation would demand upending international property rights law and justifying it in the name of saving twelve money center banks no longer charged or expected to physically warehouse depositor savings. Further, unlike 1933, the Chairman of the Fed (at his last Congressional testimony) and everyone else freely admits gold is not money.

Structurally speaking it would be far easier for governments to ditch the existing monetary system entirely and start over with another baseless currency. Such a monetary reset was actually done in Weimar Germany on November 15, 1923, after massive hyperinflation forced the Papeirmark/US dollar exchange ratio out to 1,000,000:1. Papiermarks were replaced with the Rentenmarks at a USD exchange ratio of 4.2:1. The lessons of history are not easily dismissed. A monetary reset from paper to paper would be tantamount to admitting failure and bringing the legitimacy of the new currency along with government itself into question. The fall of the Weimar Republic and the rise popular discontent in Germany should serve as an example.

The most logical and politically expedient outcome is formal devaluation and transformation into a hard currency, executed by allowing central banks to tender for gold at a targeted, devalued dollar/gold exchange rate. More Federal Reserve Notes would be created and recorded as liabilities while the static quantity of gold would be recorded as an asset. Balance sheets would reconcile.

We wrote in “Apropos of Everything” about the mechanics of devaluation. The process of re-instituting gold-backed money would require a substantial devaluation of unreserved debt money (i.e. dollars, Euros Yen, etc) to gold. Perhaps this is why Western Treasury ministries and central banks cannot seem to accumulate gold fast enough presently while jawboning its barbarous qualities? And perhaps this is why Russian and Chinese governments have begun keeping much of their domestic gold mine output?

We conclude that gold would theoretically have to be deemed government-sanctioned money before it and gold mines could be confiscated by governments and by the time this would happen there would be no need for confiscation. We believe there will be confiscation of property but that it will be in real terms through currency devaluation. The time to convert paper money and assets to gold is prior to devaluation. Those entities with gold (including private holders), will effectively confiscate property from those entities without it through increased relative purchasing power. Governments have no incentive to confiscate the little gold held by private parties that would profit from devaluation.

Taxing Matters

Conceivably governments could try to tax gold ownership at higher rates than they do presently, but we think this is highly unlikely. First, gold is already treated differently than financial assets. In the US, for instance, gold and many derivative claims on it (including popular ETFs) are treated by the IRS as “collectibles”, which carries a higher tax rate than long-term capital gains. Additionally, we think compliance would be next to impossible in the case of trying to tax above-ground, non-registered gold holdings. Unlike 1933 when gold actually backed USDs, governments do not know which taxpayers own physical gold and would have to rely on voluntary taxation.

Further, we suspect most privately-held gold is held by powerful people with influence over government authorities. Taxing gold would not serve them personally. Finally, the mere act of imposing new taxes on gold would signal its high value to governments, which we think would make it more difficult (not less) for governments to obtain it from private holders.

Could governments impose a special excise tax on earnings from gold production? To be sure, government authorities can do whatever they wish as long as the general population (and military) goes along with it. It is certainly conceivable US and Canadian governments might consider taxing gold production, as they are doing in Peru and attempting to do in Australia. But we think this is highly unlikely as a preemptive maneuver.

Gold production is getting caught up in Australia’s attempt to increase taxes on domestic corporations benefitting greatly from exporting natural resources. Australian miners, which comprise a significant percentage of GDP, are exporting record amounts of resources like iron ore, copper and coal to Asia and their revenues and earnings reflect this. The government is seeking to capture some of this “windfall” and it has been negotiating with some of Australia’s largest publicly held companies for a bigger share. As discussed, this “Super-tax” would effectively have a return-on-capital hurdle rate above which tax rates on incremental earnings would climb. It is important to recognize that revenues and profits from gold mining do not comprise a large portion of large Australian miners’ ROAs.

This scheme is not applicable elsewhere in the G7. There would be no justifiable reason to levy taxes on North American gold production because, with very few exceptions, gold miners tend to be concentrated exclusively on gold production and gold production is almost undetectable as a percentage of GDP. (This second point discounts Peru as an applicable data point due to its economy’s small size, relatively undiversified industrial sector, and reliance on exportation.) Revenues and potential taxes from gold or silver mining in the US and Canada would be trivial within the context of their output. Additionally, as mentioned above, the product produced by gold miners is almost useless in industry. Its only value is monetary and so any threat to tax gold production at even higher rates before it is officially devalued would serve to raise the price of gold and the revenues and earnings of gold miners.

Thus, we think a preemptive excise tax on gold producers is unworthy of serious consideration. We would expect to be selling our shares if and when Congress begins debate about charging a windfall profits tax on precious metal miners, and perhaps rolling the profits into fully-monetized distressed government bonds with positive real yields.

The Play

Though investing in them has been a tough row to hoe of late, we think gold miners are ridiculously, unsustainably cheap. First, they have historically been of dubious repute (i.e. “A gold mine is a hole in the ground with a liar on top”, not actually uttered by Mark Twain, as is usually credited, but poignant just the same.) Further, large investment banks influencing the majority of investment capital do not go out of their way to provide support to the gold industry. (Why would they?) One need only look at the absence of research coverage of precious metal miners and the very low official projected gold prices across Wall Street, which feeds directly into projected miner revenues and earnings for anyone looking to value them on a financial metric.

To make matters tougher, good and honest miners have generally been bad financial operators and unresponsive to shareholders, led by salt-of-the-earth geologists and their relatives struggling to answer irrelevant financial queries from urban money changers more concerned with stuffing unrecognized gains into the current calendar year to bonus-up for beach homes and Wii2s. Mining relatively small ore bodies is a laborious and unpredictable process. It does not translate well into a financial architecture.

A tree falling in the woods makes a sound even when no one hears it. The play in gold miners is not their management or even on-time delivery of surprisingly good earnings. It’s all about their gold inventories. There are cheap, independently-audited companies mining or able to mine proven reserves in politically stable, well-situated domains. The current monetary food fight that increases the value of gold increases the value of their inventories.

Gold mine output growth has actually decreased in recent years even as the gold price has risen. This implies true scarcity and the exhaustion of mature mines owned by very large miners also producing consumable commodities. (Gold production and revenues as a percentage of their total revenues is small.) If the largest miners of iron ore, copper and coal want to replace their gold inventory then the cheapest and quickest way to do this is through acquisition of smaller miners in control of quality mines. If they do not, then smaller miner intrinsic valuations will appreciate on their own in a very levered fashion. The critical metric is asset valuation of pure-play gold miners. Reserves on the balance sheet are the key, and we think they must and will be recognized.

As for producing revenues and earnings, we expect revenues generated by existing producing miners will rise substantially more than input costs. Established miners with permitted proven and probable reserves will gain from increasing gold prices, economies-of-scale related to energy and labor costs, and from new discoveries and ore-grade increases within already-permitted zones. Further, the cost of production per ounce mined and sold will diminish as by-product metals increase in price as well.

Unsophisticated financial operations, investor unfamiliarity, rising energy and labor costs and fears of government shakedowns do not mean that the upside for gold mining shares in developed economies is limited. In fact, we think the upside in pure gold (and silver) miners may be substantially higher than the underlying metal.

This has not been recognized yet. In fact, shares in gold miners have badly lagged the price appreciation of gold futures. The graph below shows the normalized spread separating Spot Gold from the NYSE Arca Gold Bugs Index (HUI) over the past five years. As you can see from the bottom panel, shares of precious metal miners have greatly underperformed spot gold since mid-2008 and this trend has been greatly exaggerated since March of this year. In fact, for 2011 spot gold appreciated 28.5% while the HUI Index rose only 4.4% through August 31.

How might we explain this underperformance? We think there may be a few reasons. First, recent gold converts (or reluctant momentum players) may be fairly unfamiliar or unconcerned with value over time. They may simply want immediate exposure and the easiest way is through listed futures. The other alternative gold expression hindering miner sponsorship has been publicly traded gold ETFs. Gold ETFs have done a credible job of tracking the daily performance of gold futures. However, as we alluded to above, we think there is great room for investor disappointment in some of the more popular ones.

For example, the SPDR Gold Trust, which is reputed to have the sixth largest inventory of gold in the world, is a Grantor Trust contractually obligated to deliver to its shareholders a dollar-equivalent gold value in the form of each day’s closing share price. Doug Hornig of Casey Research recently researched GLD by scrutinizing its prospectus and interviewing its sponsor. He concluded that ownership in it, even among investors holding more than 100,000 shares pre-approved for share/gold conversion, does not practically constitute gold ownership for shareholders. Were there to be a sudden run on physical gold that would close gold futures trading, GLD’s sponsor would not be able to open the shares for trading. All credits and debits would be reconciled in dollars. In the US any long-term profits would be taxed at the 28% tax rate on collectibles. So we think there is considerable room for disappointment among ETF holders that believe they have adequate exposure to physical gold or the performance of physical gold if and when that exposure is most needed.

We view this as a potential powder keg that will lead to sudden sponsorship of gold miner shares, analogous with the bullish argument associated with large short interest in a stock (only better). ETF shareholders are already sold on the merits of having long gold exposure. What they lack currently is the knowledge that they own a vehicle that would not provide them the benefits of gold when they need it most. We expect re-allocation from ETFs to gold miner shares as this becomes known.

Given: 1) a $10k Shadow Gold Price and current macroeconomic fundamentals supporting further monetary inflation; 2) the maturation over the last five years of exploration, permitting, production, balance sheets, access to capital and stabilized energy and labor costs within the miner space; 3) ten years of “curing” (the benefits from survival bias for both miners and gold miner investors that has already occurred); 4) the vast underperformance of shares vs. spot more recently; and 5) the “high priority” of miners within the list of all potential gold expressions when monetary issues present themselves more obviously to the public; we conclude that this particular investment space will produce significant out-performance.

Over the last two months we have scaled out of our bullion plays and re-allocated towards miners we know and about which we are enthusiastic. Three of our precious metal miners were acquired in 2010. Last month, one of our miners, Northgate Minerals, a Canadian firm in which we built a decent stake over the last few years, agreed to be acquired at almost a 50% premium. Like many other miners we hold, NXG had been very profitable for the Fund even before that announcement.

We think the assets owned by certain miners will encourage more transactions or else they will be re-priced in step-shift fashion by the markets. (It is reminiscent to us of base metal miners in the spring of 2009.) Our only metric for staying long precious metal miners is that their inventories remain cheap to above-ground physical gold, which in turn remains cheap to past and future money and credit growth.

One Last Thing

Come next February we will have been managing assets for five years together, using a strategic macroeconomic approach. The process of defining and valuing proper economic and financial identities and trying to apply them profitably in the markets has been incredibly gratifying. We look forward to continuing QB until we retire, hopefully many years from now.

As you may have noticed we tend to like our independence. Nevertheless, the big footsteps of Dodd Frank are rounding the corner and we have begun the process of registering with the SEC as a registered investment advisor. We are happy to comply, even if the legislation demands we formally label ourselves a “hedge fund”.

Be that as it may, we will be making some changes to coincide with our registration. First, we plan to raise our asset base, initially by $50 million, so that our early investor class reaches capacity. With the additional fees generated from this new AUM we would hire another analyst and dedicated administrative/compliance personnel. (Please let us know if you are interested in investing in our US or Cayman fund — accredited investors only, $500,000 minimum investment, fifty investors maximum.)

Second, we plan to consolidate our operations. As it stands, we have occupied two offices, one in New York City and one in upstate New York. The plan is to take space in Connecticut and work from one office.

Third, we plan to winnow down direct distribution of our written reports. We will be resetting our distribution list and access to our website accordingly.

We have enjoyed engaging in conversations with many of you, learned much, and of course we hope to continue such dialogues.

Kind regards

Lee Quaintance & Paul Brodsky

pbrodsky@qbamco.com

August 2011

~~~~~~~

THIS MATERIAL IS NOT AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO PURCHASE SECURITIES OF ANY KIND. RETURN FIGURES HEREIN ARE ESTIMATED NET OF ALL FEES AND CHARGES. PAST PERFORMANCE MAY NOT BE INDICATIVE OF FUTURE RESULTS. ANY COMPARISONS HAVE BEEN OBTAINED FROM RECOGNIZED SERVICES OR OTHER SOURCES BELIEVED TO BE RELIABLE. THIS REPORT MAY CONTAIN FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD-LOOKING STATEMENTS INVOLVE INHERENT RISKS AND UNCERTAINTIES, AND WE MIGHT NOT BE ABLE TO ACHIEVE THE PREDICTIONS, FORECASTS, PROJECTIONS AND OTHER OUTCOMES WE MAY DESCRIBE OR IMPLY. A NUMBER OF IMPORTANT FACTORS COULD CAUSE RESULTS TO DIFFER MATERIALLY FROM THE PLANS, OBJECTIVES, EXPECTATIONS, ESTIMATES AND INTENTIONS WE EXPRESS IN THESE FORWARD-LOOKING STATEMENTS. WE DO NOT INTEND TO UPDATE THESE FORWARD-LOOKING STATEMENTS EXCEPT AS MAY BE REQUIRED BY APPLICABLE LAWS. NO PART OF THIS:

(MoJo)

Lee Quaintance & Paul Brodsky

pbrodsky@qbamco.com

What's been said:

Discussions found on the web: