Real Return Investing

Macroeconomic issues currently playing out in Europe, Asia and the United Sates may be linked by the same dynamic: over-leveraged banking systems concerned about repayment from public- and private-sector borrowers, and the implication curtailment or non-payment would have on their balance sheets. Global banks are linked or segregated by the currencies in which they lend. Given the currencies in which their loan assets are denominated, market handicapping of the timing of relative bank vulnerability is directly impacting the relative value of currencies in the foreign exchange market, which makes it appear that the US dollar (and economy?) is, as Pimco notes, “the cleanest dirty shirt”. Is there a clean shirt anywhere – creased, pressed and folded? We think so, but first some preliminary points:

• The current macroeconomic landscape presents strong evidence of a global balance sheet-centric malaise brought about by the end of an almost 40-year global credit cycle. Both creditors and debtors are starved of base money (currency in circulation and bank reserves held at central banks) with which to service debt. The end of this cycle is characterized by issues not present within more typical “economic cycles” that commonly define recessions.

• Conventional monetary and fiscal policy responses seeking higher growth and more efficient spending cannot work. The current perceived “debt crisis” across developed economies is by extension a global currency crisis for which there are two potential policy responses: 1) debt monetization – more currency is created by monetary authorities to purchase outstanding debt, and 2) asset monetization – monetary authorities create new currency to buy assets instead. Both debt and asset monetization requires currency creation (inflation), which leads to rising prices.

• The modern process of creating currency is to lend it into existence by issuing debt. First, global treasury ministries increase their borrowings. Second, primary dealer banks or central banks buy their debt directly and pay for it with newly-created electronic “credit credit” or “base money” respectively. Base money is currency in circulation plus bank reserves held at the central bank. In a fiat currency system, base money may be created only by central banks. It serves as “reserves” against which credit money is issued by private banks.

• “Credit money” is created in the banking system and is all money in existence that is not base money. It is unreserved electronic accounting entries used by the public in exchange for labor, goods, services, and assets. Credit money is conjured through the process of fractional reserve banking wherein banks issue loans that are literally unreserved by base money. Banks do this by simultaneously making loans (treated as assets on their balance sheets) and deposits (treated as liabilities). As it works through the system, credit money funds commerce, wages, consumption, investment and, circuitously, the majority of bank deposits. So, credit money is unreserved currency ultimately dependent upon the central bank to literally monetize it as base money so that it may settle – not just roll – actual debts. (The central bank must also provide the interest/rent that debtors owe the banks for the “service” of creating the credit money.)

• The difference between “credit money” and “credit” is that credit money is commonly yet erroneously perceived by the public as fully-reserved money that can be used in commercial exchange without cost. Credit, per se, can either be reserved (non-bank to non-bank) or unreserved (bank to non-bank borrower). It is explicit lending at a higher rate of interest than available to bank depositors with the explicit agreement that the obligation will be repaid. While credit money earns interest when lent, including to banks that borrow it (deposits), explicit users of credit (debtors) must pay higher rates, thereby giving banks a positive net interest margin. (Banks literally create the credit money collateralizing the credit they extend.)

• The ultimate obligation for all debt repayments within the current global monetary system, whether conjured initially through credit money or outright credit creation, falls to central banks that enjoy monopoly franchises to issue base money. Base money comprises only about 13.5% of total bank deposits (about 8.5% in bank reserves and about 5% in circulated currency). So, the vast majority of global bank deposits are comprised of credit money, meaning the current global monetary system is unreserved by a factor of over seven times. (For example, US bank deposits held domestically and abroad total almost $20 trillion while base money is about $2.7 trillion.) The gap separating credit money deposits from base money defines systemic leverage. Outright credit held by the public is fully-collateralized by private sector assets or future wages.

• The global commercial marketplace, comprised of significantly leveraged banking systems and an indebted (but not necessarily over-leveraged) public, is currently pressuring monetary authorities to de-leverage credit money by creating more base money. Systemic deleveraging can occur either through: 1) credit deterioration and debt write-downs, or 2) base money creation. Base money creation is far less socially disruptive and more politically expedient, and thus we believe base money inflation is highly likely to continue.

And to set up the blockbuster movie about to hit theaters near you…

• As we are seeing, the dominant determinant of economic and asset performance at the end of a long credit cycle is the nature, speed and extent of necessary systemic deleveraging. Within this context, the pursuit of risk-adjusted relative performance of financial assets no longer seems a credible (certainly not complete) investment objective. Rather, we believe investors should explore the pursuit of properly defined real (inflation-adjusted) returns.

• Contrary to popular perception, over the last forty years financial asset returns have not kept pace with the general price level or have only marginally exceeded price inflation. The likely need for even more money stock inflation, including base money and credit money (unreserved electronic deposits posing as base money), suggests significant future price inflation.

• We believe the purchasing power of currency in which financial assets are denominated will continue to decline more than most nominal financial asset prices will increase (certainly the case for fixed-rate bonds). In a highly inflationary or hyperinflationary environment, simply maintaining purchasing power would appear as substantial nominal investment performance.

• Zero-bound sovereign interest rates suggest that the generally accepted perceptions of safety and risk are currently diametrically reversed when considered in real terms. We believe prudent asset allocators today should consider increased allocations in:

a. “treasure” (unlevered non-financial investments and irreplaceable property)

b. unlevered and/or term-funded scarce resources with inelastic demand properties

c. unlevered and/or term-funded productive businesses providing goods or services with inelastic demand properties (pricing power regardless of nominal prices)

The following movie trailer focuses on treasure – the most optimal risk-adjusted allocation in the pursuit of positive real returns. Warning: the following trailer is rated “GIV” for graphic inflationary violence.

Time for Treasure

(The Trailer)

Dramatic Voice Over: In a world where time series stand still…and real purchasing power value has no meaning…a few monetary bodies stand between economic death and destruction…between commercial hope and financial despair…between risk-free returns and return-free risk …

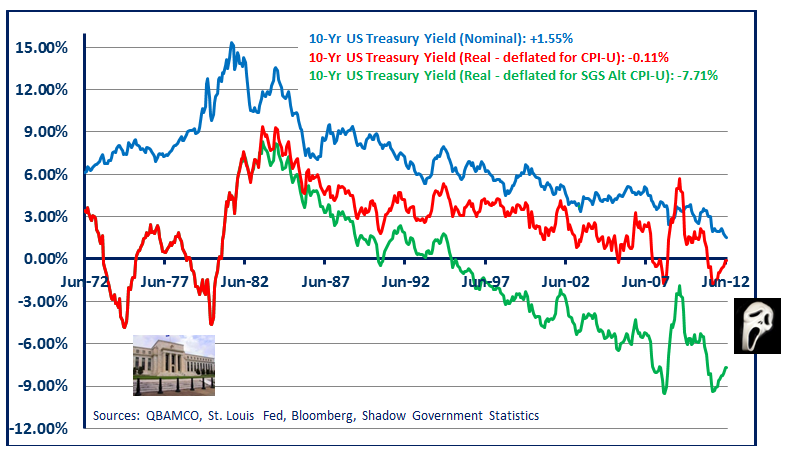

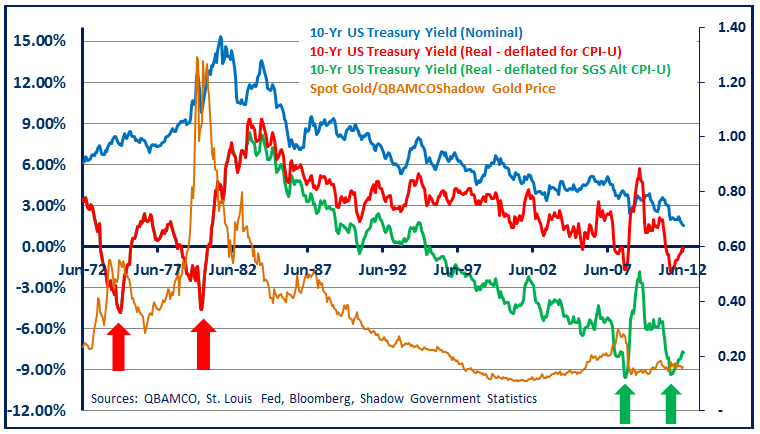

Concept: Like a Hollywood fantasy, confidence in the integrity of Treasury yields – the benchmark annual return against which the value of all global assets is ultimately judged – relies on the suspension of disbelief. As we have argued, significant past and current systemic credit issuance must be followed by significant monetary base inflation, which in turn must lead to significant goods and services price inflation. Why then do ten-year US Treasury notes currently offer negative real (inflation-adjusted) yields, calculated using either official CPI data (-.11%) or CPI data many would argue is more consistent with experience (-7.71%)? (The red real yield line on the graph deflates nominal yields by the BLS CPI-U, which is continually adjusted by the Bureau of Labor Statistics. The green line uses the SGS 1980 Alternative CPI-U, which reflects the BLS methodology used prior to 1980 and unadjusted since then. )

Negative real sovereign yields prevail in the US and across the world because central banks are acting as buyers (or funders of buyers) of last resort of sovereign debt. (See sovereign yield table at the end of this note.) Central banks are synthesizing demand for the highest quality sovereign debt by: 1) outright purchases; 2) giving leveraged banks and hedge funds incentive to own it as one leg of an arbitrage; and 3) withholding credit to competing sovereigns in distress, in turn forcing dedicated sovereign allocators into the highest quality debt. Capital Asset Pricing Models (CAPMs) cannot be accurate in such an environment. Further, the market signal that low or negative real sovereign yields would ordinarily send is deflation (i.e. the increasing purchasing power of money); however, central bank maneuverings are greatly distorting default-free rates and sending a false signal. Thus, unleveraged investors seeking true preservation of purchasing power are being fooled as to what constitutes safety and risk.

Dramatic VO: On a Meta plane where Heisenberg uncertainty is vanquished and where time is stopped by proclamation…huff and puff financial men of uncommon intelligence and unclear motives…prophets with bold and indefatigable resolve whispering get-rich-forever secrets to the bottom 99% of the top 1% who think the cost of free cable is a fair price to pay for privileged investment insights…

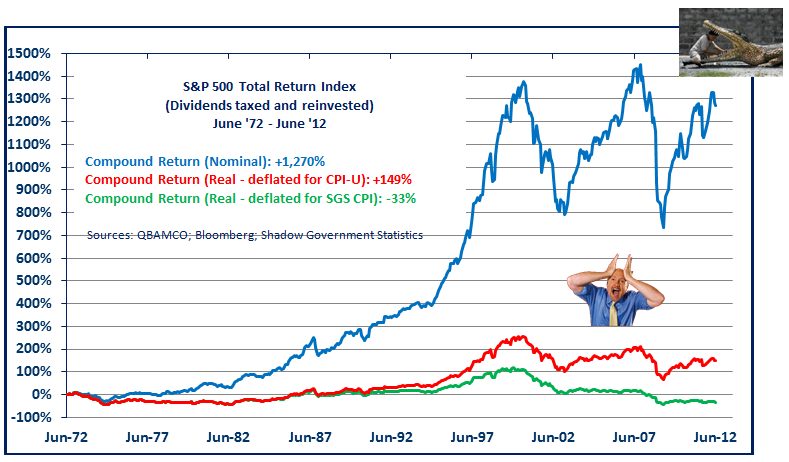

Plot: Have equities delivered positive real returns? Well, as the graph above implies, timing is everything. (We will show this in more detail later.) It shows the compound monthly returns of the US S&P 500 Total Return Index (includes dividends) in both nominal and real terms, and indicates consistent positive nominal and real returns were generated until 2000. Returns since then have been negative and quite volatile. It seems clear that US equities over time have been a more dubious store of purchasing power than most acknowledge.

We believe the average level of broad equity indexes is biased to climb in nominal terms over time, but it seems unlikely they will be positive in real terms. The basis of this assertion is that base money inflation will continue to outpace credit growth while the total money stock, (base money plus unreserved credit-money that comprises the balance of broader monetary aggregates), will in aggregate inflate more than the supply of goods, services and real assets.

There is a very close relationship linking credit growth and equity returns. Without total money stock growth there would be natural de-leveraging from credit and debt deterioration, which, in turn, implies no systemic re-leveraging and declining equity market sponsorship from explicitly or implicitly leveraged market participants. Further, Western equity investors are likely to be net withdrawers of capital from the markets to fund consumption in retirement, making credit-money growth even more critical.

So we suggest that while equity indexes may be pulled higher over time by monetary and price inflation, the gap separating nominal from real returns is very likely to widen. In fact, we assert broad equity markets will produce negative real returns (equity indexes will not increase as much as the general price level). We further think equities would generally decline in the event interest rates were to rise to levels that provide investors with positive real returns (via contracting P/E multiples as rates rise). Thus, we believe the risk-adjusted case for broad equity indexes is poor in real terms.

Dramatic VO: For over forty long years a Trojan horse called “wealth” was delivered to the masses… exorbitantly privileged financial societies enjoying a permanently high plateau…wisely taking on unsupportable debt together…so that its ultimate destruction would be in real terms, and would also have to be borne by their lenders…

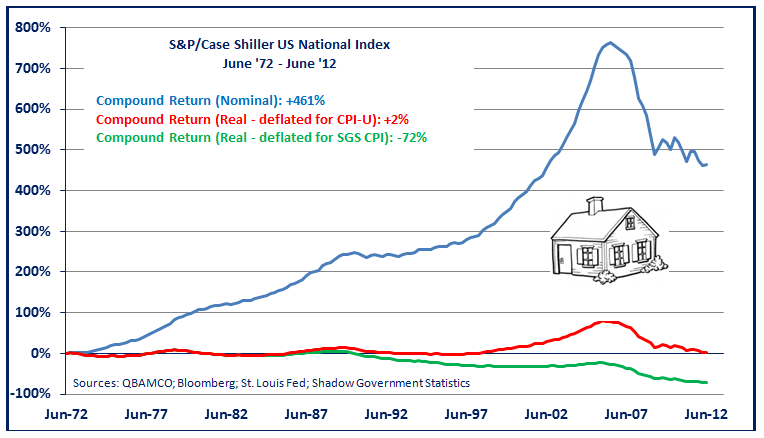

Storyboard: What about housing, the American (and Spanish and Irish) dream? Considerable bank credit creation was channeled to the housing market from 1994 to 2006. The extraordinary quantity of credit issued by banks and by buyers of mortgage-backed securities over this time served the interests of credit issuers and home buyers alike. For banks, earnings continually rose from lending transactions and the apparent health and value of their loan books increased as home prices rose. For MBS buyers, relatively wide yield spreads on perceived high quality cash flows and a calm interest rate environment provided attractive and stable yields. For mortgagees, term funding ultimately derived from overnight repurchase agreements (from bank loans) or from stable pension capital (from MBS buyers), provided easy access to levered asset speculation and granite countertops.

The graph above does not show the exorbitant amount of bank credit extended and pension money lent, both of which were necessary to drive home prices higher. (We and many others have shown countless graphs indicating consistently rising systemic debt levels.) When one considers the credit/debt funding boom behind the housing boom, it becomes clear that: a) all homes effectively became financial assets – more akin to corporate equity shares than real estate, and b) the embedded risk of future losses would ultimately be borne by both borrowers and lenders.

As with equities, declining nominal home price performance could certainly be reversed through money creation, sufficient enough to de-leverage homeowner balance sheets so that systemic credit could be re-ignited. Again, this would imply significant asset value losses in real terms. And, just like equities, rising interest rates would likely generate further housing losses in both real and nominal terms. So, we think mismatched-funded real estate also seems to be a poor risk-adjusted bet in real terms – even despite the painful correction to date. (Yes, the graph shows that homeowners over the last forty years have either gained 2% or lost 72% in real terms, depending upon which CPI figure one chooses to use.)

Dramatic VO: Never before in our short memories have societies been wrested from their financial dreams. Never before in our short memories have powerful human forces had to unite to fight the dark forces of overwhelming economic leverage. Never before in our short memories have global icons had to face-down the curious relationship between political imperatives and compounding interest…

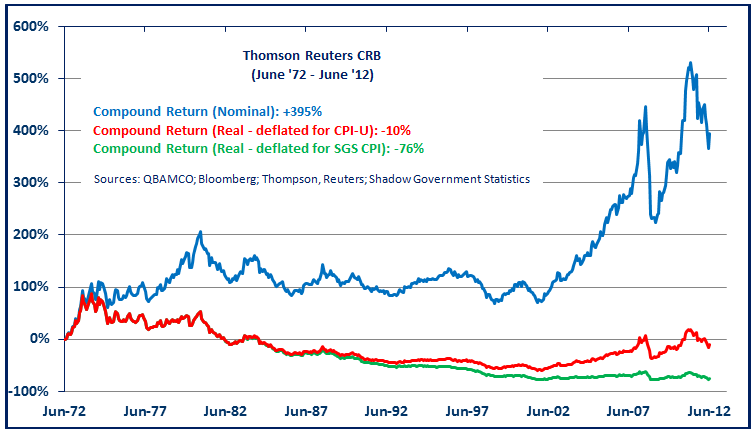

Arc: Investor allocations to commodities over the last forty years has been comparatively slight, most reasonably because physical delivery involves significant transaction costs and requires more complex infrastructure capabilities than simply rolling derivative contracts. Derivative products further demand that investors accept holding leveraged, potentially volatile contracts. (The price volatility of commodity futures contracts would be quite tame were they not implicitly leveraged.) Further still, steep contango curves, unjustified by the time value of money, tend to eat away returns over time for longer-term investors seeking exposure to commodities. As a result, commodity derivative products understandably tend to be limited to hands-on professionals executing short–term trades or arbitrage positions. They exert enormous influence over physical commodity pricing.

Physical commodity prices tend to represent input costs for manufactured goods and services that impact consumer behavior. Thus, speculation in economically critical commodities such as oil – whether based on valid macroeconomic projections or financial speculation – invites political and regulatory scrutiny. Speculations in futures or fundamental supply/demand dynamics that drive spot prices down tend to be socially acceptable. Higher consumable commodity prices; however, place an economic burden on consumers with relatively static wages. In financially-dominated economies politically structured to rely on perpetual nominal growth, rather than allowing market forces to work towards economizing (increasing affordability), political energy is geared towards perpetuating increasing demand. Higher commodity prices work against this objective.

So it is easy to understand why investors of all sizes and at every level of sophistication have not wholeheartedly embraced consumable commodities. Relative to unleveraged financial asset capital structures in the West commodities are difficult to own and disown and are generally biased to be fraught with social and political angst. As a result, natural resources as a store of purchasing power have been trivialized over the last generation and not fully embraced by Western capital asset pricing models.

Dramatic VO: In a world where hyperventilating gold bugs frantically extinguish their burning hair with tin foil hats…willing the sky to fall while warning of impending doom and gloom…only an elite monetary fighting force stands between financial chaos and the menacing threat of barbarous austerians…

Dramatic VO: In a world where hyperventilating gold bugs frantically extinguish their burning hair with tin foil hats…willing the sky to fall while warning of impending doom and gloom…only an elite monetary fighting force stands between financial chaos and the menacing threat of barbarous austerians…

Rising Action: Using the US as a proxy in the graphs and discussion above, we can see that the past real returns of stocks, housing and commodities have been less-than stellar over time. Wealth, in the form of sustainable purchasing power, has had to rely on timing investment allocations correctly and indeed shifting them quite aggressively. As for sovereign bonds, whatever positive real returns may have been generated since 1981 double-digit yields cannot be repeated from zero-bound interest rates.

In order to form a reasoned opinion about potential future performance of investment assets in real terms we must provide a framework that further defines the basis for purchasing power parity (PPP). It is time financial asset investors consider gold as a proxy for ongoing PPP that transcends credit cycles. (No, seriously.)

Imagine gold as a money-form not currently used as legal-tender currency (i.e. not currently used as a medium of exchange or unit of account). Indeed, gold remains on the balance sheets of most treasury ministries and central banks as an asset, (not so the BOE and BOJ), and as such it may be monetized if necessary. Its only current use (and intrinsic value) therefore, is as a relatively scarce item that potentially may be called upon by monetary authorities to be a currency, or, more likely, the basis of value for sovereign-issued (fiat) currencies.

The Fed continues to hold gold certificates in the event that US dollars, as the current basis of value for all global currencies, are not perceived to provide the global marketplace with a store of purchasing power, and gold remains on the balance sheets of most developed treasury ministries and central banks for the sole purpose of allowing them to devalue their currencies against it if need be.

Physically-held gold is not an obligation of its possessor (unless specifically pledged as collateral, and to do so would defeat the purpose of holding it). As such, gold is treasure – an unlevered monetary asset that negative real interest rates make cheap to own. There is very little cost currently associated with holding gold relative to holding cash balances or investment instruments denominated in major sovereign fiat currencies.

Indeed gold’s increasing exchange rate vis-à-vis other currencies (i.e. its rising price in terms of all currencies) has become very well-established since 2000. This rationally suggests there is a link connecting increasing gold prices with the trend towards negative real interest rates in major currencies and low or negative real returns in financial assets denominated in them.

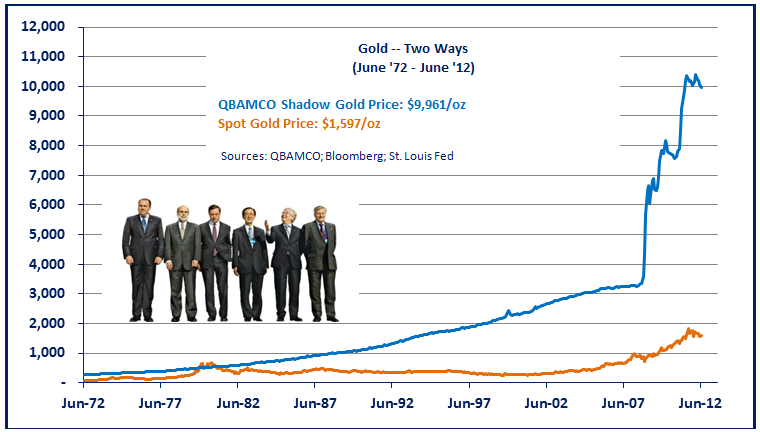

The graph on the following page is a time series showing the price of gold in US dollar terms and our Shadow Gold Price, which is calculated by dividing the US Monetary Base (i.e. currency in circulation plus bank reserves held at the Fed) by US official gold holdings (in troy ounces). (The SGP formula was used to define the gold/USD exchange rate under the Bretton Woods global monetary system from 1945 to 1971.) The Shadow Gold Price is the intrinsic value of gold given past monetary inflation. In short, it is the credit-adjusted purchasing power parity of gold to US dollars.

The widening spread of the two lines from 1981 to 2008 implies a stable stock of official US gold, (about 8,300 metric tons), and an increasing stock of base money (about $2.7 trillion presently). The sudden spike of the SGP in 2008 and continued increase in the spot gold/SGP gap ever since indicates the dramatic Fed-administered increase in USD base money (in the form of bank reserves) through quantitative easing.

The takeaway of the graph above is that US dollars, as the benchmark reserve currency in a global monetary system where all currencies are un-anchored, have been diluted far more than the gold/USD exchange rate has increased. In other words, even though nominal gold prices have risen consistently since 2000, gold’s implied future purchasing power has actually increased far more than the prospect for US dollar purchasing power. Why? Because interest rates are already zero-bound, credit money is tougher to perpetuate, and only base money creation can ease credit conditions. The more base money the Fed manufactures, the higher the Shadow Gold Price rises. The higher the SGP rises, the cheaper gold becomes to its “intrinsic fair value”. (This relationship would reverse if either a large sum of USD base money is destroyed or a large sum of US official gold is added).

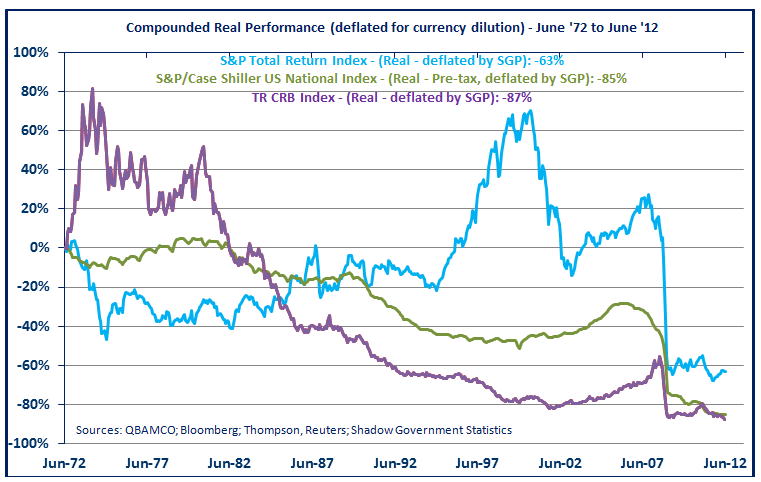

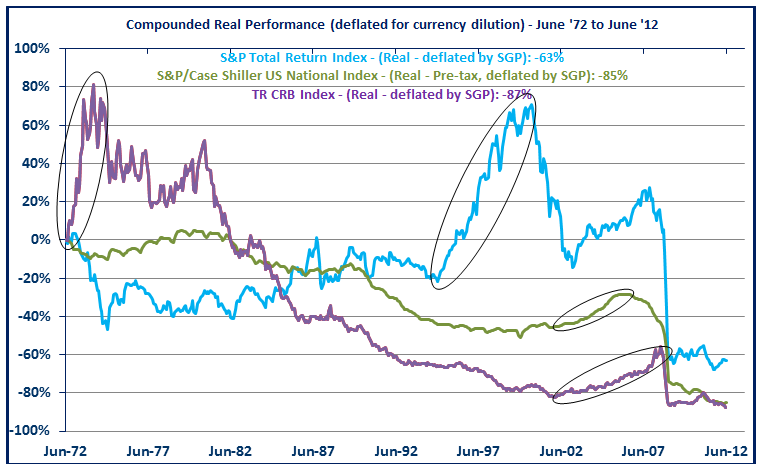

Past and potential future real performance in financial assets is startling when deflated for the SGP – the intrinsic value of gold (and by implication the intrinsic value of US dollar purchasing power). The graph on the following page shows past compounded returns of US stocks, housing and commodities in terms of the intrinsic value of gold. We believe it indicates accurately the purchasing power loss experienced by investors over the last credit cycle when adjusted for currency dilution.

The point of the graph below is not that stocks, housing and commodities are rich or cheap relative to each other, but that their performance in real terms can be quite negative at times. (More on this later.) It shows that when we consider implicit purchasing power loss of the currencies in which they are denominated, equities were quite rich in real terms in 2000 and housing and commodities were quite rich in 2008. Looking forward, either these markets must increase enough to overcome past currency dilution that leads to price inflation (the tacit goal of global policy makers), or else they will continue to provide negative real rates of return for investors.

Dramatic VO: This mighty band of monetary brothers valiantly launches an epic battle against nature…fighting arm in arm to hold back commercial and trade incentives…until suddenly, out of nowhere…a flash of clarity “no one could have foreseen”…the silent bell of human cognition…

Climax: For savers, the ultimate question is (or should be): “where should one place current purchasing power with the objective of maintaining it without risk?” For investors: “where should one allocate current purchasing with the objective of increasing it commensurate with prudent risk?” We believe the greatly overleveraged nature of global public and private sector balance sheets currently suggests the acknowledgement of substantial ongoing currency dilution (base money inflation-induced deleveraging) as the driver of future asset valuation. In such an environment we believe the optimal risk-adjusted play is to allocate capital towards treasure.

Treasure comes in many forms including fine art, rare property and, of course, gold. (We understand some enterprising wine marketers promote a return to “SWAG” – silver, wine, art and gold – though we would categorize wine more as a consumable commodity.) Treasure does not need to have any functional utility. The all-important common characteristics of treasure are scarcity and ongoing demand. It is simply, quite simply really, a sanctuary for purchasing power during a period of currency dilution. The more currency in existence, the more currency chases scarce items.

Whether he knows it or not, (and we would bet he most definitely knows it), Leon Black just personally exchanged US dollars for treasure by paying almost $120 million for the original pastel of Edvard Munch’s The Scream. Though Leon may like the piece because it matches his sofa, there should be no doubt that its value is in its scarcity. It is treasure and it is highly likely (to use a phrase Black made famous funding takeovers with junk bonds at Drexel) to maintain its purchasing power upon liquidation – no matter how much the general price level rises. The same would be true for signed first edition Edith Wharton books, original Chippendale chests, Honus Wagner baseball cards, and Wyatt Earp pistols. They are all scarce, easily verifiable and portable (just like gold).

Beachfront homes and midtown Manhattan properties are scarce but not portable. The value of natural and human resources rely on perpetual marginal global demand that may come and go with innovation and political shifts. Taxing powers and control over shipping lanes ensure great wealth for nations but also come with great carrying costs and risks. We believe it is time to hold treasure because it is the very definition of unadulterated, undiluted, unlevered wealth (just like we learned as small children).

Treasure is quite literally priceless because price is derivative of value. Price is just a number but there are only four original versions of The Scream. They may be exchanged currently for about $120 million or about 75,000 gold ounces. Were central bank-issued currency to increase in quantity by 10 times, Mr. Black should theoretically be able to exchange his picture for $1.2 billion or, well, 75,000 gold ounces.

Treasure is quite literally priceless because price is derivative of value. Price is just a number but there are only four original versions of The Scream. They may be exchanged currently for about $120 million or about 75,000 gold ounces. Were central bank-issued currency to increase in quantity by 10 times, Mr. Black should theoretically be able to exchange his picture for $1.2 billion or, well, 75,000 gold ounces.

Owning the picture for $120 million today allows Mr. Black to maintain his purchasing power tomorrow relative to a society currently over its head in unreserved credit posing as currency and financial assets. Did he pay too much? We don’t think so. Given past and likely future base and credit money creation, we think treasure represents the best store of purchasing power – and the best risk-adjusted investment class – because most investors still do not realize its current intrinsic value in real terms.

So we think precious metals should be taken very seriously by financial asset investors because of the potential (likelihood?) for recognized systemic monetary inflation leading to manifest price inflation. Whether physical possession is taken above-ground or below ground (via shares in precious metal miners), gold is the only treasure that is fungible, liquid, held by public and private sectors across the world, and has a long history of being recognized as money. It is the official asset to which today’s baseless currencies may be devalued, and we think this likely explains central bank hoarding presently (see table at the end of this note).

Let’s look further at gold’s value as a discrete investment in the current environment. Please recall that the Shadow Gold Price (SGP) divides US base money by US official gold holdings, the value of which was almost $10,000/oz at the end of June (see graph on page 8). The graph below further divides the spot gold price by the SGP. At a ratio of 1.00, the stock of US dollars and the stock of official gold would be at theoretical equilibrium (i.e. the stock of base money would be fully-reserved by gold). Above 1.00, a holder of gold would have incentive to exchange gold for dollars. Alternatively, below 1.00 a holder of dollars would have incentive to exchange them for gold. As the graph below shows, gold has been theoretically cheap vis-à-vis US dollars since shortly after the parabolic blow-off peak in 1980.

So why would this relative gold cheapness be reversed anytime soon (and with a vengeance, as we think it will)? The answer: it has been rational for savers and investors to ignore gold’s cheapness for most of the last generation because positive real returns were available in various financial assets over that time. This is no longer true. US dollars no longer provide sanctuary to savers in real terms and so global financial markets no longer provide investors with positive currency-adjusted, risk-adjusted real returns.

We reprise the graph below from page 9 and add circles to stress the periodic availability of positive real returns in liquid equity markets, housing market and commodity markets. The obvious and precipitous fall in the SGP-adjusted real returns of stocks, housing and commodities in 2008, and continued decline since then, comes directly from the first and second rounds of quantitative easing.

We think the gig is up on levered financial asset markets until baseless currencies are made sound again. If one believes there will be further quantitative easing, then one may easily envision further purchasing power loss in the currencies supporting the indexes on the graph above. The point here is not to arrive at a quantitative terminal projection for negative real returns in popular investments, but to show their implied past performance in PPP terms, to justify the bullish trend in gold since 2000 (and in fine art and trophy properties since 2008), and to raise the prospect of an extension of this well defined trend.

The busy graph below is worth the time it takes to understand it. It overlays nominal and real Treasury yields with the spot gold price divided by the SGP. (Nominal and real 10-year Treasury yields are shown on the left axis while the ratio of spot gold to the SGP is shown on the right axis. Please recall that the SGP is base money divided by official US gold holdings, and that the ratio of spot gold to SGP implies over- or under-valuation of spot gold in US dollar terms (below 1:00 => under-valuation).

We believe the graph illustrates the great disconnection between the spot gold price and real interest rates. Either real rates must climb measurably to justify the current spot gold price or the spot gold price must rise measurably to justify the current level of real interest rates. The fundamental macroeconomic arbitrage is this: interest rates are negative in real terms, perhaps at record negative yields, so spot gold should logically trade at a premium to the SGP (as it did briefly in 1980), not at a huge discount. Collecting interest on a 10-year Treasury while holding the SGS 1980 Alternative CPI-U constant over a ten year period implies one would lose about 80% of purchasing power by maturity. Alternatively, holding gold for those ten years – without collecting interest and even assuming no further base money printing – implies at least a 6x nominal return upon a reversion of spot gold to the SGP. (It is further rational to assume that the base money stock will be far bigger in ten years than today, which implies an even higher SGP and most likely a much higher CPI, all else equal.)

Thus, we believe treasure, and for most investors, gold (properly purchased), offers the most fundamentally cheap risk-adjusted way to protect and enhance purchasing power. Consumable resources with relatively inelastic demand properties should also re-price well in a base money inflationary environment regardless of an increasing general price level. As for productive businesses with pricing power, we cite the masters at Berkshire Hathaway who methodically built enormous wealth through a one-way secular inflation bet over the entire credit cycle by effectively borrowing to own consumer franchises with bulletproof branding. Obviously one should be more cautious borrowing to own assets today with interest rates zero-bound and with consumers already highly leveraged. We should also note that businesses with pricing power – and even consumable resources – would likely lag treasure if inflation is accompanied by a decline in economic activity. Treasure actually benefits from having no functional utility beyond being a store of value. It is held in physical possession of its owners unlevered and therefore is impervious to shifting rate markets and popular liquidity.

Dramatic VO: The reviews are in! The New York Mimes calls Time for Treasure “ ”. E. L. James gushes; “It’s a macroeconomic bodice ripper!” The El Paso Intelligencer raves “a damn near perfect little golden nugget of Yee Ha“! El Diario Miami warns, “¡Corer, no caminar! James Carville wants to come back in another life as Treasure. Get “Treasure” at an investment board near you!

Denouement: Now that we are at zero-bound rates, either there will be significant further base money inflation and rising prices or there will be irreconcilable debts, asset deterioration and a decline in economic activity. Investing in advance of significant inflation should not be considered a rogue position.

CPI, regardless of how it is calculated or who calculates it, is a contemporaneous indicator of consumer prices that lags past money stock inflation. It has not yet flared because the value of systemic credit has been deflating. The longer this trend lasts, the deeper the value of assets sink, the lower credit demand and economic production drops, the sooner intense base money inflation will be administered by central banks to reverse it, and the sooner and higher the general price level will rise. Economic activity and the general price level can travel in opposite directions, as they did in the 1970s stagflation.

Contemporary Western financial asset investors are struggling to make sense of an investment environment offering negative real returns because analyzing assets in absolute currency terms is not commonly practiced. There was no reason to do so prior to 1971 when currencies were ostensibly disciplined by gold’s scarcity, and since then positive real returns have been sporadically available in fiat currency-denominated financial assets. This is no longer the case.

We have become conditioned over the last forty years to invest in relative terms, with the underlying presumption that the mostly unreserved currencies in which assets are denominated will be relatively stable to other fiat currencies, without regard for potential step-shift inflation in the general price level of goods, services and resources. Thus, Western investors have not invested in treasure in any meaningful way. (Total precious metal investment among global pension funds amounts to 0.15% and total investment in precious metal ETFs and precious metal miners is less than the market cap of AAPL.)

The current set of circumstances underlying the global economy and the financial assets tied to them remains very unstable, and for good reason. Monetary and fiscal authorities seeking to execute market-expectations management and seeking to maintain bank system solvency through monetary inflation provide little defense against the potential for a rational and widespread loss of investor confidence in fiat currencies, and little defense for savers and holders of financial assets denominated in those currencies. Indeed, central banks are the cause of the dilution.

Coordinated Whack-A-Mole currency debasement cannot mask forever the loss of absolute purchasing power. It seems likely monetary authorities will save their banking systems by destroying the purchasing power of their currencies. The catalyst for broad recognition of such conditions will likely be the global commercial marketplace, not the capital markets. Commercial counterparties – manufacturers, exporters, vendors and laborers – will eventually opt out of accepting “a reasonable quantity of currency” in exchange for their goods and services. This naturally comports with reduced incentives among consumers and purchasing managers to borrow further to consume or to increase capital expenditures, regardless of the nominal level of borrowing rates.

We have repeatedly argued about the fundamental relationship linking the quantity of base money to the gold price. Over the last fifteen years market trends have driven real rates into negative territory while aggressively suppressing the spot gold price in SGP terms. More recently, the overall money stock, (loosely defined as the sum of the base money stock and the prevailing quantity of credit money), has ceased to grow and has even contracted because unreserved bank credit growth (deposit growth) has fallen or gone negative. The stagnation/contraction of bank deposits thus leaves only base money growth in the form of bank reserves to fill the void. This process has already begun.

Central banks may follow the markets and provide reserves as nominal bank credit expands. That has been the Fed’s modus operandi for 25 years. On occasion the Fed has also led the markets by targeting sequentially lower Fed Fund rates, thereby increasing reserves. (Such maneuvers prompted the mortgage and corporate refinancing waves.) However, the policy of expanding nominal output growth by expanding credit is likely finished because private markets are now in a well-established deleveraging phase. Escalating public market borrowing filled this gap to some extent recently, yet even this is quickly becoming a source of strain as the events enveloping the PIIGS are proving.

If neither the private sector nor the public markets demand incrementally more credit, central banks would be left with only one policy option: asset purchases to expand base money. Gold is the monetary asset owned by monetary and fiscal authorities and the asset against which they would devalue their currencies (by inflating the base money stock to purchase gold). Central bank gold monetization would achieve two goals:

1. Bank system deleveraging would expand the leverage denominator (base money) and sustain (or even goose) the nominal pricing of assets underpinning the numerator (bank credit).

2. Maintain (or even goose) the nominal quantity of the money stock available to service and retire existing nominal debts.

For now, it would be imprudent to expect central banks to stop inflating their base money stocks. There is no direct marginal cost of producing fiat base money. In the current regime, the traditional supply/demand curve relationship (downward sloping demand curve, upward sloping supply curve) does not exist. So, central banks can shape sovereign yield curves any way they wish (e.g. Operation Twist). Contrary to basic microeconomic principles then, one may be prone to argue that the slope of the base money supply curve has been and continues to be negative rather than positively-sloped, as most supply curves are conventionally thought to be (i.e. the Fed has been supplying more reserves at ever lower rates). However, one could also argue, perhaps more rationally, that the supply curve at any point is perfectly flat and that central banks have been shifting the curve lower. (The latter is probably the better representation of what happens under a Fed Funds targeting policy regime.)

So, on one hand central banks may supply infinite reserves at a given interest rate but this does not mean they will always be able to control the demand for goods and services, which are also underpinned by the prevailing stock of bank deposits – even at zero-bound interest rates. On the other hand, the demand curve for bank credit is traditionally downward sloping to a point, but seemingly becomes vertical as credit loses its propensity to expand – even at a 0% cost of money. Central bankers are well-versed in such matters.

The point here is that if the monetary base is theoretically infinite with zero marginal cost of production and, ironically, base money is very much in demand to alleviate systemic credit pressures (as our banking systems are prone to deleveraging), then it seems base money has little potential value on one hand and very dear value on the other. Such is the current paradox. Amid this set of conditions it seems entirely prudent to position purchasing power in vehicles that would benefit as the nominal stock of base money grows at a rate far in excess of the gold stock growth rate. Logic certainly bears this contention out and historical data confirm it.

We believe “the market” has it wrong, but not in a way that should invite suspicion. “The market” to which we refer is not the smattering of real-return investors currently sponsoring treasure so they can maintain purchasing power. It is the great majority of institutionalized investors dedicated by mandate or inertia to highly-mismatched financial asset markets producing negative real returns and the likely prospect for more. The collective market value of treasure will continue to be dwarfed by the market value of financial assets, until suddenly economic conditions force reconciliation. (Perhaps it is time to tweak the Capital Asset Pricing Model?) We think early investors in treasure will be well rewarded.

Lee Quaintance & Paul Brodsky

QB Asset Management Company, LLC

pbrodsky-at-qbamco.com

P.S. In the “do as they do, not as they say” department, the table below shows global treasury ministries are shorting fiat-denominated long-term debt to the markets at puny costs…

(Not shown on this table: Portugal 9.80% and Greece 24.73%)

…while the table below shows global central banks are buying gold…

We think it is best not to fight central banks.

What's been said:

Discussions found on the web: