Nikkei 225: Potential breakout into a secular bull market

Source: Bank of America Merrill Lynch

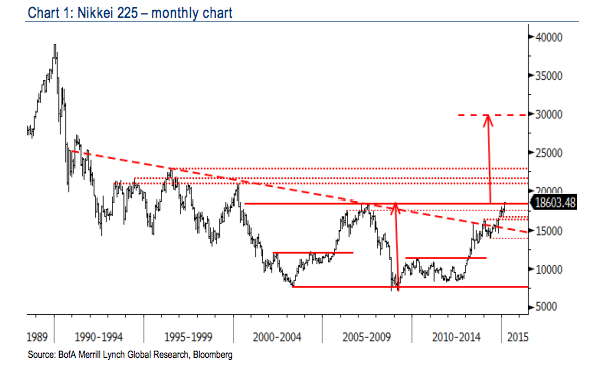

We continue to favor Japan’s Nikkei 225. The Nikkei 225 is pushing above the 2007 high of 18,300, which has the potential to end the secular bear market for Japan that began in 1989. This is a focus chart in our 2015 Year Ahead and our February Monthly Chart Portfolio. A sustained breakout above 18,300 would confirm a secular double bottom for the Nikkei 225 off the 2003 and 2008/2009 lows and point to longer-term upside toward 28,000-30,000. Resistances come in at 20,900-21,575 and 22,750 (mid 1996 peak). Key 2015 support for the Nikkei is 16,700-16,300 with the October and April 2014 lows additional support at 14,530-13,885 (Chart 1). Nikkei 225 shows a base even when priced in USD Given the recent weakness of Japanese Yen, the Nikkei 225 has lagged and has yet not broken out above the May 2013 peak in USD terms. However, the big picture base or bottom is intact for the Nikkei regardless of whether it is priced in Japanese Yen or US Dollars. The potential is for a big breakout the Nikkei 225 in both JPY and USD (Exhibit 1). New highs for A-D line confirm the highs in the Nikkei 225 The strength in the Nikkei 225 advance-decline (A-D) line reflects strong breadth within the Nikkei 225 and supports the case for sustained breakout above 18,300 and continued upside for Japan’s equity market (Exhibit 2).

A massive debt to GDP ratio, horrible demographics, expensive stocks, and the government working in lock-step with the central bank to pump stocks higher. What’s not to love?

The same recipe for success is in effect in Europe right now, although their debt burdens and demographics aren’t nearly as bad.

Breaking out in real or nominal terms? Surely, if the USD/JPY goes to 200, Nikkei-30k isn’t such a big news. On the other hand… once the algos, HFTs, trend-followers, etc buy this “break-out”, the gains in Nikkei will, for a while, outpace the devaluation of the local currency. After all, the best performing stock market in recent years has been…(drum roll) … Venezuela’s market! In nominal terms, of course…

~~~

ADMIN: See http://www.bloombergview.com/articles/2015-03-04/adjusting-stock-indexes-for-inflation-is-a-waste-of-time

Technical analyses can be very good, but only if the fundamentals are there to support it. In Japan’s case they aren’t. It’s population is shrinking (http://www.npr.org/blogs/thetwo-way/2015/01/01/374382369/japans-population-declined-in-2014-as-births-fell-to-a-new-low) and it’s loath to allow immigration (http://fortune.com/2014/11/20/japan-immigration-economy/). So who will there be to take advantage of Abe’s monetary easing? Robots? Maybe robots can run profitable businesses, but I wouldn’t count on it. Any pop in the Nikkei, if it happens, is likely to be very short lived.

Um, yeah. If this were happening while they had a stable currency, implying real organic strength in the economy that would be notable. But alas it is not. The Nikkei is a mirror of the Yen. They are destroying the Yen. So necessarily the Nikkei reprices higher as the currency dives. Don’t forget to hedge any long position in Nikkei with a short in the Yen or you will not wind up gaining anything. The real story here is “hey they are destorying their country, lets see if we can somehow profit from the spectacle. Not unlike what is happening here in the good old US of A, just a couple of orders of magnitude worse.

Barry,

What do you consider to be the preferred vehicle, NKY?

Thanks

Joseph