About a year ago, we discussed what happens “When Correlations Lie.” Delving into the classic logical fallacy that correlation implies causation, we looked at equities and a variety of supposedly related factors, including gross domestic product, rising interest rates, earnings surprises, new financial products and the “death cross” involving daily moving averages. All were classic coincidences of correlations that didn’t have any actual causal effect on subsequent equity performance.

But the issue of a lack of causation doesn’t seem to stop traders from looking for some way to create an actionable trading opportunity. An entire mythology has developed around  relationships of dubious causal value between variables.

relationships of dubious causal value between variables.

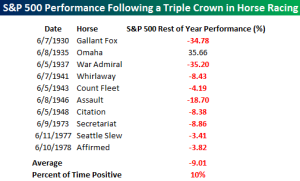

Let’s look at the relationships between stocks and two variables: Triple Crown winners and regional banks. This came up during the weekend as two of my go-to sources discussed each . . .

Continues here: Triple Crown Winners and False Correlations

BR, maybe this will clarify the causation and correlation issue for you.

http://www.businessinsider.com/triple-crown-winners-stock-performance-2015-6

I think the writing this was serious, or is this an Onion article. Can’t tell which.

Causation versus correlation: http://xkcd.com/552/

~~~

ADMIN: You are years late!

http://ritholtz.com/2009/03/correlation/

Have fun …

http://www.tylervigen.com/page?page=1

~~~

ADMIN: That link is in the full BBRG piece

Useless correlation? A case in point:

“LEON COOPERMAN: I sent Obama an angry letter and then I got audited by the IRS”

I had a friend in college who showed in a statistics course there was a “correlation” between the degree of “plunge” in Vanna White’s neckline on “Wheel of Fortune” and the following day’s close of the DJIA. He said the prof was not amused.

out sourcing leads to lower prices?