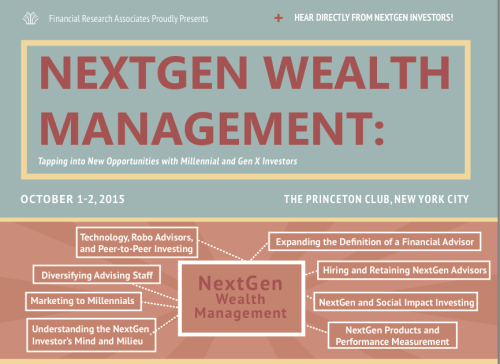

I am speaking at the NextGen Wealth Management conference this afternoon. Pop over to the Princeton Club of NYC and say hello . . .

Beyond the Call of Duty: Expanding the Definition of a Financial Advisor

The “typical” SEC-Registered Investment Adviser has a median of $331.2 million in regulatory assets under management, is 50 years old, and has 26–100 clients. Advisors are accustomed to focusing on picking investments and balancing portfolios, but how will

the profile of an advisor and wealth manager change as NextGen investors come to prominence? Even demographically, the changes are significant—72% of baby boomers are white, while only 56% of millennials identify as such. NextGen investors are looking for collaboration and coaching with their investments and so how might financial advising evolve to match these needs? What suites of services and skills might savvy advisors begin to offer in order

to meet these needs? Will legal services, estate planning, and wills become a part of the equation?