@TBPInvictus here

In my recent piece on U-6, I mentioned that the labor force participation rate (LFPR) is a favorite target for critics of the economic recovery (and the Obama administration). I mentioned that I’d written about the LFPR quite some time ago, and that Bill McBride had done likewise at Calculated Risk:

What is probably my most comprehensive piece on the LFPR is here, published in May 2014. Bill McBride, over at Calculated Risk, has also done some work on this file (see here and here). (Bill is one of the best economic bloggers out there, and I have a ton of respect for his work and am thrilled to have gotten to know him a bit over the years.) LFPR out of the way, let’s move on.

Bill has referred to critiquing the LFPR as “the last refuge of scoundrels.” And with good reason. I had no intention of revisiting LFPR, but a recent piece of research changed my mind, as you’ll soon see.

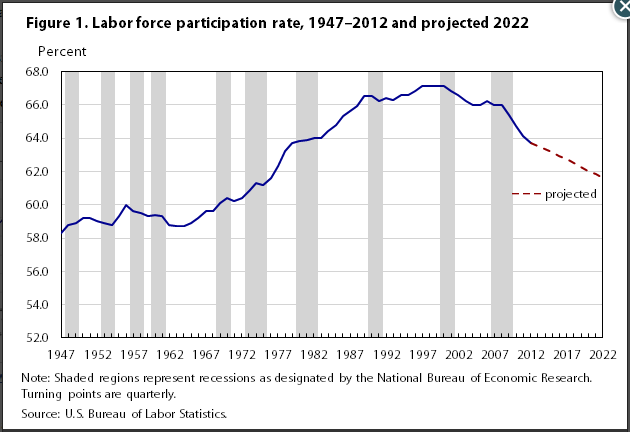

In what I believe is her most recent piece (December 2013) on the topic, BLS economist Mitra Toossi – probably the foremost authority on the subject – projects that the LFPR will continue to decline, incorporating this chart into her work:

But enough about Bill McBride, Mitra Toossi, and me. My good pal Dave Rosenberg weighed in on the LFPR in the November 12 edition of his always fabulous Breakfast With Dave. If you subscribe to one top-notch, top-down, daily view of the world, you should make it Dave’s – it’s easily the best daily insight out there, and you can scrap five others in favor of his.

Oh, and those of us who know Rosie personally found Ritholtz’s interview with him (yesterday, here) to be both informative, with parts that are hilarious.

This is a longish, thorough, and informative read, so sit back and enjoy. And remember, no credible talking head would cite this stat. Keep this in mind as you watch various business channels and shows. Continue on, then impress friends and family at upcoming Thanksgiving gatherings with your newfound knowledge!

(See also Bonddad Blog’s work on this topic here and here.)

Reproduced here with the author’s permission. Take it away, Rosie:

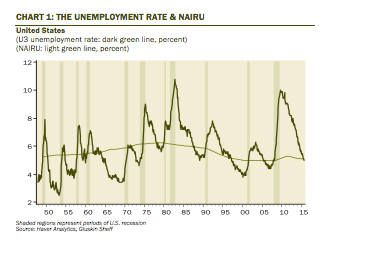

They ain’t coming back

There has been a surprisingly large amount of commentary writing off the improvement in the U.S. unemployment rate — which dipped below the Congressional Budget Office’s estimate of the non-accelerating inflation rate of unemployment (NAIRU) for the first time since February 2008 in October — given that we have not seen an attendant uptick in the labour force participation rate.

The thinking behind this makes some sense on the surface — the traditional unemployment rate focuses on the labour force, so in a situation where there is a huge whack of people falling out of the labour force due to discouragement over job prospects (i.e. not counted as “unemployed” and not included in the labour force), we would see a decline in the unemployment rate but no improvement in the participation rate.

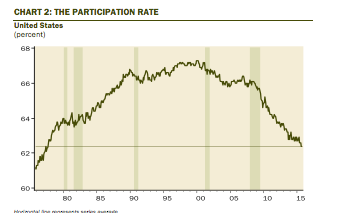

And this line of thinking is consistent with what we are seeing in the U.S. right now with the unemployment rate touching cycle-lows at 5.0% in October while the participation rate sits at a 40-year low of 62.4%.

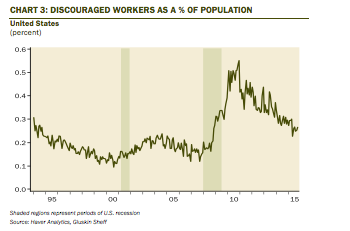

But, as we have talked about repeatedly before, the fact of the matter is that those that refer to themselves as “discouraged workers” represent only a very small fraction of the overall population (just 665,000 people or a tiny 0.26% of the working-age population in October).

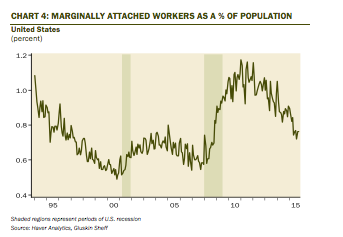

If, instead, we expand our view to all of those workers classified as “marginally attached to the labour force” — so, workers that are available and want a job, but have not looked for one in the past month; discouraged workers are a subset of this, as are those that have family responsibilities, ill health or a disability, or in school — that share of the population increases, but is still very small (1.9 million people or just 0.76% of the working-age population).

So, while changes in worker discouragement may have an impact on the participation rate on the margin, the change in the labour force participation rate is a reflection of structural shifts in the labour market that are driven by demographics more than anything else — this is the reason that the participation rate has remained (and will likely continue to remain) notably below its pre-recession peaks, plain and simple.

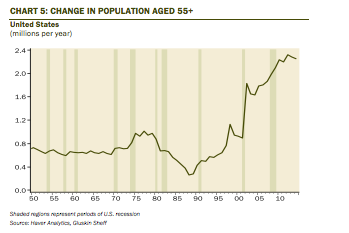

The first members of the “baby boom” generation — those born between 1946 and 1964 — starting turning 55 in 2001 and the ranks of the population aged 55+ has been rapidly increasing since, with a sharp acceleration seen start 2007 — the Census Bureau projects that we will see the population over 55 increase by two million per year out to 2020 (when the last of the baby boomers hit 55).

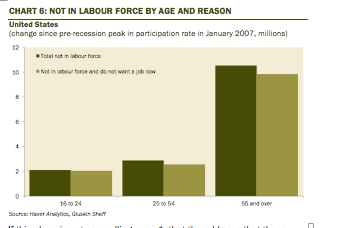

Now, if we look at the breakdown of the change in the population that is not in the labour force since the participation rate touched its recent in January 2007 (see chart below), it is perhaps unsurprising that the vast majority of these people falling out of the workforce are aged 55 or older (68% or 10.5 million people out of the 15.5 million increase in those not in the labour force).

Moreover, fully 93% of these people aged 55 or over that are now out of the labour force reported that they do not want a job now.

If this alone in not compelling enough that the odds are that these people are retirees and thus not likely to start looking for work again, let’s turn our attention to the data produced by the Bureau of Labor Statistics that looks at the flows of people within the labour market.

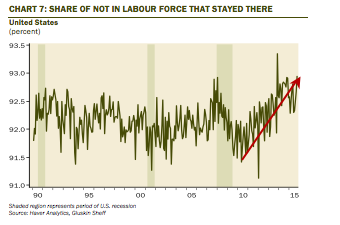

These data give an idea of the movements among the ranks of the “employed”, “unemployed” and “not in labour force” that makes up the headline employment numbers and what is of particular interest to us here is the number of people that remain outside of the labour force on a month-to-month basis.

The chart below showed that 93% of those classified as “not in the labour force” in October also resided there in September. Furthermore, since this share hit its cycle-low in June 2010, there has been a clear upward trend and we are currently around historically high levels.

In other words, an increasing share of Americans outside of the labour force are not making an effort to come back.

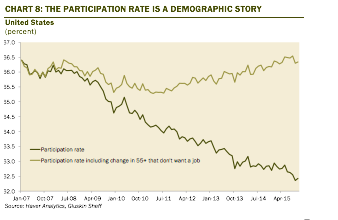

Now, as a fun exercise, let’s add all of these people over the age of 55 that do not want a job back to the labour force (there were 9.8 million more of them in October than back in January 2007) and look what that means for the participation rate.

The chart below plots the actual participation rate and what the rate would be if instead of leaving the labour force, those aged 55 and over that do not actually want a job remained in the workforce (either as unemployed or employed; for this context, it doesn’t matter).

What do you know? If we included these likely retirees in the labour force, the participation rate would have been 66.3% in October rather than the actual 62.4% — note that the pre-recession peak level was 66.4% in January 2007.

So, if not for these people who are very likely retirees leaving the labour force, the participation rate would effectively have remained steady at its pre-recession peaks — that increase in people aged 55 and over that do not want to work since 2007 has accounted for the entire four percentage point decline in the participation rate.

It is very simply the demographic impact of the baby boom generation reaching their golden years that is the story behind this drop in the participation rate and nothing else.

So, once again, any mention of the participation rate — or alternatively, mentions of a participation rate-adjusted unemployment rate or anything else of along those lines — as an indicator of labour market slack or as an argument for why the unemployment rate is obsolete and should be ignored, especially in the context of the policy discussion.

GOP blames aging Americans on Obama’s Health Care Socialization

“Moreover, fully 93% of these people aged 55 or over that are now out of the labour force reported that they do not want a job now.” They are not talking to the same people that I am talking to. Now 93% is a number that I can believe in 62 an older. They have retired, most of them between 62 and 66 involuntarily. Still once you have retired, it is hard to go back to the daily grind of arising in the dark and fighting inhuman traffic to a soul-destroying job.

I would believe around 50% for women 55 to 62 whose families no longer need the second income and are starting to have medical issues. However, the blunt fact is that except at the bottom of the economic barrel, industry does not want older workers. Twenty or thirty years experience is not desired any more. Much cheaper to hire an H1-B or a kid right out of college.

I’m surprised to hear you parroting the Republican line that the unemployed are just loafers who want free stuff from the government.

It would appear that I am among those that have attached too much significance to labor participation rates in attempting to understand our current situation. I would say this, the flat wages/increasing costs of the last 15 years are likely contributing to retirement decisions and even to the escalating disability claims.

“If the incentives are wrong, the behaviors are wrong. I guarantee it”

Charlie Munger

When you brake it down to 25-55 year old and 55+ (as Bill McBride does) there is an uptick in participation rate for the 55+ (a subgroup that cannot afford to retire) and a small but undeniable reduction in participation rate for the prime working age groups. I am not sure exactly what that is driven by (trust fund babies, underground economy, temporary family responsibilities/disability, etc.). However, the absolute numbers are not big enough to represent a substantial “additional labor force reserve”.

The only real problems in employment that remains is an elevated level of long-term unemployed people and a residual minor problem with part-time unemployed. This is probably the main reason we can have a U3 of 5.0% and no sign of increased wages.

While I am substantially persuaded by the case presented, I am still a bit puzzled as to why this effect has been felt less rather than more in other developed economies facing much stronger demographic headwinds such as Japan or Germany.

I think those countries have much better public pension and health care systems – as well as better public social support systems.

At this point I am not sure if the differentiation is important, I am unsure where the facts of slow job growth, no wage growth and generally higher costs coupled with commodity crashes lead us. Probably some form of less predictable and selective demand destruction both in terms of employment and consumption.

When we sweep away all but the most general distinctions, it can be said with fair certainty that a large swath of Americans are working for flat or less wages in a slowly growing job market that has generally maintained steady increases in productivity. If we were to back out the elite workers and senior managers who have enjoyed relative wage growth, the situation becomes more stark. How relevant are the no wage growth people to the economy? What if this trend continues for another 5-10 years? My point is I don’t know and neither does anybody else…

I think the lack of wage growth is much more problematic for economic growth than the current unemployment problems. In essence the only way to grow the economy is to increase demand, and all demand comes directly or indirectly from consumption. So you grow the economy by growing consumption. But without increases in income for the consumer class you cannot get sustainable increases in consumption. We had a period of growing consumption by letting people borrow and go bankrupt then borrow then go bankrupt, but that was stopped for political reasons. Then we had a housing bubble with equity withdrawal to finance growing consumption, that also ended (in tears). Maybe some other temporary boost to consumption can be found, but it seems to me we are back to the basics – consumption will stall if the consumer class doesn’t get increased income.

If all goes as planned, I will be one of the prime age workers not participating in the labor market due to early retirement. I see people complaining about LFPR as anti-retirement or just negative people unable to accept that there is mostly good news on the economic front.

1. “…what the rate would be if instead of leaving the labour force, those aged 55 and over that do not actually want a job remained in the workforce” – and how do you KNOW that they don’t want a job? How many of economics professors have been unemployed long enough to KNOW what it feels like? When one is unemployed for 1-2 years, the real answer to a survey question “do you want a job?” is either “What do you think, moron!” or a simple “F**k off, a-hole.” But those aren’t the options on the questionnaire, so they answer that they don’t want a job. The problem with the “Ivory Tower” economists (who, along with Goldman ex-bankers, happen to run the central banks in most of the world) is that they trust models and formulas (especially those based on “soft” data) more than their eyes!

“…fully 93% of these people aged 55 or over that are now out of the labour force reported that they do not want a job now.” – that’s just bullshit. I know that, you know that, and and I know that you know that.

After 2 crashes, each destroying over 50% of 401(k) balance, no growth in real estate equity for most people over last decade, zero percent interest on savings, median wage lower than in 1989, you’re telling me 93% don’t want a job? How do they survive? Do they live in their kids’ basements?

2. “…all of those workers classified as “marginally attached to the labour force” — … — that share of the population increases, but is still very small (1.9 million people or just 0.76% of the working-age population).” – 1.9 million is a small number, you say? Hmmm, but the FOMC claims that 80k additional jobs in October is enough “strength” in the labor market to start tightening? 80k won’t even make a dent in 1.9mil (even in a course of a quarter or even 6 months), so someone is LYING!

3. The number of employed 25 to 55 is DROPPING, at least according to BLS surveys. The number of 55+ is rising. Implications:

3a. if younger workers don’t work, they don’t pay into social security, while those over 62 are collecting.

3b. if younger workers don’t work, many of them collect fake disability.

3c. if younger workers don’t “work”, many of them work off-the-books, and many of those collect disability as well. They pay NO income nor payroll taxes either.

It’s all good as long as the gov’t can borrow @ almost zero percent and grow the deficit/debt. This has to end one day, right? Where will the $$ come from to pay in the longer term? (oh, i know: dropped from the helicopters!)

4. Any middle class US resident (that does NOT include ivory tower Ph Ds) will testify that its’ almost impossible for a 55+ individuals (even for those with advanced degrees) to get a job because of their age. As a result, they remain on the jobs where they are. They do not demand pay raises and the managers are not threatened by them leaving. This pushes overall wage growth LOWER.

5. Invictus, if “they aint’s coming back”, why the heck do we need to spend $1 trillion to “fix” roads and bridges (in reality 80% of that is a giveaway by corrupt officials to mafia-like structures that control bidding process and who “fix” roads some 300% over budget and it lakes them 200% longer than planned) if fewer and fewer people will have jobs to drive to? Who is going to pay back for that $1 trillion spent?

6. “…any mention of the participation rate — or alternatively, mentions of a participation rate-adjusted unemployment rate or anything else of along those lines — as an indicator of labour market slack or as an argument for why the unemployment rate is obsolete and should be ignored, especially in the context of the policy discussion.” – even if you justify the drop in participation rate as 100% due to “natural” aging of the population (it is not!), it doesn’t make it easier to help us solving the issues such as long term deficits, economic growth, wage growth and income inequality because if those who aren’t in labor force “aint’s coming back”, where’s the growth going to come from, aside from “stimulus” induced nominal growth (i.e. inflation that mostly affects the 55+ retired crowd?) “Slack” or no “slack”, when more and more people do not work (regardless why), who’s going to put in the man-hours to earn income to pay taxes to support the not-in-labor-force crowd?

I am one of those boomers who dropped out of the labour pool due to recent retirement. Between lower taxes and dropped expenses I have more disposable income now than when I was working. If I would re-enter the job market I would lose mine and the wife’s Social Security and because of pension income would be bumped up two tax brackets. And this is without tapping retirement savings.I was highly skilled but now the marginal cost of employing me is very high to make economic sense to me. And frankly I have better things to do now and can pursue them being economically independent. This piece makes a ton of sense to me. The generation behind mine is smaller. So employers are going to have to train and employ those other people (minorities) if they want to keep their companies humming. We have enough workers , just a lot of them are going to be brown and black in the future.

You have a pension? Good for you. Do you think 93% of the “people aged 55 or over that are now out of the labour force reported that they do not want a job now” also have pensions?

“If I would re-enter the job market I would lose mine and the wife’s Social Security” – that’s a bit disingenuous statement: you can suspend Soc. Sec. payments and have larger checks when you restart it later.

If you are “highly skilled”, you must have been making a lot above median wage, so you must have one heck of a pension, or you used to drive 200 miles/day to work in a $100K car that depreciated to zero in 2-3 years…

45.6% of people 65 or older had pension income based on the following 2007 article:

http://www.ebri.org/pdf/notespdf/EBRI_Notes_03-20071.pdf – Page 2

National pension system. We need one. We can just expand Social Security to get the job done if we want. All it takes is taxes that will simply replace the monies going into the utter failure of our patchwork of deferred taxation plans. (IRA, 401k, 403b, 457, etc, etc – what a joke.)

There is a fair amount of BS in this post. You act like no one ever adjusted for age in looking at participation rate before. But people do know the demographic trends, have adjusted for it, and still the rate is dismal. Anyone who claims we are truly at “full employment” today has been taking notes from Orwell.

The labor market today may not be as bad as it was in 2010, but it was still far more healthy in the 1990s. Good jobs were abundant then and employees had some leverage in the workplace.

The leverage today is all with the employer. What that means is that for a great many people, work sucks. You do what you’re told and you’re told just be thankful you have a paycheck.

I was lucky to take an early retirement offer at age 56. A year and a half later, I’m still not looking to go back to work. Maybe another year I will find something to do. I am too young not to be working, and I still would like to think that work can be meaningful and it’s a better thing to be productive. But I will never again go back to being a corporate slave, which is what work has become for too many people today. There is something wrong with the labor market when work is little more than a grind and a source of great stress and misery for many people who are employed.

The LPR IS important and WILL continue to decline due to two factors:

1. Ever increasing population growth through both birth + immigration

2. Ever advancing development and deployment of automation, technology and robotics, which together destroy many more jobs than are created through the advanced technology.

For those who missed this post I made a week or so ago here:

============

Robots may shatter the global economic order within a decade

‘The pace of disruptive technological innovation has gone from linear to parabolic,’ says Bank of America

By Ambrose Evans-Pritchard

05 Nov 2015

Robots will take over 45pc of all jobs in manufacturing and shave $9 trillion off labour costs within a decade, leaving great swathes of the global society on the historical scrap heap.

In a sweeping 300-page report, Bank of America predicts that robots and other forms of artificial intelligence will transform the world beyond recognition as soon as 2025, shattering old business models in a whirlwind of “creative disruption”, with transformation effects ultimately amounting to $30 trillion or more each year.

“The pace of disruptive technological innovation has gone from linear to parabolic,” it said. Any country that fails to embrace the robot revolution will slip rapidly down the rankings of competiveness, and will be left behind.

…

http://www.telegraph.co.uk/finance/economics/11978542/Robots-may-shatter-the-global-economic-order-within-a-decade.html

===============

I do note that participation was in the 58% to 60% range when I was a kid and anyone who breathed could get a job. There were not that many wives in the labor market then as pay was decent and most families did OK on one paycheck.

I’d like to see more demographic data, say participation based on narrower age ranges, race, and gender.

As for the 5% employment rate, it is totally hokey due to how the BLS rules manipulate who is considered part of the labor force and considered actively looking for work to the governments advantage (same as with CPI). The real employment rate is probably 2-3% less than 5%. This is WHY inflation in salaries is not occurring!

Also, per the BLS rules, if you work even ONE hour a week, you are considered fully employed. There are many people working short hours that would prefer to be working one full-time job, including many over 55YO.

Yes, as a few people above stated, there really are many people 55+ who would like to work but no one will hire them, especially in the corporate and technology worlds. I know displaced people over 55 who are physically healthy, mentally competent and would like to again work at something challenging.

Now just the other day I saw a story (on NPS Newshour?) about yet another program that wanted to fund entrepreneurial young people to create new businesses and companies. But WHY are they always looking for young people? Older people’s brains often still work well and they can be entrepreneurial also. Are Bill Gates, Larry Ellison, Warren Buffett and many others of similar age over-the-hill? I don’t think so.

So why does everyone seem to believe that only young people can have new ideas? That only young people are worthy of incubation support and funding?

Few people know that it is only illegal to discriminate against people OLDER than 40 in employment, not people younger than 40. So how about some of the moneyed set backing companies where everyone is a previously out-of-work, over 40 or 50 YO? [lol]

Let’s use a real world example to match your abstract statistics:

Henry, a successful electrical engineer, worked in the technology sector for a company on the margin. He is 55 with a wife and two children, one who just graduated from college while the other has just entered. He was just offered a two year buyout, which he accepted. He was replaced by an H1B new hire at a significantly lower salary. Henry has not applied for unemployment, has scanned the job market but at his age and prior pay scale his options are minimal to none as most of the other new hires in his field are either going to H1B individuals, other immigrants or younger, lower paid workers. Henry would like to find meaningful work but feels excluded by our current environment.

So I am curious how these individuals fit into our abstract world. Obviously Henry is part of the LFPR, is the H1B hire a new hire for the labor statistics? In an earlier time with the economy going through a transition, people like Henry would have been absorbed into new small business or themselves as an entrepreneur, but not today. (https://www.washingtonpost.com/news/on-small-business/wp/2015/02/12/the-decline-of-american-entrepreneurship-in-five-charts/)

It would seem to me that people as smart as Mr. Ritholtz would spend their time figuring out how to ignite the economic engine of entrepreneurship rather than justifying the progressive status quo.