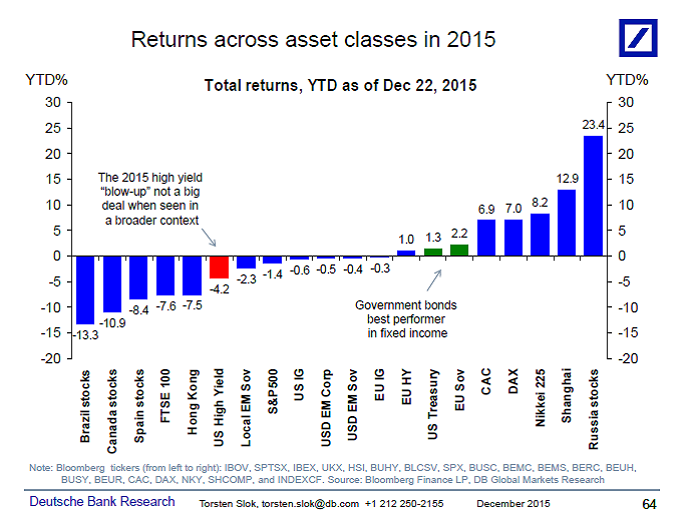

The chart below shows returns across asset classes in 2015. Key conclusions:

– The turbulence in high yield was really not a big deal when compared with the performance of other risky assets, including equities

– US stocks down 1% and stocks in core Europe up 7%

– EM equities at the extremes, with Brazil down 13% and Russia up 23%

– USD EM corporate bond returns down modestly

– The best performer in fixed income was…US and European government bonds

For more discussion of the outlook for credit in 2016 see also here.

Source: Torsten Slok, Ph.D., Deutsche Bank Research

I would like to see the returns with and without currency-hedged ETFs.

BR, off-topic, but: I visited a local Best Buy store this afternoon and though there were many people in the store and the parking lot outside was 80% filled, there was only one cashier open!!! The other five stations were shutdown. I remarked to the cashier about only one cashier being needed to handle two days before Christmas business and that “Amazon must’ve really gutted Best Buy.” She laughed.

I think … if I stretch this chart into a somewhat-longer rectangle, and twist it once in the middle, connect the ends … I’d have a mighty fine Mobius strip!

I mean, looking at their respective national economies, is there a lot that distinguishes the Brazilian economy from the Russian economy? Sure, one is being strangled by sanctions and plunging prices of their secondary export (their primary export, like ours, is war), while the other is being torn apart by corruption and mismanagement, but both possess a certain lack of profits/prospects, and their success or failure in the markets is due more to the fickle markets trying to anticipate or react to their past over-reaction of how badly these economies have been hurt.

But of course, I forget, that stock markets and national economies are only loosely connected … and that in 2016, the hot stock market to be in will like as not be … Brazil.

But it strikes me that this is more than a little like chasing falling dead cats, trying to guess which one will bounce the highest … nothing related to rational investing.