Invictus here:

There are those of us, like me, who are always looking at numbers and data. It’s just in our DNA. What do the data tell us? Is it possible we could uncover something meaningful that’s not been scrutinized previously? Is there a correlation between data series x and data series y? I know Bonddad and NDD know what I’m talking about. Perhaps you’re similarly afflicted, or know someone who is. It’s all in the pursuit of more and better knowledge.

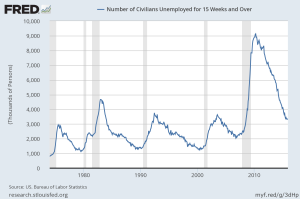

That said, in the late summer of 2007, as the storm clouds were forming, I thought about data – particularly in the labor market – that might portend a coming change in the business cycle. Not in a coincident fashion, but as a leading indicator. I thought about the number of people unemployed for a period of time, and looked at those unemployed for 15 weeks or over, my thinking being that such a metric might represent the tip of the spear, the canaries in the coal mine, for more bad news to come.

Sure enough, that metric – UEMP15OV at FRED – seemed to trough months ahead of recessions with near perfection. I discussed and shared my find with my pal Dave Rosenberg (at that time Chief North American Economist at Merrill Lynch), who penned this on September 17, 2007:

As we all know, the NBER called the start of the last recession as December 2007. Dave’s prophetic “Could the recession already be staring us in the face?” was more or less spot-on, as we now know.

I bring all this up because I have, of course, continued to follow this metric, and it’s not yet raising any yellow or red flags. The chart below begins at the same point as Dave’s – 1974 – but may look dissimilar because of the massive run-up during the crisis that hadn’t yet happened when Rosie first ran it in 2007 – it was only looking like a tiny hiccup at that point.

In fact, as Rosie wrote, it takes almost a year – and a rise in the level of about 20% – from a trough in this series to the onset of a recession. And we’ve seen no indication as yet that this metric has even begun to carve out a bottom. There are also, of course, myriad other data points telling more or less the same story.

Now, all that said, this time could be different. It can always be different. Indicators, algorithms, lucky charms, etc., all work until they don’t. And I claim no particular or unique insight into economics or markets. But, as someone who spends far too much time sifting through data, I’m comfortable with this series and trust that it’s not betraying me now. Recession calls are premature, and I take great comfort knowing that I’m aligned with Bill McBride over at Calculated Risk.

What's been said:

Discussions found on the web: