David Fiderer has worked in banking for more than 20 years. He has written extensively about the financial crisis and is currently working on several projects concerning housing finance. His e-book on Fannie and Freddie is currently being updated to include GSE policy under the Obama Administration.

~~~

Part 1: It’s the fraud stupid

In The Big Short the character played by Rafe Spall is on a due diligence trip to Florida. He knocks on the door of what he thinks is the home of a borrower who is late on his mortgage payments. But he discovers that the occupant is a renting tenant, and the name on the mortgage is the name of the borrower’s dog.

That brief scene encapsulates a big part of the foreclosure crisis in 2007. The level of occupancy fraud, used by borrowers in flipping schemes, was pretty staggering. The New York Fed found that, in the bubble states at the peak of the market, “almost half of purchase mortgage originations were associated with investors. In part by apparently misreporting their intentions to occupy the property, investors took on more leverage, contributing to higher rates of default.” Fitch found occupancy fraud in 60% of the defaulted subprime loans it reviewed in late 2007.

So when home prices stopped rising, those borrowers who wanted to make a quick buck stopped paying monthly installments and walked away. In early 2007, before home prices began to really tank, BasePoint Analytics found that 70% of early payment defaults were tied to mortgage fraud.

You didn’t have to knock on doors to figure out what was happening. You just needed to look at the prepayment rates. Among 20 subprime deals that closed in the second half of 2005 and made up the ABX 2006-1 composite, loan balances were reduced by 20% to 33% within the first year post closing. Within the first two years almost all of deals saw the original loan balance had been reduced by 50%.

Think about that for 30 seconds. Why would so many people want to prepay their subprime mortgages in the first year? Why would they willingly incur steep prepayment penalties on teaser-rate loans? Did they all suddenly feel the urge to move out of their homes? Did they all have lots of cash burning a hole in their pockets and feel sudden urge to deleverage? These were flipping schemes. Or, all too commonly, as the St. Louis Fed reported, these were distressed prepayments by people who were forced to move because they couldn’t handle the predatory loans. The St. Louis Fed study found that delinquent borrowers would prepay, instead of default, so long as home prices were rising.

As I’ve written before here and here, the evidence of institutionalized fraud, which involved just about every loan originator, and willfully overlooked by every investment bank, is overwhelming. Pinpointing what people knew and when they knew it in the originate-to-distribute chain is not easy. These are very complex transactions. But somebody along the way lied, big time.

Of the 18 banks sued by FHFA for making false claims in their SEC filings, only two, Nomura and RBS, had the chutzpah to go to trial. Here are a few excerpts from Federal District Court Judge Denise Cote’s decision:

The Offering Documents did not correctly describe the mortgage loans. The magnitude of falsity, conservatively measured, is enormous.

Each Prospectus Supplement included Collateral Tables reporting the average LTV ratios and percentage of LTV ratios in certain ranges for each SLG. To show that the appraisals – and thus the LTV ratios — were false, FHFA was required to show both objective and subjective falsity. FHFA did so.

For at least 184 of the loans, FHFA established both that the appraisal value was false and the appraisers rendering those appraisal opinions did not believe that the values they reported were the true values of the properties. The proportion of such loans per SLG ranged from 18% to 36%. This had important consequences for the accuracy of the LTV ratio Collateral Tables. For example, the Prospectus Supplements all represented that there were no loans in the SLGs with LTV ratios of over 100; the actual figures ranged from 9.3% to 20.5%. Every LTV ratio Collateral Table contained statistics that were false.

But here’s the kicker:

Today, defendants do not defend the underwriting practices of their originators. They did not seek at trial to show that the loans within the SLGs were actually underwritten in compliance with their originators’ guidelines. At summation, defense counsel essentially argued that everyone understood back in 2005 to 2007 that the loans were lousy and had not been properly underwritten.

That’s an unseemly argument. FHFA alleged violations under Section 11 and Section 12(a) of the Securities Act of 1933, which hold an underwriter liable for the accuracy and completeness of all financial disclosures. These statutes impose a strict liability standard, meaning the underwriter may be held liable for material falsehoods even if he had no intent to deceive. Our entire system of federal securities laws, and the integrity of our capital markets, is based on the notion that all investors can rely on the accuracy and completeness of disclosures filed with SEC.

Defense counsel’s ploy was a backdoor attempt to subvert that basic principle, because he says that it is not reasonable for the GSEs or anyone else to assume that the world’s largest banks made a practice of complying with the Securities Act of 1933.

Part 2: Fancy institutions whitewash fraud. Exhibit A: The Boston Fed

“The idea that mortgage-industry insiders systematically profited by selling mortgages they knew would fail is at odds with what actually happened, ” writes Greg Ip in The Wall Street Journal. He also wrote, “most economists blame the latest crisis not on Wall Street malfeasance but larger economic forces.”

Oh really? I don’t know about most economists. I have yet to read any paper by any economist who reviewed the evidence of fraud and, based on that review, concluded that other economic forces had a bigger impact. Though I have read plenty of garbage like the Boston Fed “study” cited by Ip to support his claims. I must say I am shocked that the Boston Fed would lend its prestige to this transparent piece of propaganda. So I thought it would be a worthwhile case study to illustrate the tricks and devices used by those who show scant regard for business ethics.

Everything is framed around the paper’s intro:

This paper presents 12 facts about the mortgage market. The authors argue that the facts refute the popular story that the crisis resulted from financial industry insiders deceiving uninformed mortgage borrowers and investors. Instead, they argue that borrowers and investors made decisions that were rational and logical given their ex post overly optimistic beliefs about house prices.

Those 12 “facts” are a bunch of half-lies, straw men, non sequiturs, and spurious falsehoods. They “refute” nothing. The authors–Christopher L. Foote, Kristopher S. Gerardi, and Paul S. Willen–pull out all the stops to whitewash culpability of financiers.

Consider this little gem, an exact quote: “Fact 2: No mortgage was ‘designed to fail.’” If you don’t smell something wrong with that statement, you need to develop a better nose for BS. (I’m not being glib; that’s an essential skill in business, Mr. Ip.)

Let’s quickly walk through the twelve “facts”:

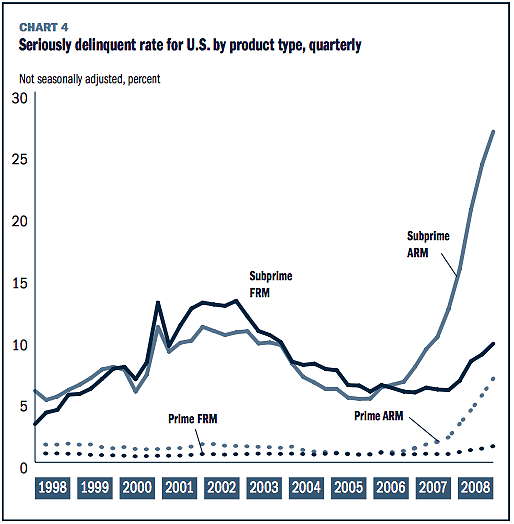

“Fact 1: Resets of adjustable-rate mortgages did not cause the foreclosure crisis.” (A straw man.)

Yeah, though you can see, below, how people got that impression from the Mortgage Bankers Association.

Their argument, which is essentially the same one Paul Willen used his Congressional testimony to deride the benefits of the 30-year fixed-rate mortgage, is that most homeowners who defaulted did not do so right before their interest-reset dates.

Though Willen also said this in his written testimony:

In 2008, my colleagues and I showed that even accounting for observable characteristics of the loans–such as credit score, loan-to-value ratio, payment-to-income ratio, change in house prices, and change in payment–borrowers were more likely to default on adjustable-rate mortgages than on otherwise similar fixed-rate mortgages. The difference in default rates existed even for pools of loans where adjustable interest rates fell, further confirming that it was unobservable characteristics of borrowers, not of mortgages, that caused the difference.

If ARMs didn’t cause the crisis, they were certainly at the heart of the mortgage crisis.

“Fact 2: No mortgage was ‘designed to fail.’” (A non sequitur and a straw man.)

Here’s a more important fact: No one ever said that any mortgage was designed to fail. The authors knowingly make a false assertion, that people described predatory mortgages as being “designed to fail,” and slime some Democrats in the process. Here’s what they say:

Some critics of the lending process have argued that the very existence of some types of mortgages is prima facie evidence that borrowers were misled. These critics maintain that reduced-documentation loans, loans to borrowers with poor credit histories, loans with no downpayments, and option ARMs were all “designed to fail,” so no reasonable borrower would

willingly enter into such transactions.(5)(5) The phrase “designed to fail” appears in speeches by presidential candidate Hillary Clinton, Senator Charles Schumer of New York, and press releases from prominent attorneys general including Martha Coakley of Massachusetts and Catherine Cortez Masto of Nevada.

I’m very familiar with the phrase, “designed to fail,” because in November 2009 I was the first one to use it in Huffington Post and OpedNews. It refers to synthetic CDOs, which were at the heart of The Big Short and The Greatest Trade Ever.

In capitalismland, the issue is not whether mortgages are “designed to fail,” but whether they are designed to recover principal and interest. And the originators didn’t care, because, for a number of years, they were selling off junk to the greater fool.

With “Fact 2” the authors’ trick is to define deviancy down to the point of meaninglessness. Which is also what happens when Greg Ip writes something like this, “The idea that mortgage-industry insiders systematically profited by selling mortgages they knew would fail is at odds with what actually happened.” (Emphasis added.)

Guess what? The legal and ethical standard is much higher than that. You have affirmative obligation to do the right thing, to make sure that you only sell mortgages that are accurately represented, and that those mortgages were underwritten so everyone had a reasonable expectation the loan would be repaid on time. Anti-predatory rules, which applied to the GSEs but not private mortgage companies at the time, prohibited loans without a clear assessment of the borrower’s ability to repay. It’s an old lesson but it’s still true: Clever people can rationalize anything.

“Fact 3: There was little innovation in mortgage markets in the 2000s.”

Oh really? What did change was the type and magnitude and pervasiveness of risk layering. Risk layering generally means neutering protections against fraud. So, if you forego verification of income, that’s probably not a big deal on a simple rate refinancing for the same borrower who has been current for the past five years. But if you forego income verification for a cashout option-ARM for an 80% LTV loan encumbered by a 15% piggyback 2nd lien, all of those credit compromises have a compounding effect.

“Fact 4: Government policy toward the mortgage market did not change much from 1990 to 2005.” (Complete BS.)

You can look at government policy in terms of legislation, regulation and enforcement. The authors ignore that and write that. contrary to what others have written, LTVs did not change markedly over time.

Let’s start with the obvious, the Federal Housing Enterprise Safety and Soundness Act of 1992, which some GSE critics view as more momentous than 9/11. This legislation mandated affordable housing goals, which increased over time. Congress also passed the Home Ownership Equity Protection Act of 1994, which tasks the Fed with regulating the mortgage industry to curtail the sorts of abuses described in The Big Short. But Greenspan refused to do his job and enforce it.

In April 2000, a joint study by HUD and Treasury found that predatory lending, which was largely fraudulent, had gone viral in the subprime industry. But Phil Gramm aborted any legislative proposals to curtail predatory lending, which were endorsed by the Clinton Administration. So HUD Secretary Andrew Cuomo imposed anti-predatory regulations on the GSEs, and exempted subprime mortgages from being included in affordable housing goals. While the Clinton Administration took aim at predatory subprime lending, the Bush Administration ignored the problem because Roland Arnall, owner of Ameriquest, was Bush’s biggest donor, and preempted the states from enforcing laws that protected their citizens.

“Fact 5: The originate-to-distribute model was not new.” (Highly misleading)

Guess what? There’s a huge difference between selling a mortgages to another financial institution and selling a mortgage to a bunch of investors who rely on the trustee and the loan servicer to preserve the value of the loans. Why? Because a single owner or guarantor of the mortgages has a strong motivation to preserve the value of the collateral. And because a solitary owner is better positioned to enforce representations and warranties.

Moreover, there’s a huge difference between selling subordinated bonds to investors who understand the risk they are assuming, and selling subordinated bonds to a CDO, which is sold to unsophisticated “sophisticated” investors who put their faith in triple-A ratings, and which is managed by somebody how has not vested interest in protecting legal rights relating to a tiny sliver inside the bond portfolio.

“Fact 6: MBSs, CDOs, and other ‘complex financial products’ had been widely used for decades.” (Half-lie)

Yeah right. Derivatives have been around since before the Chicago Board of Trade was set up in 1848. So so there was nothing really new under the sun when credit default swaps were invented, right? Speaking of language, credit default swaps are not really swaps, which are supposed to lock in the price of an asset purchased in the future. And the credit default swaps in The Big Short were specifically invented so beneficiaries got paid out well before any payment default.

Structured finance CDOs were invented at the turn of the 21st century, as were credit default swaps. Pay As You Go Swaps were invented in 2005. Subprime mortgage securitizations, which relied on tranched subordination instead of mortgage insurance, were first used in 1997.

There were plenty of complex bankruptcy-remote structured finance entities before the 20th century, but synthetic leases or utility receivables. are a heck of a lot different than a synthetic CDO. Ans, as anyone who remembers Enron can tell you, plenty of complex financial products proved to be unmitigated disasters before the 2008 crisis.

“Fact 7: Mortgage investors had lots of information.”

Once again, the authors define deviance down to the point of meaninglessness. The standard isn’t whether investors had lots of information—Enron’s investors had lots of information—the standard is whether investors were provided with disclosures that are accurate and complete. Many RMBS offerings failed to disclose any second lien information. Which, to traditionalists like me, represents a fatal gap in disclosure.

And again, thanks in large part to FHFA’s lawsuits against all the major banks, the evidence of institutionalized fraud is overwhelming. They had lots of information, but the information about LTVs, and owner occupany, in deal and deal after deal, was false.

“Fact 8: Investors understood the risks.” (irrelevant)

The authors have no way of knowing what investors “understood.” As any fan of The Sopranos or Mad Men can tell you, that people don’t say what they’re really thinking and a lot of people lie to themselves. And I can assure you that people are susceptible to groupthink. I can also tell you that the people who piggyback off of somebody else’s due diligence are in the majority. And credit ratings define reality for many people.

And I can extrapolate from my own experience when I was younger and much more naïve. I covered Enron many years ago, and though a number of things made me uneasy, I honestly thought that a public company subject to securities laws, audited by Arthur Anderson and represented by very fancy law firms would be careful about following the law. I never imagined that hundreds, perhaps thousands, of employees at one company would act like criminals.

I’m willing to bet that many investors in RMBS presumed the same thing. What I didn’t understand at the time, but certainly do now, is that New Deal investor protections had been neutered by the Private Securties Litigation Act of 1995, by several decades of Supreme Court rulings that defined deviancy down in securities violations, and, back then, by an CFTC that was intent on insulating market manipulators from accountability.

“Fact 9: Investors were optimistic about house prices.”

Once again, the authors have no idea what investors were thinking. But they presume to know what people are thinking because of one Lehman analyst report, which showed that reduced home price appreciation could get some bonds in trouble. The authors forget that few investors bought subordinated bonds, which were stuffed into CDOs and sold to a small universe of suckers who relied on triple-A ratings.

People don’t buy bonds–especially triple-A bonds–because they feel optimistic. They buy those bonds because they have a strong degree of comfort, or protection on the down side. And buyers of triple-A assets generally aren’t given the time to do a full review of all the documentation, which is largely obfuscatory.

It’s true, it you drilled down into the assumptions used by the rating agencies, you could see that they ignored the possibility of a cyclical downturn, which sounds incredible but is true. But again, there’s a strong herd instinct, and most people, including myself, did not realize the rating agencies are in a servile position to the Wall Street firms that hired them to assign ratings. I and most other people came from the corporate side, where the opposite is true.

“Fact 10: Mortgage market insiders were the biggest losers.” (A highly offensive straw man)

This one I find really offensive. The biggest losers were people who were lost their homes, their savings their jobs, their hope for the future, etc. Nobody on Wall Street ended up destitute. Yeah, lots of executives lost millions and millions in stock options, etc. But they still had a strong capital cushion. Most Americans don’t, so losing a job or a home is really devastating.

The authors point out that many large banks had retained billions and billions of triple-A RMBS and CDO bonds, and lost a lot of money as a result. They don’t appreciate how some executives were able to dissemble to senior management until it became apparent that the institutions were stuck with toxic assets. Again, a lot of this had to do with the fact that senior executives, who came up through the ranks on the corprate side, where the rating agencies act honestly, did not understand that the ratings on RMBS and CDOs were garbage and long overdue for downgrades.

“Fact 11: Mortgage market outsiders were the biggest winners.”

Oh, please. They see the winners as people who benefitted from The Big Short, which was, first and foremost, Goldman Sachs. Syntheric CDOs were invented by big banks, not for the purpose of providing liquidfity to the market or price discovery, but to invest in a sure thing, triple-B subprime defaults.

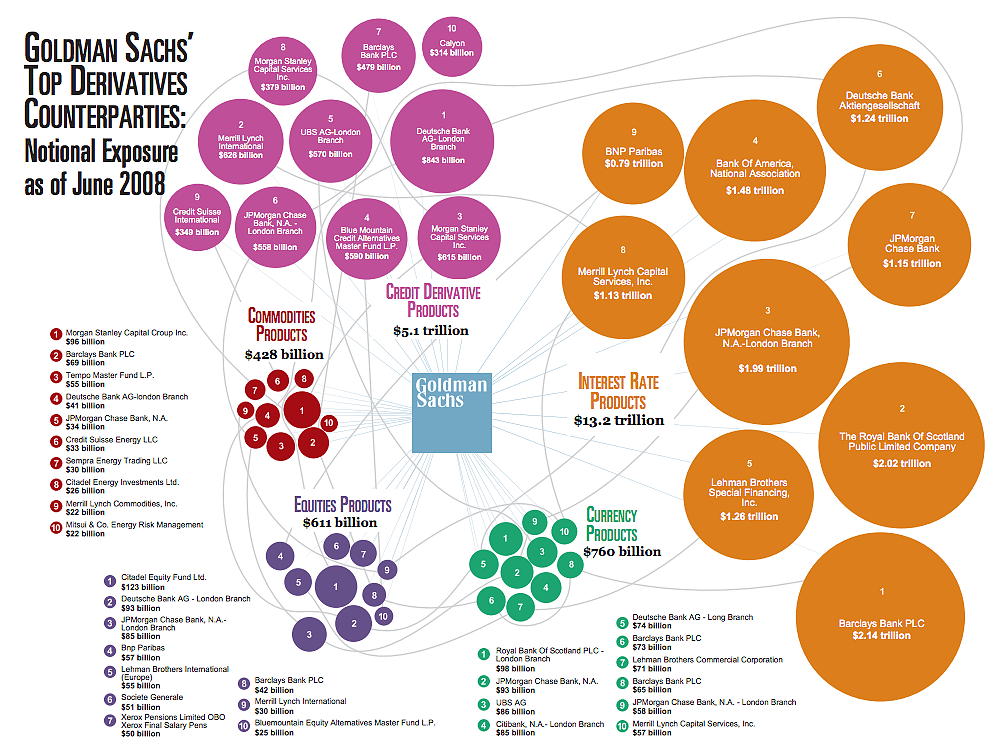

And someone like John Paulson, who walks into an investment bank’s office and tells his bankers how he would then to design a synthetic CDO so that he can short the bonds insured by the CDO is not, by any stretch of the imagination, an outsider. He may not be at the exalted levels of Hank Paulson or Jamie Dimon, but he ain’t no outsider. How about Blue Mountain Credit Alternatives Master Fund, with $3.2 billion under management in 2007? Goldman had $566 billion in credit derivative exposure to that one hedge fund, which was more than its exposure to JPMorgan Chase, UBS or Barclays. Was it just an “outsider”?

The big winners were all insiders, because they were privy to information kept from public view. Anyone could figure it out for himself, but he would be up against cognitive dissonance. And, as The Big Short movie explains, banks wouldn’t trade with him.

“Fact 12: Top-rated bonds backed by mortgages did not turn out to be ‘toxic.’”

Again, complete BS. Hundreds of billions of dollars of triple-A RMBS bonds lost money. Moody’s estimates an average 48% loss rate on 2007-vintage subprime bonds, and a 36% average loss rate on 2006-vintage subprimes. Subtracting the standard 20% overcollateralization, 28% of the 2007 bonds, and 16% of the 2006 bonds were rated triple-A and lost money. Comparable numbers of triple-A Alt-A and option-ARM bonds lost money. And we know that most of non-triple-A tranches ended up in CDOs, which were mostly rated triple-A., and which all lost money.

That’s my summary of, “Why Did So Many People Make So Many Ex Post Bad Decisions? The Causes of the Foreclosure Crisis,” which is a product of the Panglossian school of economics.

Source: David Fiderer

What's been said:

Discussions found on the web: