My Sunday Washington Post Business Section column is out. This morning, we look at what investors have been afraid of “the next sub-prime,” and how those fears have impacted their portfolios.

This is not a market call, but an observation as to how people’s normal fears and risk aversion led them to miss large gains which would have made yup for their 2008-09 losses.

The print version had the full headline Priming your portfolio for a crisis? You may miss out on big gains, while the online version The real risk in the market is staying out of it.

Here’s an excerpt from the column:

“Some investors, having been repeatedly mangled by events not of their making, never fully recovered from that 57 percent crisis collapse in the stock market. They are now dedicated to not letting any of that ever happen to them again. No more drawdowns! Every market twitch is a sign! No part of the economy is safe from another collapse — and it’s coming!

This risk aversion has led them to miss a huge run-up in U.S. equities.

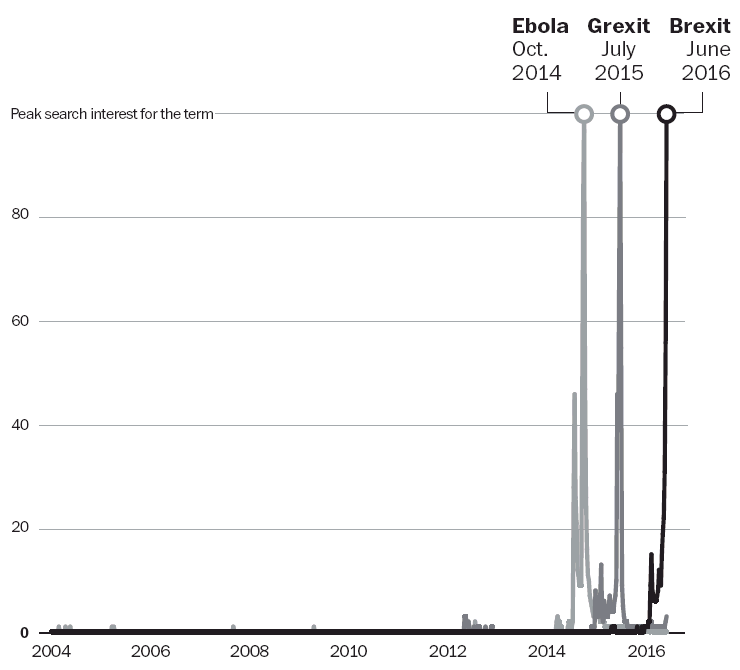

Good artwork, too, inspired by Michael Batnick:

Source:

The real risk in the market is staying out of it

Barry Ritholtz

Washington Post, June 19 2016

http://wapo.st/1UH9DwR

What's been said:

Discussions found on the web: