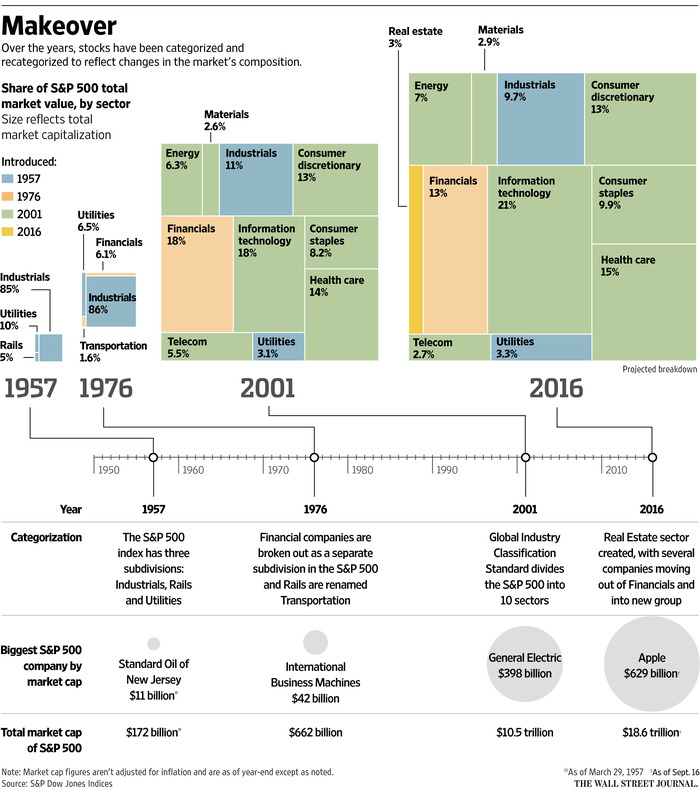

REITs are being broken out from the finance sector. While that makes some intuitive sense, S&P track record on creating new sectors has been noteworthy for its timing.

Here is the Wall Street Journal:

“Real-estate investment trusts own real estate and pay steady dividends, which have been attractive to investors with interest rates so low. More than a net $62 billion had flowed into U.S. real-estate funds since 2001 through the end of 2015, according to Morningstar Inc. data.

S&P 500 Gets Its First New Sector Since the Dot-Com Era

Source: WSJ

The number of publicly traded REITs has also risen. Since 2001, 129 real-estate investment trusts have gone public in the U.S., raising more than $38 billion, according to Dealogic. There are roughly 240 REITs listed on the New York Stock Exchange and the Nasdaq, according to S&P Dow Jones Indices.”

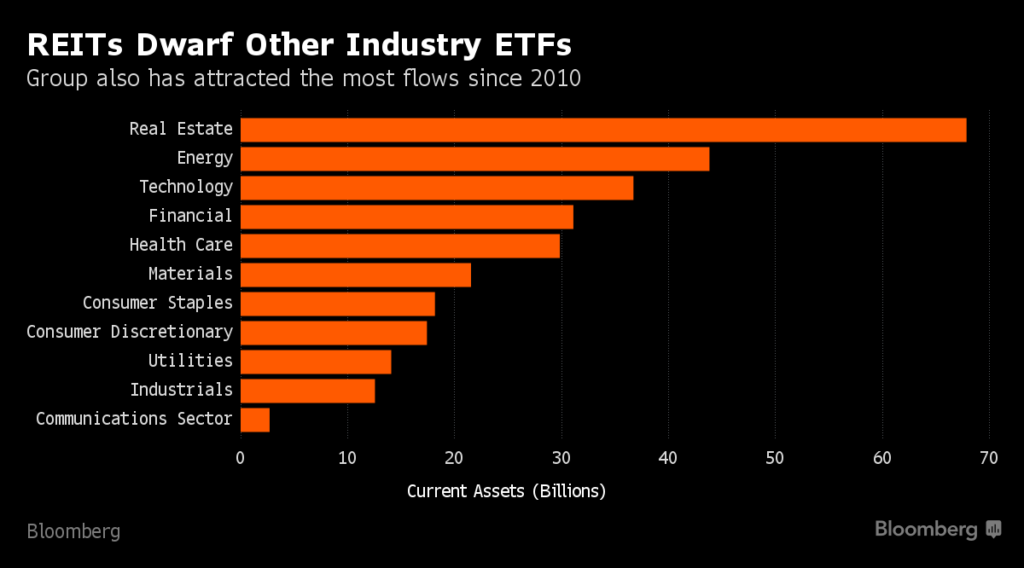

However, REITs have been huge winners, especially in the ETF space. Again, this is a sector that has already had a great run:

Real Estate Gets Starring Role in S&P 500, Spurring ETF Overhaul Source: Bloomberg

Source: Bloomberg

What's been said:

Discussions found on the web: