What the Consumer Expenditure Survey tells us about mortgage instruments before and after the housing collapse

By Taylor J. Wilson

BLS October 2016 | Vol. 5 / No. 14

RELATED ARTICLES

Spending on mortgage interest payments and charges decreases from 2007 to 2009

Patterns of homeownership, delinquency, and- foreclosure among youngest baby boomers

In December 2007, the U.S. economy entered a recession that affected most consumers in some way.1The unemployment rate rose from 5.0 percent at the start of the recession to 7.3 percent 1 year later and ultimately peaked at 10.0 percent in October 2009.2 Accompanying this recession was a collapse in the housing market—a phenomenon characterized by depreciating home values—beginning in 2007.3

This Beyond the Numbers article focuses on the effects of the housing market collapse on mortgage composition among consumers who were mortgage holders. The purpose of a mortgage loan is to allow a consumer to purchase a property by borrowing against future income at a price (the interest rate). There is, of course, inherent risk associated with taking out any loan, but the amount of risk depends on the terms of the contract reached between the lending institution and the consumer. The article uses data from the Consumer Expenditure Interview Survey (CE) to describe how the composition of mortgage contracts changed between 2004 and 2014. Following are the main findings:

- Activity in the mortgage market fell after the collapse in the housing market.

- After the collapse, consumers moved away from risky mortgage instruments in favor of less risky ones, both as a percentage of all mortgages taken out and in absolute terms.

- Fixed-rate mortgages (FRMs) are much more popular than the non-fixed-rate alternatives, regardless of the period examined.

- Consumers tend to prefer longer term mortgage contracts.

Description of mortgage data in the CE

The CE collects characteristic information about each mortgage, including the length of the term, the interest rate, and the original mortgage amount. A fixed-rate mortgage (FRM) is a type of loan such that the interest rate remains fixed over the life of the loan. An adjustable-rate mortgage (ARM) is a type of loan such that the interest rate changes on the basis of some predetermined schedule over the life of the loan. For the purposes of this article and because of the way the CE data are collected, ARMs are put in the same category as other atypical mortgage instruments. From these characteristics, it is possible to identify various mortgage instruments held by consumer units4 (CUs). Table 1 presents the number of mortgages reported, by mortgage instrument, in a 10-year pooled sample of CUs interviewed from 2004 to 2014. The interest rate associated with mortgage contracts is usually fixed, with only about 14 percent falling into non-FRM instruments, including adjustable rate mortgages (ARMs) and hybrid loans. The number of 30-year FRMs exceeds the number of 15-year FRMs in the sample.

| Instrument | Number | Percentage of sample |

|---|---|---|

| 30-year FRM | 107,991 | 61.49 |

| 15-year FRM | 25,717 | 14.64 |

| FRM with term other than 15 or 30 years | 17,221 | 9.81 |

| Non-FRM | 24,685 | 14.06 |

| Note: FRM = fixed-rate mortgage.

Source: U.S. Bureau of Labor Statistics, 2004–14 Consumer Expenditure Survey pooled sample. |

||

On average, the mortgage instrument with the lowest interest rate is a 15-year FRM.5 However, there are higher monthly payments associated with that instrument because, for the same mortgage amount, the timeframe for repaying the loan is shorter. According to economic theory, consumers will engage inconsumption smoothing,6 spreading out how they spend money across future periods instead of consuming a fixed percentage of it in the period the money is received. In the case of a mortgage loan, consumers borrow money to finance the purchase of a house, rather than saving up a large enough sum to purchase the house outright. Because the latter strategy would change their consumption patterns in a significant way, consumers borrow against their future income, leaving their current consumption patterns largely unaffected. As a result, consumers will attempt to minimize their monthly payments, pay off the loan over time, and maximize current consumption under the constraints of the loan borrowed against their future income. A preference for current consumption over future consumption suggests that consumers should generally prefer the longer term FRMs. This suggestion is supported by the prevalence of longer term loans in the sample. Fixed-rate mortgages with other terms (e.g., 20 years, 10 years) are chiefly special cases that follow the same general idea as a 30-year FRM or a 15-year FRM uses. Usually, the shorter the term, the higher is the monthly payment and the lower is the interest rate. Similarly, the longer the term, the lower is the monthly payment and the higher is the interest rate.

Interest rate risk associated with mortgage instruments

Interest rate risk is defined as the risk associated with fluctuating interest rates. Mortgage contracts contain an inherent risk that affects lenders and borrowers differently. Generally, the riskier the mortgage is for the borrower, the lower the interest rate will be. For the borrower, an FRM is the least risky type of mortgage contract that can be signed. When the contract is signed, the borrower knows exactly how much the mortgage payments will be until the mortgage is paid off. Uncertainty is minimized, resulting in minimal risk for the borrower. The other advantage to the borrower of an FRM is a predictable tax benefit: under current tax laws, consumers can write off the interest portion of a mortgage payment. Although there is a similar tax benefit associated with an ARM, the FRM tax benefit throughout the entire term of the loan is known. This knowledge also minimizes future uncertainty and decreases risk. Consider a hypothetical fully adjustable rate loan: rates move because of changes in market conditions that affect the index on which the interest rates are based; the resulting uncertainty that is due to changing rates shifts the risk from the lender to the borrower.

From the perspective of the lender, usually a bank, the risk manifests itself differently. For the lender, a mortgage loan is an asset that provides a return based on the interest rate. The risk associated with mortgage contracts needs to be understood within the context of the liabilities that the bank holds (e.g., checkable deposits). For example, fixed-rate mortgages are riskier for lending institutions. By their nature, mortgage holders pay at the same interest rate for the life of the loan. When interest rates rise, lending institutions must pay out higher dividends to their deposit holders, although the interest income generated from the fixed-rate mortgages remains constant. However, because ARM payments fluctuate with the rise and fall in the interest rate, the risk of not being able to pay deposit holders falls. Fixed-rate mortgages are relatively less risky for consumers because the payments are fixed for the life of the loan, but they are more risky for lending institutions.

Another type of mortgage contract that reflects risk sharing between the two parties is the hybrid ARM. One type of hybrid ARM is a 5–1 ARM, in which the rate is fixed for the first 5 years and is adjusted yearly following the end of the 5-year period. This arrangement backloads the interest rate risk for the borrower.

CE mortgage data over time

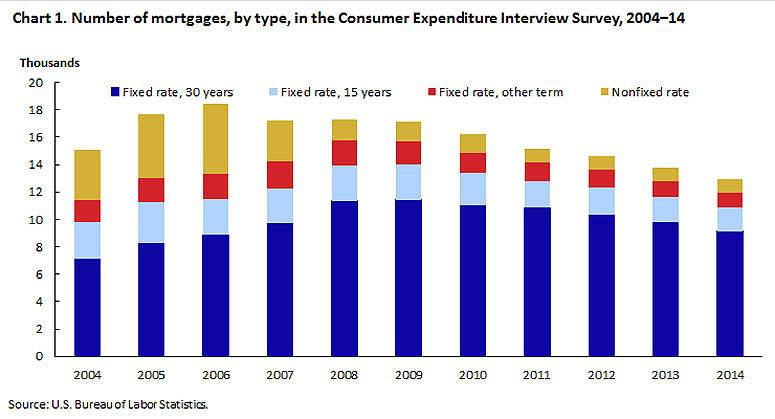

The sample composition of mortgage holders has changed in the CE, given the shock to the mortgage market caused by the 2007 housing market collapse. In a given year, the sample provides a snapshot of consumer choice within the loan market. It shows the number of mortgages in the sample and the distribution of types of mortgages that consumers take up. Because each interview represents an independent observation, each year is a unique collection of households and can be examined independently. Considering the risks associated with a given mortgage contract, the choice a consumer unit makes in financing its purchase is one of the few ways of identifying consumer risk preference. Chart 1 shows how the composition of the various mortgage instruments in the sample changed from 2004 to 2014.

The most commonly reported mortgage instrument, the 30-yr FRM, is also the least risky from the perspective of the borrower. The remaining mortgage contracts in the sample consist of a wide variety of mortgages with fixed and nonfixed rates. Information collected from respondents is insufficient to identify whether the mortgages in the nonfixed category are 5–1 ARMs, 10–1 ARMs, or special types of mortgages (e.g., ones with a balloon payment). As a result, all the mortgages are placed into the same category for the purposes of this analysis. In general, these types of mortgages are a higher risk for the borrower than an FRM. Non-FRMs made up a larger percentage of the sample prior to the housing market collapse. (See table 2.) Following the collapse and the start of the Great Recession, the market contained less risky loans from the perspective of the borrower as the percentage of non–fixed-rate options declined. Part of this change also came about from the general state of the economy. Interest rates dropped significantly in 20087 and continued a downward trend through the next 5 years. Consumers are incentivized to take advantage of a downward trend with an ARM, but if their expectation is that interest rates have “bottomed out,” consumers will want to lock in those rates with an FRM. How consumers select a mortgage instrument has a lot to do with their expectations and relative uncertainty about the future. A market collapse generates a lot of uncertainty, making more predictable mortgage instruments more attractive. Table 2 shows the decomposition of the annual total number of mortgages by mortgage type in the study sample.

| Year | Total number of mortgages held | Percentage of all mortgages held | |||

|---|---|---|---|---|---|

| 30-year FRM | 15-year FRM | FRM with term other than 15 or 30 years | Non-FRM | ||

| 2004 | 15,050 | 47.4 | 17.9 | 10.4 | 24.3 |

| 2005 | 17,666 | 47.0 | 16.6 | 10.0 | 26.4 |

| 2006 | 18,407 | 48.3 | 14.0 | 10.3 | 27.4 |

| 2007 | 17,257 | 56.4 | 15.0 | 11.4 | 17.4 |

| 2008 | 17,314 | 65.5 | 15.0 | 10.6 | 9.0 |

| 2009 | 17,155 | 65.6 | 15.1 | 9.8 | 8.5 |

| 2010 | 16,265 | 68.0 | 14.2 | 9.3 | 8.5 |

| 2011 | 15,133 | 71.7 | 12.8 | 9.1 | 6.4 |

| 2012 | 14,649 | 70.7 | 13.6 | 8.9 | 6.8 |

| 2013 | 13,806 | 70.7 | 13.3 | 8.8 | 7.2 |

| 2014 | 12,912 | 70.8 | 13.4 | 8.5 | 7.3 |

| Note: FRM = fixed-rate mortgage.

Source: U.S. Bureau of Labor Statistics, 2004–14 Consumer Expenditure Survey pooled sample. |

|||||

Comparison of types of mortgage instruments in the CE

The total number of mortgage loans decreased following the collapse of the housing market and the advent of the Great Recession. (See table 2.) The percentage of the sample made up of 30-year FRMs accelerated when the market collapsed and then remained fairly steady throughout the 2004–14 period. FRMs with other terms decreased modestly as a percentage of mortgages over the 10-year period. The percentage of non-FRMs rose until 2006 and then dropped precipitously as the housing market collapsed. This trend suggests either that non-FRMs were offered less frequently by lending institutions, or that consumers selected less risky investments, following the market collapse. The first hypothesis cannot be addressed by using CE data alone, because it follows from the supply side of the market. However, there are implications for the supply side that are based on how consumers structure demand for mortgage instruments. If consumers selected less risky investments, then the demand for the riskier types of loans would fall, resulting in a lower price for these types of mortgage instruments or an unwillingness on the part of lending institutions to offer them at the price demanded by consumers. In order to test the second hypothesis, the data can be split into subsets of just those mortgage contracts that began between 2003 and 2008 and just those mortgage contracts that began between 2009 and 2014, and the two subsets can be compared.8 Then, given the risk profiles of the various mortgage instruments, the market collapse should result in a reorganization of mortgage instruments toward various fixed-rate options as opposed to adjustable-rate options.

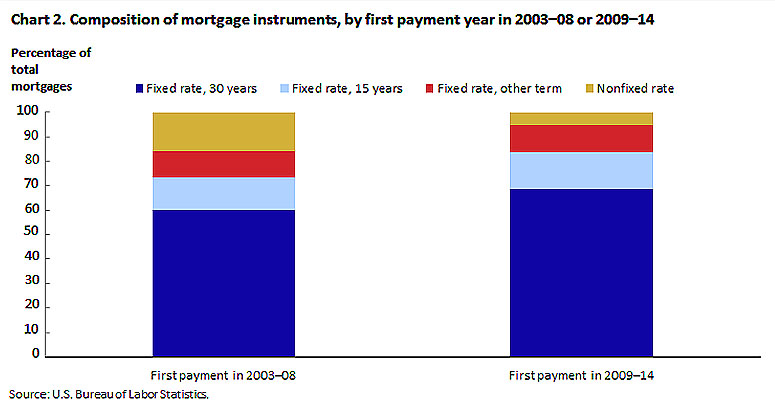

Chart 2 shows the distribution of mortgages purchased between 2003 and 2008 and the distribution of mortgages purchased between 2009 and 2014. The 2003–08 group contains 80,852 purchased mortgages, whereas the 2009–14 group contains 20,970 purchased mortgages. The difference shows the drop in activity in the market as reported by consumers in the CE.

Individuals who took mortgage loans leading up to the market collapse exhibited a greater propensity to select a non-FRM than did consumers who took mortgage loans following the market collapse. Overall, fewer mortgages were taken out following the collapse of the market. Of the mortgages that were obtained prior to the collapse, approximately 16 percent were non-FRMs, compared with approximately 5 percent following the collapse. Other FRMs made up about 11 percent of the sample in both subsamples. After the collapse, 30-year FRMs controlled a greater share of the market, rising about 9 percentage points, from 60 percent over the 2003–08 period to 69 percent over the 2009–14 period. By comparison, 15-year FRMs saw a comparatively modest increase of about 3 percentage points following the collapse, from about 13 percent to 16 percent.

Conclusions

It appears that, on average, consumers in the housing market selected less risky mortgage instruments after the collapse. There are several explanations for why this may be the case, such as changes in expectations and in risk evaluation. Another explanation could be that, since the Federal Reserve fixed rates at lower levels, consumers were incentivized to lock in lower rates for fixed mortgage instruments before future rate increases, such as the one in December 2015, could take effect. Consumers have been reacting to the large asset losses represented by the housing market collapse by entering the mortgage market hesitatingly following the shock and by actively choosing less risky investments in order to avoid being financially harmed in the aftermath of the collapse. Still another explanation may be related to how consumers evaluate the expected payoff of choosing a hybrid ARM. Many consumers choose hybrid ARMs because they intend to sell the property following the fixed-rate period of the loan—a practice that was common during the period leading up to the housing collapse. Homes became more difficult to purchase after 2008 owing to liquidity constraints imposed by the government and lending institutions (i.e., higher down payments were required). As a result, hybrid ARMs may have become less attractive because they would be more difficult to liquidate after a fixed period. The CE does not ask the questions necessary to determine whether or not a non-FRM is a hybrid ARM, so it is difficult to find out with the available data. A final explanation relates to consumers learning from the collapse. It is possible that consumers who would have selected an ARM prior to the collapse decided that that instrument was too risky for them to choose after the collapse because of how it could affect their asset value. As a result, they removed themselves from the market or chose the less risky option of an FRM. That is, their risk preference may not have changed, but their knowledge of how fluctuations in the market could affect them may have increased, altering the cost–benefit analysis of the selection of an instrument. The CE does not collect information on consumer knowledge, so testing that hypothesis is beyond the scope of this article.