Central Bank Independence: Growing Threats

Cecchetti & Schoenholtz

Money and Banking, January 02, 2017

“The independence of the central bank to set a monetary course separate from the day-to-day of electoral politics is as fragile as it is essential.” Peter Conti-Brown

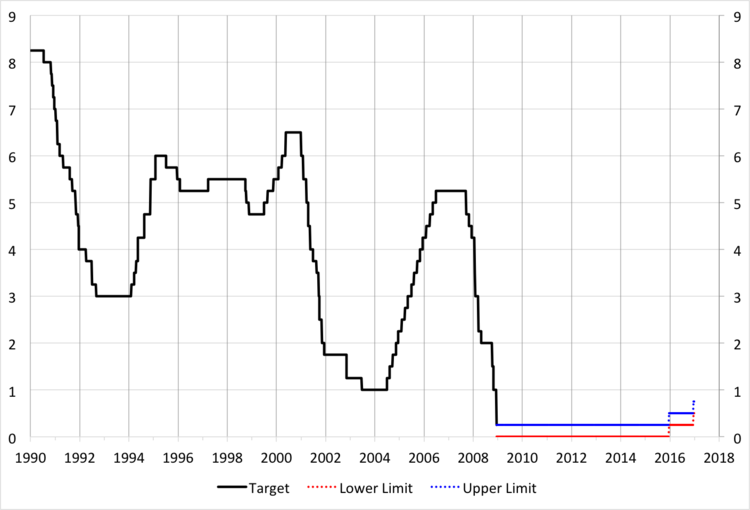

The median FOMC participant forecasts that the Committee will raise the target range for the federal funds rate three times this year. That is, by the end of 2017, the range will be 1.25 to 1.50 percent. Assuming the FOMC follows through, this will be the first time in a decade that the policy rate has risen by 75 basis points in a year (see chart). It is natural to ask what sort of criticism the central bank will face and whether its independence will be threatened.

Federal Funds Rate Target and Target Range, 1990-January 2017

Source: FRED

Our concerns arise from statements made by President-elect Trump during the campaign, as well as from legislative proposals made by various Republican members of Congress and from Fed criticism from those likely to influence the incoming Administration’s policies.

Recall that, during the campaign, candidate Trump attacked Federal Reserve Board Chair Yellen, saying that she and her colleagues were keeping interest rates low to support President Obama. President Trump is likely to have substantial latitude to remake the Federal Reserve Board in his image. While all five of the current members of the Federal Reserve Board have terms as Governors that extend at least until 2020, we expect that several incumbents will exit by 2018, leaving the new President to appoint a majority of the Board, including its Chair and two Vice Chairs. Will those appointed set policy to ensure “maximum employment, stable prices, and moderate long-term interest rates” as the Federal Reserve Act mandates? We hope so, but that is far from clear.

First, there is the risk that President Trump or his cabinet will interfere in the work of the Federal Reserve by arguing for or against specific policy actions. It is easy to envision cases in which the executive would blame independent monetary policymakers when things go wrong. As was the case during the campaign, we see a real risk that the President or his representatives will again assert that, rather than being objective and technocratic, the FOMC is pursuing a political agenda. Indeed, the more aggressively that the Trump Administration implements the President-elect’s immigration and trade plans, the greater the risk of an uptick in inflation resulting in policy rate increases and a dispute over whether the Fed is actively thwarting the Administration’s growth and employment-oriented policies.

Were the executive branch to become openly critical of monetary policy, it would break a fairly lengthy tradition that has helped to keep U.S. inflation expectations low and stable. At least since President Reagan, U.S. commanders in chief typically have refrained from commenting on monetary policy in public.

Second, over the same period, there has been bi-partisan willingness to treat the role of Fed Chair as a technocratic one that transcends party. Prior to Chair Yellen, the three previous Federal Reserve Board Chairs were all reappointed by Presidents from a party other than the one that originally put them in office. Paul Volcker was appointed by President Carter and reappointed by President Reagan; Alan Greenspan was appointed by President Reagan and reappointed by President Clinton; and Ben Bernanke was appointed by President George W. Bush and reappointed by President Obama. Like presidential self-discipline in commenting on monetary policy, this bipartisan personnel approach has enhanced the Fed’s standing as an independent agency with a policy horizon that exceeds well beyond one associated with the election cycle. That, in turn, has helped to lower the inflation premium in U.S. Treasury bonds, diminishing the burden on U.S. taxpayers. In contrast, President-elect Trump stated during the campaign that he would “most likely” replace Chair Yellen, noting that she was “not a Republican.”

As former Minneapolis Fed President Narayana Kocherlakota wrote recently, “There is absolutely nothing in U.S. law preventing [soon-to-be President] Trump from violating the Fed’s independence, a post-1979 development that rests largely on the restraint of the president. Will Trump show this restraint? We’ll see.”

As for the legislative proposals, we are troubled by both the idea of allowing the GAO to audit monetary policy decisions and by the possibility of requiring the FOMC to account for its actions with reference to a simple policy rule. On the first, we argued that the result would be that control over monetary policy would revert to congressional oversight committees. Similarly, on the second, closer congressional oversight of Fed operations—as opposed to the current framework of assessing the inflation and employment outcomes relative to the Fed’s statutory mandate—will tend to substitute congressional control for Fed decision-making. In both cases, theory and experience suggest that long-run economic prospects would deteriorate.

Finally, there are the persistent proposals to restore a gold standard. Here, we reiterate: this is a very bad idea. Rather than anchor macroeconomic and financial stability, as its advocates claim, a gold standard would be a major source of instability and (as it did in the 1930s) prove unsustainable.

Central bank independence is fragile. It is important not to underestimate the willingness of Congress and the President either to change the law or to engage in rhetorical attacks that would reduce or eliminate Fed independence. With this in mind, our defense of central bank independence, originally posted on November 16, 2015, appears again below.

A Primer on Central Bank Independence

“These are my principles. If you don’t like them… well, I have others.”

Groucho Marx

Central bank independence is controversial. It requires the delegation of powerful authority to a group of unelected officials. In a democracy, this anomaly naturally raises questions of legitimacy. It also raises fears of the concentration of power in the hands of a select few.

An independent central bank is a device to overcome the problem of time consistency: the concern that policymakers will renege in the future on a policy promise made today. Keeping inflation low and stable requires a credible policy commitment to price stability that will, from time to time, be highly unpopular. When inflation rises, the central bank must promptly raise interest rates. And, should deflation threaten and the policy rate hit the zero bound, the central bank must respond by using its balance sheet flexibility. In this way, an independent central bank improves economic performance: it can achieve a lower and more stable inflation rate without sacrificing long-run economic growth. (For a summary, see Fed Vice Chairman Fischer’s recent speech.)

With the financial crisis, an earlier rationale for central bank independence re-emerged: the need to prevent or limit panics. This was in fact the original reason for creating the Federal Reserve System in 1913 (see, for example, America’s Bank). For a central bank to serve as the lender of last resort, as leading central banks did in the recent crisis, it must have some degree of independence. In particular, it must delay disclosure about the recipients of its funds: otherwise, banks worried about being seen as fragile will not borrow, perpetuating the financial system’s liquidity shortfall and the panic. At the same time, the central bank must not lend to insolvent banks; otherwise, the stigma associated with borrowing will discourage solvent, but illiquid banks, from seeking funds.

Recent experience shows that all these actions can trigger popular discontent. For legislatures, maintaining such unpopular commitments is difficult when the benefits only arise over a horizon longer than an electoral cycle. Not only that, but Congress has a difficult time resisting the temptation to raid the central bank’s capital to meet shortfalls. The transfer of nearly $50 billion over ten years from the Fed to general treasury to fill the hole in the transportation budget is just the most recent example.

Consequently, there is an unavoidable conflict between the goals of democratic legitimacy and policy effectiveness. A legislature is legitimate by virtue of its election, but it is not an effective place for making monetary or financial stability policy decisions. Like Groucho Marx’s principles, its promises may be viewed as breakable, thus failing the time consistency test.

While an independent central bank can make these decisions effectively, and can make credible commitments, it requires a legal framework that establishes its authority. So, the designers of an independent central bank must focus on how to make it politically legitimate without undermining its ability to make credible policy commitments.

Before getting to the details, we should be clear that one precondition for delegating monetary policy to an independent institution is that policymakers’ actions do not have first-order distributional effects, transferring income or wealth between groups in society. Granted, every central bank action affects relative prices, so there will always be winners and losers. For example, interest rate changes transfer wealth between borrowers and lenders. But it is widely believed (and publicly accepted) that the primary impact of interest rate changes is on macroeconomic quantities such as output, employment and the aggregate price level, and that this impact is not principally a result of distributional shifts.

In a democracy, we typically assign policies that are purposely and predominantly distributional to elected officials. Tax policies are not only about paying for public goods, but also about discouraging certain activities and subsidizes others. (For a detailed discussion of the principles of delegation, see Paul Tucker’s discussion here.)

Turning to some specifics, there are two key elements of an effective design of an independent central bank: (1) a legislative mandate that defines and limits the central bank’s goals and powers; (2) procedures that ensure transparency and political accountability.

In a democratic society, even independent central banks do not set their own goals. In practice, what they often do is interpret their legislative mandates in ways that help ensure their accountability. For example, all central banks have price stability as a key goal of monetary policy given to them by elected officials. Today, central banks in countries accounting for two thirds of global GDP announce numerical inflation objectives based on specific price indices. These are a device to operationalize the goal of price stability and allow the success or failure of central bank policies to be easily observed. The Federal Reserve’s “dual mandate” is specified by the Federal Reserve Act (as amended in 2010) and has been made operational by the Federal Open Market Committee’s annually reconfirmed “Statement on Longer-Run Goals and Monetary Policy Strategy.” The European Central Bank’s “hierarchical mandate” (which ranks price stability first) was established by the Maastricht Treaty and was made operational by the ECB’s announcement of a quantitative inflation objective.

Independent central banks do have delegated authority to achieve their legally mandated goals. That is, they have “instrument independence,” which enables them to set policy using specified financial instruments. But even this power must be limited so that a central bank does not take over functions that are chiefly fiscal. Among other things, that means restricting the assets the central bank can buy and sell, as well as forbidding the central bank from acquiring assets directly from the Treasury (to prevent fiscal dominance, in which the government controls the issuance of central bank liabilities to meet its funding needs).

The second key element of good central bank design is a transparent framework that permits effective accountability. If the central bank’s goals and operational principles are well-defined, then the legislature and the public can hold it responsible for its actions.

For the most part, transparency also makes central bank policy more effective. For example, in the case of monetary policy, a quantitative inflation target helps households and businesses anticipate monetary policy choices so that these choices are transmitted more rapidly to the economy through financial markets. Anchoring inflation expectations also reduces systematic risk in the economy, letting households and businesses make decisions without overly worrying about temporary disturbances in aggregate prices. In the case of financial stability, transparency about prospective threats to the resilience of the system can lead investors and intermediaries to take helpful precautions by seeking appropriate compensation for risk.

Importantly, however, too much transparency can undermine the function of a central bank. For example, in the case of monetary policy, the publication of meeting transcripts (even with a lag) diminishes the give-and-take of ideas needed for a policy committee to make the best choices. Far more important, in the case of financial stability, premature publication of a central bank’s counterparties would eliminate its ability to serve as lender of last resort. Even lagged disclosure probably diminishes this capability. (See former Fed Governor Warsh’s comments here.)

The financial crisis has made it more difficult to find the balance between legitimacy and effectiveness in designing an independent central bank. The reason is two-fold. First, while the time consistency problem still exists, the distributional impact of financial stability policy is often more central to its effectiveness than is the case for monetary policy. And second, the transparency required for appropriate accountability is much more difficult to achieve.

To understand the first problem, consider the case of a real estate boom that, left unattended, will turn into a bust. The short-run impact is to increase the (apparent) wealth of homeowners, as well as the fortunes of those in the construction and real estate business. Overall, this is good for short-run growth, employment and prosperity. Now, assume that there exists a regulatory tool – such as a cap on the loan-to-value (LTV) ratio or the debt-to-income (DTI) ratio – that reduces the amplitude of both the boom and the bust. Unless the benefits of using this tool occur within the electoral cycle, a legislature will be reluctant to dampen a boom. Yet, we know from experience that credit-driven property price booms create systemic risk that can ultimately result in financial crisis.

This credit story exemplifies the challenge facing financial stability policymakers: the means used to achieve financial stability – macroprudential tools – have transparent distributional effects that are central to their success. In the property-price boom example, lowering LTVs and DTIs harms homeowners and homebuilders relative to others. Contrast that with the impact of an interest rate change, which has a very broad impact across business and society. While the targeted and surgical nature of macroprudential tools almost surely makes them more efficient devices for intervention, their distributional consequences mean that they are more difficult to delegate without controversy. (For a discussion of the economics of macroprudential regulation, see here. And for a summary of the tools and their uses, see here and here.)

Turning to the second problem, note that – compared to monetary policy – it is difficult to define the financial stability mandate in a quantitative fashion that makes it amenable to transparency and accountability. Do we say that we wish to reduce the probability of a financial crisis that lowers GDP by 4% (as in the U.S. case of 2007-2009) so that it is expected to occur only once in 50 years? 100 years? 1000 years?

Unfortunately, we lack the ability to anticipate the resilience of the financial system adequately to make this “quantitative goal” operational. This is especially true if judging the state of the system requires knowledge of the privileged information about individual institutions that a financial supervisor cannot disclose. As a result, outside observers will find it difficult to readily assess the progress toward financial stability. However complex, measuring price stability and understanding the impact of interest rate changes is far simpler.

All of this brings us back to Groucho Marx, who offered to break promises whenever expedient. It isn’t easy to sustain the credibility of an institution led by unelected officials in a democracy if people do not understand it or – worse – fear it constitutes an unwarranted concentration of power. To make an independent central bank work, political leaders must delegate the necessary powers and establish an oversight regime that ensures accountability without undermining the institution’s policy effectiveness.

This is a big challenge, but it’s a lot easier than fighting a war or ensuring recovery after a large natural disaster. Many countries now do it reasonably well or are working their way through the inevitable post-crisis controversies.