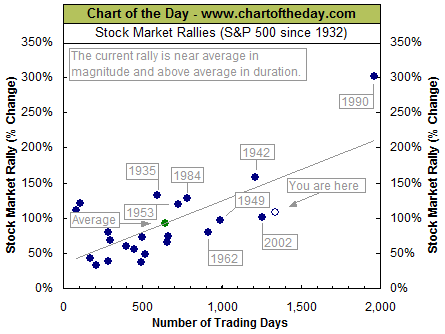

Chart of the day suggests this is the 2nd longest rally in US history:

“With the S&P 500 once again in record high territory, today’s chart provides some perspective on the current rally by plotting all major S&P 500 rallies of the last 86 years. With the S&P 500 up 107% since its October 2011 lows (the 2011 correction resulted in a significant 19.4% decline), the current rally is above average in magnitude and the second longest rally since the Great Depression.”

I have to disagree, if we reasonably define what ends the rally as either a negative year or a 20% decline.

We had both: the May to October 2011 fall of -21.68% (intraday peak to trough). Then there was 2015, a negative year for the S&P500 index at -0.73%, (total return was +1.38%).

Thus, the claim this is the second longest rally fails in 2 ways. Reset the starting clock to either November 2011 or January 2016 . . .

Source: Disciplined Investor