Interesting discussion of their core model from RAFI:

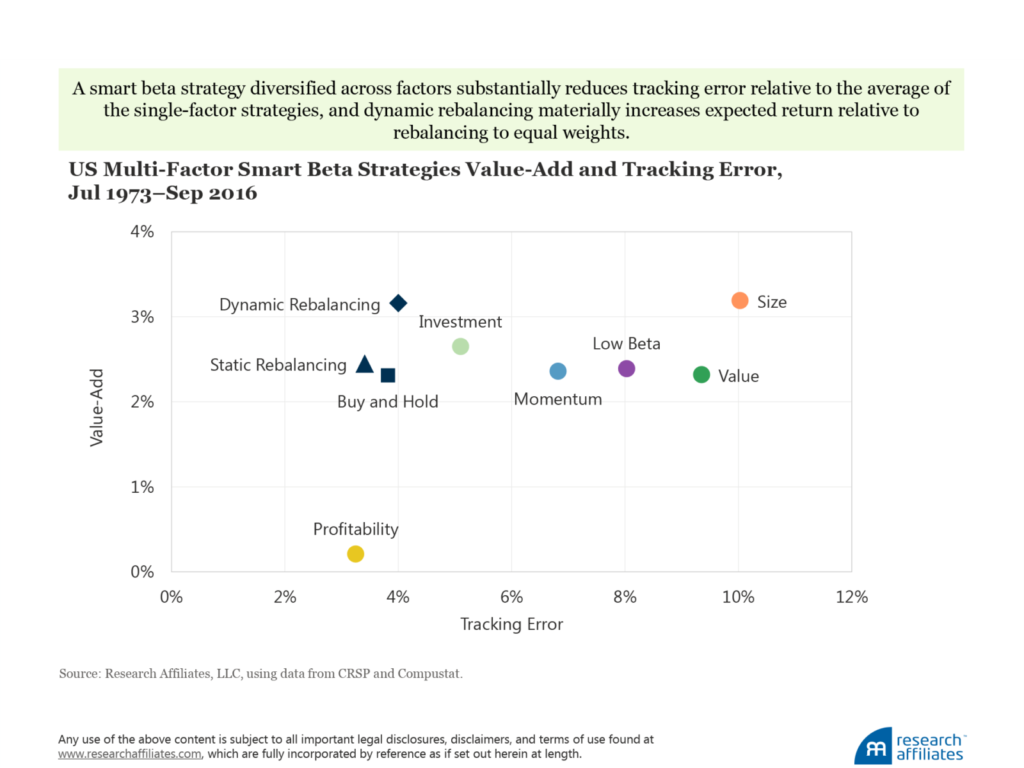

“Factor investing, also called smart beta, is rapidly displacing traditional stock picking—and for good reason. Traditional active management of equity mutual funds has delivered returns persistently below passive benchmarks. In contrast, many factor-based smart beta strategies have persistently outperformed the same capitalization-weighted benchmarks. As you consider migrating your public equity holdings away from traditional active management to smart beta, two portfolio construction questions come to the fore: which smart beta strategies should you include, and how should you manage those strategy allocations through time? We find that a smart beta strategy diversified across factors substantially reduces tracking error relative to the average of the single-factor strategies, and dynamic rebalancing materially increases expected return relative to rebalancing to equal weights.”

Their chart reviews the impact of various factors on a multi factor model:

click for ginormous graphic

Source: Research Affiliates