Can Tight Labor Markets Inhibit Investment Growth?

Dave Altig, Ellyn Terry

Atlanta Fed Macroblogm February 28, 2017

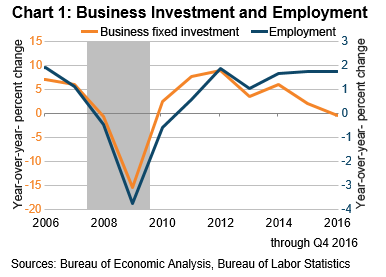

One of the most vexing developments of the current expansion has been the long and persistent reduction in the pace of business fixed investment (see chart 1).

The slide in investment spending evident in this chart has had a substantial impact on the pace of gross domestic product (GDP) growth in recent years and is also behind the slow pace of capital accumulation that has been a major factor in the slow labor productivity growth postrecession ![]()

![]() .

.

The other notable aspect of chart 1 is that employment growth has been robust during most of the recovery, and that growth remains robust. That sustained performance has taken the economy to the point where measures of labor market performance can be reasonably described as “close to a state of full employment.”

Continued strong employment growth could sensibly support a relatively bullish story on investment going forward. As the table below shows, “high-pressure” labor markets—defined as periods when the official unemployment rate falls below the Congressional Budget Office’s estimate of the “natural unemployment rate”—tend to be associated with strong levels of business fixed investment spending.

That said, we are taking note of some cautionary sounding from a special question about investment constraints on the most recent Federal Reserve Small Business Credit Survey, whose full results will be released in April. (The Small Business Credit Survey is a collaboration among Federal Reserve Banks and collects information from small businesses throughout the country. The 2016 survey was open from mid-September to mid-December, and generated more than 16,000 responses—about 10,000 of which were from employer firms.)

One of the survey’s special questions was the following: What factors constrained your investment decisions over the past 12 months? The respondents were allowed to check as many factors as they deemed relevant and, perhaps not surprisingly, the collective answer was “a lot of things,” as chart 2 shows.

Though there are a lot of contenders in that chart, it was interesting to us that the modal response (though admittedly by a hair) was an inability to find or retain qualified staff. It gets even more interesting when you focus on stable, growing firms—those that were profitable in 2016, are increasing payrolls and revenues, and have been in business for at least six years (see chart 3).

For this group—by definition, the most dynamic firms in the sample—perceived constraints on talent acquisition and retention is easily the largest issue when it comes to investment spending headwinds, independent of the size of the firm (measured by annual revenues). Indeed, more than 50 percent of the businesses with revenue in excess of $10 million identified the labor market as a problem.

We want to be sufficiently modest about interpreting these survey results. (The survey’s full results will be released in April.) We have only asked this question once and therefore have no ability to compare with historical data. We also don’t know for sure if firms truly are being constrained by their ability to find or retain qualified staff, or if respondents were simply identifying with that option as an issue with their business in general. But the idea that business investment could be constrained by access to talent is important for thinking about the growth potential of the economy. The possibility that education and workforce development efforts could have spillover effects into investment growth is intriguing.

~~~

By Dave Altig, executive vice president and research director, and