Source: Birinyi

Jeffrey Yale Rubin of Birinyi looks at the issue of low volatility. He makes two interesting observations:

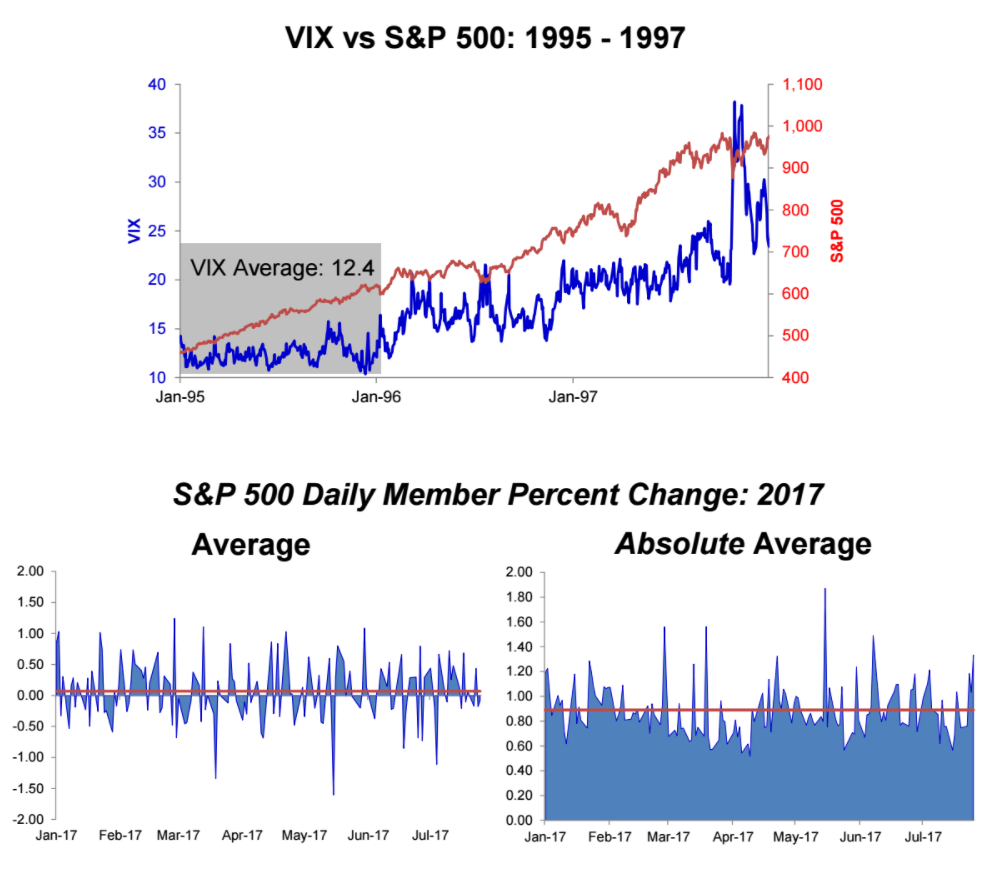

In the early 1990s (top chart) the VIX was very low, and yet markets rallied for nearly another decade. In 1995-96, the “VIX more than doubled, yet the market was to gain 58% and a further 20% in 1999.”

Perhaps the most significant idea Rubin describes is that low volatility is a misleading average that is not accurate. As the two lower charts show, using averages create a misleading picture.

Using a random day where the “average S&P 500 member fell -0.08%, while the S&P declined -0.25%. However, the average absolute change that day was 1.33%. In other words if one stock is down 5.3% while another is up 5.14% saying the market is not volatile because the average change was -.08% is a misrepresentation of the facts.”

Rubin notes that “year-to-date, daily average absolute member change is 0.89%, 12x higher than the simple average daily member change of 0.07%.”

Fascinating stuff . . .