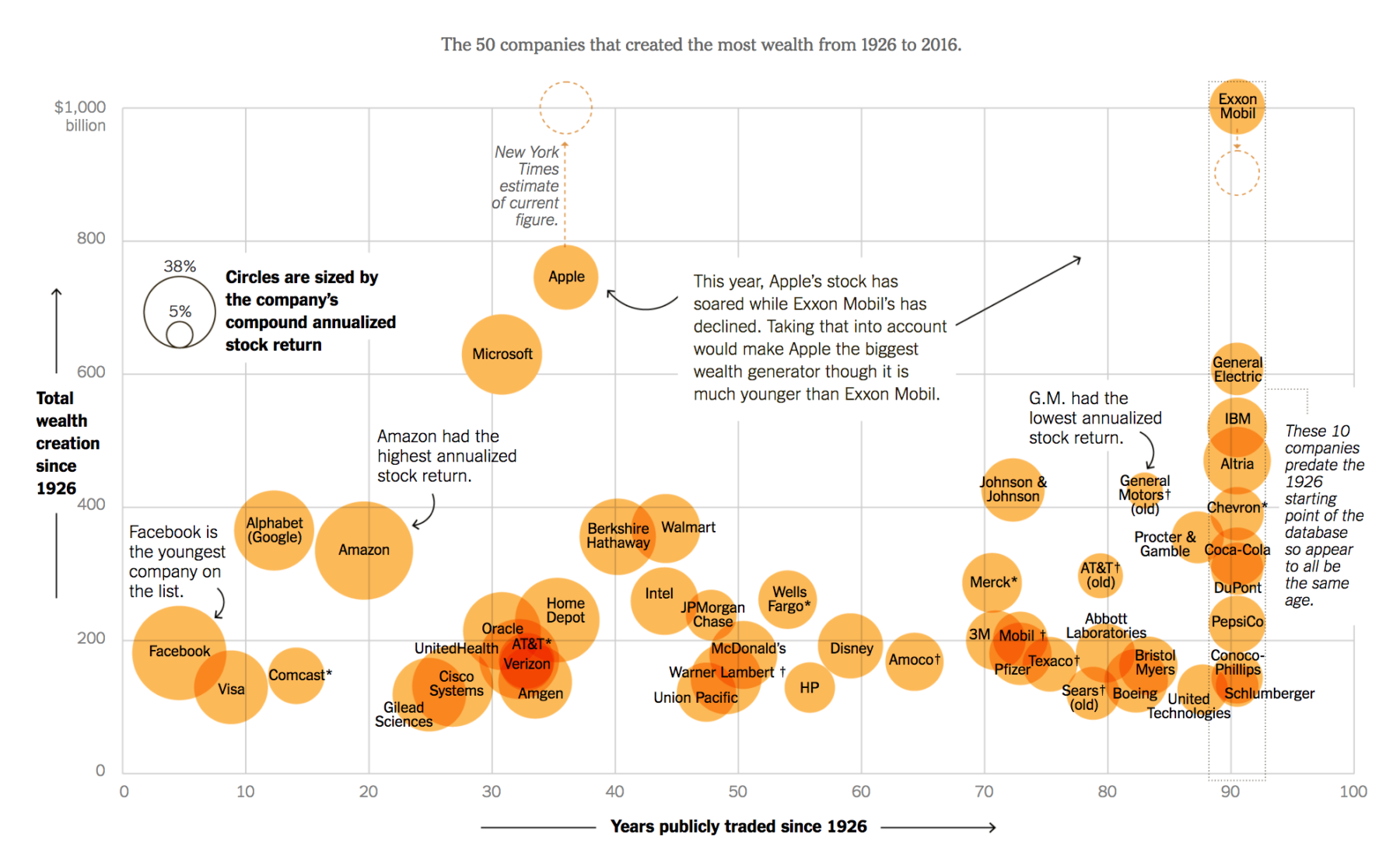

The New York Times has an excellent graphic filled with some startling datapoints:

Most stocks aren’t good investments. They don’t even beat the paltry returns of one-month Treasury bills, [Hendrik Bessembinder] has found.

But a relative handful of stocks are extraordinary performers. Only 4 percent of all publicly traded stocks account for all of the net wealth earned by investors in the stock market since 1926, he has found. A mere 30 stocks account for 30 percent of the net wealth generated by stocks in that long period, and 50 stocks account for 40 percent of the net wealth.

See the chart below, and check out the entire column. More on this later…

The Best Investment Since 1926? Apple

click for ginormous graphic

Source: Prof. Hendrik Bessembinder (W. P. Carey School of Business at Arizona State University) via Karl Russell/The New York Times

Notes: Wealth creation is total stock gains, including dividends, in excess of one-month Treasury bill returns. Company listing follows the guidelines of the Center for Research in Security Prices. Companies that are new iterations are marked with an asterisk*. Companies that no longer trade are marked with a dagger†.